What you need to know about loans against silver

In today’s Finshots, we break down the RBI’s new rules on lending against silver and why everyone is so upbeat about it.

The Story

“Jab ghar mein pada hai sona, tab kahe ko rona?”

You’ve probably heard that catchy Manappuram Finance jingle at some point because gold loan ads are on TV, YouTube, radio, everywhere.

But think about it for another second and tell us, have you ever seen or heard an ad for a silver-backed loan?

Chances are, you haven’t. And it’s not because advertisers forgot about silver. It’s because silver-backed loans never really caught on in India.

Now, there are a few simple reasons for that.

For starters, gold has always enjoyed celebrity status in finance because it isn’t just another shiny metal. It has history, emotion and economics attached to it. For centuries, entire monetary systems were built on gold. Countries used it to back their currency during the gold standard era. And even today, when global tensions flare and economies wobble, central banks quietly add more gold to their reserves. It acts like a safety net when chaos hits.

Even India has had its own dramatic gold story. Back in 1991, when the country was grappling with a balance of payments crisis, it pledged 67,000 kg of gold to the IMF to secure an emergency loan. That’s how trusted gold is as collateral.

So yeah, gold isn’t just jewellery, it's an international financial instrument, a store of value and a symbol of prosperity and stability.

Okay, Finshots, but silver also has value. So why did it never enjoy that same kind of financial reputation, you ask?

Well, there are a few and very practical reasons why lenders prefer gold over silver.

The biggest one to begin with, is storage. See, silver may look light and shiny, but from a lender’s perspective, it’s a storage nightmare. Let’s take a simple example. Suppose you pledge ₹1 lakh worth of gold and ₹1 lakh worth of silver. At today’s prices, ₹1 lakh of gold comes to roughly 8 grams. That’s easy to store and fits into a tiny locker. But ₹1 lakh worth of silver? That’s over 600 grams. Suddenly, you're dealing with bulky metal that needs more storage space, more security, and more insurance. And lenders charge storage fees based on weight or space. So, more silver means more cost for them. Naturally, that makes silver a less attractive business.

But that’s not the only headache. Silver’s price swings like a mood. Over 50% of global silver demand comes from industries in electronics, automobiles, solar panels, medical equipment, you name it. So when the economy slows down or industries cut down production, silver prices react sharply. In fact, silver can be two to three times more volatile than gold on any given day. Gold, on the other hand, is more stable because it isn’t tied to industrial demand in the same way.

Now keep this in mind and imagine what could happen if a borrower defaults on a silver-backed loan. The bank has to sell that silver to recover its money. But since silver isn’t as liquid as gold, it doesn’t attract buyers as easily or as quickly. And that’s bad news for lenders because if prices fall during that waiting period, they take a hit. Simply put, it’s a big risk.

Besides, for years, there was another problem — that of regulation. Unlike gold, silver didn’t have a standard RBI-approved framework for things like purity checks, documentation, valuation or resale. So if something went wrong, say, a dispute over purity or a borrower refusing to pay, there wasn’t a clear legal path to recovery. That scared most lenders away.

Which is why silver-backed loans did exist, but mostly in unorganised corners of the market. Local lenders or a few NBFCs would accept silver as collateral, but loan terms were messy. Low LTVs or loan-to-value ratios (which we’ll discuss in a bit), no standard pricing, no accountability if the pledged silver went missing. Basically, it was risky for both borrower and lender.

That pretty much sums up why gold became the poster child of secured lending.

But the RBI now wants to change that old story. So, about a month ago, it quietly amended the Lending Against Gold and Silver Collateral Directions. In simple terms, it wants to bring silver-backed loans into the formal banking system with just one standard framework for everyone.

The new directions apply to commercial banks, co-operative banks, NBFCs and housing finance companies. All of them must follow the same rules by April 2026. Earlier, each lender had its own way of valuing silver, setting purity checks, loan limits and other processes. It was messy, inconsistent and risky. Now, thanks to the RBI, the entire system is getting a single rulebook.

