In today’s Finshots, we dive into the journey of Nirma, a washing powder company, that’s now got its eyes on the pharma industry.

The Story

If you're a 90s kid, hearing the word Nirma might immediately get you humming a jingle —

“Washing powder Nirma. Washing powder Nirma. Nirma!!”

The ads were everywhere.

Until they weren’t. The ads disappeared. The company couldn’t keep up with the competition. And the brand slowly faded away. But now, it’s in the news again. Not because it’s breathing new life into the washing powder business but because it seems to be trying to buy a listed entity called Glenmark Life Sciences.

Yup, Nirma wants to be a pharma company.

And to understand what’s going on, we need to rewind the clock a bit. Go back to the 1970s.

Back then, washing soap bars dominated the market. They were affordable and accessible. The only problem however was that the chemicals in them weren’t exactly skin-friendly. It was abrasive. Then came Hindustan Lever’s (now Hindustan Unilever) Surf packets which took the market by storm. The powder was simply better. But, it was expensive. In those days, it cost ₹10-15 for a packet. And this kept it out of reach of many households.

That’s when Karsanbhai Patel, a Gujarati chemist, decided to change things. He wanted to make a phosphate-free stain removal detergent that all Indians could actually afford. His only goal was to keep the cost of production abysmally low. So he began experimenting.

And soon, his efforts bore fruit. He was able to make and sell these packs for just ₹3. So he named this venture after his late daughter Nirupama and got to work marketing the detergent.

He first promoted it on his bicycle door-to-door. Once demand picked up, he created artificial scarcity by stopping supplies for a month. He wanted people to believe that everyone wanted Nirma. And then he ran those iconic ads on TV to reach the masses.

Washing powder Nirma took the country by storm. And soon commanded a 60% market share.

But HUL wasn’t sitting quietly. It came out all guns blazing with Operation STING — Strategy to Inhibit Nirma’s Growth. And launched a low-cost detergent Wheel in 1988. Seeing its success, other rivals jumped in as well.

The detergent wars had begun.

And since Nirma’s focus was purely on cost, it decided to control the price of its raw material. It was classic backward integration to control its supply chain. And it ventured into manufacturing caustic soda and soda ash. These were key for soaps and detergents. But, other industries also needed them — like glass manufacturing and metals.

Its diversification had begun. However, deep down it was still an FMCG company that made soaps, toothpaste and salt! Nirma wanted to do more to secure its future. And in the mid-2000s, it zeroed in on two industries that would hopefully do just that.

The first was cement.

Now this probably made sense since the company made soda ash anyway. And the waste it generates can be used for making cement. Also, Hiren Patel, the son of Karsanbhai Patel, had come back to India armed with a chemical engineering degree and an MBA. Kind of the perfect combination for building out this business, no?

So in 2005, Nirma announced it would be unleashing a price war in cement. Just like it did with detergents.

But the company had some legal hiccups. The cement business didn’t really take off until almost a decade later. What changed? you ask. Well, maybe it was the big infrastructure push from the government but Nirma was making massive inroads here. In 2016, it paid a staggering ₹9,000 crores to buy the Indian business of Lafarge, one of the largest cement makers in the world. Then in 2020, it went after Emami’s cement business too. And by virtue of acquiring these businesses, it became the fifth-largest cement maker in the country. It called this division Nuvoco Vistas and even launched a cement IPO a couple of years ago.

And something similar is playing out with its second bet too — pharma.

Yup, if Nirma acquires Glenmark Lifesciences, it won’t be its first pharma rodeo. And if you think about it, this was right in Karshanbhai Patel’s wheelhouse. He was a chemist, remember?

In 2004, it took a bet on an ailing company called Core Healthcare that made IV fluids. Nirma thought it could disrupt the game with its low-price strategy once again. But here’s the thing. Nirma soon found that the pharma game was very different from consumer goods. Price isn’t the only factor that pushes buyers to turn to you. There’s the quality factor too. Other small pharma players were able to match Core’s prices. And Nirma couldn’t turn things around. Big Pharma continued to reign supreme.

