The Insurance Bill 2025 Explained

In today’s Finshots, we look at why India is rewriting its insurance rulebook, and why this reform could either unlock massive growth or expose uncomfortable cracks in the system.

But here’s a quick sidenote before we begin. This weekend, we’re hosting a free 2-day Insurance Masterclass where we’ll walk you through simple rules to pick the right insurance plan and the common mistakes you should avoid.

📅 Saturday, 20th Dec ⏰at 11:00 AM: Term Insurance

How to protect your family, choose the right cover amount, and understand what truly matters during a term claim.

📅 Sunday, 21st Dec ⏰at 11:00 AM: Health Insurance

How hospitals process claims, common deductions, the mistakes buyers usually make, and how to choose a policy that won’t disappoint you when you need it most.

👉🏽 Click here to register while seats last.

Now, on to today’s story.

The Story

Before we get to the meat of the story, let’s go back in time to 1991, when India opened its economy to the world. Liberalisation, privatisation, and, more importantly, globalisation (LPG) reshaped everything from telecoms to airlines to banking. Foreign capital flowed in, competition increased, new industries popped up, and other industries were forced to adapt or perish.

And the impact was unmistakable. Competition broke monopolies, leading to lower prices and better services for consumers. Indian companies learned to operate at global standards. Entire sectors scaled up because capital was no longer the binding constraint. Telecom went from a luxury to a utility. Banking was modernised and digitised, and credit was expanded far beyond the metros. All of these were good for the people, the economy, and the government in achieving its goals.

However, there was an important nuance here. A certain amount of FDI (Foreign Direct Investment) was allowed even before LPG. But it was only for specific sectors and was carefully regulated. Limited FDI was permitted under the FERA (Foreign Exchange Regulation Act or India’s law to limit foreign investment) regime, but only in select sectors, under strict equity caps, and with discretionary government approval. So, the 1991 reforms did not introduce FDI for the first time, but fundamentally liberalised and standardised the rules governing it.

This is exactly what the government hopes to do with the new insurance reforms.

You see, in the early 2000s, private players and foreign insurers were allowed to enter. The sector moved from a state monopoly to a regulated market, with joint ventures such as Bajaj with Allianz and Aditya Birla with MMI Holdings.

Over time, FDI caps were raised from 26% to 49%, then to 74%. Yet insurance never experienced the kind of explosive transformation seen in telecom or banking.

Why?

Because insurance is fundamentally different, when an insurance company fails, the damage is not just limited to shareholders but also to policyholders who may have paid premiums for decades, expecting protection at their most vulnerable moments.

That is why regulators move cautiously. Unlike telecom, where a failed operator can exit, and customers simply port their numbers, insurance failures create social and political fallout. Governments are then forced to step in, either through bailouts, forced mergers, or policy transfers, because letting policyholders lose coverage is not an option. Period.

And this is also why insurance reforms tend to be slow and incremental rather than dramatic. Each change is tested against a simple question: Does this improve access and efficiency without increasing the risk of insurer failure?

Seen in that light, the Insurance Bill 2025 starts to look less like a sudden shake-up and more like a calibrated reset. Let us explain.

