A TVS IPO after 29 years and an NSDL IPO that could be coming soon!

In today’s Finshots, we dive into two stories. The first one is a video explainer on the NSDL IPO and the other one on TVS Supply Chain Solutions whose IPO is just around the corner.

The NSDL IPO

NSDL is one of two depository services currently operating in India. And the company is soon going to go public. So we thought we could put together a quick explainer on how the IPO is shaping up. And honestly folks, this is a video you have to watch. It's got scandals, tectonic shifts and a great story behind it all. Here's the link.

The TVS SCS Story

In the 1900s, Henry Ford set about revolutionizing the automobile industry. He found suppliers in the neighbourhood. He brought the material to the factories. He got his team to automate and assemble it. He took out ads in the papers to stir interest. And he even bought his own fleet of trucks, railways, and ships to get the cars to buyers.

He controlled everything.

But over time, carmaking began to get complicated. The world became globalized. A carmaker might have one factory in the US. And another in Australia. The supplier of parts could be in Taiwan or Japan. The customers could be in the UAE or South Africa. Spares for repairs had to crisscross all around the world too. There were a lot of moving parts.

Carmakers simply wanted to make good cars. And make money. They didn’t want the hassles of having too many things on their plate.

So they began to outsource bits of the process. And they began with ‘logistics’. Instead of owning trucks and fleets in-house, they’d hire a logistics expert to handle the delivery.

But soon, logistics companies began to get more ambitious. So they went to carmakers and said, “Listen, we believe your processes are actually quite inefficient. You stock too much inventory. There’s material wastage in your factories. Your warehousing costs are too high, etc, etc, etc…We can help you streamline everything — from sourcing materials, demand forecasting, warehousing, monitoring and the final delivery of products. Even handling spare parts and repairs. We’ll add our technology to the chain, track everything and reduce turnaround times. We promise we’ll improve your margins.”

This folks is what’s now known as ‘Integrated supply chain solutions’. It’s a start-to-finish service that links each part of the chain to the other.

Now while we’ve used cars as an example, these solutions could be deployed in any manufacturing industry. It could be for an electrical company that makes fans and switches. It could be for an FMCG company that makes personal care products like shampoos and soaps. Even a pharma company that manufactures drugs. Anyone.

For instance, in 2016 American grocery chain Walmart decided to trace a package of sliced mangoes to its source. The team had all the data. But it still took nearly 7 days to get the required information to trace its path. But then, they got a special supply chain tech solution on board. And voila, the information was available at the snap of the fingers — in just 2 seconds.

Imagine what such things would do for efficiency in an organization, eh?

Well, that’s the market that folks like TVS Supply Chain Solutions are trying to capture. We say ‘trying’ because the industry is quite nascent. Manufacturers haven’t warmed up completely to outsourcing it all just yet. And that means, ‘supply chain solutions’ are just a tiny sliver of the logistics pie in India. TVS’ IPO document says it’s just 5% of the overall logistics business.

So one way to look at it is that the opportunity is quite immense here. The pandemic has shown us how it can disrupt supply chains across the world. And more and more companies are realizing that they need help to fix things. Not to forget that India is trying to become a manufacturing hub too. We’re doling out incentives to attract manufacturers of all kinds — electronics, textiles, pharma, automobiles. And when foreign companies set up base here, they’re going to need all the help they can get.

And maybe TVS Supply Chain Solutions is best placed to capture this shift. It does claim to be the pioneer in the domestic industry. That’s probably a fair assessment if you think about it. The parent company has been around for over 100 years. And they manufacture two and three wheelers, tyres, electronics and a whole host of other stuff. They have the experience of dealing with the entire supply chain. So it probably made sense to just spin it off as a separate entity and service the needs of other companies across the globe.

Much like how Amazon started AWS as an internal project and then decided it had immense business potential too?

But when a company launches an ₹880 crore IPO, we need to look beyond the stories. We need to filter through the noise to see what’s really working for the company and what isn’t.

On the face of it, TVS SCS is doing a lot of things right.

For instance, if you break down the revenue, you’ll see an almost even split between two sources — one which it calls integrated supply chain solutions (ISCS) which deals with whatever we mentioned earlier and the other which is called network solutions (NS) that handles the logistics bit through freight and air. That means if the ambitious plan of trying to get its foot in every point of the supply chain doesn’t work out, the logistics business will keep it chugging.

They’ve also managed to cultivate long-standing relationships with their clients in both these segments. Their top 10 customers have stuck with them for longer than 10 years on average. So that definitely shows they’re willing to repose quite a bit of faith in TVS’ supply chain capabilities, doesn’t it?

