Why the Piramals are letting go of VIP

In today’s Finshots, we tell you why Dilip Piramal, the chairperson and part of the founding family behind VIP Industries, has decided to pack his bags and sell a majority stake in the company to a private equity firm.

The Story

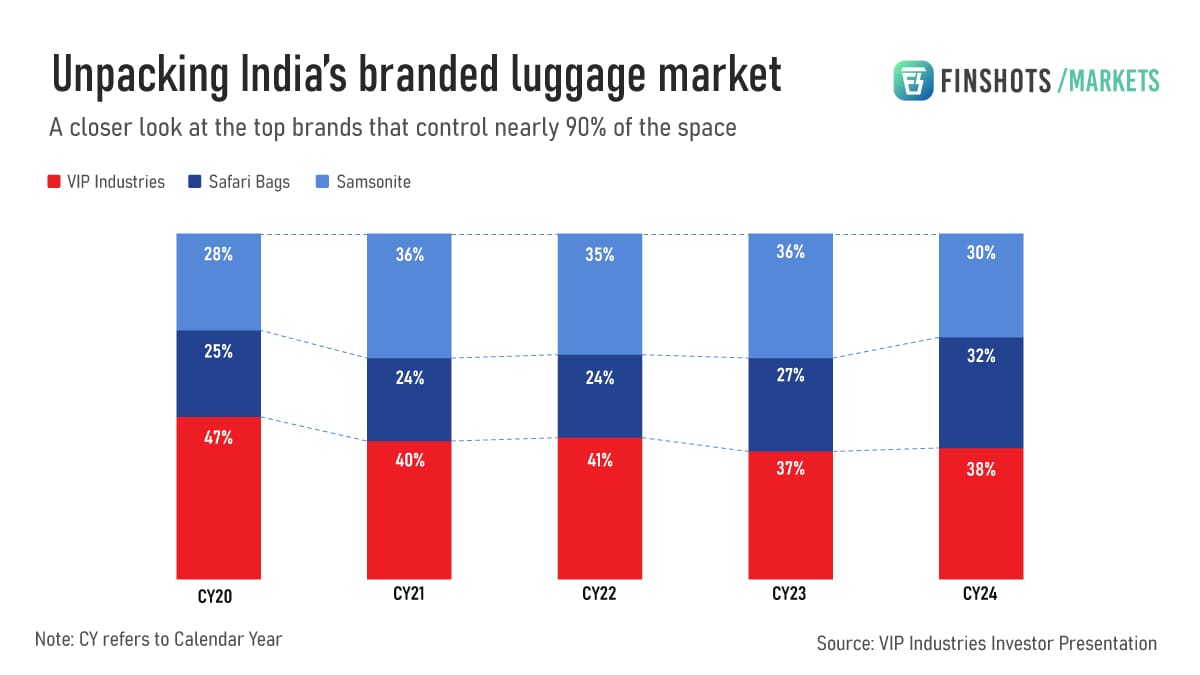

India’s branded luggage market is dominated by three big names — Samsonite, Safari and VIP, in ascending order of popularity and market share. And together, they command nearly 90% of the entire industry.

Now, if you break that down even further, VIP Industries still comes out on top. It’s India’s largest luggage manufacturer.

But just a few days ago, something big happened. The company’s chairperson and founding family member, Dilip Piramal, decided it was time to part with control. He will soon sell a 32% majority stake in VIP to a group of investors — Multiples Alternate Asset Management (a private equity firm), Samvibhag Securities and Mithun Sacheti and family (founders of CaratLane).

And that’s not all. The investors will also make an open offer to buy another 26% from public shareholders, spending about ₹1,400 crores for that chunk alone. If the offer goes through, the total deal could add up to nearly ₹3,200 crores, giving them a 58% stake in the company.

But VIP had always been a family-run business. It began in 1968 as Aristoplast Pvt. Ltd., and in 1980, Dilip Piramal took the reins after the passing of his father, Gopikishan Piramal.

So why sell now, when VIP has been ruling the luggage game for years, you ask?

