The Making of a Startup Scam

In this week’s wrapup we talk about the unusual slump of Divi’s labs, cover all our stories from last week and discuss our latest video — The Making of a startup scam.

The Making of a startup scam

FTX, GoMechanic, Zilingo, Theranos… What’s the one common thread that unites them all? Well, they’re all startups embroiled in controversies these past few years. More specifically implicated in scams. And while many of our readers have asked us to talk about why startups are increasingly resorting to fraud these days, we never really got to it. Until a few weeks back, when we decided to piece together the phenomenon in another well-researched video. You should definitely watch this. It’ll be worth it, we promise.

Link to the video: The Making of a startup scam!

What ails Divi's?

If you’re a pharma company, you primarily have 3 options. You could:

- Spend years and billions of dollars in research and development to create pathbreaking drugs. Then you apply for a patent to protect the drug for 20 years. No one else can copy it during this time.

- Wait for patents of popular drugs to expire and create copycats called generics. Or you find ways to reverse engineer the final product and create the drug. These will be cheaper drugs that will be consumed by the masses. And lots of pharma companies in India go this route.

- Become a contract manufacturer for pharma giants. You’ll help supply the active pharmaceutical ingredients (APIs) that every drug needs — whether a new blockbuster one or a patent-free generic. Think of the API as the raw material needed to make the drug. And pharma giants save costs through outsourcing.

Nearly 30 years ago, Murali Divi, the man behind Divi’s Laboratories decided that his company would focus on just one thing — become a contract manufacturer. While its peers in India were busy churning out generic drugs and directly competing with Western pharma companies, Divi’s told these pharma giants, “Hey, we won’t compete with you. We’ll help you manufacture your stuff instead. We’ll give you the raw material needed.”

It worked. Pharma giants knew there was no conflict of interest unlike other Indian pharma companies — Divi’s wouldn’t manufacture the drugs on their own and compete with them.

So, Divi’s began with an ingredient for a drug called Naproxen — a popular anti-inflammatory drug. Divi’s found a more efficient way to manufacture it. It used enzymes instead of chemicals to induce a reaction from the drug faster. It was better. So Divi’s screamed from the rooftops about it. And despite being late to the party, pharma giants realized that the Indian pharma upstart was onto something. Slowly, they began outsourcing their manufacturing to Divi’s.

But this kind of API for the generics business wasn’t a money spinner. Divi’s needed to find another niche. So it trained its sights on custom synthesis. This simply meant that it would help manufacture small, custom quantities of a drug for clinical trials. It would create special molecules only for the drug in question. Top secret work that’s all hush hush because the drug isn’t out for public use yet. And because most pharma companies don’t want the hassle of creating these small batches on their own, they outsource it. This kind of business would give Divi’s margins a big boost.

It made generic APIs. It made custom synthesis APIs. And there was no other company quite like it. Divi’s became a star of the Indian pharma industry. Its share price rocketed by a staggering 1000% between 2010 and 2020.

