Will Disney breakup with Star India?

In today’s Finshots, we explain why everyone believes that The Walt Disney Company is set to sever ties with Star India.

The Story

“We believe fixing Disney’s India mess would be a great start to improving long-term cash flow and profitability.”

That’s what research firm MoffettNathanson said last week.

What are they talking about?

Well, in case you didn’t know, Disney has been in a spot of bother for a while now. It announced that it was laying off 7,000 people. It said it would cut over $5.5 billion in costs. And last year, it brought back its former CEO Bob Iger to fix things. But despite all this, its share price is at an 8-year low. And it has underperformed the broader S&P 500 index by 24% in the past year. If you were to pick out one number that reflects these troubles, that would be the net income — it’s lower than what it was 10 years ago.

The media conglomerate’s problem is simple. Its traditional TV business is struggling. It has been spending billions on creating original content for streaming but the payoff hasn’t been great so far. And its movie business hasn’t delivered blockbusters of late.

Disney has lost its magic.

And India is a particular sore spot. It’s a market of 1.4 billion people that promises so much, yet yields so little.

The thing is, for Disney, India came as a package deal when it acquired media company 21st Century Fox in 2019. And you could say that Disney inherited its baggage. We’re talking about Star India, owned by Fox.

See, there’s no denying that Star is prime property. It commands a 20–30% share of Indian TV. But there was one problem — cricket. The folks at Star had spent over ₹40,000 crores in the past decade just to acquire the media rights to stream cricket on TV and on its OTT platform Hotstar. But the ad revenues just weren’t enough to justify these spends.

To make matters worse, Reliance entered the fray last year with its big pockets. It snatched away the digital rights to stream the lucrative IPL. And it even let people watch the 2023 season for free.

So a short while after Disney arrived to steer the ship, Star had already lost its marquee digital property. It was left with just the TV rights to the IPL. And well, that’s just not enough in the age of OTT.

And if you drill down, you’ll see more problems.

On the face of it, there’s no one bigger than Disney+Hotstar in the Indian OTT world. It has over 50 million subscribers while Amazon and Sony Liv have around 20 million and Netflix is only at 7 million.

But here’s the thing. These subscriber numbers don’t reveal the full picture.

You see, there’s the ARPU or the Average Revenue Per User problem. While Disney+Hotstar might boast about its subscriber count, these folks don’t seem to be adding much value at the end of the day. It has earned a measly $0.60 per user on average. And if you look at the ARPU of the global streaming platform Disney+, after excluding India, that number hovers at around $7. The numbers are diverging more starkly as each quarter goes by.

That means, it doesn’t contribute much to the parent company’s bottom line either. Hotstar is just 5% of its revenues. And estimates say that Star will lose money next year.

So getting rid of it won’t really hurt Disney. At least from a financial perspective. Meanwhile, such a move will give its investors hope that Disney is willing to make the hard calls to bring its business back on track.

Anyway, let’s assume that all this is true and that Disney indeed wants to wash its hands off of India. So it still needs a saviour to step in. And some big names have already made the news. There’s Reliance which already has a major presence in media through Viacom18 and JioCinema. Acquiring Star would give it quite an unmatched heft. There’s also Sony. While it is in the midst of trying to acquire Zee, the deal has its own legal issues right now. And they could consider Star if the proposition is attractive.

But, there’s another name in the mix too. Some analysts think that the dark horse in this fight could be the Tata Group.

Why Tata, you ask?

Well, Disney already has a relationship with the Tatas. It has a 30% stake in Tata’s broadcast entity Tata Play. Sure, it was part of the package when Disney acquired 21st Century Fox, but it’s still something.

Also, Tata has been a distributor of content for a while now through Tata Play. It brings TV channels to people’s homes. And it even sells subscriptions to OTT bundles. It has been trying to make its mark in the digital space as people ditch regular TV. But Tata doesn’t have anything to really call its own. It’s simply a conduit.

Maybe this is the perfect chance for it to change that?

Anyway, all this is speculation for now. We don’t know what’s next. All we can say is that Disney does seem to be giving India a bit of a snub of late. It hasn’t mentioned India even once during all their earnings calls in the past year. So maybe that is a sign of things to come. And we’ll just have to see how it all plays out now.

Until then…

Don’t forget to share this article on WhatsApp, LinkedIn, and Twitter.

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

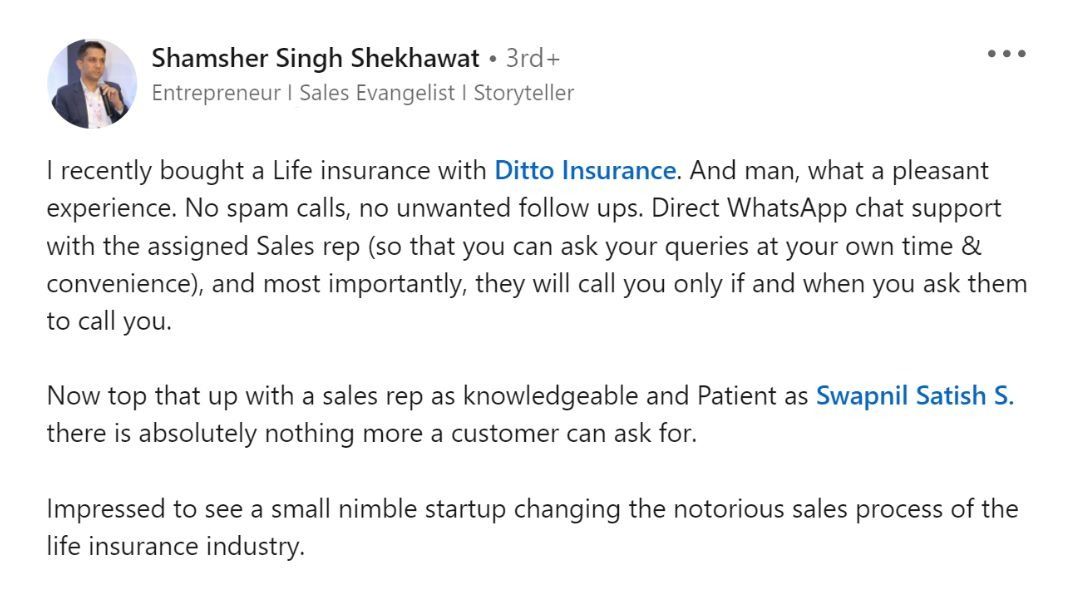

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here