Why did SEBI ban IIFL Securities?

In today’s Finshots, we explain why the Securities and Exchange Board of India (SEBI) has slapped a temporary ban on the stockbroker IIFL Securities.

The Story

When you take the plunge to dabble in the stock markets, you can’t just go to the company and say, “Hey, I want to buy 10 of your shares.” It would be mayhem if everyone did that. Instead, you have to pick a stock broker. That’s the middleman who’ll help you buy and sell shares of the said company. These folks have relationships with the stock exchange where the said company has listed its shares — such as the Bombay Stock Exchange or the National Stock Exchange. So things just become quite easy.

But to do this effectively, you’ll first need to open an account with your stock broker. You’ll be able to deposit money into this which is used for trading shares. And you’ll be able to see details of all the shares you hold through this account.

Now here’s a question that might spring to your mind now — Can the stockbroker mess with the money I’ve parked in my account?

Well, as per everything in the rulebook, they can’t. See, way back in 1993, the Securities and Exchange Board of India (SEBI) passed a regulation which basically had a clause saying, “A stockbroker must keep all money received from clients in a separate bank account. It should not be mixed with the proprietary money of the broker.”

And the rule was in place just to ensure that brokers didn’t get into anything dubious. That they didn’t use client money for their own gains. For instance, if you kept ₹10 lakhs with your brokers, they could’ve simply used that money for whatever they pleased. They could’ve dipped into it to make their own investments or meet the daily requirements of running the firm. And in case you suddenly asked for it, they could’ve dipped into the extra balance of another client and handed it off to you. No one would be any wiser.

So the rule asked brokers to maintain a separate bank account for their own money. And another one for client monies. In fact, SEBI said that all such client accounts should be clearly labelled “Client”. That way, SEBI could track and follow any money trail easily in the event of any investigation.

And this brings us to IIFL Securities.

So, IIFL has been involved in the broking business for a long time now. And although they’re not in the top 5 of India’s biggest brokers anymore, they were right up there in this list in 2011. They were pretty big.

Anyway nearly a decade ago, SEBI wanted to ensure that their books were spick and span. So they launched an inspection. Maybe they had a tip off or they suspected something, but they launched an investigation to look at IIFL’s records between April 2011 and December 2013. Ensure that IIFL was following the 1993 regulations to the T.

And well, they found that things were a little messy.

See, SEBI looked at a sample of 45 client bank accounts. And found that 26 of these accounts weren’t titled ‘client’ account as the rules mandated. Now sure, you could have argued that it was an oversight. It was merely a labelling issue. But the problem was that IIFL seemed to be taking client money and mixing it with its own money into a pooled account as well. And this was completely in contravention to what SEBI’s rules stated.

Now IIFL argued. It kind of admitted that that it pooled the monies of clients and itself. But it also said that it never touched the client money. It simply used its own money that was also lying in the same pool account.

But any 5th grader can tell you the flaw in that logic, right? Imagine you fill a tub with water from Tap A and Tap B. And then smartly say that you’ll use a mug to remove only the water that came from Tap A. Once the water is mixed, how on earth do you distinguish what came out of which tap? Well, that’s the same thing with money. So you can imagine that SEBI was quite annoyed by that argument.

And since there wasn’t any segregation of monies, SEBI also thinks that it meant that IIFL probably used client money to make investments into its PE debt fund. It probably used client money from the pool account to pay salaries of its staff. It used it to make investments in mutual funds.

Yup, it’s definitely not a good look for IIFL.

But SEBI wanted to check for one more thing when it came to misuse of funds.

See, at the end of every trading day, a client enrolled with stockbroker may have a credit balance or a debit balance. Crudely, think of a credit balance as a case when the client has money in the account or sells shares one day and is owed the money. And a debit balance could be if he/she has taken a margin (a loan) to buy shares and now has to deposit money to settle things.

Now SEBI’s rule is clear — you cannot use one client’s credit balance to deal with a debit balance of someone else. It’s just not done. But IIFL did it anyway. The discrepancy was often to the tune of a couple of hundred crores due to this practice.

And SEBI says that’s a flagrant violation of the rules.

Anyway, the only thing we can say for now is that IIFL didn’t seem to siphon off money. It didn’t use client money to meet its own objectives. And that’s a relief. It wasn’t a massive scam of sorts. Granted there were a few mistakes made. But it took steps to correct them when SEBI pointed out the problems.

