Weekly Wrapup: The PVR Inox Merger

Before we get to today's story, a quick recap on all the things we covered this week. On Monday we spoke about human smuggling, next we discussed India's record breaking export figures. On Wednesday we talked about the big incident at the Oscars, then we discussed SEBI's intervention and Ruchi Soya, and finally we saw what's happening at Sri Lanka.

Alright we that out of the way, let's get to today's story. It's about the PVR Inox merger

The Story

Just 3 weeks ago, everybody was talking about an impending merger between PVR — India’s biggest multiplex chain and Cinepolis — the 3rd biggest pan India multiplex chain. Then, just a week later, there were reports suggesting Inox — India’s 2nd biggest multiplex chain was plotting a massive move of its own with plans to acquire Carnival and Miraj Cinemas.

And then guess what happened.

PVR and Inox announced that they were joining forces instead, to create a combined entity PVR INOX. And with one fell swoop — a merger of epic proportions, they will now control 50% of India’s multiplex industry. And if you aren’t impressed by this sort of thing, here’s another stat for you — For every ₹100 made at the box office, this giant could pocket a cool ₹42! The scale here is insane!

But why are they joining hands now? Why are two competitors, who once went toe to toe now becoming friends all of a sudden?

Well, it doesn’t take a genius to figure this out, but if you want a brief on the matter — It’s the pandemic doing the damage. Over the past couple of years, multiplex chains have had a horrid time. People were cooped up at homes, movies weren’t coming out thick and fast and nobody wanted to go to the cinemas when the threat of an invisible virus loomed large. In the meantime, box office collections fell through the roof. Some estimates suggest that the Indian film industry lost at least ₹15,000 crores in the process. It was bad.

And to make matters worse, it wasn’t the only thing affecting the likes of PVR and Inox. OTT players like Netflix and Amazon Prime doubled down on their frontal assault. They convinced producers to bring their movies to online channels directly while nudging them to skip the theatrical release altogether. In other cases, moviemakers willingly cut the theatrical window short to bring their movies to OTT platforms as soon as possible. They weren’t playing ball with multiplex chains and OTT players incentivized them to further bolster their conviction.

This was another blow to an industry already reeling from the after-effects of the pandemic. Needless to say, they had to do something. And this merger is proof that they aren’t going to just take all of this battering lying down. In fact, during the announcement, both companies mentioned that this union was an attempt to “fight the onslaught of OTT players.” It’s their words. Not ours.

In summary, this merger offers more breathing room to both companies and may even help them thrive in the long run.

But…. How?

How exactly does this help the companies thrive?

Well, one research report called it an “invincible size advantage.”

In common parlance, it’s called bargaining power. When you control a sizeable chunk of the market you can dictate terms to both your suppliers and your customers.

Let us explain.

Today, multiplexes take a 50% share of box office revenue. That is a sizeable sum. However, the only thing that’s stopping them from going higher is… competition. They are fiercely competitive with each other and they can’t dictate terms to producers quite as easily. However, if a single entity (like PVR-INOX) comes to own a sizeable chunk of the market, producers will have a tough time saying no, even if they demand a higher cut. And it’s not limited to box office revenues. Take Advertisements for instance — Today, Inox lists advertisement spots at a discount of 30%, compared to PVR. If the deal is consummated, that discount is unlikely to stand.

Finally, there are people like you and me. We are already paying a lot each time when we go to the movies — with the food and beverages costing a ton of money. But now, it may actually turn even more expensive. This is what bargaining power does.

Ideally, when somebody wields this kind of influence, the competition commission of India steps up to vet the merger. They’ll try and see if the union negatively impacts customers, innovation and growth in the industry. However, both PVR and Inox did not need CCI’s nod.

Why?

