RBI's fictional letter to the Government - on inflation

Before we get to today’s story, if you’re someone who loves to keep tabs on what’s going on in the world of business and finance — why aren’t you subscribed yet? We’ll send you this newsletter every morning with crisp financial insights straight to your inbox. Subscribe now!

If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Inflation in India is at a 5-month high. It hit 7.41% in September.

It’s a problem for the RBI. Because the central bank has a mandate — to keep long-term inflation between 2–6%. It’s called ‘inflation-targeting’ and it’s a strategy etched into the RBI’s job description (JD!) since 2016.

That means the RBI is failing.

And anytime inflation breaches this band for 3 quarters, the RBI needs to explain what went wrong. They need to do the explaining to the government by the way and they also need to articulate how they intend to bring inflation back on track.

And so far, they’ve not had to do any explaining. They’ve done a pretty decent job overall. But now, that record is in jeopardy. Inflation has consistently stayed above the 6% mark these past few months and they’ll have to draft that letter. Also, it’s quite historic since this will be the first time since 2016 that the RBI will have to do something of this sort.

But there’s a speed bump though. Unfortunately, it seems like we may not get to see the contents of the letter. The RBI has said that it wants to keep it under lock and key. It could go straight into the classified folder in government offices.

But…maybe we can guess what it’ll say?

In fact here’s an imaginary letter for you. A letter we put together after cobbling bits and pieces from a recent discussion by some of the top guns at the RBI. Remember, it’s just fiction.

***

Dear Government of India,

We know our mandate very well. Price stability is at the heart of everything we do. We know how inflation eats into the savings of citizens. We know how it reduces their purchasing power. And we know how it makes their lives worse.

But inflation isn’t always a bad thing. Some inflation may actually aid growth. However, if people start thinking that the price rise could persist indefinitely, then, they’ll panic. They’ll ask for a pay rise. Landlords will start raising rent indiscriminately. Businesses will bump up the final price of everyday items like milk and bread.

Ergo, that expectation and consequent behaviour alone could trigger further inflation.

It’s a vicious cycle.

Now one way to control that expectation is to ‘communicate’. Tell people that we’re on top of the game and we’ll keep it to an acceptable level. In our case, that’s 2–6%.

And if we manage to keep inflation steady as promised, people will begin to trust our process. Then, even if inflation inches up a bit, they’ll simply go about their daily lives as normal.

The vicious cycle of expectations leading to inflation can be halted in its tracks.

And this worked for nearly 6 years. If you look back at all the surveys we’ve conducted over the past few years to gauge what people think of inflation, you’ll see it’s more or less around the target band we’ve set for ourselves.

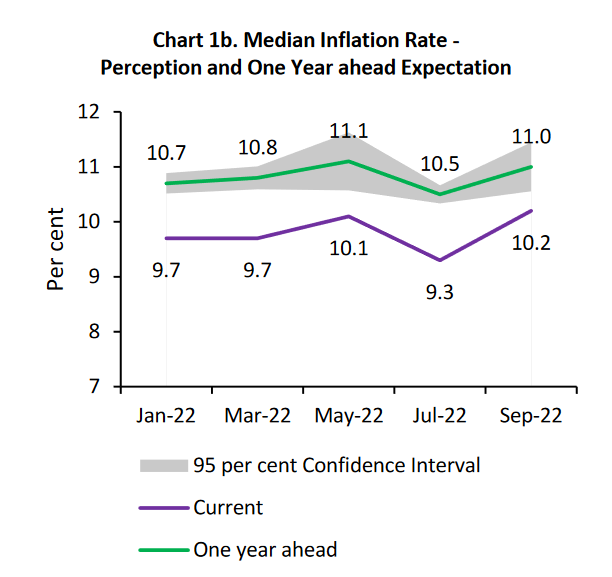

But, that’s changing. Because in the survey we ran in September, we had a shock. People expect inflation to hover around the 10% mark over the next year.

And that’s a bit of a problem. If we don’t anchor these expectations, inflation will be ingrained in their psyche and they won’t trust us anymore.