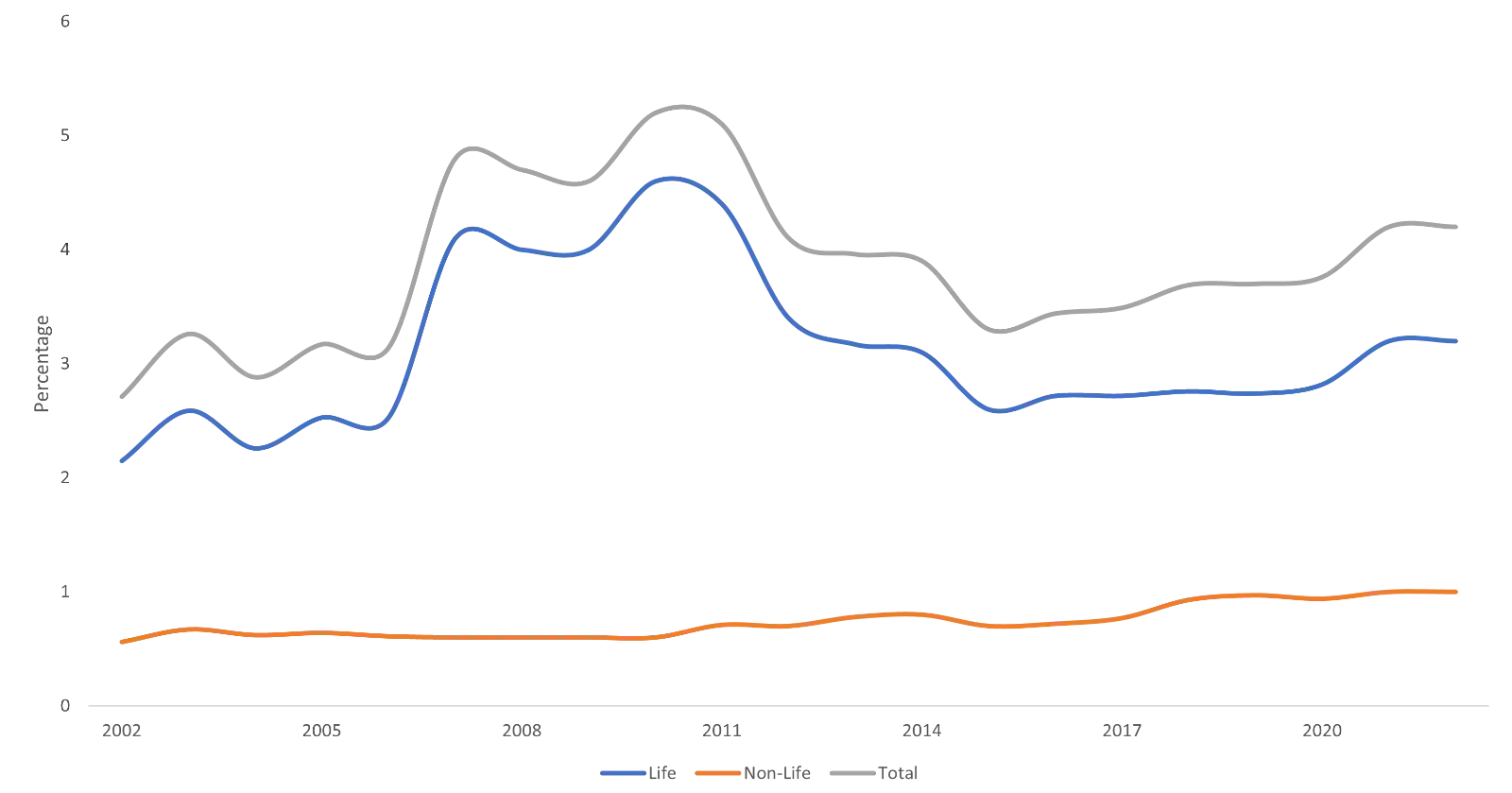

At the heart of the Bill is a simple idea. Currently, India’s insurance penetration is about 4%. And the government wants every citizen to be insured by 2047.

This means that we need more insurance companies, the existing ones need more capital, and certain norms have to be changed for more flexibility and room to experiment. However, they also need to remain stable.

So, what exactly is changing under the 2025 insurance reforms passed in the parliament?

First, IRDAI gets wider and more explicit powers. The new law strengthens IRDAI’s role as a principles-based regulator. Instead of being bound by rigid, prescriptive rules written into the Act itself, IRDAI is given greater rule-making and supervisory discretion. This allows the regulator to issue regulations, modify norms, and respond faster to market developments without waiting for legislative amendments every time the industry evolves.

Second, the government steps back from micro-regulation. Earlier frameworks hard-coded several operational requirements into law, including ownership structures, licensing constraints, and capital rules. The 2025 reforms consciously move many of these from the statute to delegated regulation. That matters because laws are slow to change, while regulations can evolve with market realities. The state retains oversight, but day-to-day control shifts to the regulator.

Third, ownership and FDI rules become more pragmatic. While FDI limits had already been raised to 74%, the real friction was in control and governance conditions. This is probably the main reason for the breakup of Bajaj and Allianz, one of the earliest insurance joint ventures in the country.

The new framework places less emphasis on rigid ownership thresholds and more on effective control, board oversight, solvency margins, and fit-and-proper criteria. Foreign capital is welcome, but only if the insurer remains well-capitalised and compliant with Indian regulatory supervision.

Fourth, reinsurance entry barriers come down. In a nutshell, reinsurance is insurance for insurance. The Bill proposes reducing the capital requirements for reinsurers from ₹5,000 crore to ₹1,000 crore. This is because if there are more insurance companies, there must also be enough reinsurance companies to support them. And this is what creates a healthy insurance industry.

Another unintended advantage could be that with an increased FDI limit, more USD will flow into India. This could stabilise the rupee and control the fall.

So, while these changes are welcome, some trade-offs are easy to miss.

For instance, while 100% FDI sounds like a floodgate moment, capital alone does not solve distribution, trust, or claims behaviour. Some insurance companies are already struggling with a declining claim settlement ratio and customer dissatisfaction. More foreign players could intensify this problem, eventually leading to stricter underwriting and tougher claims scrutiny.

Then there’s the question of who really benefits from competition. Large, well-established insurers will likely gain more than smaller or regional players. And global insurers often enter with deep pockets, excellent actuarial models, and advanced pricing tools. Meanwhile, domestic insurers without scale may find it harder to compete on commissions, technology, or even brand visibility. In other words, the market may grow, but it could also consolidate faster.

So the Insurance Bill 2025 walks a tightrope. It opens doors without throwing them wide open. It welcomes capital but keeps control with the regulator. And encourages growth but also draws clear boundaries around risk.

The Insurance Bill 2025 is one of the most important resets the sector has seen in decades.

But it does not promise instant transformation. Instead, it quietly rewires incentives, strengthens regulatory authority, and creates space for capital to enter without dismantling safeguards. If implemented well, it could gradually push insurance deeper into Indian households, improve pricing discipline, and make insurers more resilient.

But the real test will not be in how many new insurers enter the market. It will be in whether claims are settled fairly, whether products remain understandable, and whether policyholders are protected when things go wrong.

Because in insurance, trust is not optional.

Until then…

Note: The website version includes an additional point on FDI inflows and the rupee that is not reflected in the email edition.

If this story helped you understand the new insurance reforms, feel free to share this with your friends, family or even strangers on WhatsApp, LinkedIn and X.