In today’s Finshots, we look at whether India’s blazing growth is of the high quality kind.

Before we begin, if you're someone who loves to keep tabs on what's happening in the world of business and finance, then hit subscribe if you haven't already. We strip stories off the jargon and deliver crisp financial insights straight to your inbox. Just one mail every morning. Promise!

If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

The GDP or Gross Domestic Product is a beautiful thing. It takes all the human activity in a country and compresses it into just one figure. Whether someone’s manufacturing glass bottles or whether a hotel is providing rooms to tourists, it’s all accounted for. And that one number gives us a sense of which direction the economy is headed — up or down.

For instance, take India’s latest GDP figure that was announced last week. We grew by 7.8% during the April to June quarter. That’s compared to the same period in the previous year, of course. And once we have this figure, it’s easy to compare ourselves against other countries too. Then we can say, “Hey, we’re the fastest growing major economy in the world!”

But there’s one thing that GDP might be missing…

Okay, there are many things, but for the purposes of this story, let’s narrow it down to one bit — efficiency! Or to put it in today’s LinkedIn lingo, it misses productivity and hustle. The GDP doesn’t tell us how efficiently we use our resources.

See, the thing is that we can propel growth by simply drumming up our investment activity. So for all we know, we might be pumping in a lot of capital or money without commensurate results. This extra money may not be moving the needle by much. Sustainable growth on the other hand is a consequence of productivity gains.

So how do you get a clearer picture of this?

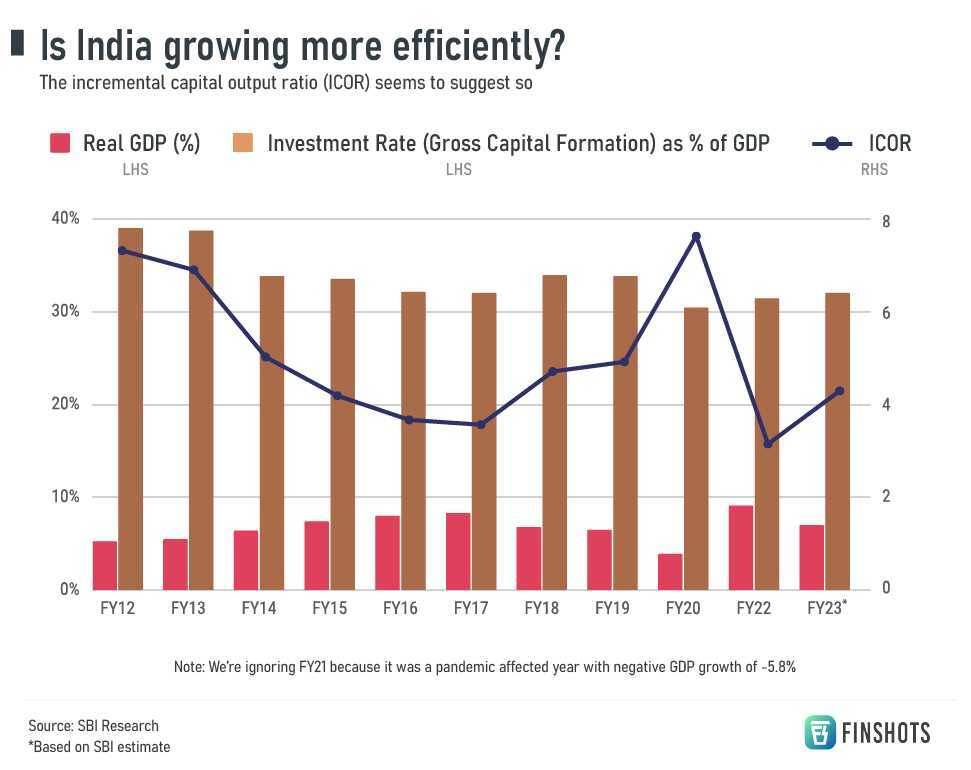

Well, there’s something called the ICOR or the Incremental Capital Output ratio. And it’s something that evolved from the Harrod-Domar Growth Theory in 1939. It looks at how much money is being put towards fresh investments. And then adjusts it against the actual economic growth. Or put another way, it tells us how much additional capital is needed to generate a 1% higher output. So, if you need 10% more capital to make that output leap, then ICOR is 10. So in this case, lower the ratio, the better it is. That’s when our capital is productive!

