How long will it take India to recover from the pandemic

Last week, the Reserve Bank of India published its annual report on Currency and Finance. And while these are long, boring documents — this one has over 150 pages, we’ve speed read it for you and tried to offer a couple of interesting insights from the report.

So that’s what we will talk about today

The Story

If there’s one thing that everybody can agree on, it’s that the pandemic wreaked havoc on the economy. And as countries hunkered down, we saw the effects spread to every nook and corner of this country. Machines stopped whirring. Cars stopped humming, restaurants shuttered their doors, and office lights went dark. Economies came to an abrupt standstill.

And it left a very deep scar on the Indian economy. How deep, you ask?

Well, according to the latest RBI report, we lost a whopping ₹19.1 lakh crores in 2020–21! For context, that’s like losing ₹218 crores every hour!!!

But that’s not all. With the second wave, we lost another ₹17.1 lakh crores in 2021–22. And we’ll likely lose an extra ₹16.4 lakh crore in 2022–23. It’s a lot of economic value that simply slipped through the cracks!

The problem however is that we received a different number from the government. In the Union Budget, the finance minister noted that the Indian economy lost ₹9.57 lakh crores in 2020–21. So how come the RBI’s estimate is so different — almost twice the sum quoted by the honourable finance minister.

Well, that’s because they’re not calculating it the same way. The government took the easy way out. It said, “look, our GDP was ₹145 lakh crores in FY20. And when we calculated the GDP in FY21, it came to around ₹ 136 lakh crores. This means that we lost close to ₹ 9.57 lakh crores because of the pandemic. So our economy dropped by 6.6%.”

That’s an entirely fair assessment. However, the RBI did things a bit differently. They said — “Hey if the pandemic never came along, our economy would have grown by at least 6.6% in FY21. So we could’ve generated nearly ₹154 lakh crores worth of economic value. And if you account for this lost opportunity, you get ₹19.1 lakh crores.”

So the next obvious question is — How do we recover it?

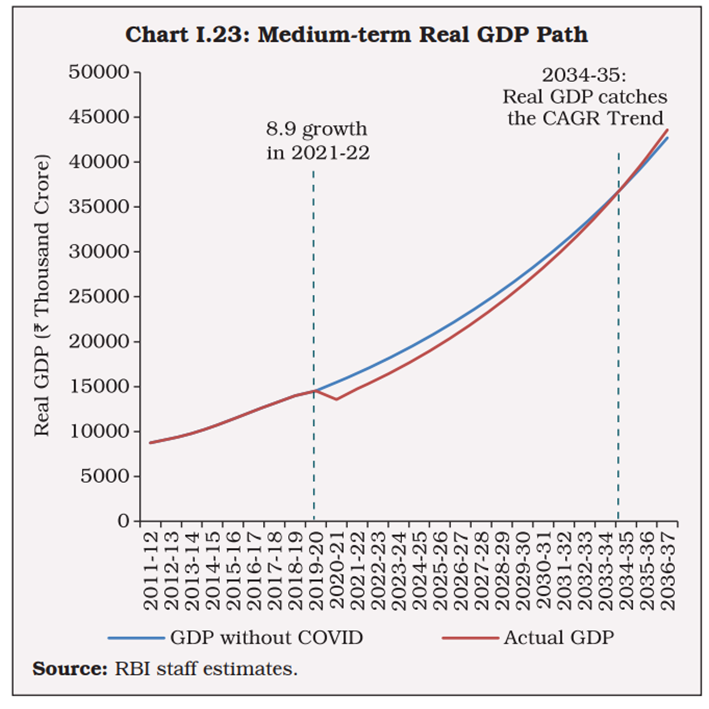

Well to do that we need to grow at a faster pace than we originally anticipated. For instance, we grew at about 6.6% every year pre covid. If you extrapolated that figure you’d get a nice curve without any aberrations. Aberrations we saw during the slowdown years. However, if we throw in the pandemic years all of a sudden you see a dip. That means we need to play catchup. And if we were to grow at 7.5% from the next year (a difficult but relatively reasonable proposition), we could finally catch up in the year 2034–35.

It would take a grand total of 12 years to recover the losses accrued during the pandemic, assuming we grow at 7.5%.

Now you could get to this growth figure by asking the government to spend big money on creating infrastructure that could propel the future. But you could also get there by simply maintaining a low-interest-rate environment — making it easy for people to borrow money.

This is what the RBI has been doing so far. However, too much money is also a bad idea. And it was apparent when the RBI went ahead and made a rather surprise announcement yesterday. They conducted an off-cycle meeting with the monetary policy committee — folks responsible for setting interest rates in this country. And they increased the repo rate by 40 bps i.e. they took it from 4.0% to 4.4%.

And by the way, if you still don’t quite understand what the repo rate is, that’s fine. But know that every time RBI tunes the figure upwards, it becomes more expensive for corporates and individuals to borrow money. Also, they fiddled with the cash reserve ratio and while the technical term may not make much sense, you’ll now be seeing banks hold on to more cash.

Through it all, they hope to suck excess money floating around. And while many people saw it as a surprise, it really wasn’t. They’ve been hinting at this for quite some time. Even the currency and finance report makes a mention. In it they note — “Large surplus liquidity that helped financial conditions to ease significantly during COVID needs to be withdrawn in a calibrated manner. This is because when surplus liquidity persists at above 1.5 per cent of NDTL, for every percentage point increase in surplus liquidity, the average inflation could rise by about 60 basis points in a year.”

Translation: During Covid, we introduced policies that pushed a lot of money into the economy. But now that we are in the recovery phase, it’s time we start removing some of it since the excess supply may aid inflation.

And that’s all there is to it. India isn’t immune to inflationary pressures. And if the RBI doesn’t do something about it, they’ll be breaking their own mandate of containing inflation.

The only question though — Why now? Like why wouldn’t they do it in the previous meeting — the one that happened on 8th April? It’s not like a lot has changed since then. And while we wish we could offer additional commentary on the matter, it‘s a bit premature for that now. Let’s see if we receive any updates in the coming days.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Also, at Finshots we have strived to keep the newsletter free for everyone. And we’ve managed to do it in large parts thanks to Ditto — our insurance advisory service where we simplify health and term insurance for the masses. So if you want to keep supporting us, please check out the website and maybe tell your friends about it too. It will go a long way in keeping the lights on here :)