Weekly Wrapup: The Extraordinary Manyavar & Mohey

Before we get to today's story, a quick recap of all the things we covered this week. On Monday we talked about China's trojan horse. On Tuesday we discussed Credit Suisse's problems. On Wednesday we took the day off. On Thursday we discussed the PM Kisan scam and finally, we talked about Truecaller's true colours

And with that out of the way, let's get to today's story, shall we?

The Story

Over the next few months, your Instagram feed will be packed with images of quirky ‘save the date’ invites, mehendi, and people dancing in banquet halls. It’s a reminder that the Indian wedding season is now in full swing and will likely be an extraordinary season.

Why? you ask.

Well, it’s already a $50 billion industry and when you consider the fact that the pandemic soured the mood the last couple of years, you’ll understand why there’s so much at stake this season. Don’t believe us?

Try booking a banquet hall or fancy rooms in a 5-star hotel between November and January and you’ll see what we mean. Everything’s gone — reserved, taken, booked.

But this story isn’t about hotels. It’s about another business that makes a killing every wedding season — Clothes. More specifically wedding apparel. There are 13 million weddings in India each year. And everybody wants to look their glamorous best. You’ve got the Mehendi, the cocktail party, sangeet, the actual wedding, and the reception. It’s an extravaganza and depending on what you wear, you may end up spending a sizeable chunk of your savings on apparel alone.

And there’s one company that’s come to dominate this space — Vedant Fashions. Now you probably haven’t heard of this company. But these brand names will probably ring a bell — Manyavar? Mohey?

Yup, that’s Vedant Fashions for you. The wedding wear industry isn’t very organized. Branded players only have a 15–20% market share. But Vedant Fashions has firmly imprinted itself in the Indian consumer's psyche. They’ve married Bollywood and Cricket by roping in brand ambassadors like Anushka Sharma and Virat Kohli. They’ve sponsored IPL teams like Kolkata Knight Riders. And they’ve ensured that Indians across the income spectrum first think of Manyavar or Mohey when they think of weddings.

In fact, their revenues have grown by over 24% annually in the past decade. It’s quite something.

But there’s more to this story than just the top line. They have net profit margins of 26%. That’s big, even for this industry. Their peers — Nalli Silk Sarees and Jahanpanah Clothing have profit margins in the low single digits. Even its Return on Capital Employed stands at 41% — it tells you that they’re able to generate Rs. 41 on every Rs. 100 they deploy in the business.

But how did they get here you ask?

Well, the year is 1998. Ravi Modi, a young man working in his family garment business in Kolkata has a fallout with his father. Modi decides to venture out on his own and build his business from scratch. So he turned to his mother, asked her for seed capital of ₹10,000 and set up his own clothing venture selling men’s ethnic wear.

During the first 10 years of the business, Modi simply sold his apparel to outlets that would also stock multiple other brands. He even sold to large stores like Shoppers Stop and Westside. But he missed the pulse of the customer. After all, he spent his formative years directly interacting with customers at his father’s garment shop. But selling through other outlets didn’t give him a sense of what the customer was thinking and feeling. And the outlets didn’t give him data on customer preferences.

So Modi changed his business model. In 2008, he set up Manyavar’s first exclusive brand outlet (EBO). A standalone store that would grab eyeballs. He didn’t want to rely on being ‘one among many’ in someone else’s store.

Initially, it was the COCO model. That is Company-Owned-Company-Operated. But he had to tie up a lot of capital in running these stores. So he changed the structure once again. He moved into franchises. And by 2016, all of Manyavar’s outlets ran on a FOFO model. Or Franchise-Owned-Franchise-Operated. You see, this way, the company didn’t need to spend a lot of money on setting up its own stores.

All it needed to do is pick the right people to run the franchisees, get them to shell out ~₹50 lakhs and set up the stores themselves. Vedant Fashions simply took a fee for lending the brand name and operational expertise.

Then there’s the profit margin.

For starters, both Manyavar and Mohey have positioned themselves as aspirational brands through their advertising. That means it’s able to command a premium. And since weddings are usually once-in-a-lifetime events, people are willing to shell out big money to wear a brand.

If you take a look at Manyavar’s website, you’ll see that the cheapest wedding attire (something that looks like what a groom would wear) starts at ₹12,000. The average selling price for a Mohey lehenga is ₹20,000.

And guess what…if you were hoping to snag one during an ‘end-of-season’ sale, tough luck. Manyavar doesn’t do discounts! Have you ever walked past a store and seen a ‘50% off’ sign? No, right?

That’s because it has all the data in the world about customer preferences that it has been able to limit the slow-moving inventory to less than 4%. Essentially, they don’t have ‘old stock’ to clear and they don’t need a sale.

