Axis Bank x CreditAccess Grameen, 500% Tariffs, and more...

In this week’s wrapup, we discuss the sequel to our story on what would happen if India faced a 500% tariff, the PhonePe DRHP, why PVR INOX sold 4700BC to Marico, the India–EU Free Trade Agreement, and the latest Economic Survey.

And in this week’s Markets edition, we explain why Axis Bank is suddenly interested in acquiring CreditAccess Grameen, a microfinance institution, despite a not-so-great experience with a similar acquisition in the past. You can read it here.

With that out of the way, let’s look back at what we wrote this week.

Part 2: What will happen if India gets a 500% tariff?

When the US imposed a 50% tariff, Indian exporters didn’t slash prices. They protected margins and accepted lower volumes. That tells us that tariffs didn’t hurt Indian producers as much as they hurt American consumers.

But now imagine a 500% tariff. An $800 iPhone made in India would cost nearly $5,000 in the US. Diamonds, medicines, electronics, and even IT services would become unviable overnight. This spike in prices would eliminate demand almost entirely.

So, who exactly is the winner in this? Read our Monday story to find out.

Breaking down the PhonePe DRHP

Last week, PhonePe filed its updated DRHP. And its IPO, at ₹13,500 crore looks pretty big.

But here’s the twist. The company isn’t raising any new money at all. It’s a pure exit for early investors. That alone changes how you should read this IPO.

After all, PhonePe looks like a free payments app, and UPI transactions don’t really make money.

So why list now, and how does a company built on “free” payments suddenly report improving margins? We broke this down in Tuesday’s newsletter.

Why PVR INOX let 4700BC go

When you got o the movies, you almost swear that you won’t buy popcorn. But just five minutes later, you’re holding the biggest tub anyway.

Cinemas know this trick well. For them, tickets might lure you in, but popcorn is what really pays the bills. Which is exactly why PVR once thought that owning 4700BC, a popcorn brand, made perfect sense.

But last week, PVR INOX decided to sell this very brand it bought cheap and nurtured for a decade, to Marico for ₹226 crore. But why?

We break it all down in our Wednesday story here.

The India-EU Free Trade Agreement Explained

After nearly 20 years of negotiations, India and the EU have finally sealed a free trade deal linking India to a 27-country bloc and over 450 million consumers. But this agreement isn’t just about cutting tariffs. It’s about anchoring India more firmly into Western supply chains as global trade fragments.

The deal boosts labour-intensive exports like textiles, leather, pharma, and engineering goods, while also opening doors for Indian professionals and students to work across Europe. At the same time, it puts pressure on protected sectors like the automobile, wine, and gourmet foods. So is this FTA a growth engine or a stress test for the Indian industry and talent retention?

Read the full breakdown to find out.

The Economic Survey 2026 Explained

Every year, just before the Union Budget grabs all the headlines, the government quietly releases a document that does the real scene-setting — the Economic Survey. This document narrates the story of where the Indian economy has been, what held it together, and what could trip it up next.

And the latest one paints a reassuring picture. It tells you that growth is holding up despite global chaos, that consumption is doing the heavy lifting, and that India is positioning itself as a steady outlier in an uncertain world.

But scratch a little deeper and you’ll notice the fine print: a falling rupee, shaky investor confidence, how much the country is dependent on foreign inflows and more.

So is this Survey a confident progress report or a polite warning? Find out in our Friday story here.

Finshots Weekly Quiz v2.0 🧠

Hey folks! A few months ago, we hit pause on the Finshots Weekly Quiz because we were cooking up something new. And last month, we finally unveiled the Finshots Weekly Quiz v2.0. If you missed out, don’t worry. Click here to check out the rules and set a reminder to participate consistently starting next month!

