Sunny Side Up 🍳: Panda diplomacy, pizza wars and toxic money thoughts

Hey folks!

China might officially end its panda diplomacy with the US by December. Wait… What’s that?

Well, back in the day when China was ruled by emperors pandas were handed over as diplomatic gifts to other nations. This practice changed over the years from gift giving to loan lending. Basically, pandas were loaned out to other countries like Scotland, Denmark, Germany, the US and more. The host country would in turn pay China a million dollars every year as fees. The country could attract some tourism, while China would be able to strike good relationships with them.

But now that the geopolitical scenario between the US and China isn’t too sweet China’s apparently letting these loan contracts expire and calling their pandas back home. The US can’t keep panda cubs born there either because they too have to be sent back home before their 4th birthday.

So for the first time in half a century, the US will be panda-free. What a bittersweet parting!

Here’s a soundtrack to put you in the mood 🎵

Humam by Salman Elahi

Thanks for the recommendation, Sushant Shankar!

A couple of things caught our eye this week 👀

Pizza wars

“Pay less, get more” That’s the pizza mantra Domino’s is chanting these days. Thanks to the Cricket World Cup and a deadly threat ― smaller rival pizzerias like MojoPizza, Ovenstory and La Pino’z.

You see, Domino’s saw a 74% decline in Y-o-Y net profit during the first three months of FY24. And analysts suggest that it could be because of cut-throat competition and a cluttered pizza market. Apparently, regional chains form 30% of the total pizza outlets in India. And brands like La Pino’z are scaling fast, more than doubling their stores in just 3 years!

That’s definitely a point of worry for Domino’s. Here’s why.

See, India is a pizza loving market but they love it when they get a bang for their buck. According to the South China Morning Post, smaller pizza makers including street pizzerias offered a pizza for as low as ₹99 in 2021. And even though you could get a Domino’s pizza at that price, you’d agree that it can’t match the size or toppings of regional pizza brands. In fact, IIFL says that Domino’s is not the most economical pizza brand even if you pick a combo. So despite commanding over half of the Indian pizza market, it might not be India’s favourite pizza.

Can the price drop help Domino’s win back its pizza appeal? You tell us.

***

Colgate wants a detox from the Ayurveda Effect

In FY16, ayurvedic toothpaste was all the rage. Patanjali was killing it with its Ayurvedic products. It created a ₹10,000 crore empire in under a decade. And that troubled Colgate. Its toothpaste sales were falling and its market share dropped by ≅ 2%.

Patanjali was able to throw it a challenge from its presence in just 2 lakh retail stores as against Colgate’s 5 million+ stores!

So Colgate decided that it had to do something. It set up an army of Ayurvedic toothpastes to stand tall against the likes of Dabur and Patanjali. And sent its delivery vans to the remotest of places to reach the untapped market where toothpaste wasn’t even used much. The move sort of worked in its favour.

But Colgate now wants to take a step back from its Ayurvedic defence and concentrate more on innovation. Why, you ask?

Well, the brand thinks that Patanjali distracted it from its business objectives. Over 5 years ago people were drawn to natural products especially since they were associated with Ayurveda which has an Indian essence. So the ‘natural’ toothpaste market grew by about 9% between 2016 and 2019. But now it seems to be showing signs of decline.

You see, over 300 million Indians don’t use toothpaste at all. That includes half of rural India who don’t brush their teeth with branded products. So the opportunity doesn’t really lie in helping India choose what product to use to brush their teeth. The real opportunity is in educating and encouraging more people to brush their teeth. And brush it at least twice as against just once which most urbanites do.

Now, Colgate wants to start with the easier task of getting people to brush at least twice a day by banking on the middle class who’s being attracted by premium products. Well, that needs a creative push rather than stress on Ayurveda. And with that Colgate Palmolive India hopes to become a $1 billion strong subsidiary of the international brand.

Do you think it’s headed in the right direction?

