Vedanta takes a U-Turn

In today’s Finshots, we dive into Vedanta’s latest efforts at a demerger.

Also, a quick side note. If you have a flair for writing and are enthusiastic about joining our creative team, Finshots is looking to recruit Content Writers and Marketers to work out of our Bangalore Office. Click here to apply

The Story

In 2012, Anil Agarwal looked at his sprawling commodity empire — copper, iron ore, oil and gas, aluminium — and decided that something was amiss. He felt that it needed a boost. And he decided the best way to do that was to embark on a merger of epic proportions. All the Indian businesses would be nestled under one entity.

The rationale? Back then, Agarwal said, “If you look at the diversified company and the pure play [standalone entities — such as one that focuses just on Oil & Gas, another that does only Power etc], diversified has 30%-40% more value. So it was simplifying the process, creating more value for shareholders.” Bottom line — mergers create more shareholder value. Companies can share resources and cut costs. It will bump up profits.

But cut to today, and Anil Agarwal is taking a u-turn on this philosophy.

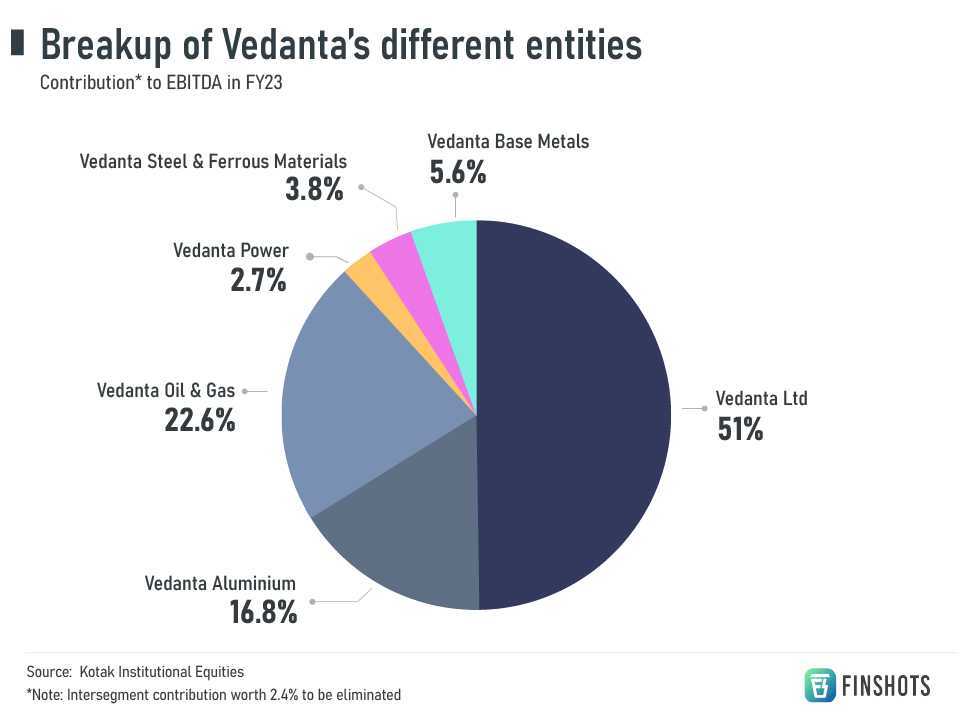

He’s announced a demerging spree. Basically undoing everything he did in the past decade. This time, there will be 6 listed businesses on the stock exchange. Yup, even more than before. So if you currently own one share of Vedanta Ltd, you could soon hold one share of 5 more entities — Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Steel and Ferrous Materials, and Vedanta Base Metals.

What’s the rationale this time, you ask?

Today, the feeling is that “pure-play” listed companies are better. The investing environment has changed. And by listing each company separately, it gives a choice to investors. Someone who wants to dabble in Oil and Gas may not want to touch aluminium. So it might just make fundraising that much more easier. And since each entity will have dedicated management who specialize in that commodity, it could unlock greater value and lead to faster growth.

Now it seems like two completely different and bizarre incidents, no? You might have raised your eyebrows already thinking that Vedanta has lost the plot. Why would someone jump through all these financial hoops in just 10 years?!

