India’s biggest ever bank fraud?

In today’s Finshots, we dive into what’s being touted as India’s biggest ever bank fraud

Spoiler alert: It involves the underworld and helicopters!

The Story

In February, there were news reports about a massive bank scam. In fact, the biggest bank scam ever. ABG Shipyard was the alleged perpetrator and reports indicated that the company had cheated nearly 28 banks to the tune of ₹23,000 crores

But ABG Shipyard could only hold the crown for a few short months. They’ve been dethroned by yet another company that seemed to have cheated banks out of nearly ₹35,000 crores.

Who might that be, you ask?

Well, it’s the Wadhawan brothers of DHFL fame!

Remember DHFL?

It was a non-banking financial company (NBFC) that doled out housing loans to lower and middle-income group individuals. They were seemingly doing quite well, until a couple of years ago, when the company collapsed rather spectacularly due to financial mismanagement. The Piramal Group finally acquired DHFL, but the promoters haven’t been offered any respite. The CBI and the Enforcement Directorate are still on their tail and for the Wadhawan brothers, it’s looking a bit grim.

DHFL’s antics

Okay, so it all began during the first half of the last decade. The home loan business was taking off and DHFL found itself in the thick of things. They began doling out home loans in bulk. But if you’re an NBFC, you can’t keep up this kind of growth, unless you borrow large sums of money yourself.

Where does an NBFC borrow this money you ask?

They borrow it from banks. And since DHFL needed a lot of money, a consortium of 17 banks led by Union Bank had to jump in. From 2010 to 2018, they sanctioned nearly ₹43,000 crores to DHFL.

And everything was fine for the most part. But then a stunning investigation by Cobrapost revealed a shady nexus between DHFL’s promoters and a number of shell companies. They claimed that the promoters borrowed money from banks to enrich themselves.

The lenders panicked. They’d given out a lot of money to DHFL and wanted to get to the bottom of this fiasco. So, the Union Bank of India got the pros involved — they hired consulting firm KPMG and demanded a special audit of DHFL’s financial accounts. And well, KPMG found exactly what Cobrapost had claimed. The rot ran deep and a lot of money had indeed gone missing.

We are talking about thousands of crores.

At this point, the banks had very few options left. They couldn’t label these as bad loans anymore. They had to classify it as fraud!!! So the Union Bank of India complained to the CBI last year.

But wait. What did the promoters do with the money?

Well, take for instance, an elaborate scheme called the “Bandra Books”. To perpetrate this scam, DHFL set up a dummy branch that existed only on paper. It was a virtual account carved out in the internal loan management software. They made it seem as if they disbursed home loans to 2.60 lakh individuals. But instead, they lent out the money— nearly ₹11,000 crores to 91 companies.

What were the antecedents of the 91 companies you ask?

Well, as you may have suspected already, most of them did not have an actual business operation. They were simply a front to route money into the Wadhawans’ own pockets. When the CBI got involved in this investigation recently, they found that the Wadhawans had bought expensive art and luxury properties with this ill-gotten money. And it also seems like some of this money found its way into the underworld and dreaded gangster Chota Shakeel!

Now here's the thing. This has been in the news cycle for a while now. You could turn around and ask — “Why are we talking about it now?”

Well, that’s because the CBI only filed a case back in June. And it was only then that we had the official stamp of approval from the appropriate authorities to call this the biggest bank scam ever.

But wait, there’s also some new stuff that emerged recently, involving a helicopter. So let’s try and clear that up for you as well. So far we’ve been talking about DHFL and its many indiscretions. But it seems the promoters also teamed up with another entity to further their dubious objectives.

Enter Yes Bank

It seems DHFL borrowed money from Yes Bank to work on the Bandra Reclamation Project. But the project was a charade. DHFL instead channelled the money to a real estate company called RKW Developers — a firm linked to the Wadhawan Family.

Then last week, as the CBI was painstakingly poring through all the evidence, they chanced upon a helicopter hidden away in a real estate developer’s hangar. They checked the ownership records and a name popped up — Varva Aviation.

Guess who owns a stake in this aviation company?

Why, it’s RKW Developers, of course!

So now the contention is that this money came from Yes Bank and the likes of Union Bank of India. But wait, this doesn’t implicate Yes bank no? If anything, they were defrauded, just like other banks.

But…

There’s also an allegation that Yes Bank’s former CEO Rana Kapoor got kickbacks (a bribe) from the Wadhawans for facilitating this loan. So Rana Kapoor knew exactly what the Wadhawans were up to and yet he looked the other way because he was standing to gain from the transaction.

Or at least that’s the charge.

So yeah, it seems the DHFL saga is far from over and we have to wait and see what other gnarly details pop up in the near future.

Until then…

Ditto Case Study: Dealing with complicated cases

Most people think buying health insurance is a rather straightforward endeavour. However, that is only true for a small subset of people. If you have complicated health conditions, things can get very tricky.

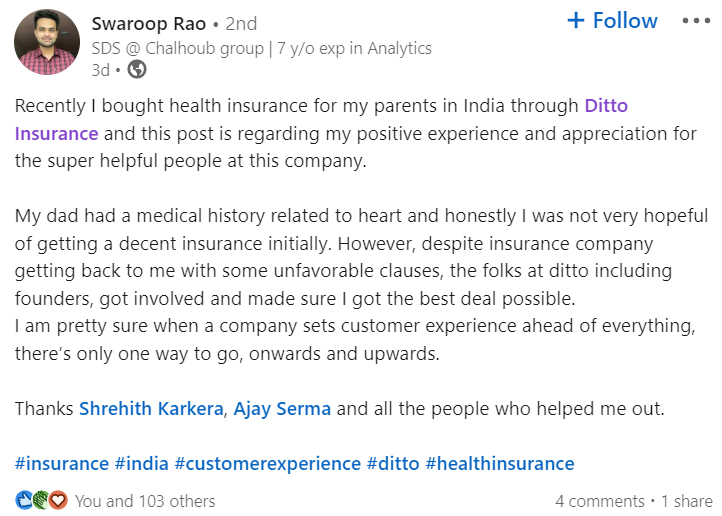

Take for instance Swaroop — the gentleman who posted the very nice review we’ve attached at the top. He wanted to cover his parents and he was looking for a comprehensive option. However, we soon found out that the doctors had performed a benign heart procedure on his father a while back. And this immediately made things a lot more complicated.

For one, most insurers don’t consider applicants with heart issues, even if they’re in perfect working condition. So we had to pore through our database to see which insurer was likely to consider the application. But even with this knowledge, we soon found out that the insurer wasn’t willing to consider his proposal. Now, most people give up at this point. And rightfully so.

But the thing is — there’s always recourse.

We quickly reached out to the insurer to see if we could get additional clarity on the matter. We wanted to know why the policy was rejected. The insurer was kind enough to set up a call and explain to us the issue. And after some deliberation, we knew that we still had a chance if we could submit additional reports regarding his health condition. The insurer made no promises. But they were willing to reconsider. So our advisor put together a list of reports, made a compelling case and submitted these details to the insurance company. It took a while but the insurer came through extending a policy with some caveats, of course.

So here’s what you should do if you ever find yourself in such a situation. Always try and see if you can get the insurer to list out the actual reason for rejection. Then ask them if there’s any room for reconsideration. If they tell you that they would reconsider the case with additional documents, then you can promptly mail it to them and see if they change their mind.

Or you could simply talk to us at Ditto — our insurance advisory platform and we will fight for your cause.

Until then...

Don't forget to share this article on WhatsApp, LinkedIn and Twitter