Breaking down ITC’s businesses

We’ve written about ITC a few times in the past. But we’ve never really pieced its entire business together into one snapshot. So we decided to change that and put together a summary for you. But if you prefer watching a comprehensive 30-minute explainer instead, click here. You’ll love it!

Cigarette Monopoly

113 years ago, the British decided that it would be a great idea to manufacture and sell cigarettes in India. So it created the Imperial Tobacco Company. And even though ownership shifted to the hands of Indians and the name was shortened to simply ITC, one thing hasn’t changed. At its core, it’s still very much a cigarette company.

And in some sort of way, it owes at least a part of its success to the government, For starters, there’s the ban on advertising tobacco and tobacco products. This was a body blow to new entrants but for ones already selling the sticks, it didn’t matter too much. Their brand name held up — Wills and Goldflake really didn’t need much advertising.

Now in order to manufacture cigarettes, you also needed a licence. And the government wasn’t doling this out. This helped ITC further strengthen its position.

Also, the government even banned Foreign Direct Investment (FDI) in the tobacco industry in 2010 which eliminated the threat of foreign competition.

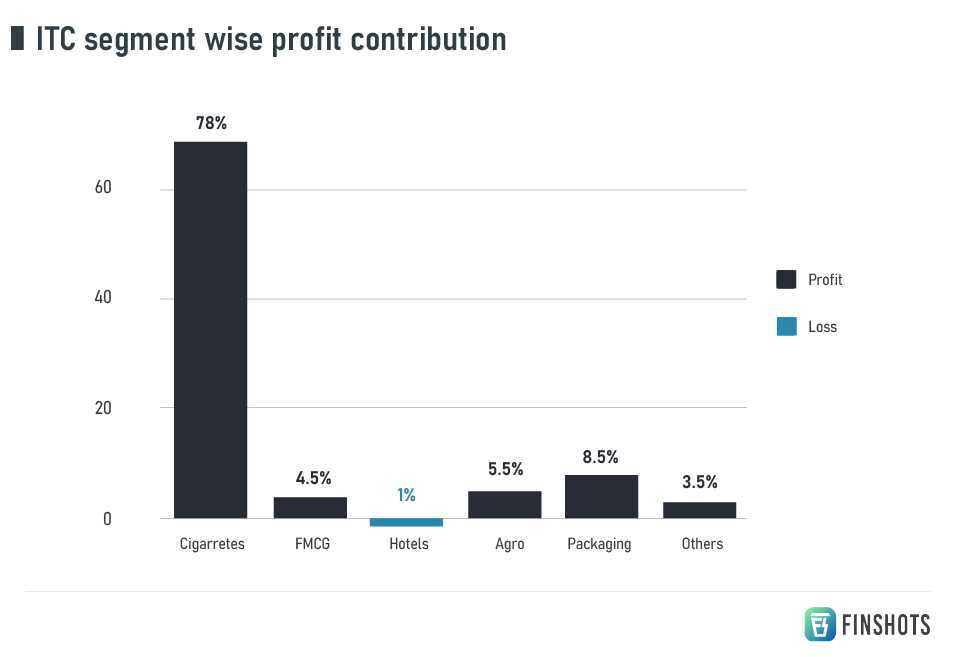

The end result was that ITC became a virtual monopoly that controls nearly 80% of the legal cigarette industry. And this cigarette business alone makes up close to 75% of the company’s operating profit,

Sure, revenues from cigarettes may not keep rising and rising. After all, people are getting more health conscious. But ITC keeps making money. It keeps hiking prices. It’s reducing the length of its sticks. And since consumption is fairly inelastic — demand is less affected by price hikes because people are addicted to it — it’s able to enjoy hefty profits.

In fact, the volumes are actually going up again since the government hasn’t fiddled with the taxes on cigarettes too much. And since the price hikes haven’t been unbearable, people are eschewing illicit cigarettes for legal ones. ITC is riding that wave. In the quarter ending December 2022, cigarette volumes grew 15% compared to the quarter the previous year. So suddenly there’s renewed optimism.

ITC needs to keep this cash machine whirring because of its diversification ambitions.

FMCG Behemoth

In 2001, ITC made perhaps one of its most ambitious moves ever. They entered the Fast Moving Consumer Goods (FMCG) business. But they did it by launching Ready To Eat foods. Like the Mughlai Paneer. All you had to do was empty the packet into a pan and heat it for a few minutes. Super convenient but super new as well. And Indians were not very used to this idea. So it wasn’t exactly a roaring start.