But the issue is that any business that deals with money runs on trust. So SEBI’s looking at this breach of trust quite harshly. Sure, it didn’t lead to defaults and losses for clients, but the trust once broken can’t be rebuilt. And it could affect the entire ecosystem. That’s SEBI’s contention. And you can see why they believe IIFL Securities deserves a 2-year ban on onboarding new clients.

But this isn’t the final nail in the coffin yet. Sure, this is SEBI’s final order on the matter after years of investigation. But IIFL will appeal this at the Securities Appellate Tribunal (SAT) and try to get a ruling in its favour. They have some arguments of their own. Especially saying that some of SEBI’s calculations on misuse are based on a circular that came out in 2016. So we’ll have to wait and see what happens.

Until then…

Don’t forget to share this story in WhatsApp, LinkedIn, and Twitter.

Term life insurance prices are rising!

A prominent insurer is looking to increase their term insurance rates in the next few weeks.

For some context: when you buy a term life product, you pay a small fee every year to protect your downside. And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones.

The best part? When you buy early, you can lock in your premiums to ensure they're not affected by any future rate hikes.

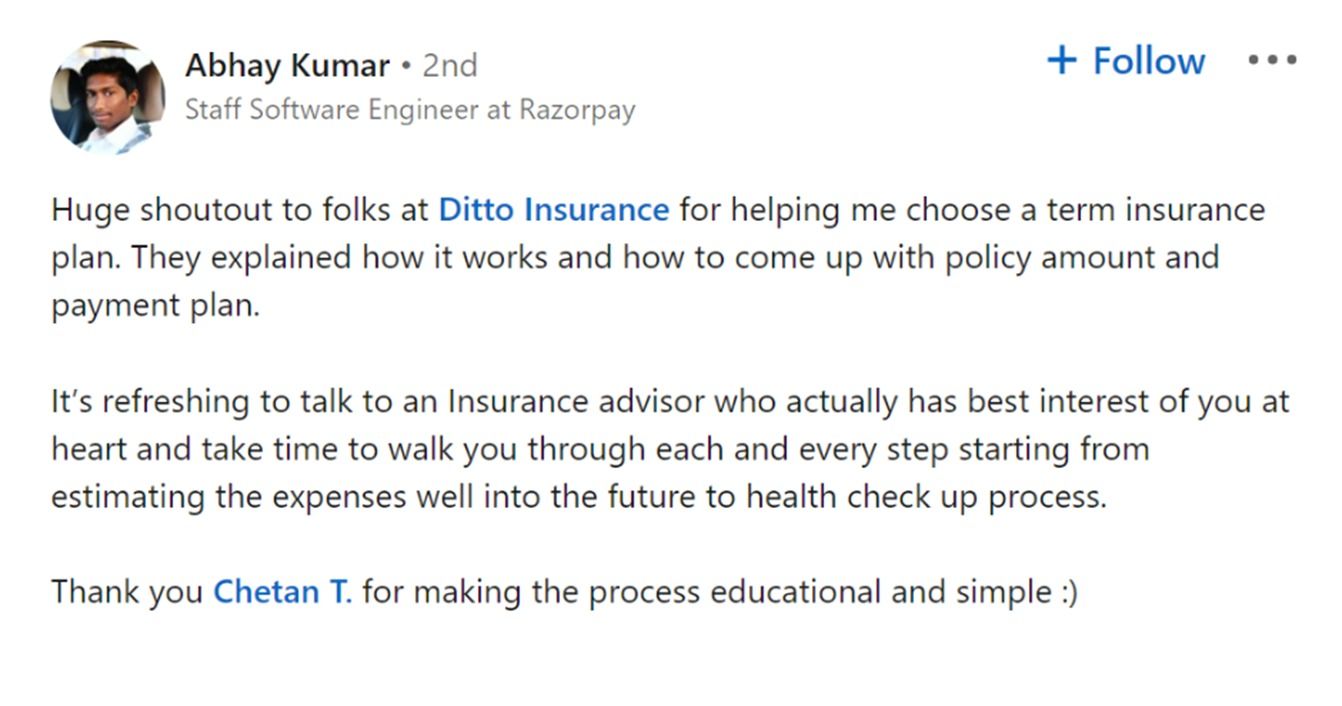

So, if you've been thinking of buying a term plan, now might be the best time to act on it. And to help you in the process, you can rely on our advisory team at Ditto.

Head to our website by clicking on the link here

Click on “Book a FREE call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!