Phillips Curve Conundrum

In today’s Finshots, we explore the (ir)relevance of a popular economic theory from 1958.

Also, a quick side note. If you're someone who has a flair for writing and are enthusiastic to join our creative team, Finshots is looking to recruit Content marketers to work out of our Bangalore Office. Click here to apply.

The Story

Americans are confused.

The unemployment numbers in the US are at the lowest level since 1969! And that’s a good thing because you know that more people are gainfully employed. They’re not out on the streets looking for work.

Also, inflation seems to be cooling down. Prices of goods and services aren’t rising as fast as they did just a year ago.

On the face of it, this is a fantastic state of affairs — Prices are firmly in control and more people have jobs. Right?

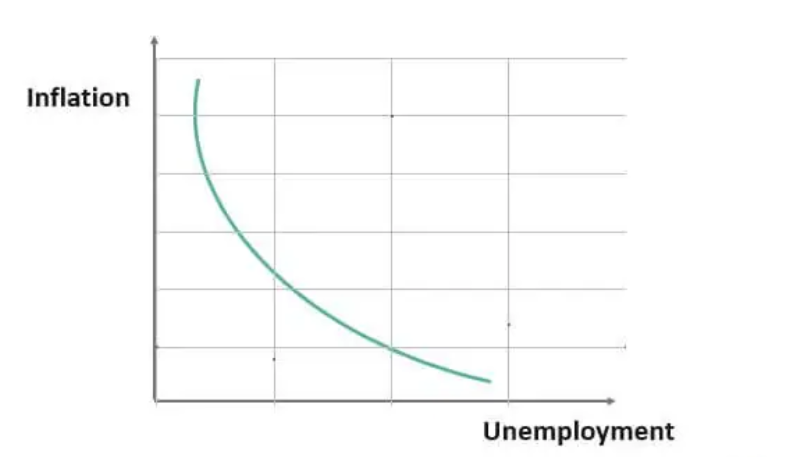

But, according to what economist William Phillips discovered in 1958, the world isn’t supposed to work this way. He’d painstakingly pored over 100 years of data in the UK and realized that unemployment and inflation actually have an inverse relationship. When unemployment falls, inflation rises and vice versa. And this downward-sloping curve that was plotted on paper became famous as the Phillips Curve.

Source: WallstreetMojo

But wait…what explains this weird phenomenon?

Okay, think of it this way — if unemployment is low, it means you don’t have a lot of available workers. And if there are fewer people competing for jobs, the workers can demand higher wages. For instance, if someone earns $10 an hour, they can go up to their employer and say, “Look, you need workers and you have a shortage. Imagine if I leave my position. You’ll be short-staffed. So give me an incentive to stay. I want at least $12 an hour.”

Employers have no option but to oblige. And wage inflation rises.

Since companies price products and services as a markup over their cost, if their labour cost rises, you can imagine they’ll crank up their prices too. So when we go out to shop, we’ll feel the pinch of inflation.

Makes intuitive sense, right?

But central banks don’t like to sit back and watch this unfold. They feel the need to do something. After all, they’re in charge of keeping prices stable in an economy. But they can’t really influence labour supply directly. The only weapon in their arsenal to counter this trend is monetary policy. They tweak interest rates.

Theoretically, a higher interest rate makes it expensive for companies to borrow money. They may hit the pause button on expansion plans. They’ll cut back on hiring. And employment levels including salaries will drop.

The end result? Workers won’t have as much money to spend. Everyone tightens their purse strings. We consume fewer stuff. And when demand softens, prices of things will automatically drop too.

Anyway, the point of the Phillips Curve is to say, “Look, there’s a ‘natural’ state of order. There’s a utopian point on the curve where unemployment will neither be too high nor too low and inflation will hold steady and not cause trouble. It’s not the middle of the curve, but it’s somewhere there.”

Now imagine you’re someone making policy decisions. You could look at the Phillips Curve and see the trade-offs — at 5% unemployment, inflation could be at 3%; at 3% unemployment, inflation could be at 6% and so on. You’d then tweak interest rates to get to this optimal point. It’s not a perfect solution, but everyone likes these heuristics that make life easier.

Remember, this is a very simplified version of the Phillips Curve. And seasoned economists will probably be poohing and paahing at this. But anyway…

This brings us to today. US central bankers are facing a simple dilemma — over the past year, they’ve been hiking interest rates to fight inflation. And it seems to be working. Inflation has dropped from 9% to 6.5%. But unemployment is also at a multi-decade low. So, how will it impact inflation?

It’s tricky. And what the central bank will do really depends on how much trust they place in the Philips Curve. Or even an updated Phillips Curve 2.0 with extra bells and whistles.

Because if they trust it, then they’ll be wondering if the drop in unemployment is an ominous sign of things to come. Wages will rise and push up inflation again. So they’ll feel the best option to stay ahead of the curve is to keep hiking interest rates.

That seems to be the camp the US Fed is on. They believe in the Phillips Curve.

And people are worried that’s a recipe for disaster. Because the Phillips Curve has proven unreliable in the past. Even just as recently as 2013–2016 when both unemployment and inflation remained really low.

But, if the Fed is still relying on it to make decisions about monetary policy, it could be catastrophic. They might ignore the fact that inflation is cooling. They might focus on unemployment and be tempted to hike interest rates to increase the unemployment rate. Get ahead of the problem. Just a little. To get it to a ‘natural state’.

And before you know it, the Fed loses control. Unemployment shoots up. It hurts the common folk the most. And the US enters into a recession.

The economist John Maynard Keynes (allegedly) said, “When the facts change, I change my mind. What do you do, sir?” Well, that’s a question the Fed has to answer about the Phillips Curve. Will the reliance on a suspect economy theory from 1958 take the US into a recession? We’ll have to wait and watch.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

PS: In November 2021, folks at the Reserve Bank of India published a paper to identify if the Phillips Curve is alive and kicking in India. And they found that the Phillips Curve was pretty much dead during a 6-year period from 2014 to 2020. But, they seem to think the curve is making sense again.

Does the RBI rely on it in policy decisions?

We’re not sure. Because when we went through the minutes of the previous 7 RBI policy meetings, we found that no one talks about unemployment and wage growth in conversations about inflation and economic growth. The only interesting observation we saw was in February 2021 when Dr Ashima Goyal said that it’s not wise to create unemployment in order to reduce inflation. Basically — don’t just rely on the Phillips Curve?

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you’re at it.

1. Just head to our website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!