Sunday Special Edition-Important Talking Points of the Budget

In today’s newsletter, we want to cover some of the most interesting bits from yesterday’s budget so that you can be up to speed when you’re at the coffee table discussing this stuff tomorrow.

Enjoy!!!

The Story

Let’s start with the biggest talking point of the day — Income Tax. The government has proposed a new tax regime, which on the face of it looks like a better alternative than the previous one.

But remember you can opt for this tax structure only if you forego all exemptions. For instance, if you were a salaried individual. you can point out that a part of your salary goes towards paying house rent. Now, under certain conditions, the tax code will allow you to deduct a part of this rent from the computation of your total taxable income.

Imagine you made 5,40,000 this year. But then you claim that you paid 60,000 in rent that ought to be excluded from the total taxable income. And immediately the number drops from 5.4 Lakhs to 4.8 lakhs. And since your total taxable income is now less than 5 lakhs, you don’t pay any tax. However, if you choose to forego the exemptions and opt for the new tax regime, you pay 10% tax on 40,000 (income above 5,00,000)

Also, you don’t just claim exemptions for house rent. You could claim exemptions on certain investments, payment made towards medical insurance, on loan payments etc. So it only makes sense for you to opt for the new regime if you can’t claim most exemptions.

Also, there’s a very good reason why these exemptions were introduced in the first place. It was the government’s way of nudging salaried individuals to invest money and buy insurance. With the new tax regime in place, some people might not have the same incentives anymore.

Sad!!!

On Dividend Distribution tax

When you go out there and buy stocks, you are effectively part-owner of the company. And as such, when they decide to give away some of their profits (through dividends) you are entitled to a tiny share. However, the government levies an additional tax called the dividend distribution tax when the money leaves the company’s coffers. Let’s say this adds up to 26% including cess. Meaning if you were entitled to Rs. 100 worth of dividends. You would only see about Rs 74 at the end of it.

Now, with the dividend distribution tax abolished, you will see the whole Rs 100. But there’s a catch.

Although this dividend wasn't taxed at the company's end, the government will tax you when this Rs. 100 reaches your bank account. The tax rate however will be decided based on how much you make at the end of the financial year. If you made 4 lakhs, the Rs. 100 will be added to your total income and you will not be taxed at all (because you fall in a tax bracket where the effective tax rate is 0).

But what if you are one of those people who’ll have to pay 30% tax on your income? Well, then you’ll have to pay 30% of the Rs. 100 and you’ll be left with just Rs. 70.

On Deposit Insurance

Last year, we had the infamous PMC bank scandal where thousands of depositors were left stranded after the RBI imposed strict withdrawal limits thanks to a major scandal. One of the biggest talking points was how it would have been amazing if bank deposits were insured beyond the nominal amount of 1 lakh, considering many people had deposits running into several lakhs all locked up because of the RBI notification.

And the government seems to have listened to us. So now, they’ve gone on and increased the amount to 5 lakhs. So in case, you lose your bank deposits, you’ll now have 5 lakhs as insurance to protect your downside.

On Startups

ESOP’s are all the rage now. Unfortunately, in the old system, your ESOP’s were taxed on 2 different occasions. Let’s imagine your total salary amounts to 30 lakhs. You get 20 lakhs in liquid cash and you get the remaining 10 lakhs in stock options. But you agree to wait 3 years before you exercise your right to buy these shares.

3 years pass and you decide to buy the shares. You get your 10 lakhs worth of stocks and this is when the government will tax you once. But remember, you haven’t sold them yet. Once you do sell them, the government will see if these shares have appreciated in value. If they have, they’ll tax the gains once again.

Under the new regime, the tax payment can be deferred by 5 years (once the shares are allotted) or till you leave the company or when you sell the shares, whichever is earliest. So, if you have ESOP's in your kitty you can rest easy, knowing that you won't have to worry about paying taxes for a while now.

On Growth

The government’s calculations have been premised on the notion that India could potentially achieve nominal growth rates of 10%. The key word here, however, is nominal. While 10% might seem impressive, it won’t matter all that much if inflation keeps up with current trends.

For instance, if prices increase 6% and economic activity remains stagnant it can only mean one thing — the country hasn’t managed to produce more goods/services this year. And yet, you will still see nominal growth of 6% because everything is pricier now.

Hence, one must take this number with a pinch of salt.