Meanwhile, it spun off the pharma division. Gave it a new name — Aculife Healthcare. And began to sell medical devices.

So yeah, you could say that pharma runs in Nirma’s DNA. And with the recent success it’s seeing in cement, maybe it decided to double down on pharma too. And this isn't coming out of the blue.

Last year, there were rumours that Nirma was eyeing a buyout of Maneesh Pharmaceuticals. Just a couple of months ago it acquired Stericon Pharma, a company that makes contact lens cleaning solutions and eye drops. And now there’s this news of buying Glenmark Life Sciences.

But why Glenmark?

Well, because Glenmark’s made quite a name for itself in the active pharmaceutical ingredient space (APIs). Think of these as the raw materials for your medicines — like paracetamol that goes into Crocin or Dolo. Glenmark Life manufactures APIs for a whole host of drugs — one used for cardiovascular diseases, pain management and diabetes.

Now the thing is, India’s heavily dependent on China for APIs. We import 70-80% of our requirements. And the government has been trying to change that equation. It wants domestic pharma to get into the API game fully. It’s doling out incentives for manufacturers too.

And if Nirma gets its hands on Glenmark’s API business, it could finally realise its pharma ambitions. It might be able to snag these incentives and bring down the prices of drugs too. And its dream of an affordable pricing strategy could work out.

So yeah, that’s Nirma’s story. From a washing powder brand to a cement giant and what now looks to be a serious pharma contender.

Will it all work out for the iconic brand? Time will tell.

Until then…

Fun Fact: In 2010, Nirma decided to delist its stock from the Indian bourses. Maybe it didn’t want shareholder interference with its diversification plans. But as things stand, it now has a cement business that is listed. And if it buys Glenmark Life Sciences, it could have a listed pharma play too.

Don't forget to share this article on WhatsApp, LinkedIn and Twitter.

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

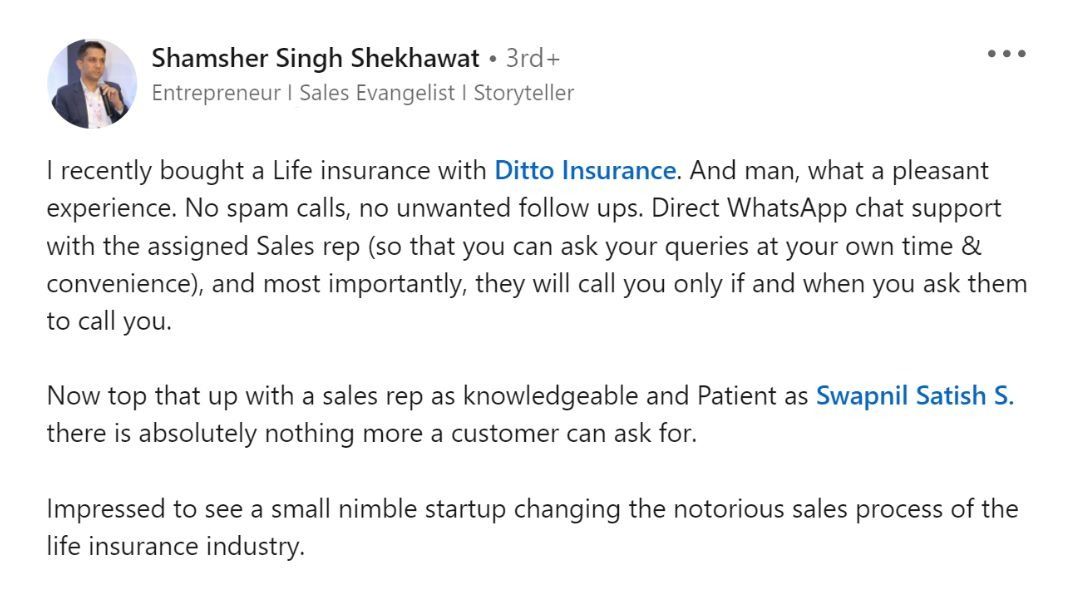

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here