Well, the short answer is that the next generation isn’t interested in carrying the legacy forward. But that’s just part of it.

Piramal also believes that he should’ve exited the business much earlier and that holding on too long has cost him dearly. And to understand why he feels that way, we’ll quickly need to go back and look at how VIP’s business works.

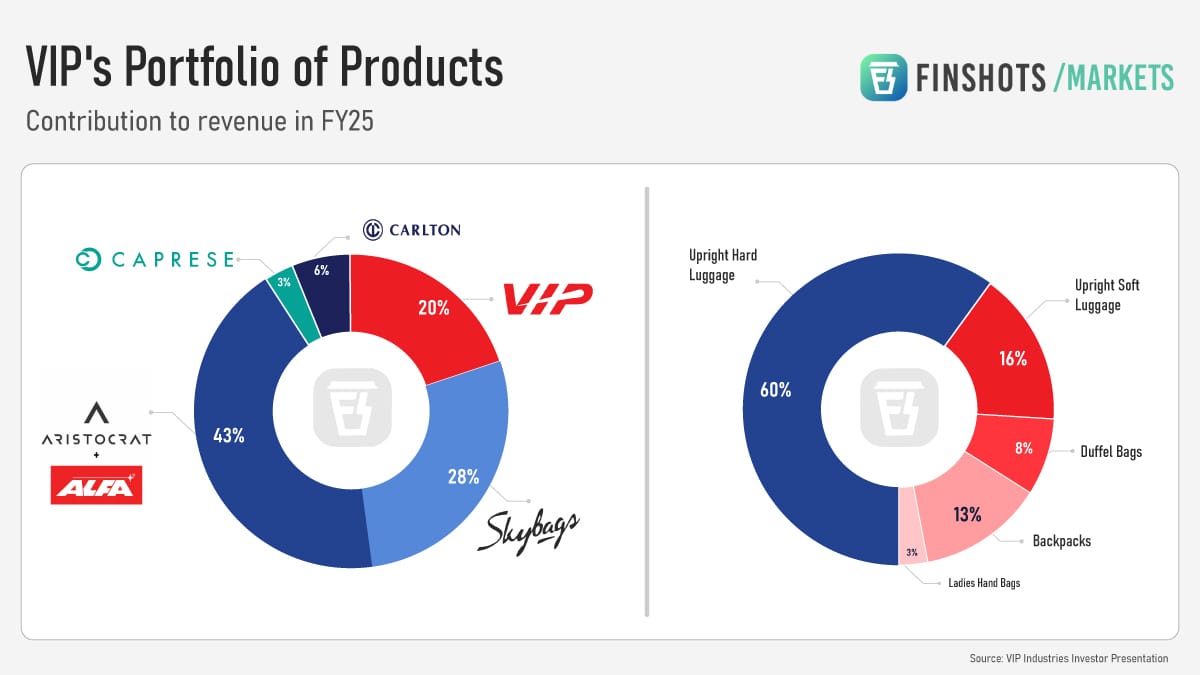

See, there are two terms you should know to make sense of the luggage market: hard luggage and soft luggage.

Hard luggage is your classic hard-shelled trolley — plastic-like on the outside, built to protect everything inside. So if you’re worried about airline baggage handlers tossing your bag and decimating everything inside, this is what you’d pick.

Soft luggage, on the other hand, is typically made of fabric or polyester blends. It’s lighter, easier to squeeze into overhead bins, and generally more flexible to handle.

Now, here’s the thing. The luggage industry tends to swing between these two based on consumer trends. Both have their place, but at any given time, demand leans more heavily toward one. And right now, it’s swinging decisively toward hard luggage, which makes up nearly 80% of all sales.

The problem?

VIP didn’t quite see that coming despite starting out as a hard luggage maker. Piramal himself admitted in his interviews that the company was struggling to wrap its head around the shift back from soft to hard luggage.

And that’s ironic because VIP actually started off as a hard luggage company, making those vintage briefcases that we used to see in India and were built to last. One customer even wrote to Piramal saying that they’d used a VIP briefcase to shield themselves from gunfire during the peak of militancy in Punjab in the 1980s.

