What is de-dollarization, anyway?

The US dollar is getting a lot of hate.

A very senior Indian banker called it a ‘financial terrorist’ (though he later backtracked). The French President warned about the ‘extra-territoriality’ of the dollar. The Google search trends for ‘de-dollarization’ are through the roof.

But is it really game over for the currency? In today’s Finshots, we attempt to find out.

The Story

Everyone’s got only one thing on their mind this year — de-dollarization.

For the uninitiated, the US is the most dominant currency in the world. It’s the currency that most countries use when they want to buy and sell any sort of goods and services among themselves. And it’s also the currency that global central banks turn to when they wish to park their emergency foreign exchange reserves.

But over the past year, countries are having second thoughts about the dollar dominance. You see, everyone witnessed what happened last year when Russia invaded Ukraine. The US froze billions of dollars worth of Russia’s assets. They imposed sanctions and kicked Russia off the SWIFT messaging system that’s used for banking transactions.

And other countries freaked out because they too had lots of assets in dollars. They began to fear that the US had way too much power. A trust deficit began to build. And they started talking amongst each other to slowly nudge out the dollar and deal in their own currencies for trade.

As we wrote in March 2022: “If every country starts thinking along these same lines, then it could challenge the dollar supremacy. Perhaps even give rise to an alternative financial order, with some other country leading the pack.”

That’s de-dollarization — An attempt to break the dollar’s iron grip over international trade.

But the question is — Is it so easy to break the dollar? Or is it simply wishful thinking?

Well, let’s try and understand how the US dollar became a powerful currency by rewinding a bit into history, shall we?

So there’s a popular story everyone turns to when they want to explain the dollar’s rise. They begin in 1944 when the second World War was coming to an end. Countries back then realized that they needed to set up a new financial world order for the advent of globalization. So 700 representatives from 44 countries gathered in the mountains of Bretton Woods (US) to hash things out.

And the US emerged a winner because it had an ace up its sleeve. It had accumulated massive reserves of gold thanks to a couple of things.

Firstly, the government had banned its citizens from buying and storing gold just a decade ago. And the government accumulated the gold instead. Secondly, during the second world war, it exported military equipment and took payment in gold.

The end result was that over 70% of the world’s gold reserves were with the US.

So the US used that to its advantage. They said they’d use the base as gold since everyone was used to saving in gold anyway. And they said they’d peg the dollar to gold. It would keep the rates steady. And then, other countries would simply have to piggyback on this and peg their currencies to the dollar.

This one Bretton Woods meeting changed everything. The dollar became powerful. Countries parked their reserves in dollar assets. And it served as the primary currency for international trade.

But, that’s just one part of the story.

In reality, the dollar dominance was already a work in progress by the time Bretton Woods came about.

You see, since the 1820s at least, the British pound had been the reserve currency of the world. Maybe partly because it had a massive empire and forced its colonies into trading with the pound. Or maybe because the country absorbed 30% of the world’s exports. Either way, for nearly 100 years, the pound wore the crown.

But things began to change during the first world war. Britain was neck deep in it and was struggling for money to fund its military. So was France. The US on the other hand had stayed away from the war initially. It had money that the others didn’t. So the American government and bankers hatched a plan to lend money out. And in October 1915, a massive $500 million ‘Anglo-French’ loan was granted. The US was making inroads. And by the 1920s, the dollar had become quite popular.

But it still couldn’t dethrone the pound quickly enough. And there came a point when there were actually two dominant reserve currencies — the pound and the dollar. This shared status continued for at least 20 years before the Bretton Woods meeting.

As you can see, the dollar dominance wasn’t an overnight affair led by one event. It was slow. It was gradual. And even though the British economy was stumbling, it took time for the dollar to really come into its own.

So maybe when everyone talks about de-dollarization, it’s more of a, “Hey, we see this happening in the next couple of decades kind of thing.” Sure, countries are getting increasingly annoyed at the US weaponising its dollar. They want alternatives. But the problem is TINA or There is No Alternative. Unlike how the dollar emerged to replace the pound, we don’t have a like-for-like option today.

What about China, you ask? That’s the direction everyone’s pointing towards anyway.

Well, think about it, will people really trust China more than the US? Of course not. There’s a massive trust deficit here. There’s zero transparency when it comes to economic policies. It doesn’t allow capital to flow freely. It restricts foreign investment into its bonds. The economy is tightly controlled by the ruling party.

Okay, what about India? We’re an emerging superpower, no?

Sure. We may be a lot more transparent about our affairs when compared to China. And we’re increasingly trying to get folks to settle trade in rupees. But we’re still not a completely open economy like the US. We have restrictions on how much of our government bonds foreign investors can buy and such.

Also, as some folks point out — while such bilateral deals have been attempted in the past, they’ve all been short-lived.

So at the end of the day, the dollar is still supreme. Nearly 88% of global trade and 60% of the world’s $12 trillion foreign exchange reserves are in dollars even today despite all this talk about de-dollarization.

To paraphrase the idea of investment professional Brad McMillan, think of switching between Amazon and Flipkart when you want to order something. It seems straightforward but it’s easier said than done. You probably already have a wishlist on Amazon. You have Amazon Prime which gives you insanely quick delivery. You’re used to dealing with it — you know the reputed sellers.

So yeah, the dollar is Amazon. And everyone else is Flipkart. They could share the podium, but as long as the US remains a large and open economy that everyone else wants to play in, switching out of the dollar may not be easy.

And that means we’ll probably be talking about de-dollarization even a decade from now.

What do you think?

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

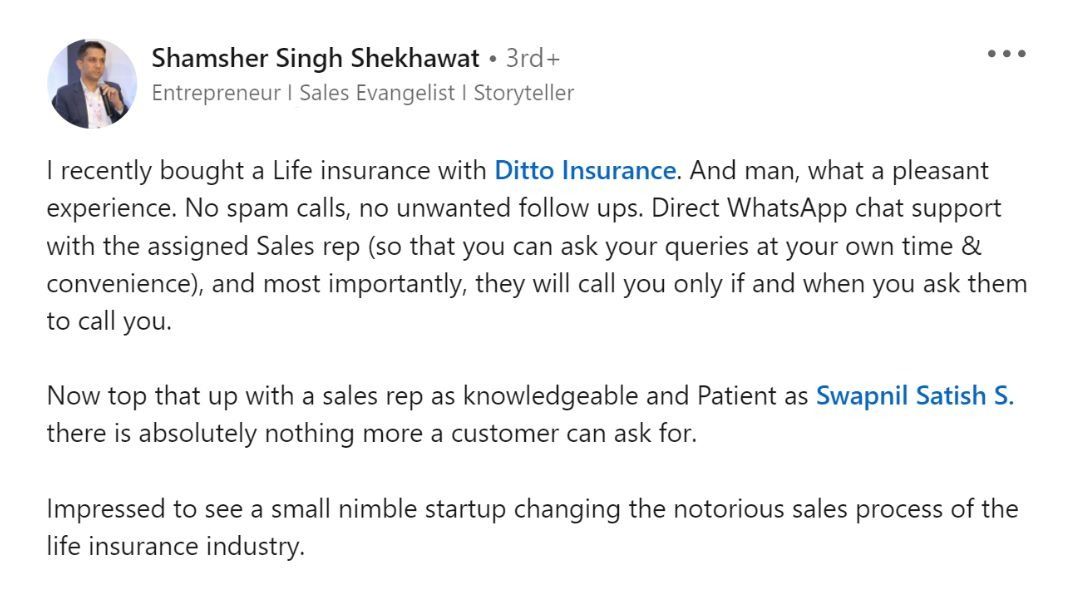

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here