What about other costs, you ask? After all, most of this ethnic wear requires fancy embroidery and manual work, right?

Well, the company keeps a firm lid on that too. It runs all its operations out of a central warehouse in its home city of Kolkata. It has local artisans and craftsmen who do the work. And it maintains only 25 designers on its payroll. And since the company is all about efficiency, it has been able to slash costs by automating its supply chain — from procuring fabrics from vendors, to replenishing stores with new stocks, and even assigning tasks to their jobbers who create the apparel.

And all this has worked spectacularly for the company.

Since its IPO in February, Vedant Fashions has only seen green. Its shares have zoomed by over 60% and shattered targets set by brokerages. It seems everyone’s only seeing the bull case with some fund managers calling it the next Titan! But there are some issues.

- There’s the valuation for starters. It’s trading at over 100 times its FY22 earnings. Meaning people are willing to pay ₹100 for every ₹1 that the company makes. And that’s crazy.

- Then there’s the concentration risk. While the company has nearly 600 exclusive brand outlets, the top five franchisees account for 30% of revenues.

- And while being completely based in Kolkata has helped Vedant Fashions become more efficient, the geographical concentration has a flip side. Natural or manmade disasters could have a significant impact on their supply chain.

- There’s also the competition. Big names like Reliance Retail and Aditya Birla have noticed that the organized wedding apparel market is still in its nascent stages. And they don’t want to miss out. So Reliance has been aggressively acquiring various established designers in the recent past. We’re talking brands like Manish Malhotra, Abu Jani-Sandeep Khosla, Ritu Kumar, and Satya Paul. Even Aditya Birla has struck deals with Sabyasachi, Tarun Tahiliani, and Shantanu & Nikhil to grab a piece of this pie.

So yeah, Vedant Fashions is sitting in a very pretty place right now. But will this purple patch continue? You let us know.

Don't forget to share this Finshots on Twitter and WhatsApp.

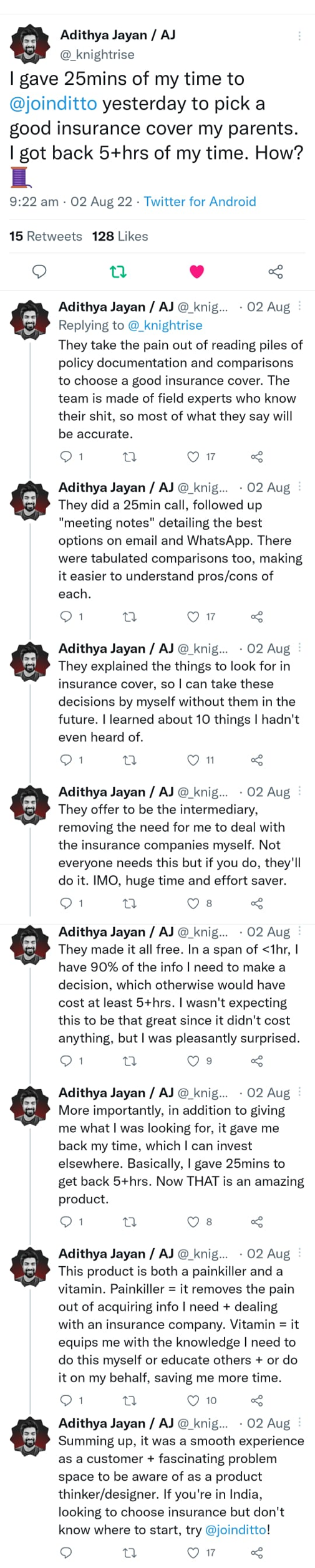

Ditto Extras: How a customer review changed the way we pitch Ditto

A few weeks ago, a customer put out a tweet thread explaining why they enjoyed Ditto so much. You can read the review yourself.

Needless to say, this was an extremely well-thought-out review. But it also did something else for us. It changed our perception of Ditto — the very product that we’d built. Until recently, we’d market Ditto by spelling out in bold “How you can book a free call to discuss all things insurance.” The focus was on the word “free.” After all, why wouldn’t you take free insurance advice if you’re out on the market looking for insurance.

But Ditto isn’t just free. It saves time.

As Adithya noted, you give us 25 minutes, and we’ll give you 5 hours back. This was such a powerful testimony. We obviously knew about it already. But we never actively marketed this bit. But since Adithya’s review came out, we have changed our pitch slightly.

Ditto isn’t just free. We give you back time.

And if you want to save some time, and do something productive instead —

1. Go to Ditto’s website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term or Health Insurance

4. Choose the date & time as per your convenience and RELAX!