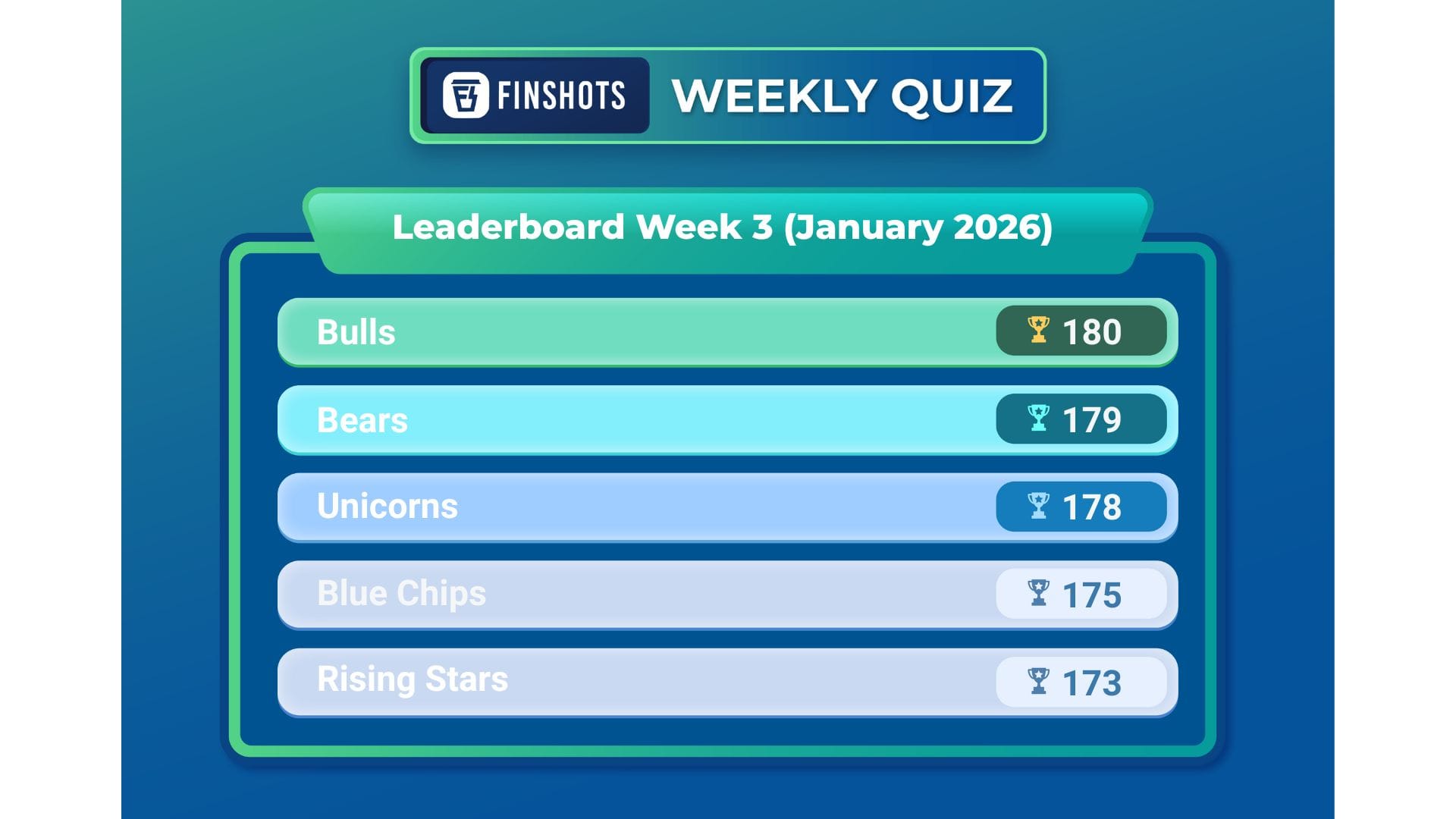

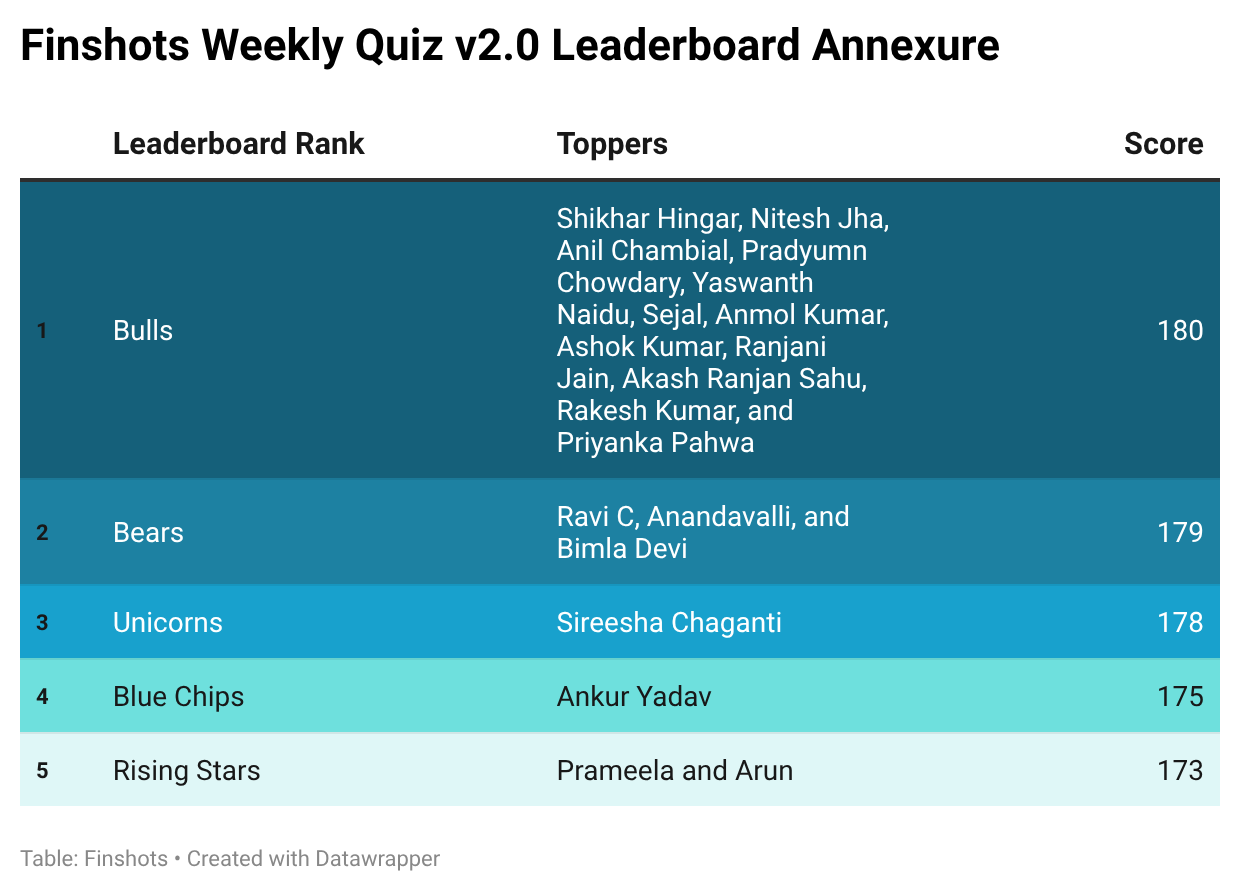

But for now, it’s time to announce the top scorers of our previous weekly quiz. There were a whole bunch of you who participated, and many of you ended up with the same scores. So we’re calling you Bulls, Bears, Unicorns, Blue Chips, and Rising Stars. Here’s how the leaderboard looks right now:

If your name has been featured on the leaderboard, then congratulations! If not, don’t lose hope. If you attempted last week’s quiz, keep at it and answer all the weekly quizzes this month. You never know when the turntables! Click on this link to take the last quiz of the month, which is open till 12 noon, Friday, 6th of February, 2026. The more answers you get right, the better your chances of appearing on the Finshots Weekly Quiz leaderboard. We’ll publish it every Saturday in the Weekly Wrapup. And January’s will be announced next week.

Liked this week’s wrapup?

Don’t forget to share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X. And subscribe to Finshots, if you haven’t already. Plis!

Did you know? Nearly half of Indians are unaware of term insurance and its benefits.

Are you among them?

If yes, don’t wait until it’s too late.

Term insurance is one of the most affordable and smartest steps you can take for your family’s financial health. It ensures they do not face a financial burden if something happens to you.

Ditto’s IRDAI-Certified advisors can guide you to the right plan. Book a FREE 30-minute consultation and find what coverage suits your needs.

We promise: No spam, only honest advice!