Gold is the new treasury?

In today’s Finshots we tell you why central banks now hold more gold than US Treasuries and what that tells us about money and investing.

But before we begin, if you love keeping up with the buzz in business and finance, make sure to subscribe and join the Finshots club, loved by over 5 lakh readers.

Already a subscriber or reading this on the app? You’re all set. Go ahead and enjoy the story!

The Story

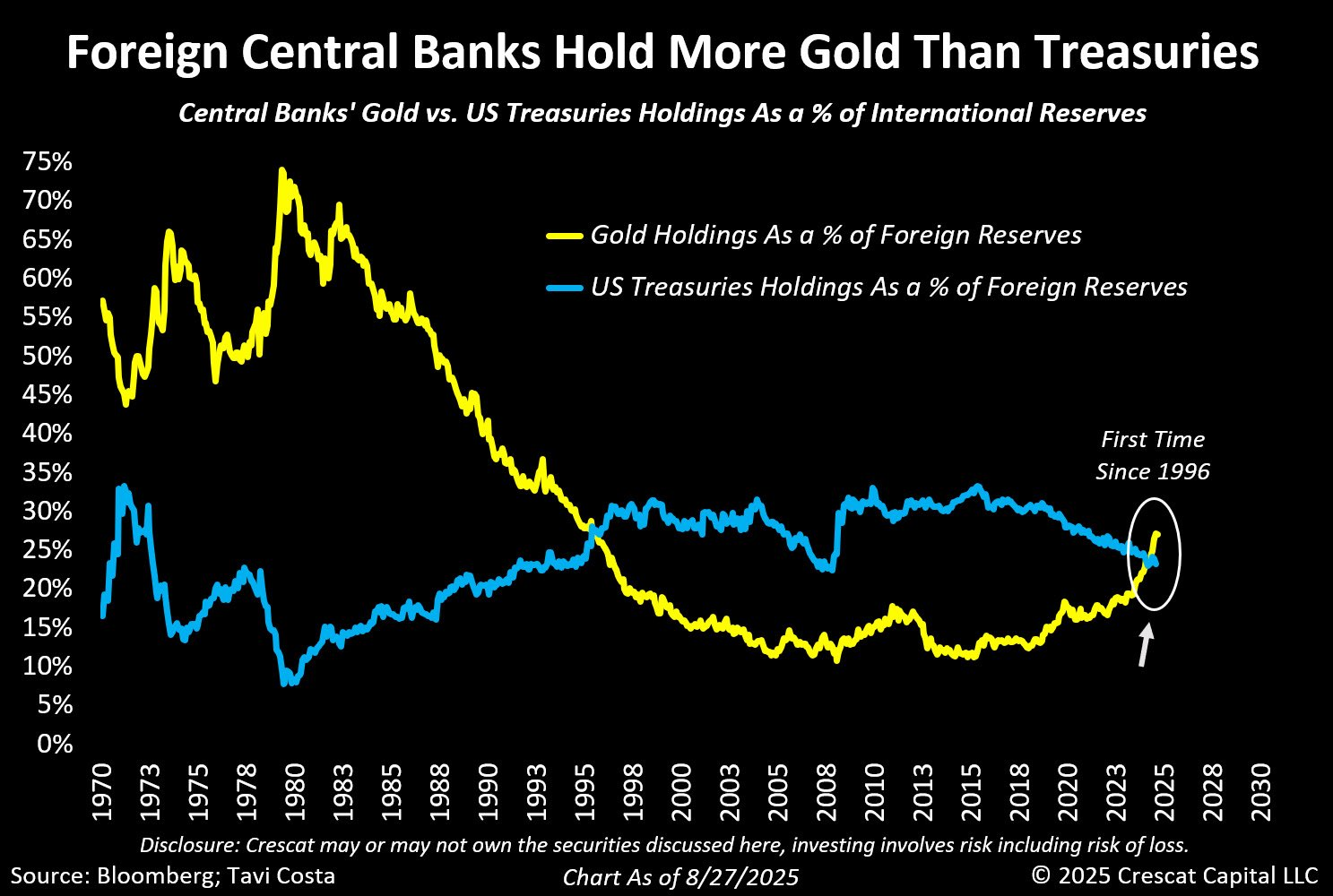

Last week, central banks — the people who decide what money is — quietly crossed a line. For the first time in almost 30 years, the value of gold in their vaults overtook the value of US Treasuries they hold.

It’s a bit like discovering your grandmother’s jewellery box is worth more than the fixed deposit she’s been boasting about for decades. Well, that’s essentially what just happened, except on a macro scale and that changes a few things.