But within the next couple of years, they would introduce new brand product lines that are now pretty much iconic. In 2002, they launched Aashirvaad Atta. In 2003, they would launch Sunfeast biscuits. And this became massive. The atta turned into the biggest branded one in the country. And Sunfeast stormed the cream biscuit segment.

And in FY2022, the FMCG business alone contributed nearly 16,000 crores to the top line. That’s massive for any FMCG business.

Ideally, this should have made investors very happy. But they’re not.

And that’s because while the FMCG business has potential, it’s a long game. You can’t build brands overnight. And it took ITC 2 decades to get to where it is today. So if ITC wants to have 10 brands that can all whip up ₹3000–4000 crores in revenues each, it is going to take time.

And investors aren’t the most patient bunch.

Because they’re also eying the margins. Since brand building and setting up manufacturing guzzles a lot of money, it compresses the margins. In FY22, the FMCG business had EBITDA margins of 9.1%. On the other hand, HUL posted EBITDA margins 23–24%.

ITC doesn’t have too many high margin plays in FMCG. Yet.

Paperboard and Packaging

Truth be told, there’s not a lot to say about this division because in the past few years, growth has been hard to come by. Between 2016 and 2021, revenues merely increase from ₹5300 crores to ₹5700 crores. Profits meanwhile increased from ₹910 crores to ₹1100 crores. Nothing extraordinary.

Sure, after the pandemic, demand boomed. People were shipping stuff and buying stuff and there was greater demand for packaging. Especially from e-commerce. And ITC managed to bump up its revenues and profits too. The revenue suddenly jumped from ₹7600 crores and profits to ₹1700 crores.

It actually turned out to be the second highest profit generating division in the company. But it hasn’t been a great money spinner in the past and it’s tough to say that it will be in the future.

Agricultural Commodities

Most people don’t think much of ITC’s agribusiness. But the scale at which they operate is extraordinary. ITCs association with farmers goes all the way back to the early 1900s. And today, they’re one of the biggest buyers of agri-produce in this country. They source over 4 million tonnes of agri produce from 22 states in India and they are one of the largest exporters of agri commodities.

So you would think that investors would be pleased about this. Well, they are, but there are issues.

Mainly the financials. During FY2022, the segment contributed ₹16100 crores to the company’s top line. That’s almost 26% of the total revenue. Unfortunately, earnings (before interest, tax etc) added up to only about ₹1000 crores. That’s an operating margin of roughly 6%. Not too bad. But you have to remember how agri-commodities work. This business is volatile. One bad monsoon and everything goes for a toss. Their margins can disappear.

There’s also another problem. About 20–25% of the agri-business’s external turnover comes from leaf tobacco alone — the raw material that goes into making cigarettes.

And with cigarette volumes dropping globally, this leaf tobacco business doesn’t look attractive either. Which is why ITC is trying to diversify. They’ve ventured into frozen shrimp and frozen peas to make better margins.

Glitzy Hotels

Hotels are extremely capital-intensive. It needs years and millions of dollars to get them up and running. Then you have to worry about maintaining its pristine condition every day too. Not to forget the seasonality — you have months when it’s packed. And months when it’s practically empty. It’s quite tough.

And for ITC it’s not even a big contributor. Not in terms of revenue nor in terms of profits. Revenues for FY22 barely touched ₹1347 crores. That’s less than 2% of the total revenues. Earnings are even worse. The segment reported a losss of around ₹180 crores. Now bear in mind, 2021 and 2022 were pandemic years and hotels across the world took a beating. So the earnings figure are a bit misleading. But in the best year, profits have never breached the ₹200 crore mark. It’s just not a money spinner.

And even worse, it keeps eating capital. Every year ITC sets aside hundreds of crores to keep the hotel business running. But the return on that capital? Merely 2% on average. So if ITC simply did a fixed deposit, they could earn a better return on capital.

But right now, this segment is in a purple patch. Call it the post-pandemic revenge travel or whatever but hotel occupancy rates are through the roof. So investors are excited about this too.

IT Boom

Finally, there’s the ITC Infotech. Now this may not be a huge revenue earner but it also doesn’t chug a lot of capital. In FY22, the division reported revenues of ₹2288 crores and net profits of ₹518 crores. Very respectable numbers.

And the end result of all this?

Well, in FY22, the company reported gross revenues of nearly ₹60,000 crores and net profits of ₹15,000 crores.

Quite extraordinary, no?

So yeah, that’s the ITC business in a nutshell for you. And if you want to know how investors have been reacting to its business prospects over the past few years, don’t forget to check out the video.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.