Do you like Airports?

In today’s Finshots, we dive into why everyone’s suddenly interested in the airport business.

The Story

People are flying again. Air travel is booming. And the travel industry is pleased as punch.

Now if you want to bet on this, you could pick up airline stocks. They’re the ones ferrying all these passengers around. But the problem is that airlines don’t really make too much money. Remember that famous quote attributed to Richard Branson — “If you want to be a millionaire, start with a billion dollars and launch a new airline.” Yeah, it’s a tough gig alright.

But what if you could bet on the very thing that enables these airlines to take off and land?

We’re talking about the airports, of course!

And here’s where it scores over an airline stock. An airline has lots of dependencies — they have to lease aircraft, pilot costs are high, and steep competition means that they’re often jostling to provide cheap fares at a detriment to their profits. And not to forget the turbulence of volatile oil prices too.

Airports have none of that. Sure, it has the fixed cost of setting up swanky terminals. But after that, airlines compete to pay the airports for the best landing slots. And most cities have only one major airport. So it sort of becomes a monopoly. Also, looking at all the new airlines mushrooming around us, it’d be fairly safe to say that it’s much harder to get into the airport business than it is to launch an airline.

In investing terms, airports have what’s often called a moat — or a high barrier to entry.

And this shows up in the numbers too. If you compare the operating margins of listed airports and airlines globally, the difference is stark — airports had average margins of 32% in the four years leading up to the pandemic; airlines had close to 8%. And when margins crashed in the pandemic year, the margins for airports still remained in the green.

So that’s why investors love the airport business.

And the one pure-play airport player that’s listed on India’s stock exchanges has soared by 60% in the past 6 months — GMR Airports Infrastructure.

At the moment, the company operates 3 airports in India — Delhi, Hyderabad and a new one in Goa. But there are another two in the pipeline at Bhogapuram (Andhra Pradesh) and Nagpur too. With these airports in the kitty, GMR already has a market share of 27% when you account for air traffic across the length and breadth of India. It even has stakes in a couple of international airports — in Greece and Indonesia.

So how do airport operators like GMR make money, you ask?

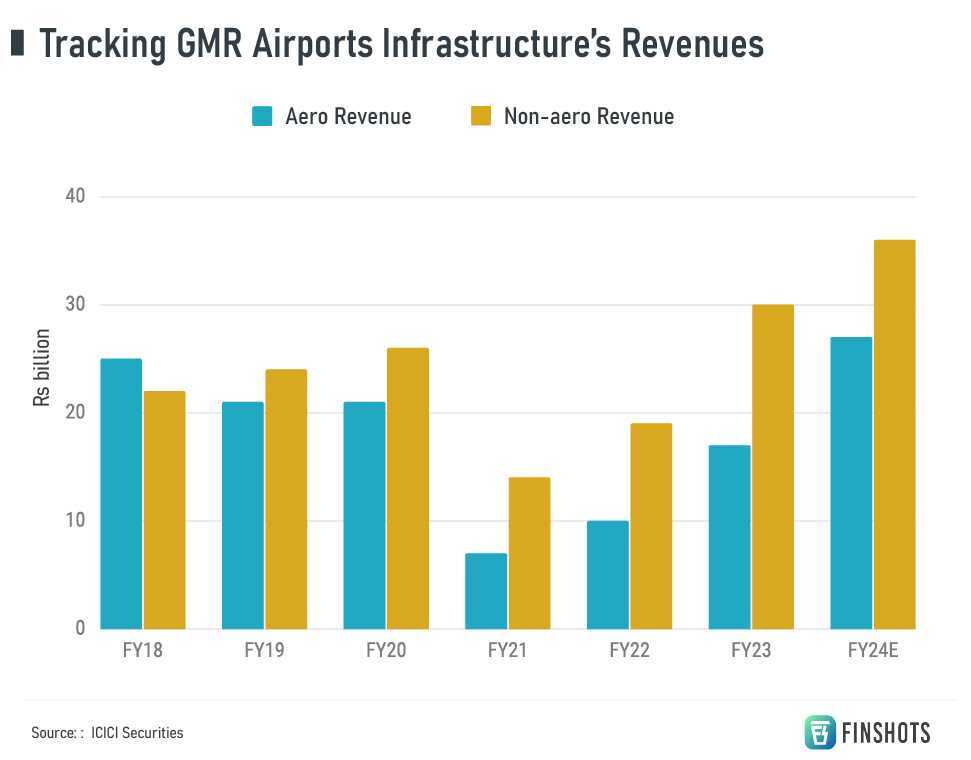

Well firstly, there’s the aero revenues. This could be the stuff like landing and parking fees from airline companies. They might charge user development fees from the passengers. And revenues from handling cargo too. Typically it includes anything that’s directly connected to the business of flying.