But wait…what if we told you that at the core, there’s something that connects the two decisions. It’s debt!

You see, Anil Agarwal’s journey is quite interesting. It’s one of those rags-to-riches stories that everyone loves. He started off in the 1970s as a trader of scrap metals in Mumbai. And then slowly built the sprawling Vedanta Resources (the London-based parent company) conglomerate through acquisitions. But to achieve his ambitions, he needed money. Boatloads of it. So he racked up a lot of debt. As per Forbes, Vedanta Resources (the parent company) had a total debt of $1.7 billion in 2007. But by 2012, it had ballooned to a whopping $17 billion.

With the merger, Vedanta Resources would transfer some of the debt away from its books. It would pawn it off on the newly listed subsidiary. The plan was a 60% cut in its debt.

But that was just a temporary respite. As the company’s ambitions grew, so did the debt levels. And these high debt levels have now become quite a hindrance. The net debt to EBIDTA is nearly 4x. That’s massive. And as per Nuvuma Equities’ report, the parent company Vedanta Resources owes its lenders over $4 billion in repayments over the next year and a half. And credit rating agencies have made a lot of noise about downgrading Vedanta’s credit ratings. Which means that it’ll find it hard to borrow more money. Some of the dollar bonds have been trading in the market at a 30% discount. Investors don’t want to touch it because they fear a default.

And even when Vedanta tried to raise a few billion dollars earlier this year, things didn’t quite go its way.

Do you remember our story from February 2023? We called it “Why the government is unhappy with Hindustan Zinc?” If you don’t, here’s a quick recap. See, Hindustan Zinc is a cash cow. It’s the second-largest miner of zinc-lead and a top 10 silver producer in the world. And guess what…it’s owned majorly by Vedanta. So whenever the parent company (which also has many other companies within it) needs an influx of cash, Hindustan Zinc opens up its coffers and pays dividends. Now Vedanta decided to put Hindustan Zinc to use in another way this year too. It wanted the subsidiary to use its cash and buyout some of Vedanta Resource’s mines in Africa. At a humungous premium. That way, the parent company would be able to pare down some of its debt.

But investors weren’t happy. Hindustan Zinc’s stock price crashed. And the Indian government got annoyed. You see, they had a stake in the company too. And when they saw how Hindustan Zinc’s value was being eroded, they were worried. They felt that if they tried to divest or sell their stake, they’d lose out on potential gains. So they opposed the deal.

Vedanta Resources didn’t get the money it desired.

Finally, it had to sell 4% of its India-listed Vedanta Ltd a couple of months ago in a desperate bid to raise money.

Okay. But how is a demerger of the Indian arm going to help in reducing debt, you ask?

Well, it won’t. At least not directly. It’ll simply split the India-listed subsidiary Vedanta Ltd. into a few bits and pieces. But this could very well be a strategic ploy. Maybe, Anil Agarwal is using this exercise just to buy some extra time. See, this demerger isn’t going to happen overnight. It still needs shareholder approval. Lenders need to weigh in too. It’ll take over a year. And then you have the time it’ll take to really set the ball rolling in each new entity. Some analysts believe that it’ll take 2 years for Vedanta to set its house in order. And that’s enough for Vedanta to go back to lenders and say, “Look, we’re doing everything to ensure that we create a nimbl organisation. Don’t worry about debt. Just refinance us. Give us time and we’ll continue to repay like we’ve always done.”

Maybe that’s the plan. And once a demerger is executed, Vedanta Resources might be able to more easily find buyers who’ll pay up for stakes in the newly listed entities. Maybe that’s the cash that Vedanta will eventually use to settle its dues.

Will it work?

Well, as former Vedanta Resources CEO Tom Albanese told Bloomberg, “Anil has always been a survivor.” He’s been there and done that. And most of the businesses actually generate a nice chunk of profits. So maybe the demerger is going to be the magic pill. Maybe it’ll actually unlock new heights for Vedanta. Or maybe investors will see right through this and there could be even more pain ahead. We’ll have to wait and see.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and X (formerly Twitter).