Sunny Side Up 🍳: Samosas, India’s chai woes and junk food finance

Hey folks! Missed us?

Well, we’re back with some news about samosas. Samosa crusts actually! It seems they’ve been grabbing headlines over the last week.

Samosa Party, a Bengaluru-based eatery (or Quick Samosa Restaurant😉) launched a new dish with just samosa crusts. They call it samosa corners.

All this, inspired by a Twitter user’s poll asking tweeps which part of a samosa they enjoyed more ― the crust, the filling or neither. Turned out, 57% of them liked chomping on the crispy corners.

And that’s how a Twitter poll became a real product.

And why not? Every day around 60 million samosas are sold and eaten in India. It’s a $4 billion business opportunity. With this kind of fan following, it’s quite smart to toss what customers like most on their plates no?

Are you craving for crusty samosas now? Well, that’s the perfect weekend food recommendation!

Here’s a soundtrack to get you in the mood 🎵

Ei Sohor by Kaysee

You can thank our subscriber Sumanth Girish for this awesome recommendation!

And yeah, our next story is about chai. So make yourself some maybe?

Ready when you are.

What caught our eye this week 👀

T for tea, T for tangle

India’s chai market is in tangles.

For starters, Russia is turning to us to import tea because Kenyan tea is getting expensive. Russia is Kenya’s fifth largest buyer. And Sri Lanka’s economic woes are pushing up the demand for orthodox Kenyan tea. Hence, spiralling their tea prices up to an eight-month high!

Which is why Russia’s buying more tea from India.

As of today, India’s tea exports to Russia have gone up 5% over FY22. But this bounce in sales doesn’t seem to cheer our tea growers.

You see, India produces excess tea ― nearly 4–5% more than the global consumption. So, even if Russia’s buying more tea from us, there’s not enough global demand to push prices up. In fact, we’re exporting tea at an average price of ₹163 a kilo against a market price of ₹180.

Besides, Russian demand isn’t even enough for us to meet our tea export targets. Sure, it’ll help prop up our exports to 140 million tonnes from around 120 million tonnes currently. And we’ll still be way behind our industry target of 300 million tonnes.

Unenthusiastic demand means more pressure on tea prices, and nearly 13% lesser income for tea-makers.

So, what’s the solution? You ask.

One way is to work on branding and packaging to make Indian tea more attractive globally.

Another way is well, drinking more tea. And we mean it. Look, on average each Indian consumes just about 830 gm of tea every year. If only we were to stretch that a bit more, then tea producers could actually start getting better prices for their tea.

See? We weren’t just casually asking you to make yourself a cup of chai before you dived into this story!