Now this might seem very lucrative when air travel is booming. Especially since, as we mentioned earlier, airport operators have a virtual monopoly in a city. They could end up charging quite exorbitant rates. But it doesn’t work that way because there’s a regulator to keep them in check. They’re called the Airports Economic Regulatory Authority Of India (AERA) and their role is to ensure that these airport operators don’t get too greedy. So they have price caps that are determined by a formula that considers the return on capital, depreciation, operating expenses, and taxes.

So airports have to make up for this. And that’s where the non-aero revenues come in. This is the rent that gets paid by the shops and restaurants in the airport. Or it could be from advertising boards and spots that are given out. It might be from parking fees that are charged. And all this adds up to quite a bit of money.

There’s no one to regulate this. At least, most of the time. India’s rules do typically dictate that 30% of these revenues are used to subsidize the airport charges.

But there’s one other bit in the non-aero segment that could be a mammoth revenue generator — real estate. Or what they call city-side development.

See, when operators take on an airport project, they’re not simply building out runways and terminals alone. They also acquire large swathes of land in the vicinity. Maybe they’ll use it for airport expansion later. Or they could even rent it out to others to build warehouses, hotels, offices, and even shopping malls.

And as per a report by ICICI Securities, GMR seems to be sitting on a goldmine of prime land — a total of 230 acres in Delhi, 1,467 acres in Hyderabad, and 232 acres in Goa. GMR can pretty much do what they please on these lands without the regulator butting in. That’s the big monetization potential everyone’s waiting for right now.

GMR isn’t tackling this opportunity alone either. It has actually got a strategic partner on board — Groupe ADP. This is the entity that manages one of the busiest airports in the world in Paris. So you can imagine that it’s quite a catch for GMR. They’re getting top technical know-how. Apparently, while other European airports have struggled to increase passenger spending at the airport in the last decade, the CDG Airport in Paris managed to double it.

So who knows, maybe it’ll have some tricks up its sleeve to aid GMR’s growth too.

And with more interest from international investors coming in, GMR Group is simplifying its business structure too. It’s an attempt to make itself more attractive.

Currently, there are two entities. There’s GMR Airports Infrastructure which is listed on the stock exchange. And this entity further owns GMR Airports Ltd in partnership with Groupe ADP. But with the clean-up and merger, everything folds into GMR Airports Infrastructure. That’ll be the last man standing.

But what about the risks?

Now we started the story by saying that airlines are prone to burning out. They fail quite often and they fail hard. But we have to point out that it could happen to airport operators too. Maybe to a lesser extent, but, it’s still possible.

Just look at what happened during the pandemic. With air traffic at a standstill, Europe’s top 20 airports had to raise money to survive. They racked up debt that was worth nearly 60% of their annual revenues. And many feared there would be bankruptcies. In fact, an airport in the German city of Frankfurt ended up filing for bankruptcy in 2021.

Could it happen with GMR too?

Well, you never really know. The group, which is also involved in building roads and commercial properties, has been in all sorts of debt trouble in the past. So that’s not very encouraging. Also, a report by Kotak Institutional Equities says that GMR Airports’ expansion spree in building out new terminals has led to its debt ballooning. Debt had hit 10 times the value of its equity and that’s never a good thing.

But the only thing we can say is that most of GMR’s airports are in high-traffic areas. And they command a near monopoly in those prime cities. As air travel becomes affordable for more people, you’d expect the steady stream of passengers to only rise. Sure, there’ll be competition from high-speed rail networks, but it may not necessarily make a huge dent immediately.