Also, we discovered that when growth falls, Indian households expect inflation to rise. They also believe that inflation will increase when interest rates increase.

We’ve got to change that thinking. So we’ll improve our modes of communication with the citizens. Maybe we should appear in the media more. And even write columns in newspapers across all languages to get our message across.

Anyway, anchoring inflationary expectations is one thing.

But once inflation does rear its ugly head, we turn to tools like interest rates. If we raise interest rates, it’ll be more expensive for people to borrow money to buy a car or to buy a house. People will cut back on consumption and demand drops. Ergo, inflation also cools down.

Also, 45% of households we surveyed said that their income hadn’t gone up in the past year. While that’s unfortunate, that could automatically quell demand too.

Anyway, since the pandemic, we’ve kept a hawk’s eye on inflation. And since the numbers were steady, we didn’t change interest rates either. We kept it at 4% for almost 2 years. Incidentally, the low rates also boosted our economic growth which was on shaky ground after the pandemic.

But we missed the bus. We didn’t quite realize that inflation is here to stay. And we took a bit of time to reverse interest rates. Since April, though, we’ve hiked interest rates to 5.90%.

But things still aren’t quite working out. Because as your esteemed selves will know, inflation is primarily of two types — Demand-led and supply-led.

While interest rates can deal with demand-led inflation, it isn’t particularly effective against supply-led issues.

For instance, take the war in Ukraine. It has disrupted the supply of oil & gas across the world. There’s less of it going around and prices have shot up. It has even had a significant impact on agriculture and fertilizer prices globally. We can’t do much about this.

Or look at our inflation measure — CPI. Nearly 45% of its value is derived from food prices. In the US, that’s below 15%. Can we really control the prices of onions and tomatoes using interest rates? Not really.

So we’re pretty much dependent on the government to figure out ways to tame food prices. Like cutting import duty on sunflower oil to zero so that it softens prices. Or banning wheat exports so we have more for domestic use.

But in all honesty, we can’t tell how much of this inflation is due to demand spikes and how much is due to supply problems.

And hey, it’s not just us, you know. Every country is struggling. Even the US inflation is at a 40-year high. Times are tough.

So maybe give us a bit of a break?

Anyway, we’re going to increase interest rates even further when we meet in the first week of December. That’s probably the only way to anchor expectations and rein in the prices. And we believe we can get inflation to 5% in April-June 2023.

We promise you.

***

So yeah, that was our fictional version of the RBI letter. Maybe we’ll do another one if the contents of the letter do come out in the future.

Will supply-side pressure ease up and cool inflation? Can the RBI battle against the ‘Psychology of Inflation’ and brings things under control? We don’t know. But we certainly hope so.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

PS: If we’re being pedantic, this isn’t the first time inflation has breached the RBI tolerance levels. Yup, in 2020, during the pandemic, inflation shot up too. But it didn’t have to submit an explanation. Because of the lockdowns, it said they couldn’t get the right data to calculate inflation.

Ditto Insights: Why you should always consider riders

Most people buy term insurance for the core offering of a death benefit — i.e. so they can leave money behind for their family in the event that they pass away.

But did you know that you can enhance your term plan by simply opting for some add-ons?

Here are a few riders you should definitely consider:

1) Waiver of Premiums.

Imagine if something happens to you — you become seriously injured or physically impaired and you end up losing your job.

Your family suddenly loses their source of income.

How are you supposed to pay insurance premiums in such a condition?

In such scenarios, some insurers allow you to opt for a waiver.

So for a small fee, you get to keep the policy and don’t have to worry about the premiums in case you get disabled in some way.

Brilliant!

2) Critical Illness Rider.

Every day, an increasing number of people are diagnosed with critical illnesses like cancer or chronic lung disease.

In such situations, you are at risk of losing your job and your family will have to make do without your income.

However, if you opt for the critical illness rider, your insurer will help you cover the cost of such a crisis.

Note: Some policies may pay the corpus from your sum insured, so your term cover will reduce by an equal amount.

And in case you need help selecting the right term plan, here’s how you can book a FREE call with us -

1. Go to Ditto’s website — Link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!

And our advisors will take it from there!