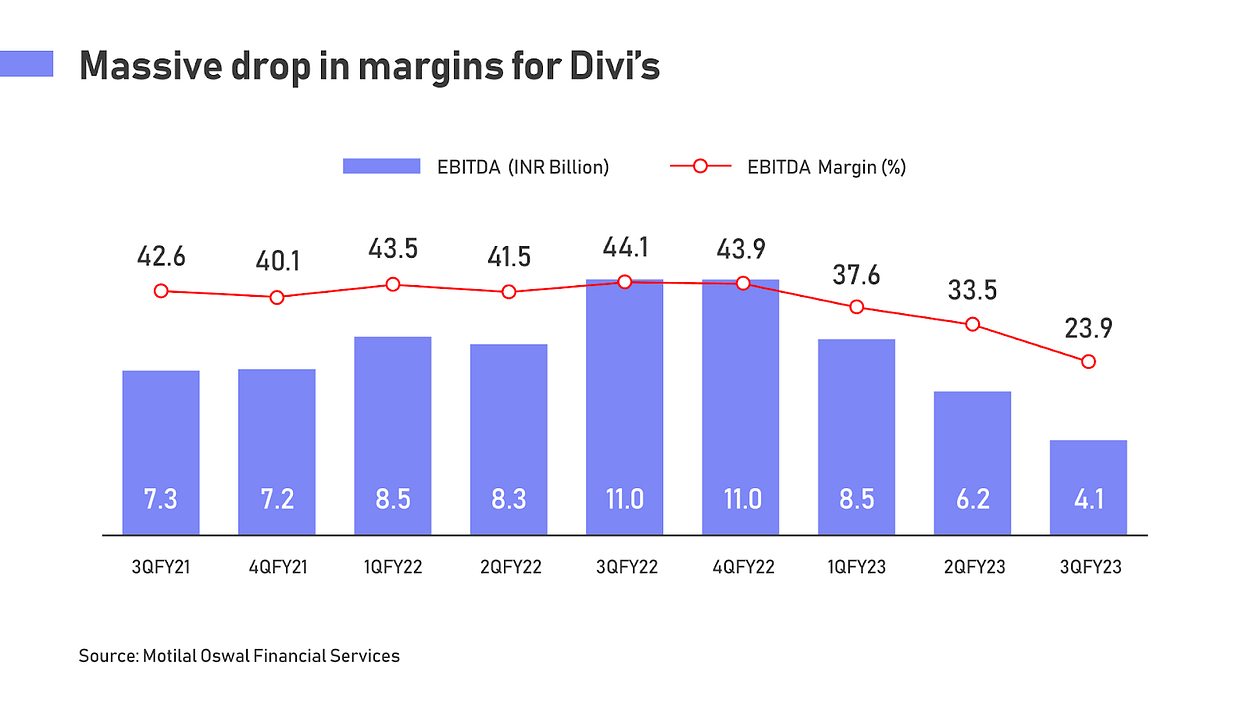

But the last 1.5 years have not been kind to the company. Its shares have crashed by nearly 50%. And more recently, its EBITDA margins for October to December 2022 nearly halved to just 24% compared to the 44% it earned during the same time in 2021.

So, you have to ask — what on earth ails Divi’s?

For starters, blame Covid. While we should be glad that the deadly illness seems to be largely behind us, many healthcare companies had a dream run during the pandemic. Vaccines, tests and drugs were in vogue. And while India didn’t have a listed company that produced vaccines, we did have Divi’s that manufactured the API for one particular Covid drug — Molnupiravir. It was a Covid pill developed by global pharma major Merck and the pill quickly gained popularity across the world. So much so that Merck even allowed other drug companies to make generic versions of it quickly.

But even if a pharma company wanted to manufacture a generic version of the drug, most of them would have to go to Divi’s for the API aka the raw material. It was great. And FY22 turned out to be quite brilliant for Divi’s. The demand for Molnupiravir led to a massive surge in sales. And it was a high-margin custom synthetic business too. Divi’s made a lot of money.

But then Covid faded into the distance. The threat dissipated. Sales of Molnupiravar took a hard knock. Without the covid pill, Divi’s business lost its super-charged growth. Things went back to normal. And while the custom synthetic share had jumped to nearly 60% of its business in FY22, it has fallen back again to just 40%.

Investors were disappointed. They’d bought the stock in anticipation that these good times will continue. But it wasn’t to be.

And the thing is Divi’s custom synthesis business isn’t in its control. Divi’s is dependent on its clients — the pharma giants actively creating new drugs and running clinical trials. This development process ebbs and flows. And Divi’s’ share price reacts to this too. It’s not immune to short-term variations.

Then there’s some turmoil in its generic APIs business as well.

The prices of popular generics have dropped by 5–10%. And that’s creating downward pressure on the margins that Divi’s can earn. Also, while Divi’s creates the API (raw material) for drugs, it still needs its own inputs to make these in the first place. These inputs are called key starting materials or KSM. And nearly 50% of its raw material requirements are met through imports from places like China. And when China went through multiple lockdowns and faced power outages, it led to an increase in the prices of raw materials too. And that hurt Divi’s.

So, should investors be worried?

From a business perspective, maybe not so much.

Because Divis still has a solid API business for generics. The prices are low and stable. And you can expect some degree of consistency in sales. This is the core of the business. The bit that provides stability.

And as western pharma companies reduce their reliance for APIs on China, businesses like Divi’s are well-positioned to capture the additional demand.

Divi’s is also gearing up to meet the demand for drugs that will soon go off patent in the next 3 years. A slew of generics will flood the market then and pharma companies will turn to Divi’s to create APIs for the generic versions.

It’s also expanding the scope of its API. It’s venturing into something called contrast media API. Think of it as injectables needed for medical imaging. It helps to make the structures and fluids in the body clearer during scans.

So growth prospects aren’t dead and buried.

What you have to worry about is the valuation.

Quite often, investors tend to get a bit irrational. They’re prone to flights of fancy. They might look at historical financial performance and see the company has grown by 20% every year. Through all kinds of market cycles. Through regulatory changes. Through turmoil that might be unique to the company.

And then they’ll sit back in their chairs and make these fanciful assumptions and project that the company will grow in a similar manner well into the future. The end result is that they’ll be willing to empty their pockets and pay a higher price today to get a piece of this promising future. At one point, the stock was trading at 50 times its earnings. Simply put, this means investors were willing to pay ₹50 for ₹1 of profits. Quite crazy, no?

But sometimes, those projections go wrong. The growth juggernaut hits a speed bump. Like what’s happening now. And everything goes for a toss. Even a small hurdle can skewer the share price.

The business is probably still solid. But investors ran ahead of themselves.

All that Divi’s can do is keep its head down and focus on relentlessly executing its plans. Like it has done for the past 30 years.

So, what do you think? Is Divi’s a great buy today or is it a case of trying to catch a falling knife not ended yet?

Until then…

You can share this Finshots on Twitter and WhatsApp.

Weekly Wrapup

Also, here's a quick recap of all the things we covered this week. On Monday we talked about Millets. On Tuesday we talked about Elon Musk. On Wednesday we talked about Red Sanders. On Thursday we talked about the angel tax and finally we talked about the Phillips curve