🍳The COP hypocrisy, recession recession and more...

Hey folks!

The Economist made an interesting observation this week. It says that apart from the pandemic slump in 2020, the world hasn’t really had a “normal” recession since the 2008 financial crisis. And even after COVID, the global economy has been growing at roughly 3% a year since 2022. Unemployment is low. Company profits are solid. So it almost feels like we’re living through a “recession recession” or a world where recessions have gone missing.

Sounds pretty good, right?

Well, The Economist isn’t so sure. It argues that economies sometimes need small recessions, just like the body needs an occasional detox.

So yeah, recessions are a bit like detoxes for capitalism. They trigger something economists call “creative destruction”. If you read our recent story on why the Economics Nobel went to Joel Mokyr, Philippe Aghion and Peter Howitt, you’ll remember what that means. It’s simply the old making way for the new. When weak or outdated businesses shut down, the people, money and resources tied up in them naturally flow to stronger, more promising companies. And that shift ends up strengthening the whole economy.

And interestingly, research shows that startups born during recessions often outperform those launched in boom years. Microsoft, Apple and Uber are all classic examples.

Now, some rich countries, especially the US, actually look ready for a mild “detox”. Not because everything is crashing, but because a few things look stretched. The US government’s debt has crossed $38 trillion for the first time ever. Nearly 30% of American household wealth is sitting in stocks, which is a record high. And there’s a massive rush of money into AI companies, some of which may not have the strongest long-term prospects.

But modern governments rarely sit back and let recessions run their natural course. They intervene aggressively by supporting households, banks and companies whenever the economy shows signs of wobbling. That prevents downturns, but it also means piling on more public debt.

Which makes us wonder — what about India?

By the technical definition, India hasn’t had a homegrown recession in roughly 40 years. If we ignore the COVID shock (which hit every country), our last real recession was in 1980. The Iranian Revolution and the Iran–Iraq war pushed global oil prices up, India’s inflation shot to nearly 29%, and GDP shrank by around 5%. But after that, India grew steadily through liberalisation, the IT boom, foreign investment inflows, startup growth, digitisation and finally the payments revolution.

Today, India looks relatively stable. Inflation has dropped to a 13 year low of 0.25% recently. Our debt-to-GDP ratio hovers near 81% and is expected to gradually decline. GDP growth is stronger than most big emerging economies. And while market valuations do look stretched, much of that would correct itself naturally if the hype subsided. It’s unlikely to trigger a recession as long as the underlying companies remain fundamentally strong. A bit of selective investing and caution should keep things healthy.

Meanwhile, countries that might actually need a “detox” are working overtime to avoid one. For context, rich-world public debt has climbed to levels not seen in more than two centuries because governments keep writing cheques to prevent downturns. And yet, J.P. Morgan says that the probability of a US or global recession in 2025 has fallen from 60% to 40%.

So maybe we’re just building up more debt and delaying a deeper crash. Or maybe policymakers will keep kicking the can down the road for a while. Until then, enjoy this strange “recession recession” while it lasts.

Here’s a soundtrack to put you in the mood 🎵

Break free by When Chai Met Toast

Ready to roll?

What caught our eye this week 👀

The COP hypocrisy

The 30th annual UN climate change conference (COP30) kicked off in Belém, Brazil this week. And everyone’s focus had been on the traditional questions.

Will rich countries step up with climate finance for developing nations?

Can fossil-fuel-dependent economies make a real shift?

Will Brazil launch a major fund to protect its forests?

Until something unexpected caught their attention. The official COP website itself may be a surprisingly huge emitter of carbon.

Wait... what?

Yup. A recent study by the University of Edinburgh found that the websites built for COP conferences emit up to 10 times more carbon per page-view than the global average webpage. And between the late 1990s and 2024, average emissions from these COP websites jumped by more than 13,000%. For context, the average internet page emits about 0.36 g of CO₂ equivalent per view. But these glossy COP sites now emit more than 2.4 g on average per visit. And in one case, traffic to a COP homepage generated roughly 116.85 kg of CO₂ equivalent — enough to need five to ten mature trees a full year to absorb it.

So why is this happening?

Well, one big reason is digital design bloat. The COP sites increasingly include high-resolution media, interactive features, complex scripts, all of which drive up energy use and emissions.

The study also points out that the COP30 website is not yet verified as being hosted on renewable energy powered infrastructure. Meanwhile, the UNFCCC (United Nations Framework Convention on Climate Change) host-country framework doesn’t currently require sustainable digital infrastructure or energy-efficient web design when approving COP websites. Because resources and attention often go to the physical logistics of the conference, such as the venue, accommodation, transportation, and waste management, digital infrastructure can get neglected.

But this isn’t just a technical footnote. A few years ago, at COP28, the host (UAE’s) website’s “low-carbon toggle” button was criticised as greenwashing when investigations found it barely reduced emissions.

So yeah, even the websites we visit to track climate action deserve a climate check.

Because if the flagship conference of the climate movement can’t match its own digital actions to its ambitions, it basically shows that it has a long way to go on the bigger climate fight.

What do you think?