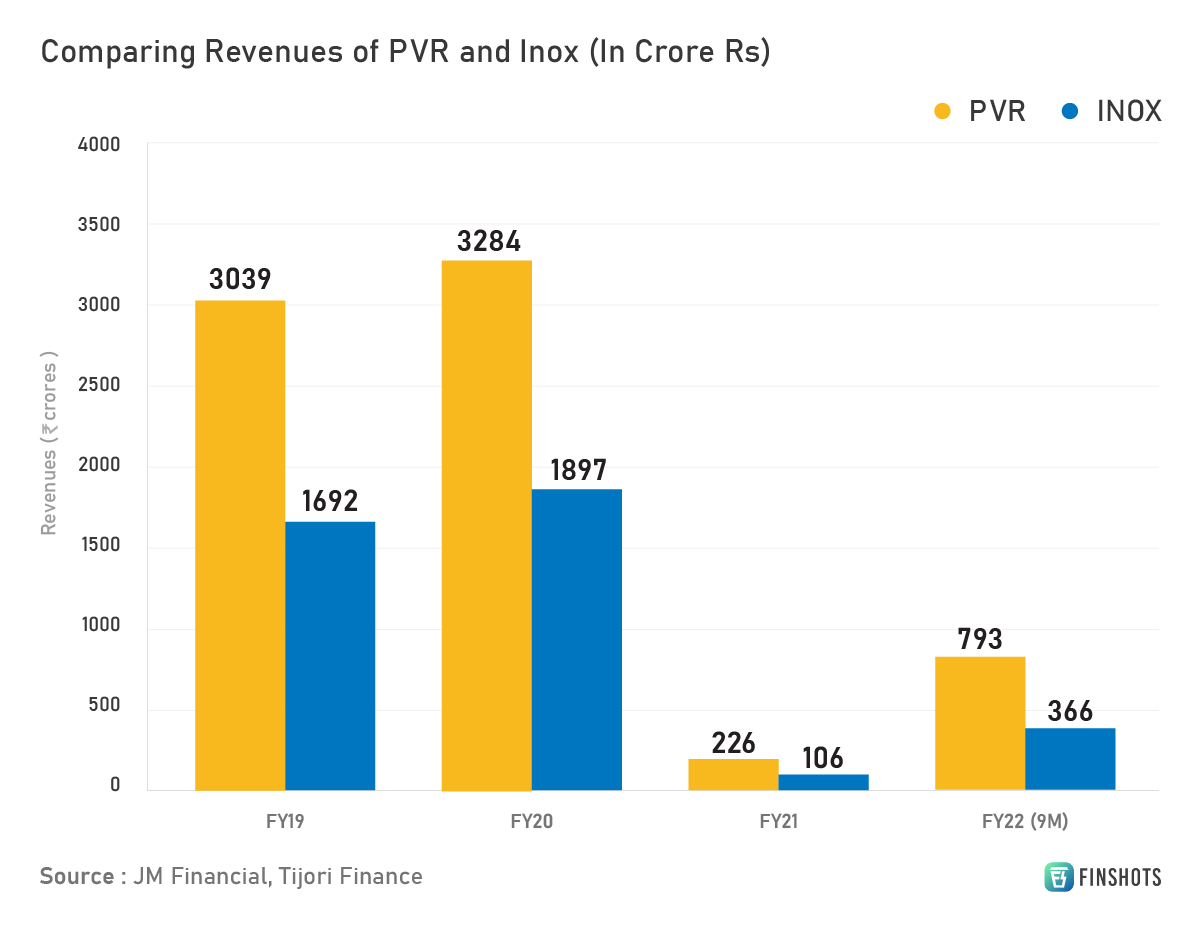

Well, their rules state that companies do not need explicit approval to merge if their combined revenues don’t exceed the ₹1,000 crore mark. And considering we witnessed lockdowns, closures and mass shutdowns the previous financial year, this was never going to be a problem. From a combined total of over ₹5,000 crores in the financial year 2020 (FY20), Inox and PVR have seen their revenues tumble to ₹300 crores in FY21.

They weren’t breaching the ₹1,000 crore mark.

That being said, however, incumbents can still complain to the CCI. The only problem? They’ll have to show that PVR and Inox are in fact violating anti-competitive guidelines.

The question here being — Is PVR-Inox in fact a virtual monopoly?

And the answer to that…. Maybe not. Sure, they have a 50% share in the multiplex industry. But if you consider all movies, including single-screen theatres their share drops down to less than 30%. If you include OTTs in the mix as well, then this is a non-starter.

There’s also something else. Despite its love for movies, India has very few movie screens. The 9,000 screens in the country translate to only 6 screens per 10 lakh people. The US on the other hand has 125 screens for every 10 lakh people. So in some ways, PVR Inox could argue that the market needs big players to further expand the market.

Anyway, all this is speculation now and the deal will likely take another 6–9 months before it’s fully consummated.

Until then…

Don't forget to share this Finshots on WhatsApp and Twitter.

Also, remember that popcorn prices may shoot up once this merger goes through. But the one thing that won’t shoot up — Term Insurance prices. It's like this - Once you buy a term insurance policy, your premiums don’t change every year and you can get particularly affordable quotes if you choose to buy young. So if you have dependents and you want to protect their downside, the best thing you could do is buy a term plan now and lock up your prices. Talk to Ditto. — We’ll help you out.