Now this can happen because maybe everyone’s hustling. Or maybe there’s more technical progress that helps us to squeeze output. Maybe it’s a combination of the two. But the end result is that it indicates the economy is becoming more efficient.

So, what’s happening with the ICOR in India, you ask?

It’s currently at 4.4!

But wait…is that good or bad?

Well, let’s first say that looking at just the latest ICOR number doesn’t reveal the full picture. We might be in a situation where we’re stuck at this for a while. Or imagine there’s one year in which some big investments are made. It may not necessarily yield an output immediately. It could take time to show up in the ICOR. So ideally, we need to average it out over a period and look at the trend too.

And the numbers seem to be adding up quite well here. In the past decade, we’ve dropped from 7.5 to roughly 4.5. We seem to be heading quite nicely towards the sweet spot of 3–4 that economists recommend.

But what explains this sharp drop in ICOR, you ask?

Well, research and ratings agency CRISIL has a couple of theories.

Firstly, after the global financial crisis of 2008, as the economy recovered, companies used the benefits of low interest rates to set up new ventures. There was over-investment and all this new capacity remained underutilized. The capital wasn’t efficient enough. But eventually, the investments bore fruit. Consumption activity gradually improved and it propelled GDP ahead. And since no new investments were needed to meet this demand, the efficiency of the past investments began to show up in ICOR.

Secondly, in the past few years, the government has been spending money on projects with a faster turnaround time — things such as roads. These infra projects have a multiplier effect on jobs and growth. If you believe the government, every ₹1 spent on such capital expenditure creates an immediate multiplier effect of ₹2.45. So that will show up as better productivity too.

And the thing is, if we’re able to squeeze more output out of our capital, we might be able to get away with investing less as well. Even if there’s a time when the private sector and the government is constrained by capital, this efficiency might keep the GDP chugging along at the same pace.

So yeah, now you know why we asked you to “Forget GDP. Look at ICOR.” Because productivity is the name of the game.

Anyway, before we go, we do have to point out that the ICOR has its flaws too. It’s not perfect. For instance, it’s really a metric built for a manufacturing economy. Not one where services rule the roost. Consider software. The upfront capital needed might be low. But the economic output might be massive. And that alone might cause the ICOR to look good optically. We might think we’re getting more efficient but that may be a lie.

So maybe, in order to truly understand this, we need to break it down sector wise. Take a capital heavy industry like auto or industrial manufacturing and calculate their ICOR. That’ll probably reveal our real productivity.

Until then…

Don’t forget to share this article on WhatsApp, LinkedIn, and Twitter.

Stop Paying Your Medical Bills From Your Pocket!

2/3rd of all medical bills in India are paid out of pocket. And it’s wiping out your savings:

You can’t expect to grow your investment if you can’t protect your savings. Even if you start with ₹1 Lakh and compound it by 10% every year, a trip to the hospital can wipe out your gains and your principal in a few days.

Medical inflation is growing at over 10% in India: While healthcare procedures have generally become more accessible, a stay at the hospital can set you back quite a bit, simply because the rooms are now expensive.

No tax benefits: When you’re paying for medical procedures out of pocket, you don’t get to have tax benefits. However, if you have insurance, you can protect your savings, avail of tax benefits and beat medical inflation all at the same time.

So get yourself a comprehensive medical insurance plan right now before you start your investment journey.

But who can you trust with buying a health plan?

Well, the gentleman who left the above review spoke to our team at Ditto. With Ditto, you get access to:

1) Spam-free advice guarantee

2) 100% free consultation from the industry's top insurance experts

3) 24/7 assistance when filing a claim from our support team

You too can talk to Ditto's advisors now, by clicking the link here