Another one bites the dust

In today’s Finshots, we talk about the merger between Lakshmi Vilas Bank and DBS Bank India.

The Story

Lakshmi Vilas Bank is old. Almost 94 years old. And while it mostly tends to customers in Tamil Nadu, it does have a pan India presence. But over the past couple decades, unfettered ambition and corporate greed pushed Lakshmi Vilas Bank (LVB) on a dangerous path. As we wrote in one of our articles—

It was becoming apparent that the company was no longer content in being a small bank. So between 2010 and 2017, LVB pushed for growth by extending large loans to big corporates. The hope was that these big-ticket loans would aid revenues and profitability in a big way. And truth be told it did. Between FY10 and FY17, LVB’s loan book grew by 4 times and revenues by 3 times. It seemed like everything was going according to plan. But corporate loan books have their own set of problems — A few bad apples and you could be looking at hundreds of crores in unpaid loans.

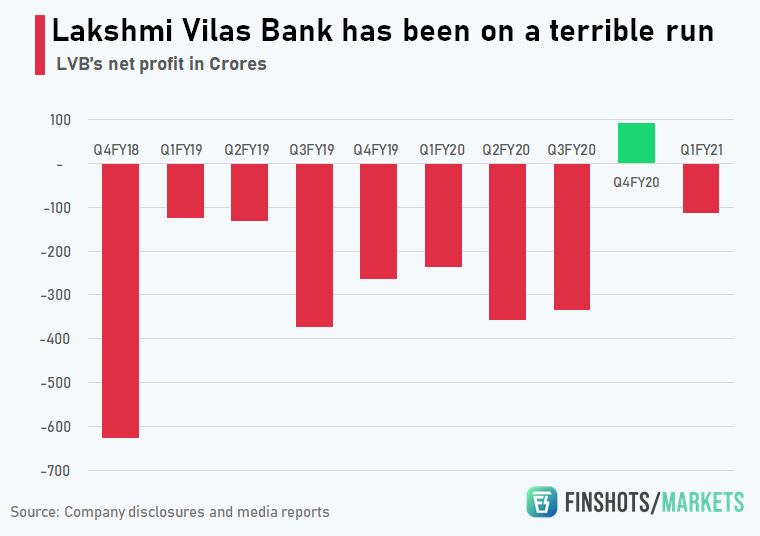

And LVB was no exception here. At the time it had loaned out close to ₹5,000 crores to companies in the Textiles, Infrastructure and Metals space. Companies that were struggling to make their interest payments. And soon enough, the unpaid loans began to pile up. In March 2018, the company reported a loss of ₹650 crores for that quarter. Now although you might be tempted to think this is a negligible amount, note that LVB only made profits of a couple hundred crores during the best of times. So this was a big hit. And it didn’t stop there. The bank has been reporting losses every quarter since.

In fact, when we originally wrote this piece a month ago, LVB's shareholders had ousted seven directors from the company all in one go. The company was running short of funds. Potential investors were still dillydallying. And there were talks about merging the company with Punjab National Bank — another troubled entity. It was in complete disarray.

But then, out of the blue RBI announced a merger between LVB and DBS Bank India, an entity with a Singaporean heritage. As part of the plan, DBS Bank India said its parent would bring in Rs 2,500 crore to shore up the reserves. In return for LVB's customer base, access to 500+ local branches (of LVB) and a stronger foothold in the Indian market. It’s a win-win for both parties. Or at least so it seems.

But although they are calling it a merger, it’s actually not a merger in the conventional sense. In most cases, when a company merges with another company, existing shareholders are offered new shares in the combined entity. But in this case, shareholders of LVB get nothing. DBS will subsume all the assets and liabilities of LVB and that’s it. Nothing more, nothing less. And while this isn’t how most mergers work, banks aren’t like most companies either. They work with public deposits and the regulator aka the RBI has wide-sweeping powers to protect their interests.

Second, the sale is pretty unique. RBI blessing a merger between an Indian and a foreign bank — That doesn’t happen often. Okay, technically, LVB isn’t merging with a foreign entity. It’s merging with a subsidiary of a foreign bank — DBS India and the subsidiary is also tightly regulated by the RBI. However, it’s still quite remarkable that the RBI has blessed the merger considering our regulator has been quite sceptical about foreign banks in the past.

Also, we haven’t yet talked about the moratorium.

Right now, if you are a customer of LVB your options are pretty limited. You can’t withdraw more than Rs 25,000 until December 16, 2020. But in the event of an emergency, or payment towards higher education or marriage, then you can withdraw up to 5 lakhs. And if you are wondering why this moratorium was imposed in the first place, you have to consider the nature of this merger.

The merger isn’t approved yet. It still needs the government nod. And although the plan is likely to go through, it's imperative to plan ahead and see what could happen between now and next month, when the final formalities conclude. If you still have trouble connecting the dots, let me help you a bit. Without the moratorium, people will panic. They will withdraw their funds en masse, and LVB will have nothing to show for it. However, if the proposed merger does go through without a hitch, depositors can rest easy knowing that a big foreign bank is now liable to pay them. There probably won’t be mass hysteria when the merger is finally approved. So the moratorium was essential.

Although, it’s a terrible tragedy that it has come to this.

Another day, another troubled bank. Such a sad state of affairs. Sigh!!!

Until next time…