Weekly Wrapup: Hot potato

In this week's wrapup, we talk about a Bank of Baroda fraud, a DJ CEO, India’s mining rules makeover and more.

For the markets edition this week, we see why JSW Infrastructure’s recent IPO has got investors excited about its ports business. You can read it here

Meanwhile, here’s a recap of what we wrote over the week.

Adani versus Financial Times?

A couple of days ago, the Financial Times released a controversial report on the Adani Group. It alleged that the conglomerate has been inflating fuel costs, forcing millions of Indian consumers and businesses to overpay for electricity. How’s that, you ask?

Well, FT suggests that the group has repeatedly imported coal from countries like Indonesia at inflated prices. Sometimes exceeding even 50-100% of the value shown on paper while it was being exported from the source country. Now, the conglomerate obviously doesn’t agree with these findings.

But we wrote a story about what may be happening after all. We couldn’t publish it due to an unforeseen technical error. But you can listen to it on our daily podcast here (Spotify), here (Apple Podcasts) and here (Google Podcasts).

Bank of Baroda is involved in fraud?

In July, international media channel Al Jazeera made a shocking revelation about Bank of Baroda. It said that India’s second largest government-owned bank linked mobile numbers of strangers to its mobile app ‘bob World’ to boost app registrations, compromising security. The bank denied this report then.

But a couple of days ago, the RBI (Reserve Bank of India) suspended Bank of Baroda from onboarding new clients to its app. So, what really happened? We took a look at it in our Tuesday’s newsletter here.

Will India’s new mining rules be a gamechanger?

By 2070 India wants to achieve its net zero target. Meaning it wants to nullify all of the emissions from human activity. And if you’ve been a regular Finshots reader you probably know this by now. The country has a roadmap to get to its net zero goals. So we’re aiming for at least 30% of private cars on the road to be EVs (electric vehicles) by 2030. We also want to meet 65% of our energy requirements through renewable sources. And that’ll need a whole boatload of batteries.

But here’s the thing. India is heavily dependent on China and Hong Kong for its battery ecosystem. We import nearly 95% of our lithium-ion batteries from them. So we obviously need to let go of that. And the good news is that we’re getting there. We discovered massive reserves of lithium in Jammu and Kashmir. Such mineral reserves can help India make crores of batteries.

And as with most good things in life, we need to clear some hurdles to get there. We’re talking about the restrictions laid out in the Mines and Minerals Act which was first formulated post-independence. The government recently tweaked the rules though. So, we wrote about how it could possibly be a game changer for the mining industry in our Wenesday’s story here.

When a CEO moonlighted as a DJ

Last week, the Financial Times reported that David Solomon, the CEO of Goldman Sachs had called time out on his side hustle —deejaying. Yup! We’re talking about disc jockeying. Sounds crazy, we know. So we wrote 3 things that could seem problematic when a Wall Street CEO indulges in a side hustle. You can read it here.

The Ghost of RBI’s Past?

In April 2022, the RBI took the road less taken to reduce the amount of money circulating in the economy. It used something called a currency swap. This simply means that the RBI hands over its excess Dollars to banks in exchange for Rupees. Banks part with their extra money. So it reduces the amount of money it can lend. People and corporates, thus end up borrowing less in loans. It helps control inflation. But only temporarily.

That’s because the RBI reverses this deal after a certain period of time and takes back its Dollars from banks, offering them a premium. This means that if the RBI sold its Dollars to banks at ₹70/$, it will promise to buy it back at say, ₹73/$ after a couple of months. It’s sort of an incentive to convince banks to enter a swap deal with the RBI. And the central bank removed nearly ₹40,000 crores from the banking system using this tool.

But this deal expires in a couple of days. And here’s the thing. Banks don’t seem to have so many dollars in their accounts. So now they’re scrambling to get their hands on the greenback by buying Dollars. And that could be a slippery slope because when the demand for Dollars increases, it could pull down the Rupee.

If that fires up some curiosity, we give you a primer of what’s happening in our story here.

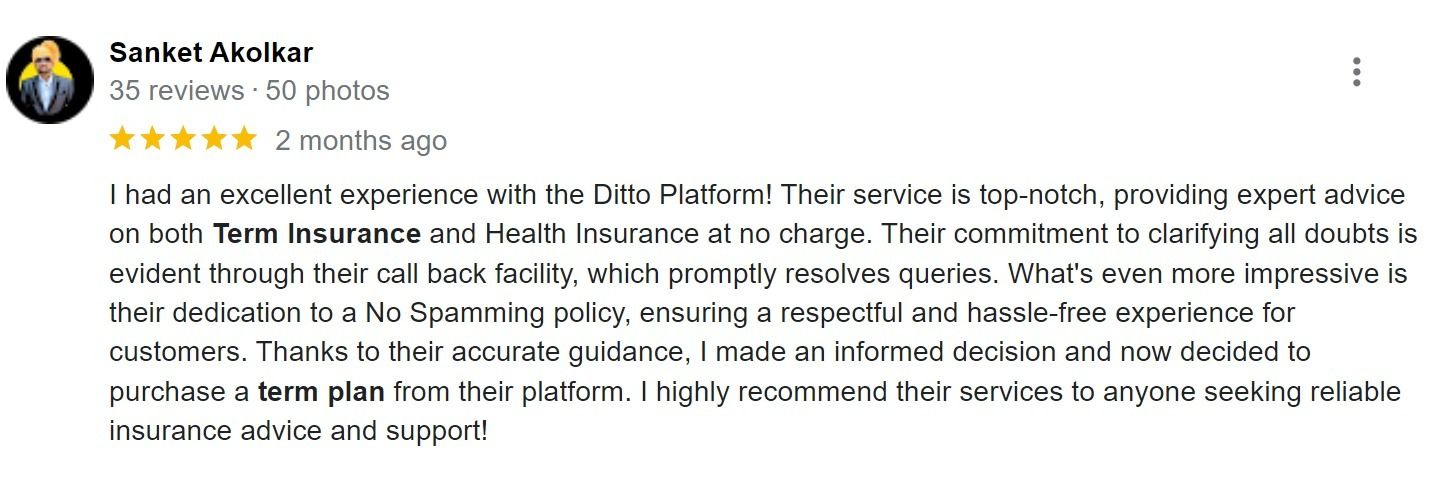

Ditto Insights: Why you must buy a term plan in your 20s

The biggest mistake you could make in your 20s is not buying term insurance early.

Here’s why

1.) Low premiums, forever!

The same 1Cr term insurance cover will cost you much lower premiums at 25 years than at 35 years. What’s more- once these premiums are locked in, they remain the same throughout the term! So if you’re planning on building a robust financial plan, consider buying term insurance as early as you can.

2.) You might not realize that you still have dependents in your 20s:

Maybe your parents are about to retire in the next few years and funding your studies didn’t really allow them to grow their investments — which makes you their sole bread earner once they age.

And although no amount of money can replace you, it sure can give that added financial support in your absence.

3.) Tax saver benefit: You probably know this already — section 80C of the Income Tax Act helps you cut down your taxable income by the premiums paid. And what’s better than saving taxes from early on in your career?

So maybe, it’s time for you to buy yourself a term plan. And if you need any help on that front, just talk to our IRDAI-certified advisors at Ditto Insurance.

Go to Ditto’s website — Click here

Click on “Book a free call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!

Anyway, with that out of the way, we hope you enjoyed our weekly wrapup. Have a great weekend!

Until then…

Don't forget to share this newsletter on WhatsApp, LinkedIn and X (formerly Twitter).