For decades one of the safest forms of money you could own has been US government bonds. Or call them Treasuries. They’re an important part of global finance for a few reasons. The US government is considered the ultimate borrower. Unlike a company or a household, it cannot technically go broke, because it can always raise taxes or print dollars to repay. Then, the Treasury market is also the deepest and most liquid in the world, where roughly $29 trillion is held by investors worldwide. You could buy and sell them in minutes, which is a priceless feature if you’re a central bank juggling reserves. And Treasuries pay you interest, unlike cash sitting idle.

Gold, on the other hand, is the sentimental favourite. It sparkles in vaults and certainly has history. But it doesn’t yield, it doesn't compound, and it costs money to store. So central bankers weren’t as keen on adding it to their balance sheets as they have been over the last few years.

The change in central bank holding value you saw above is because, well, first, gold’s price went berserk. Since 2024, it rose from $2,000 to touch $3,400 an ounce today. Which meant that even if central banks hadn’t bought a single extra bar, the ones they already had were suddenly looking very plump indeed. But they went on buying over 1,000 tonnes of more gold in 2024 alone, and 410 tonnes more in the first six months of 2025. So that’s some serious commitment, you could say.

Meanwhile, Treasuries have lost their edge.

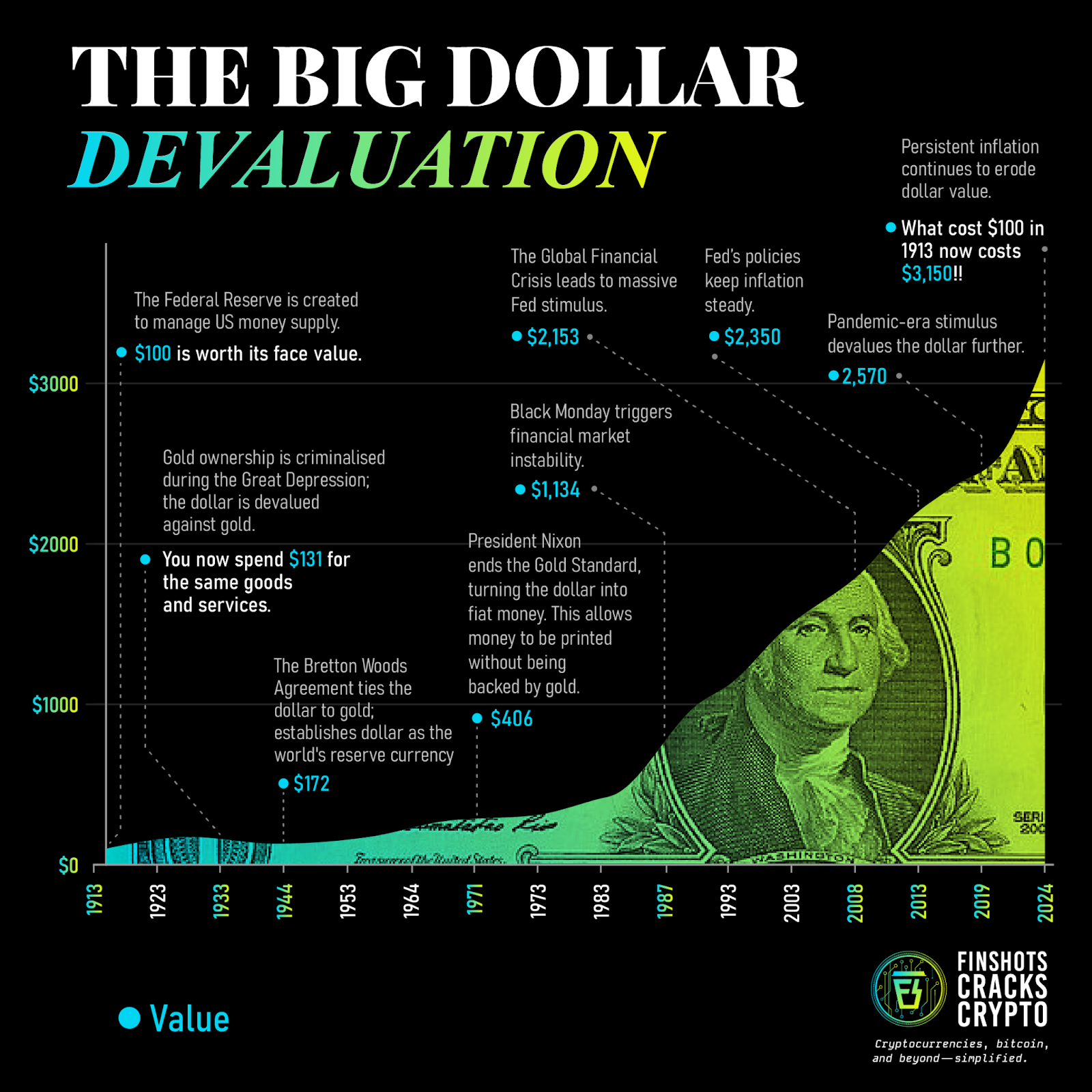

The reason comes down to the dollar itself. While we tend to talk about the rupee “losing ground,” the US dollar has been losing its purchasing power too.