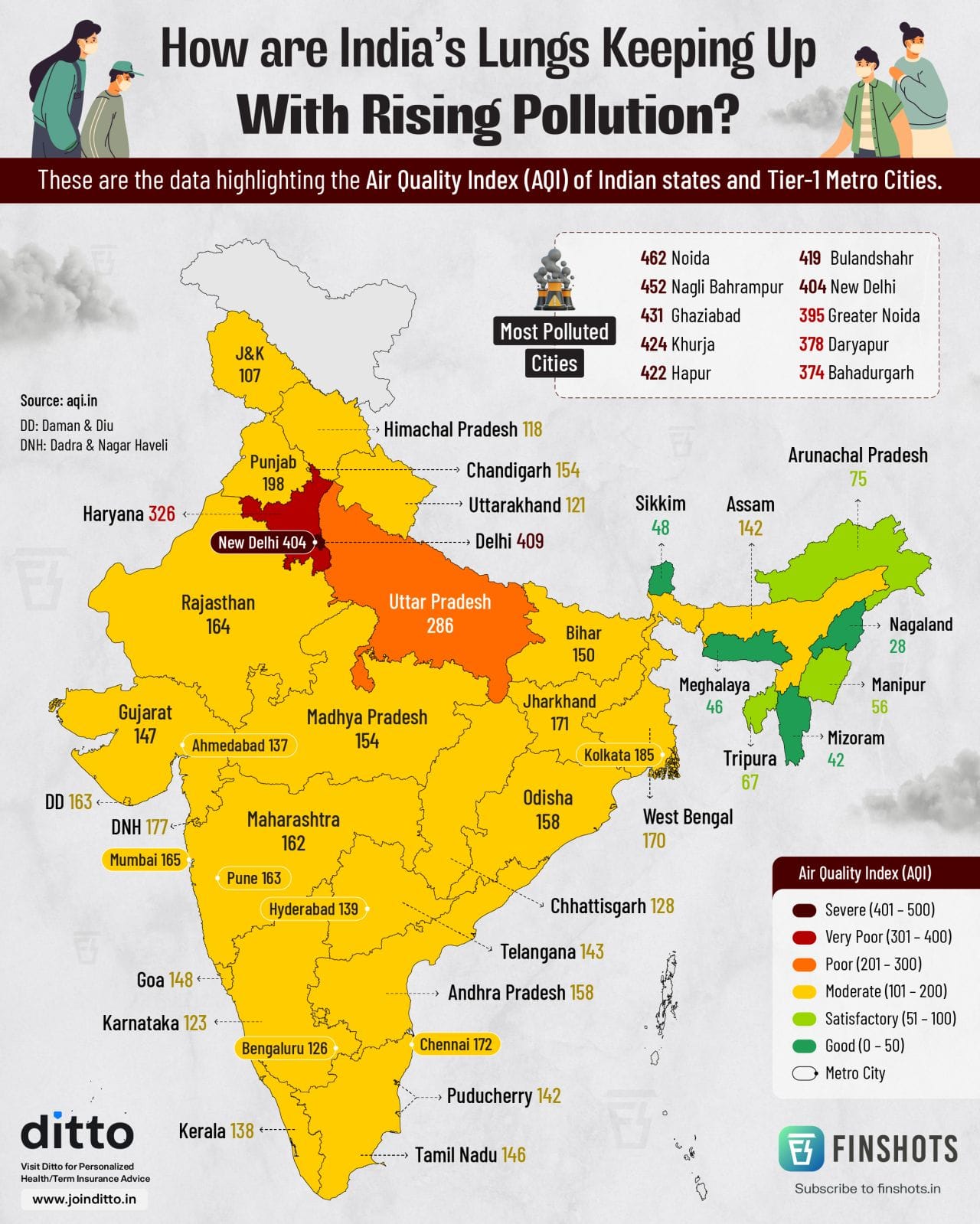

Infographic 📊

📺Can Gen Zs ever be rich?

According to the RBI, the biggest reason for taking loans — about 27%, is travel. And a lot of this comes from Gen Z, who love travelling and don’t mind splurging on expensive stays just for vacays. But can this carefree, debt fuelled lifestyle, lack of discipline, and a world full of geopolitical changes really pave the way for Gen Z to become rich?

In this episode of Finshots TV, we spoke to Gurmeet Chadha of Complete Circle Wealth Solutions about how to choose funds while investing, how to pick the right fund managers, and whether tariffs and de-globalisation are real threats for investors. Check out the full video here.

Readers Recommend 🗒️

This week, our reader, Anuradha Rao, recommends reading Global Derivative Debacles by Laurent L Jacque.

It takes you through the biggest derivatives disasters of the last 50 years from banks busting to hedge funds failing, showing how clever financial models went badly wrong. And tells you how derivatives aren’t just risky because of markets, but because of misuse, flawed design and weak controls.

Thanks for the rec, Anuradha!

That’s it from us this week. We’ll see you next Sunday!

Until then, send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Also, don’t forget to tell us what you thought of today's edition. Just hit reply to this email (or if you’re reading this on the web, drop us a message at morning@finshots.in).

🖖🏽

Don’t forget to share this edition on WhatsApp, LinkedIn and X.