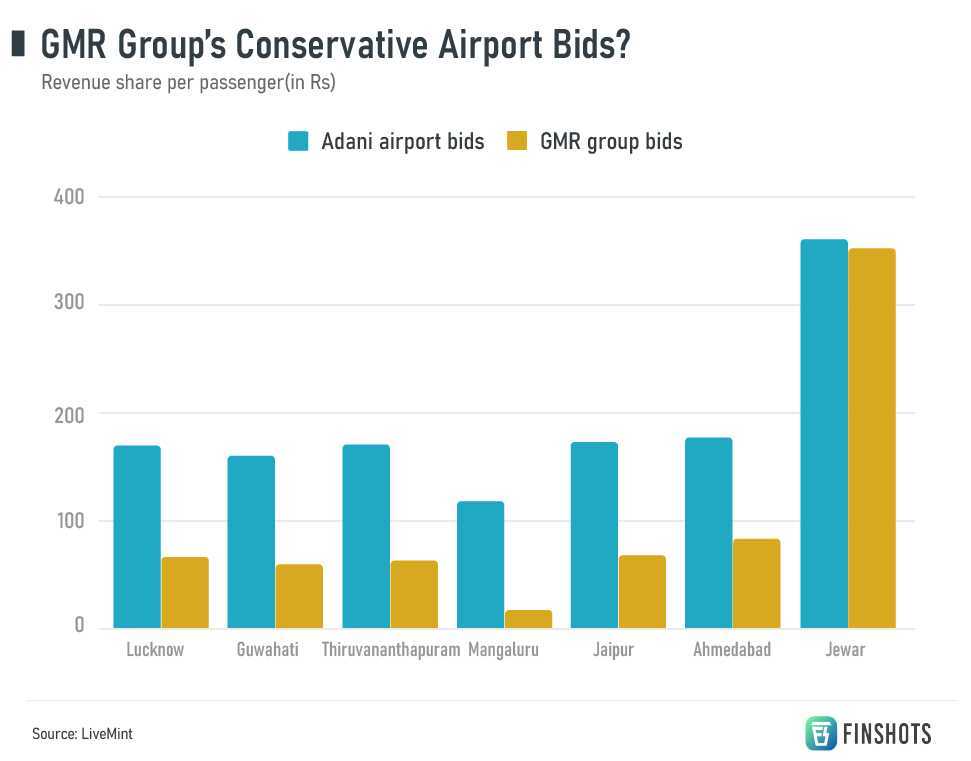

Also, GMR doesn’t seem to have gone overboard in bidding for new airports in the past either. For instance, in 2019, when the government opened the opportunity to run the airport in Ahmedabad, GMR only offered to pay a revenue share of ₹85 for each passenger. Adani, on the other hand, bid a mind-boggling sum of ₹177. So maybe the bid was a good sign that they’re being prudent and not aggressively expanding for the sake of it? And maybe they’ll employ a similar strategy when the next set of airport bids come up in 2024.

So the only question that remains is— Is the stock too expensive already?

Well, despite all the positives around the stock, the interest on debt is eating away at the income. GMR Airports Infrastructure’s bottom line is still in the red. And that’s what investors will have to keep an eye on before placing their bets.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and Twitter.

PS: There’s one other way to play the airport space. And that’s through the Adani Group. It has a listed stock called Adani Enterprises that owns 100% of Adani Airports. But the problem here is that with Adani Enterprises, you’re also getting a whole bunch of other businesses — roads, mining, data centres, green hydrogen…it’s quite eclectic.

STOP PAYING BILLS FROM YOUR OWN POCKET!

Your one hospital visit can cost you anywhere between ₹50000 to ₹5 Lakhs! That’s enough to wipe out one year's worth of savings in just a few days.

But, why?

Because medical inflation is growing at over 10% in India. A simple room’s rent can set you back quite a lot. Moreover, you’ll get no tax benefits if you pay your bill out of pocket!

However, comprehensive health insurance can protect your savings, reduce your taxable income & beat inflation all at once.

But, who can you trust with buying a health plan? Well, the gentleman who left the above review spoke to our team at Ditto.

With Ditto, you get access to:

- Spam-free advice guarantee

- 100% free consultation from the industry's top insurance experts

- 24/7 assistance when filing a claim from our support team

And you too can talk to Ditto's advisors now, by clicking the link here