So when the Chairperson of one of India’s top luggage makers says that the company couldn’t keep up with a demand shift towards hard luggage — a category it still sells and one that makes up more than half its revenue, it’s a bit hard to digest.

But maybe here’s a valid explanation. In the 2000s and 2010s, VIP leaned heavily into soft luggage. Indian travellers were looking for lighter, more flexible bags and soft cases fit the bill. So the company doubled down, revamping its supply chain, inventory and design to focus on this shift.

But after the pandemic, things flipped. Hard luggage made a strong comeback. And VIP suddenly found itself stuck with warehouses full of excess soft luggage inventory and a backend not quite ready to scale up hard luggage production overnight.

Then there’s the matter of deep discounting.

The luggage market is split evenly between the organised and unorganised sectors. On one side, you have the established names like VIP, Safari and Samsonite, along with rising stars like Mokobara, Uppercase, Nasher Miles and Assembly. This is the organised market, where brands compete through recognition, online visibility and of course, steep discounts. So steep, they often eat into each other’s profits just to stay relevant.

On the other side sit the lesser-known players — small manufacturers and unbranded sellers who make up the unorganised sector. Their prices are usually much lower than the big names, even if there aren’t official numbers to prove it. And sometimes, this side may even include counterfeit products floating around the market.

So legacy brands aren’t just fending off unknown competitors. They’re also undercutting each other, creating a price war that’s hard to sustain. In fact, Samsonite’s CFO blamed this very culture of discounting for their revenue drop in Asia, particularly in the Indian subcontinent. And he didn’t shy away from calling out VIP and Safari during an investor call.

VIP, of course, denied it saying the discounts were limited to their soft luggage range. They claimed that the real challenge came from new-age brands, some of whom were apparently selling below cost just to grab market share.

Still, the impact was clear. The intense price battles and cut-throat competition had begun to reflect in the numbers. And that meant that things started looking quite different for VIP.

To put things in perspective, VIP’s revenues have taken a hit since peaking in FY24. In FY25, they ended up with a loss of ₹69 crores and their EBITDA margin dropped to a measly 3% from about 9% earlier. In fact, they’ve incurred losses in three out of four quarters last year.

For comparison, Safari, another major player in the organised luggage space, is in a much stronger position, both financially and operationally. FY25 was one of their best years yet, with ₹1,772 crores in revenue, ₹143 crores in net profit, and an impressive 12% EBITDA margin.

Put all of this together and you’ll see why the Piramals think handing over VIP to a private equity firm is the best move right now. They also feel that the current professional management has hit a wall, struggling to keep up in an increasingly competitive market, even calling it an “internal management crisis”.

And like we mentioned earlier, since none of the heirs are keen on taking over, bringing in a private equity firm that specialises in unlocking value seems like the obvious next step.

But there’s something else you should know. As part of the takeover, there’s an open offer to public shareholders at ₹388 a share. That’s nearly 17% lower than the current market price, which might look like a bad deal at first. But it could actually set VIP up for a much-needed reboot. Because it’s not the only one feeling the heat. The entire luggage industry has been in a bit of a slump.

Sure, two years ago, bag makers rode the post-pandemic “revenge travel” wave. But that surge has faded. And now, among the big players, VIP seems like the only one heading into a full-blown transformation with new owners and possibly, a new strategy.

And if there’s one thing PE firms are known for, it’s pushing rapid change and creating value. Whether that turns into real gains for shareholders is something we’ll have to wait and see.

Until then…

Don’t forget to share this story with friends and strangers on WhatsApp, LinkedIn or X.

Did you know? Nearly half of Indians are unaware of term insurance and its benefits.

Are you among them?

If yes, don’t wait until it’s too late.

Term insurance is one of the most affordable and smartest steps you can take for your family’s financial health. It ensures they do not face a financial burden if something happens to you.

Ditto’s IRDAI-Certified advisors can guide you to the right plan. Book a FREE 30-minute consultation and find what coverage suits your needs.

We promise: No spam, only honest advice!