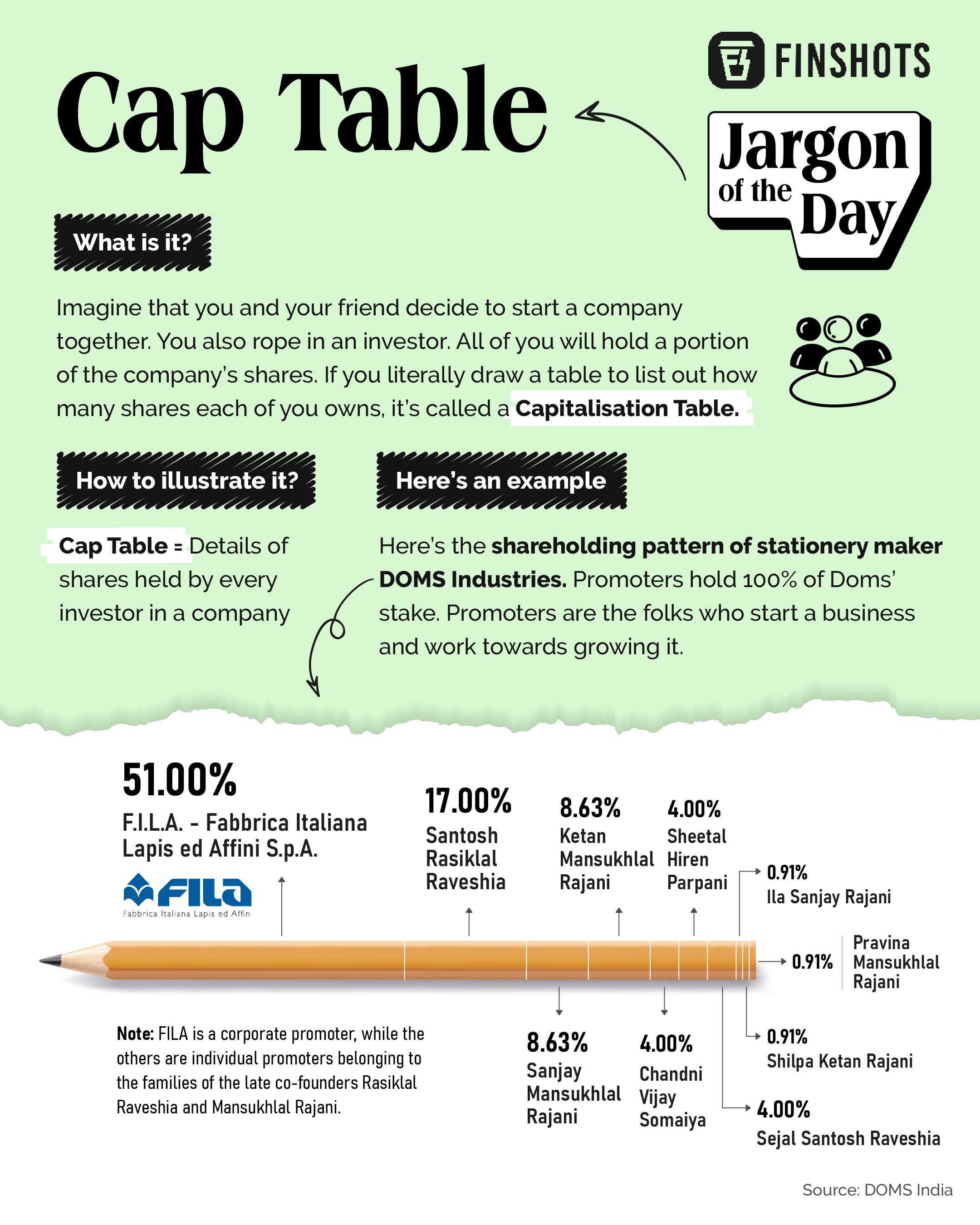

Jargon of the day ✏️

Money tips 💰

Toxic money thoughts

Have you ever felt anxious on payday?

Imagine hearing your phone beep with the sound of the SMS that says your pay is credited… and not feeling happy.

If you relate to this, then welcome to the world of toxic money thoughts. You’re always left with the feeling of not having enough money. You have to pay your bills, rent, insurance, maybe EMIs, set aside savings and your bank account is wiped off in a jiffy. Despite having everything in order, it still leaves you feeling bitter.

But why does this happen?

Well, there’s no single right answer. But it could have a lot to do with how our mindsets were shaped as growing children. Maybe our parents always told us that money doesn’t grow on trees. So, we now end up aggressively saving out of the fear of not having enough money as we age.

Maybe we grew up watching our parents work extremely hard to make ends meet. Or even struggle to pay off debts. And we didn’t want the same thing for ourselves. So we end up going the extra mile as a defence mechanism ― working overtime to earn more, postponing purchases that are necessary, socialising less because we don’t feel as financially strong as our peers; the list goes on.

It’s toxic money behaviour folks! And it’s not a healthy sign. It could damage your relationship with money. In fact, it stops you from living your best life.

While this may be an unpopular opinion, don’t beat yourself up too much when it comes to your capability to earn or spend. It’s always important to let yourself enjoy your earnings however little they may be. We’re not telling you to go all out and splash them. What’s important is to know where to draw the line between saving and spending.

And this also applies to younger folks who aren’t earning yet. You might be managing your days with a very small allowance. Maybe you can’t negotiate it with your parents. But you sure can see what you’re good at, monetise it and earn while you learn. That way you can do small things with money that give you happiness. Just make sure you keep the toxicity away, whether it’s to do with spending or saving too much. Balance is the key.

Readers Recommend 🗒️

Predictably Irrational by Dan Ariely

Today our reader Yash Kulshrestha recommends a book on behavioural economics. He says that it’s a great book in which the author conducts experiments to find out how people actually spend their money. Just check out these interesting questions from the book ―

Why do we splurge on a lavish meal but cut coupons to save a few bucks on a can of soup?

Why do we go back for second helpings at the unlimited buffet, even when our stomachs are already full?

Relatable much? Well, this book questions people’s idea of rational spending. If that sounds interesting, maybe you should pick it up. Thanks for the apt recommendation Yash!

Finshots Weekly Quiz 🧩

It’s time to announce the winner of our previous Weekly Quiz. And the winner is…🥁

Subha Bhowmick! Congratulations. Keep an eye on your inbox and we’ll get in touch with you soon to send over your Finshots merch.

And for the rest of you, here’s your next chance to grab the winner’s crown. Click on this 👉🏽 link, answer all the questions correctly and tune in next week to check if you got lucky.

Until then, don’t forget to tell us what you thought of today’s newsletter. And send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Just hit reply to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in).

🖖🏽

Don't forget to share this edition on WhatsApp, LinkedIn and X (formerly Twitter).