On Education

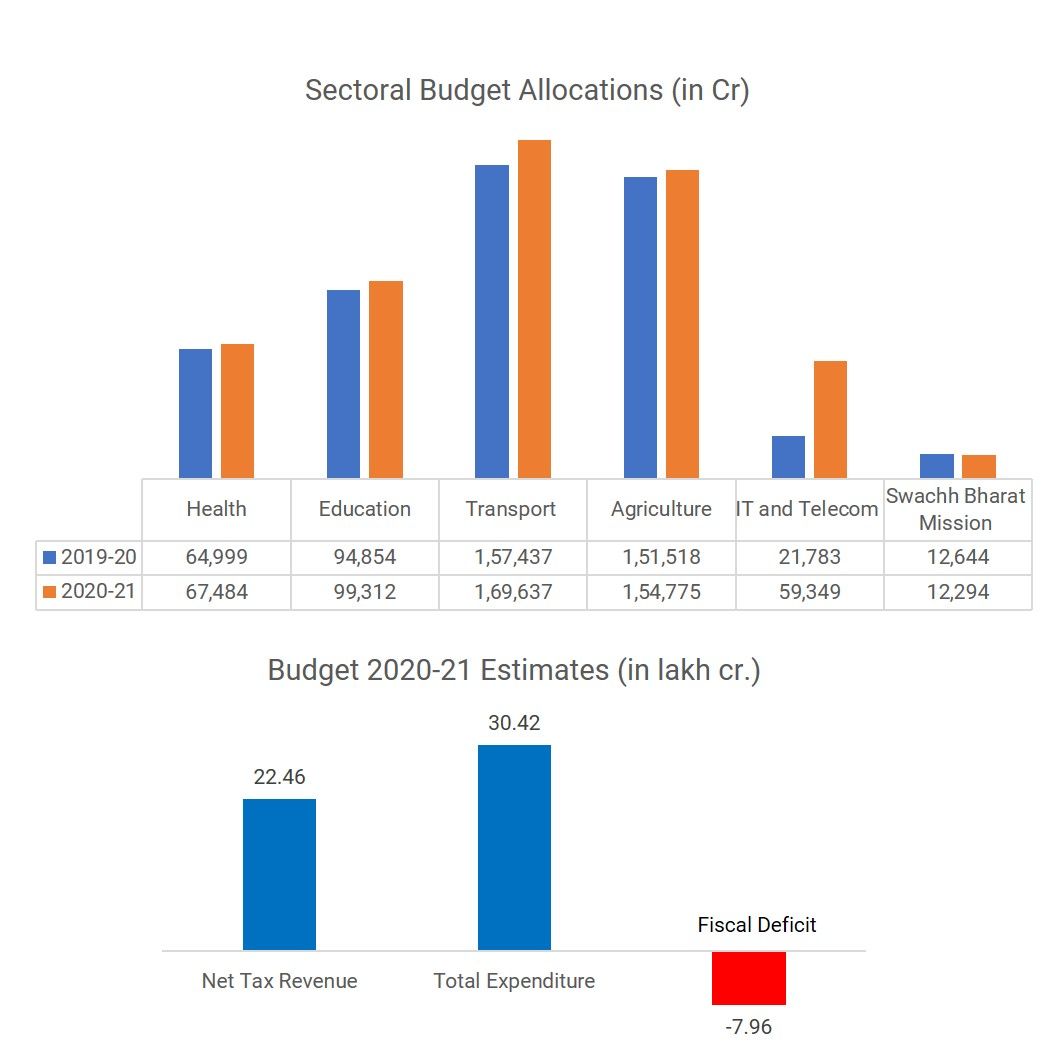

The government plans to initiate an online educational programme in association with the top 100 institutions in India to provide quality education to those deprived of it.

Sweet!!!

On Unemployment

The government will set up a National Recruitment Agency to administer a common eligibility test for recruitment to non-gazetted posts (Example- Engineers in a government-owned entity). Also, unemployed engineering graduates can soon get an internship upto 1 year with an urban or local body (Example-Town Improvement Trusts, Urban Development Authorities, Water Supply and Sewerage Boards)

The government is also planning to sell a part of its stake in LIC to the general public. But more on that sometime else.

Anyway, we have already breached our 3-minute mandate. So you will have to wait until tomorrow for additional insights. Cheers :)

Share this Finshots special edition on Whatsapp and Twitter.