So what do these rules actually say?

For starters, lenders can only give loans against specific types of collateral like gold and now silver ornaments, jewellery and coins. Raw bullion, like bars and biscuits, is off the table. So are financial products linked to gold or silver, like ETFs.

The RBI also made one thing very clear. Borrowers can’t take these loans to buy more gold or silver, nor can they use them for speculation or trading. Basically, these loans are meant for genuine financial needs, not commodity hoarding or investment games.

Then comes the LTV rule. It simply decides how much money you can borrow against your pledged metal. The RBI has kept this straightforward: up to 85% of the value if your loan amount is ₹2.5 lakh or less, 80% for loans between ₹2.5 lakh and ₹5 lakh, and 75% for anything above ₹5 lakh. These ratios apply equally to gold and silver now. That levels the playing field and gives silver its long overdue legitimacy in secured lending.

But the most significant rule in this new framework is the gold-to-silver ratio of 10:1. Simply put, it means a borrower can pledge only up to 10 kg of silver and a maximum of 1 kg of gold if they’re pledging ornaments, or 500 g of silver alongside 50 g of gold if they’re pledging coins. And while it may seem like a random ratio at first glance, there’s a solid reason behind it.

Remember how banks were always hesitant to lend against silver because of its volatility, storage hassles and poor liquidity during defaults?

This cap directly tackles that problem. Silver is far more affordable than gold, which means people could easily pledge large amounts of it. And that’s risky for lenders because more silver means more storage cost, more handling risk and more exposure to price swings.

So by capping how much silver can be pledged, the RBI is essentially telling banks, “Go ahead and lend against silver, but don’t drown yourselves in it.”