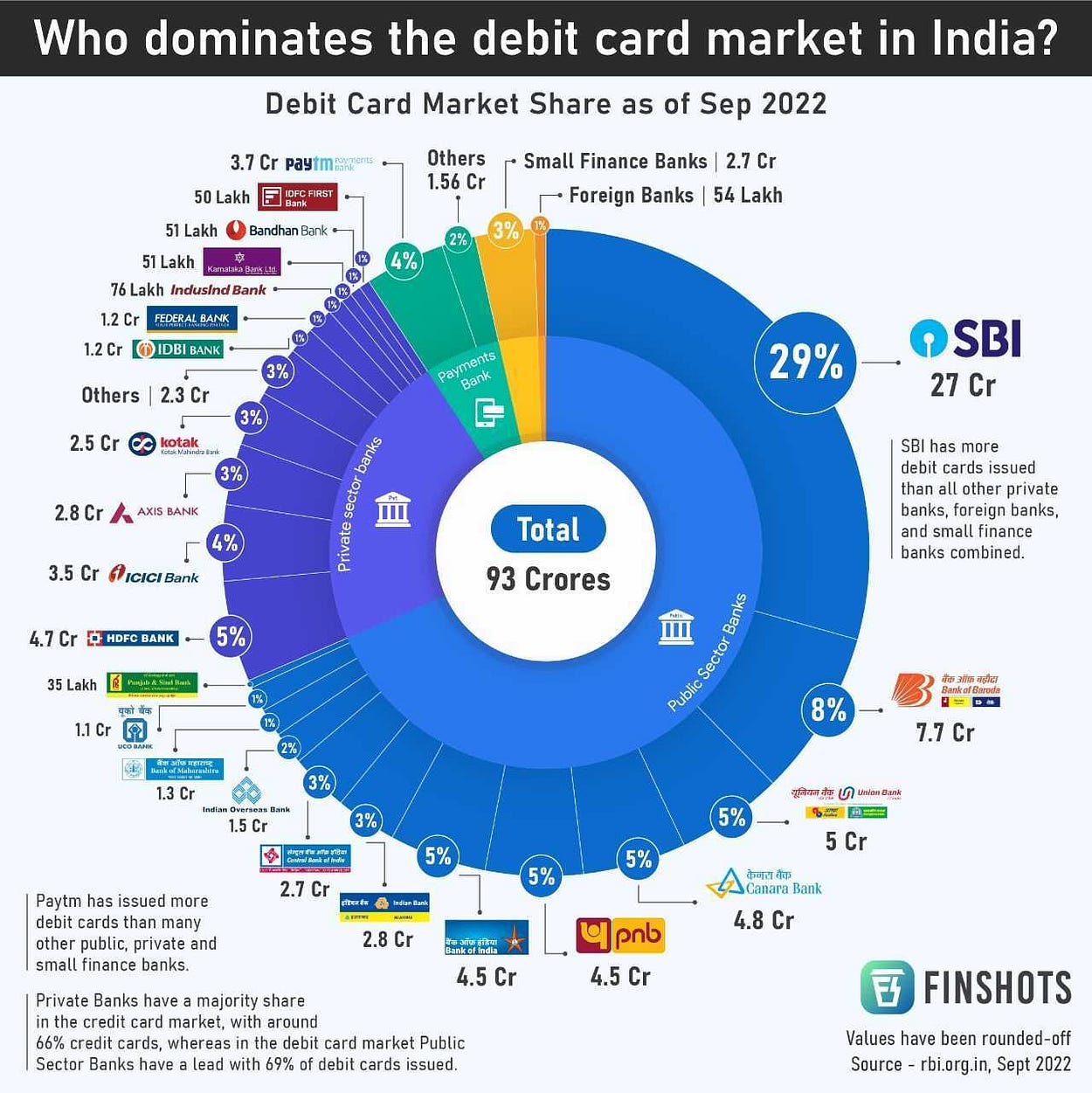

Infographic 📊

This didn’t make the cut ✂️

Remember our story asking — “Who Pays for Climate Change?”

Rich countries that have historically been big polluters have raised their hands at the recent UN Climate Change Conference and said they’re ready to compensate vulnerable countries for years of damage.

But, maybe it’s time for some others to put their hands up and accept responsibility too? Like the fossil fuel folks — oil and gas?

See, it’s no secret that the oil and gas industry is a massive pollutant. In fact, 45% of human-created greenhouse gas emissions in the world come from this industry alone. And as they exploit the world’s natural resources, they’ve been pocketing a massive $3 billion in pure profits every day over the past five decades. Meanwhile, the industry also thrives on various government subsidies worth a staggering $16 billion a day according to the IMF.

So, should they start paying reparations for all the years of damage?

Some folks certainly seem to think so. A couple of months ago, the UN’s Secretary General António Guterres said, “The fossil fuel industry is feasting on hundreds of billions of dollars in subsidies and windfall profits while household budgets shrink and our planet burns. Polluters must pay.”

Burning fossil fuels have helped economies grow over the centuries. But time’s up now! And maybe even reparations are due.

Interesting times for sure.

Money tips 💰

Junk food finance

Don’t the weekends just take your junk food cravings to a different level?

We get it. And that’s why we thought ― Why not explain finance using junk food as a prop?

Let’s start with risks ― the trans fats of the financial world. Look, anything that’s deep fried carries trans fats. Think potato chips. You’ve got trans fats in them and boy, they’re addictive. That’s why you can’t stop with just a few. You always want more.

Risks look a lot like this. If your stocks are doing well because the markets are smiling, you could be lured to pour in more money, instead of diversifying in other stuff like liquid funds or buying gold.

And just like how trans fatty foods are irresistible, risks can be too. Because they’re both hidden. You’ll only see them when the tide turns. The trans fats of the financial world could be bad for your financial health.

Next, we have hidden fees in financial products ― the added sugars of the financial world. Now, you know sugar can affect your weight if you don’t know where to draw the line. But you don’t realise how much added sugar or artificial sweeteners you indirectly consume through those “healthy” oatmeal cookies and diet colas.

Hidden fees can be the same. That no-cost EMI you used to buy your new phone? It doesn’t really come without interest you know. So do many other financial products like credit cards and mutual funds.

And that’s why it’s always wise to look out for hidden charges before you buy.

Last on the list, let’s talk about the empty calories of the financial world. Any guess what this could be?

We’re talking about swayed investments, the ones you make because the news recommends them or because companies decorate their future performance. They may not be making any progress in the right direction, but they might tell you otherwise. It’s like indulging on that piece of cake that isn’t adding any nutritional value.

And that’s why you need to do some analysis before you park your money there because you were swayed by what someone said.

And now that we’ve told you how to avoid junk foods, we also think you should know how important it is to realise these things early on to avoid repercussions in the future. A lot like realising how important it is to insure yourself and your family early on in life, so that your financial planning doesn’t come a full circle.

And if you need any help on figuring out health or life insurance for yourself, just talk to our fabulous advisors at Ditto Insurance (Yup, that’s us)!

1. Go to Ditto’s website — Link here

2. Click on “Chat with us”

3. Enter your query, and RELAX!

Our advisors will take it from there!

And with this guide to junk food finance, we think you’ll be good to go. What say you?

Readers Recommend 🗒️

Industry by HBO

Here’s what our reader Somnath says about this series.

“It’s a series based on how bulge bracket global financial institutions such as Investment Banks work. And how they affect the world through their abuse of power and evil deeds. It reflects upon the cut throat competition in the industry in general. Personally, it’s the best example of the ‘dog eat dog world’ I have ever encountered in my life so far.”

Check it out and let us know what you think.

Quote of the week 🗣️

“Essentially, [Sam] Bankman-Fried constructed the Burj Khalifa on a foundation of quicksand. And now comes the fall.” — Scott Galloway, Professor of Marketing at New York University

What’s he referring to? The collapse of cryptocurrency exchange FTX!!!

If you haven’t read our explainer about it yet, check it out here.

***

That’s all we have for today folks. But before we say toodles, here’s a little something. 🎁

Finshots has managed to reach more than 800,000 readers over the past 3 years. And this wouldn’t have been possible without your endless love & support.

Today, we want to give back. And to celebrate the occasion — we are giving away an exclusive Finshots Reading Kit to 1 lucky winner!

The Finshots Reading Kit will contain an All-new Kindle Paperwhite (8 GB) — with a 6.8" display and adjustable warm light, a premium coffee combo to keep you warm this winter and of course, a gift hamper isn’t complete without our exclusive Finshots mug.

To enter the giveaway and get a chance to win, click here right now to participate. All you have to do is follow 3 simple steps!

So what are you waiting for? Grab your chance now!

Anyway, did you like this edition of Sunny Side Up or did you not? Let us know by replying to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in).

See you next Sunday!