Since January 2020, it has lost around 30% of its value. So a chocolate bar that cost $1 in 2020 now costs $1.30. And that $0.3, or 30% difference is inflation.

Now here’s where Treasuries get tricky. They give around 4% returns today. But if inflation is 3% a year, your real return is just 1%. If inflation sneaks higher, or above 4%, you could actually be losing money.

And historically, that’s exactly what has happened.

If you track this back to 1971 (when the US ended the gold standard and dollar became pure paper money), the dollar has lost purchasing power at an average pace of about 4% a year. As this calculator shows, a dollar in 1971 has the same buying power as nearly $8 today. That works out to about 4% inflation a year on average. Which means that while the Fed keeps talking about a 2% inflation target, the long-term reality has been closer to double that.

Economists call this “debasement.” It’s the slow dilution of value when money supply grows faster than the economy. This matters for central banks today because unless yields rise above that 4% debasement rate, they’re effectively paying the US government for holding US Treasuries. And the US, bless its heart, has a debt pile so large now — more than $37 trillion — that you start to wonder whether they’re handing out these bond guarantees on the back of napkins.

And you can also blame this shift to how reserves were controlled. In 2022, when the West froze Russia’s billions worth of reserves overnight, central bankers worldwide felt a chill. It was clear that Treasuries, for all their stability, are only as safe as the politics that govern them. Gold, on the other hand, is gloriously inert. If a central bank holds the bars in its own vault, it doesn’t just own a claim, it owns the asset outright.

Now, if this all sounds faintly familiar, that’s because we’ve seen a version of it before. In the 1970s, when the US cut its ties to gold, inflation soared into double digits. Treasuries delivered negative real returns as bondholders lost money in real terms year after year. Gold, once pegged at $35 an ounce, soared to nearly $400 by 1979 and briefly touched $850 in 1980. Central banks adjusted then, too, reaching for gold instead of bonds. Sure, today isn’t a perfect repeat of that as the dollar still dominates nearly 60% of global reserves, markets are far more sophisticated, and inflation isn’t in the same league. But the rhyme is clear that when debt is heavy and trust wobbles, gold returns to fashion.

This doesn’t mean the dollar or Treasuries are dead. If you want to buy oil, settle international trades, or issue sovereign bonds, you still need them. What’s changed is that central banks aren’t putting all their eggs in the Treasury basket anymore. Treasuries still offer liquidity, while gold offers sovereignty. And a smart reserve portfolio needs both.

India, naturally, hasn’t missed the memo. The RBI has brought back over 100 tonnes from overseas reserve vaults in FY25. Because in a world tilting toward sanctions and tariffs, you don’t want your insurance policy sitting in someone else’s cupboard. And that’s why gold now makes up about 12% of India’s foreign reserves.

So what does all this mean for the rest of us?

For one, gold prices aren’t likely to collapse anytime soon. When central banks buy and never sell, they quietly take supply off the market. That alone acts like a safety net under the price. For the US, the consequence is subtler but real. It can still issue debt, and in obscene amounts. But it does mean it may have to pay a smidge more than before. And that matters because even a small uptick in yields, when multiplied across trillions of debt, balloons into billions in extra costs.

The bigger paradox is this. Central banks keep the financial system alive by printing money. Yet they seem to sleep better knowing they’ve parked a chunk of that very money in gold.

So the lesson isn’t hard to miss. If the people who mint money are hedging against money itself, perhaps the rest of us should take note too. Interesting, isn’t it? The story of finance isn’t always about invention. More often, it’s about rediscovering what we’ve always known.

Until then…

Don’t forget to share this story on WhatsApp, LinkedIn and X.

Myth Alert: I'm Too Young to Buy Life Insurance!

The other day, one of our founders was chatting with a friend who thought life insurance was something you buy in your 40s. He was shocked that it was still a widely held belief.

Fact: Life Insurance acts as a safety net for your family. The younger you are, the cheaper it is. And the best part? Once you buy it, the premium remains unchanged no matter how old you get.

Unsure where to begin or need help picking the right plan? Book a FREE consultation with Ditto's IRDAI-Certified advisors today.