And TVS SCS is not heavily reliant on one industry either. Things are quite diversified. For instance, doing all the supply chain stuff for the automotive industry makes up 23% of revenue. But, it also services the consumer industry which makes up 12% of the money it earns. And tech and tech infra account for another 12%. It’s quite a diversified set of clients. So even if one industry suffers from a recessionary downturn, there’ll be others who can pick up the slack.

Now while that’s all great, drilling down further could raise some eyebrows.

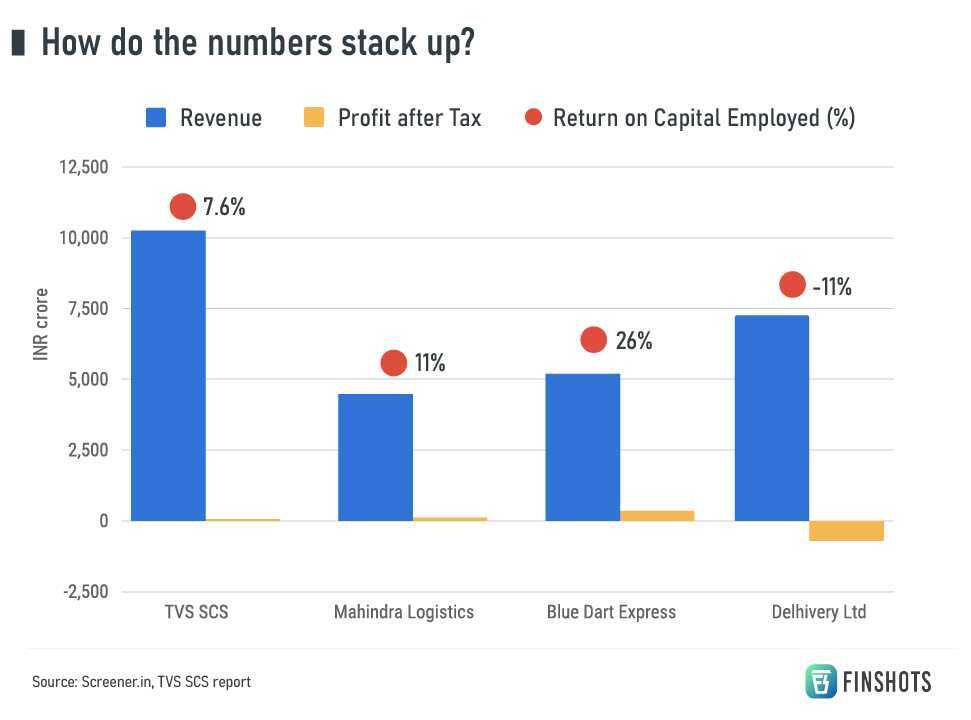

See, while it has massive revenues i.e. ₹10,000 crores and it is one of the highest earners among its peers, it hasn't translated into net profits. It suffered losses in the previous couple of years and just managed to turn a measly profit of ₹41 crores in FY23. Even the return on its capital is in single digits at just 7.6%

What’s going on here?

Well, the truth is that TVS SCS is quite a serial acquirer. It has spent truckloads of money in buying out 20 other companies in the past 15 years. And these are peppered across the globe. Now to finance this, it actually needed to borrow money. Quite a bit in fact. So that’s been an overhang.

All these acquisitions need to be well integrated into its operations and that takes a bit of time and money too.

So despite TVS SCS saying that its operations are asset-light and that it doesn’t own its fleet and warehouses outright, it hasn’t paid rich dividends to the company yet. The lease costs and everything else outweigh the benefits at the moment.

But you could argue that’s why they’re going the IPO route. They claim they’re going to pay off these liabilities now and become debt free. So that’s a good sign.

Also, if you pore through its IPO document, you’ll see something called Category A listed as its expense. And this is roughly 52% of the revenue it makes. What they mean by Category A is a bunch of variable costs that go out of pocket — things like clearing charges, casual labour, and consumption of parts for their fleet.

Now the worry here is that TVS SCS hasn’t been able to keep a check on this. And these expenses have been inching upwards from 44% of revenues to the 52% today.

And finally, there’s the pricing. For a company that has just about returned to profitability, the concern that analysts have is that it’s quite exorbitantly priced — at a P/E of 209 times its FY23 numbers. TVS SCS’s own IPO document says that the average PE of its listed industry peer set on the other hand is 43 times their FY23 numbers.

But none of this seems to have deterred investors so far. They’re buying into the logistics story. They’re buying into the TVS brand name. And as of Thursday evening (the first day of the IPO), the retail portion was already fully subscribed.

So, will TVS SCS see a big IPO pop on listing? What do you think?

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and Twitter.