SEBI's investor protection tool is annoying small companies

In today’s Finshots, we simplify SEBI’s Enhanced Surveillance Measure for small company stocks.

Before we begin, if you're someone who loves to keep tabs on what's happening in the world of business and finance, then hit subscribe if you haven't already. We strip stories off the jargon and deliver crisp financial insights straight to your inbox. Just one mail every morning. Promise!

If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Mercury EV Tech is a small Indian EV maker. You may not have heard of it before. But it appears to be a manufacturer of electric mobility solutions — scooters, golf carts, tractors and even vintage cars. At least that’s what it claims on its 1990s-looking website.

But this small company is also a listed entity. And its shares trade on the Bombay Stock Exchange (BSE). And by a small company, we mean that it’s a really small company. In fact, according to SEBI's current classification, stocks of companies with a market capitalisation of anything under ₹5,000 crores are listed as small-cap entities. And this one’s worth just about ₹400 crores. So it’s really a microcap.

But why are we talking about Mercury EV Tech now?

Well, because this tiny company took BSE to court last week!

Okay, so let's take it from the top.

Of late, SEBI has been a tad bit suspicious of microcap companies. They've documented cases of people creating over the top videos on YouTube or Telegram groups to try and manipulate their share price. The idea is to spread false information, trade the stock internally, drive up the price and attract gullible investors looking to make quick money. Once the retail investors arrive, these manipulators go on a selling spree, booking massive profits for themselves while innocent investors lose money in a flash.

And these shenanigans typically occur in smaller stocks because no one’s really keeping a close eye on them. They’re also fairly illiquid which means that not many third-party investors hold and trade in them. So manipulating them is easier. And for retail investors, buying these ‘cheaply priced’ penny stocks worth just a few rupees is affordable. Or atleast it appears affordable.

Anyway, SEBI decided to act on this. Do something to protect retail investors. And last month, it introduced something called the Enhanced Surveillance Measure or ESM after deliberating the matter with both the Bombay Stock Exchange and the National Stock Exchange. And soon enough, both these exchanges put the rules in place.

Think of ESM rules as a way to control any dubious pump-and-dump activities. SEBI looks at small stocks — worth under ₹500 crores — that are listed on the main stock exchanges. It tracks their highest and lowest prices over a period. It looks at their daily price movements and volatility. And if it sees extreme variations, it asks the exchange to move these stocks to the ESM framework.

Of course, there are different thresholds for different timelines. But we don't need to get into the technicalities. Just know that once a stock is placed under ESM, people can’t indulge in intraday trading. Meaning they can’t buy and sell on the same day. They can’t use leverage or borrow money from their broker and trade it either. They’ll have to pay the full value and wait for the stock to be delivered to their account. Also, the price band in which they can trade the stock also reduces. For example, if a stock’s price is ₹20, investors can only buy or sell it between ₹19-21. That’s a 5% band. But some stocks may even have a 2% band.

And it doesn’t stop there.

SEBI keeps surveilling the stock. And if it sees that the volatility still hasn’t reduced, then it could move the stock to the second stage of ESM. And until a couple of days ago ESM-II was a bit too stringent.

Here, stocks couldn’t even be bought and sold daily. Trading would happen once a week. That’s it. And that too through an auction system. This means you don’t really see real-time price movements. You place an order during a specified window. And the exchange will match it with other orders. At the end of the window, you’ll know the result. That means investors have a tiny opportunity to exit their investments if they wish to. They might end up being stuck with it for a long time if things don’t go their way.

Now here’s where it gets interesting.

While SEBI was going into full surveillance mode, something was cooking at Mercury EV Tech. Its prices had zoomed by 90% during the first five months of this year. In fact, if you had invested in the stock in January last year, you’d be sitting on a whopping 2,500% return!

Remember, this was a microcap that had done literally nothing in many many years. It was a dud. But this sudden movement and volatility meant that it came under SEBI’s radar. It was staring into the abyss of being an ESM stock.

And once it was put under ESM, things deteriorated quickly. All the excitement automatically died down. Its weekly trading volumes which were close to 3 million crashed to under 50,000! People couldn’t simply trade like before. And this would go on for at least 90 calendar days. And then to make matters worse, it was moved to ESM-II.

And if you look at Mercury EV Tech, they probably did nothing wrong. They must’ve finally got the business moving in the right direction. One of its subsidiaries had just received an order worth ₹110 crores for supplying batteries to one of India’s leading e2W (electric 2-wheeler) manufacturers.

Maybe some investors noticed that and went after the stock. They lapped up whatever they could. Because EV is the future and all that, no? But SEBI's new ESM guidelines automatically squeezes the company's stock and its investors without proving them guilty.

And it's not a good look for a company like Mercury EV Tech which by the way is also trying to seek international certification.

So yeah, that’s why Mercury EV Tech took BSE (the exchange enforcing the ESM rules) to the Securities Appellate Tribunal.

But it looks like SEBI’s already backing off a little. Just a couple of days ago, they said that companies under ESM II would also be allowed to trade daily. Not just on a weekly basis. So that alone offers some welcome respite.

Now we’ll just have to wait and see what SAT says this week.

Meanwhile, what do you think? Is SEBI being too overprotective of investors? Or are they hurting the prospects of small companies with such rules?

Tell us.

Until then…

And don't forget to share this article on WhatsApp, LinkedIn and Twitter.

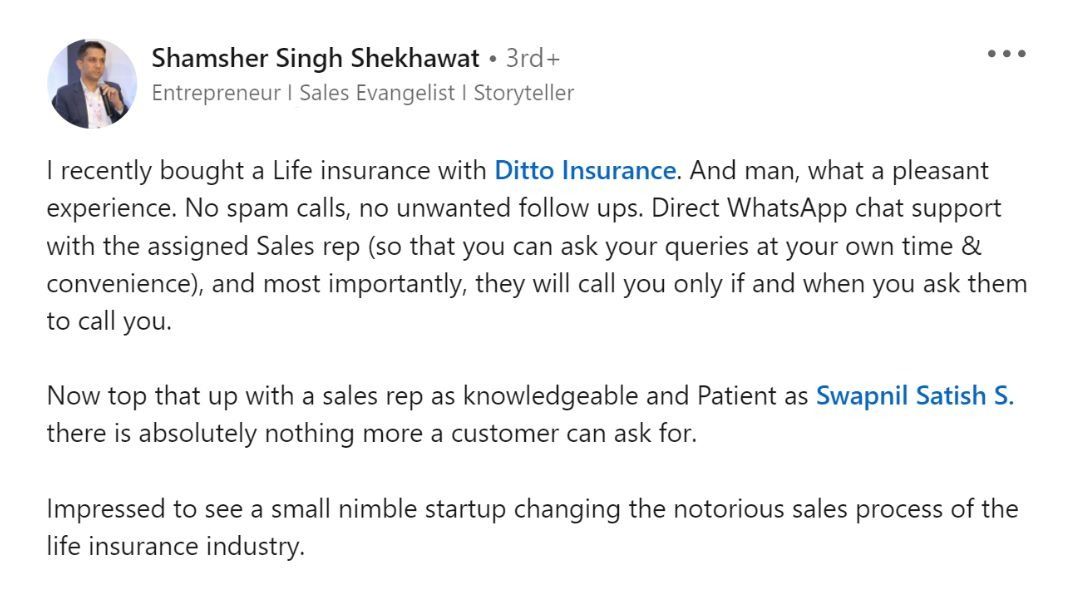

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here