In today's Finshots we will be explaining the budget in 5 minutes. Sort of... If you're a speed reader.

The Story

Personal taxes

Let’s get the big question out of the way — “Is there a change in personal income tax rates?”

Yes. And no.

See, the Honourable Finance Minister said, “Currently, those with income up to 5 lakh do not pay any income tax in both old and new tax regimes. I propose to increase the rebate limit to 7 lakh…

Everyone cheered. And thumped the tables. And then she continued after a pause…“in the new tax regime.”

Suddenly, there was pin-drop silence.

Remember the new tax regime that was introduced a couple of years ago?

Well, the government gave us all the option of picking between two tax systems — an old regime and a new regime.

In the old one, you could claim tax exemptions and deductions — you got a standard deduction of ₹50,000 just like that, You could deduct a part of your house rent under House Rent Allowance and then pay tax on what’s left of your income. You could deduct ₹1.5 lakhs under 80C for specific mutual fund investments. And ₹25,000 under 80D for medical insurance, etc.

In the new tax regime, you don’t get any exemptions. You pay tax on whatever income you make. No 80C, 80D, nothing. And it’s not been very palatable because most people still paid less taxes with the old regime.

But the government wants to change that. They’re making the new regime more attractive by raising the thresholds for tax-paying individuals. They’re tweaking the tax rates a bit. They’ve even thrown in a standard deduction of ₹50,000 if your annual income exceeds ₹15.5 lakhs (although there’s some confusion around this subject). But no matter how you dissect this, one thing is evident. They’re trying to sweeten the pot and nudge you into moving to the new tax regime.

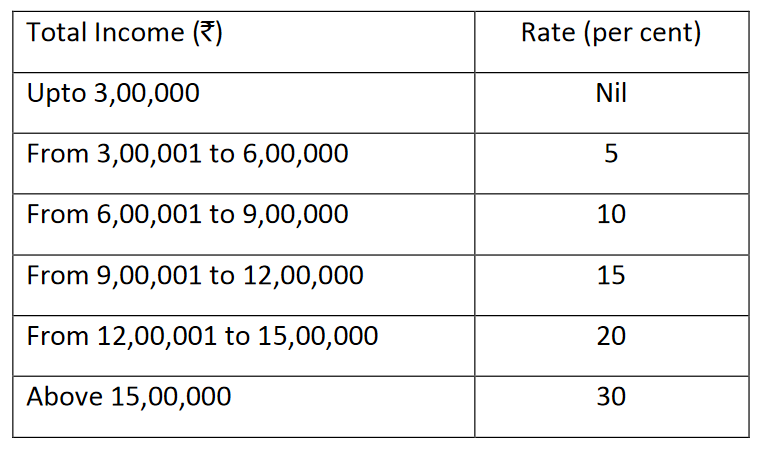

And here’s what it looks like.

Also here’s the kicker. If you earn less than ₹7 lakhs, you will not fall under any slab and will be completely exempt from paying income tax. But if you earn more than ₹7 lakhs, say ₹7.5 lakhs, then you’ll have to pay 5% on your income between ₹3 lakh to ₹6 lakh, and 10% between ₹6 lakh and ₹7.5 lakh

But if you stick to the old regime and claim your exemptions and deductions, nothing changes for you. Nothing.

So yeah, we all have to open a spreadsheet now and calculate which regime makes sense for next year.

The one thing that’s clear is that this will definitely be a big boost to people who earn less than ₹7 lakhs. Their income is completely tax-free. And they don’t need to worry about making investments and buying policies just to save tax.

But if you do think that the new regime works out better, we do have to caution you on one thing.

See, a lot of folks are forced to save and invest just because they want to save tax. You might invest in the Public Provident Fund (PPF) which has a 15-year lock-in. And that means you’ll be saving for retirement. You could buy health insurance. And that helps you in case of hospitalisations.

Since these deductions are not available under the new tax regime, you could take a laissez-faire approach and your savings rate could plummet. And you might ignore life and health insurance. We don’t want that, do we?

A rich tax

Also, while we’re on the matter of taxes, here’s a surprise. They’ve actually kind of cut the tax rates for the rich folks.

At the moment, if folks make more than ₹5 crores, they pay a 37% surcharge for being rich. That’s being tweaked now. The surcharge will now fall to 25%. Ka-ching!

The caveat again is that they have to opt for the new regime.

But, on the other hand, the government is turning to another tool to penalize the ultra-rich folks. Let’s take an investor in a startup as an example. Say they buy 100 shares in a startup. And shell out ₹10 crores in the process. Just hypothetically. The startup does phenomenally well and a few years later, a PE firm reaches out to buy their stake out completely. They offer the individual ₹25 crores. That’s a profit of ₹15 crores here. Now, in normal circumstances, they’d have to pay a hefty tax on this. Or else, they can buy a swanky residential property for that sum — ₹15 crores and not pay a penny in taxes.