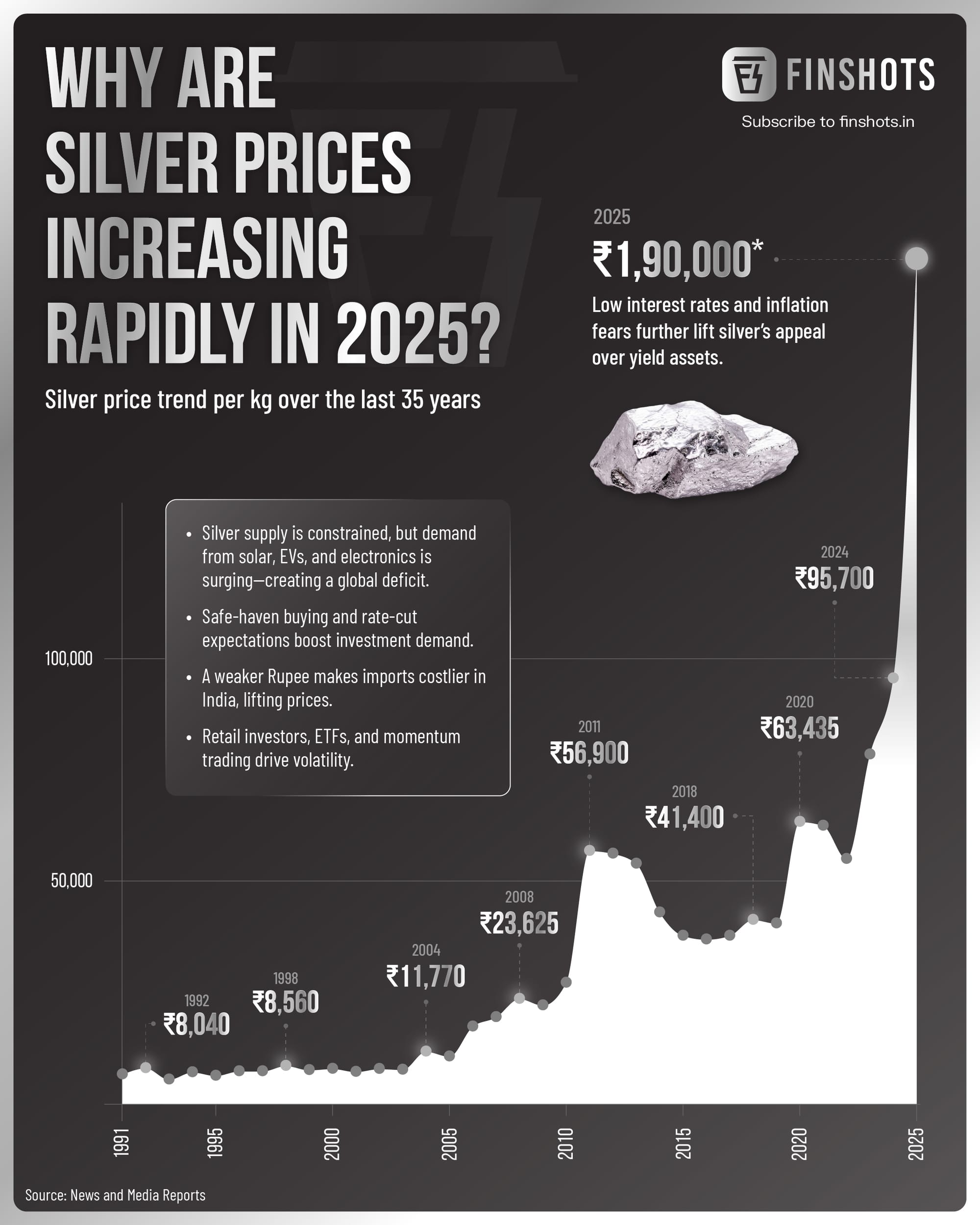

The timing of this move is interesting too. Silver prices have been on a sharp rise lately, not just because of jewellery demand but because industries love it but also because last year, Russia even said it plans to add silver to its State Reserve Fund for the first time. As a result, silver prices have jumped nearly 39% in the last six months, much more than double gold’s 18% gain.

But even with that price rise, silver is still the poor man’s gold. And that’s exactly why the RBI wants to prevent banks from overloading their loan books with silver alone. One big crash in silver prices and things could go south very quickly. And this ratio is simply a risk shield.

What it also does is open up formal credit access to millions of people who own silver but not gold. A 2019 World Gold Council survey found that while 60% of Indian women owned gold jewellery, a close 57% owned silver jewellery. That gap is marginal and it also means that silver is sitting in cupboards across the country — idle, unused and earning nothing.

But now, thanks to standardised rules, people can finally use it as collateral to raise funds when needed.

And there’s more good news for borrowers. For loans up to ₹2.5 lakh, lenders won’t ask for a detailed credit history. That makes it incredibly useful for people who are new to formal borrowing like farmers, small shop owners, gig workers, household businesses or anyone who needs quick money without complicated paperwork. These small loans can even help borrowers build a credit score, making future loans easier.

So yeah, if you’ve heard the recent rumour that the RBI has suddenly allowed silver-backed loans, we hope this story cleared things up. Silver backed loans already existed. What the RBI has done now, is bring order to the chaos. It has standardised silver lending by setting rules, removed confusion and protected both banks and borrowers.

And that means silver finally has a formal seat at the lending table. And for millions of Indians, that could change everything.

Until next time…

If this story cleared the air around all the confusing things you’ve read on the internet about silver-backed loans, then share it with your friends, family or even strangers on WhatsApp, LinkedIn or X, so no one stays misinformed. And tell them to subscribe to Finshots too!

Did you know? Nearly half of Indians are unaware of term insurance and its benefits.

Are you among them?

If yes, don’t wait until it’s too late.

Term insurance is one of the most affordable and smartest steps you can take for your family’s financial health. It ensures they do not face a financial burden if something happens to you.

Ditto’s IRDAI-Certified advisors can guide you to the right plan. Book a FREE 30-minute consultation and find what coverage suits your needs.

We promise: No spam, only honest advice!