Now the government has seen what’s happening. So they’re saying, “Hey, when we allowed you to set off the gains on the shares, we didn’t realize that you would buy such expensive property. We’re not getting our share of taxes. So we’re going to cap this to a maximum of ₹10 crore now. That’s all you can invest in a house to save tax. If you made a ₹15 crore profit and buy a house worth ₹15 crores, you’ll have to pay us the dues on the ₹5 crores.”

But the rich have been given some breathing room. This tweak will only come into effect from April 2024.

A foreign investment tax

Anyway, there’s one more thing on taxes we want to highlight. Let’s say you want to invest in stocks in the US. Currently, the bank or dealer will collect a 5% tax at source if you’re investing more than ₹7 lakhs.

But from now on, irrespective of the amount, they’ll collect a 20% tax. This means if you’re investing ₹1 lakh, ₹20,000 will be taken away immediately.

Sure, you can adjust it against your tax liability at the end of the year. But it’s still quite painful, no? Imagine having to set aside 20% of your capital every time you make an investment. It’s not fun. And if you’re wondering why the government is imposing this measure in the first place, perhaps it’s because they don’t want money going out of the country. They’d much rather have people save and invest in Indian assets in India.

Thankfully, they haven’t changed the current taxes on stock market investments or mutual funds. So there’s that.

Now on to the bigger picture — the health of the economy and our finances.

It’s tough to run an economy where we spend more than we earn. And this gap is called the fiscal deficit. To fund this deficit, most countries resort to borrowing money. And when countries go on a massive borrowing spree and this deficit becomes too big, people get worried.

But we don’t have to worry about India. Yes, the government plans to spend a lot of money. In fact, it plans to spend over ₹10 lakh crore in FY24. This is 33% higher than the outlay we have planned for this year. And it’s massive! They’re going to have to borrow quite a bit of money to fund this.

But it’s mindful expenditure. This money will be splashed on capital assets. These are assets that can yield income — roads, bridges, railways that kind of stuff. They’re assets that can create jobs. In fact, spending on such capital assets has a multiplier effect. And as per the government, every ₹1 spent on capital expenditure creates an immediate multiplier effect of ₹2.45.

That means it spurs the economy. And when private capex (investments made by private companies) is still slow, the government has to do everything in its power to keep things ticking.

And here’s the thing. The government believes they have everything under control. The fiscal deficit is calculated as a percentage of GDP. So the multiplier effect will boost the economy and help keep the figure in check. In fact, this deficit is expected to be 5.9% of GDP in FY24. And that’s a drop from 6.4% in FY23.

Also, the government is clear that the target is to bring the fiscal deficit down to a very manageable 4.5% by FY26. So fingers crossed.

It’s also trimming back a bit on the food, fertilizer and petroleum subsidies. Put together, this is the highest expense for the government after the interest it pays on its borrowings. And remember, this kind of expense is not capital in nature. Which means, there’s no multiplier effect.

However, it’s still the kind of expense that’s required. For instance, during the pandemic, the government had to increase food subsidies to help the common folk. Also, during the war in Ukraine, fertilizer prices shot up. And if the government hadn’t subsidised it, it would have translated into much higher food prices and inflation. It would’ve hurt everyone.

Now that the macroenvironment is better, the government can afford to dial back a bit without hurting the people too.

What else did the government talk about?

Well, green energy was a big talking point. The word green was mentioned over 20 times at least during the 1.5-hour speech. Like this — “We are implementing many programmes for green fuel, green energy, green farming, green mobility, green buildings, and green equipment, and policies for efficient use of energy across various economic sectors.” Now we don’t know what a lot of this will entail. But it definitely seems like we’re dead serious about getting to net zero carbon emissions sooner rather than later.

Then there was a lot of talk about Millets. And how we’re going to be the global hub for this superfood. It sounds quite fascinating and we might have to do a full story on this.

Also, lab-grown diamonds received quite a bit of air time during the speech. We’ve written about this phenomenon before so you might want to check that out. But the government believes the industry is ripe for the taking. So it’s cutting the customs duty on seeds used to make diamonds. Yes, they are called seeds.

They’re also doubling down on affordable housing. So they’ve increased the budget under the PM Awas Yojana by 66% to ₹79,000 crore. But as we’ve written earlier, money alone may not do the trick. There’s a lot to fix in the implementation as well.

There’s the very important promise of establishing 157 new nursing colleges. And we say it’s much needed because we have an acute shortage of skilled medical professionals. We only have 1.7 nurses per 1,000 people. And it’s way short of the recommended 3 per 1,000. We need at least 4.3 million more nurses by 2024 to be in a safe space.

And yeah, a special shoutout to one announcement in the budget. There’s a big plan to establish a National Digital Library for children and adolescents. Even States will be encouraged to set up physical libraries and provide access to the digital library through these places. Also, there are whispers of financial literacy material for children too! All this is absolutely great news if we can get kids to look away from their phone screens every once in a while.

So yeah, while there’s a lot more to unpack, let’s stop here. We’ve pushed our luck with the 5-minute read. Phew.

Until then...

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Correction: An earlier draft contained an erroneous explanation of fiscal deficit. The error is deeply regretted

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you’re at it.

1. Just head to our website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!