Who controls the computer in your car?

Last week, Tata Technologies announced that it had filed its papers for an IPO. Think of Tata Tech as the company that supplies a bunch of tech that goes into engineering Tata Motors and making the supply chain of Jaguar Land Rover more efficient.

Now we don’t know when the Tata Technologies IPO will happen. And when it does, we’ll probably do a full-fledged explainer on it. But in the meantime, when we went down the rabbit hole of Tata Tech’s Draft Red Herring Prospectus, it opened our eyes to the world of auto technology stocks. And we found one listed company staring right in our faces — KPIT Technologies.

So in today’s Finshots, we explore the growing role of these auto tech companies in our lives.

The Story

In 1930, the first mass-market AM radio was introduced into a car. People had to fiddle around with the knob a bit to find a radio station they liked. But no one cared that it was cumbersome. Because back then it was quite revolutionary.

Cut to today, you can simply say, “Hey, Google. Play the Finshots Daily Podcast on Spotify,” and your car will oblige. Well, it better, because we’d throw a tantrum otherwise. We’re just used to instant gratification without even having to lift a finger.

Cars these days are basically software on 4 wheels. And there’s a massive megatrend that’s playing out in the industry — it revolves around 3 big things and it’s called ACE*.

Firstly, it involves Connected vehicles that are linked to the internet. It’s what keeps your infotainment system running smoothly. And helps you download software updates for it over the air. And as per McKinsey, 95% of new vehicles sold in 2030 will be connected to the internet.

Secondly, there are Autonomous cars — the kind that can automatically help you avoid a head-on collision or alert you when it senses you’re drowsy. You can imagine that these things require complex lines of code and software to run without a hitch.

Thirdly, there’s a paradigm shift towards Electric vehicles — either due to a personal preference or as in the case of the EU, because of a ban on fossil-fuel-dependent cars by 2035. Now legacy carmakers are embracing this new normal quickly and they need to develop robust battery management systems for EVs and improve charging technology. All through software.

Now here’s the thing. Carmakers aren’t exactly what you’d call tech experts. They just want to make mechanically and aesthetically pleasing cars that can take us safely from point A to point B.

Sure, they could hire a large team, pay them the big bucks, and get them to work on the tech stuff. But heck, carmakers routinely buy even the basic components — horns, brake pads, gears from auto ancillary companies. So why should they break their head over all this complex tech, right? It’s best to leave the tech to the pros. And just do the things they’re good at — innovate and build the cars.

So when KPIT Technologies announced on 15th March that it was joining hands with Honda to help the Japanese carmaker’s self-driving ambitions, our ears perked up. Not just ours, but even the ears of investors because the stock price jumped by 7%.

Now if you haven’t heard of KPIT Technologies before, we don’t blame you. It’s not like you’ll find their logo stamped anywhere on your car. But the company actually first set up shop in 1990 when a couple of Chartered Accountants had teamed up to begin an IT outsourcing company.

Yup, we know what you’re thinking — accountants in tech?!

These folks did some basic run-of-the-mill IT outsourcing work back then. But somewhere along the way, they also saw a massive opportunity in the auto tech space. They thought the outsourcing boom would trickle into the automotive industry too.

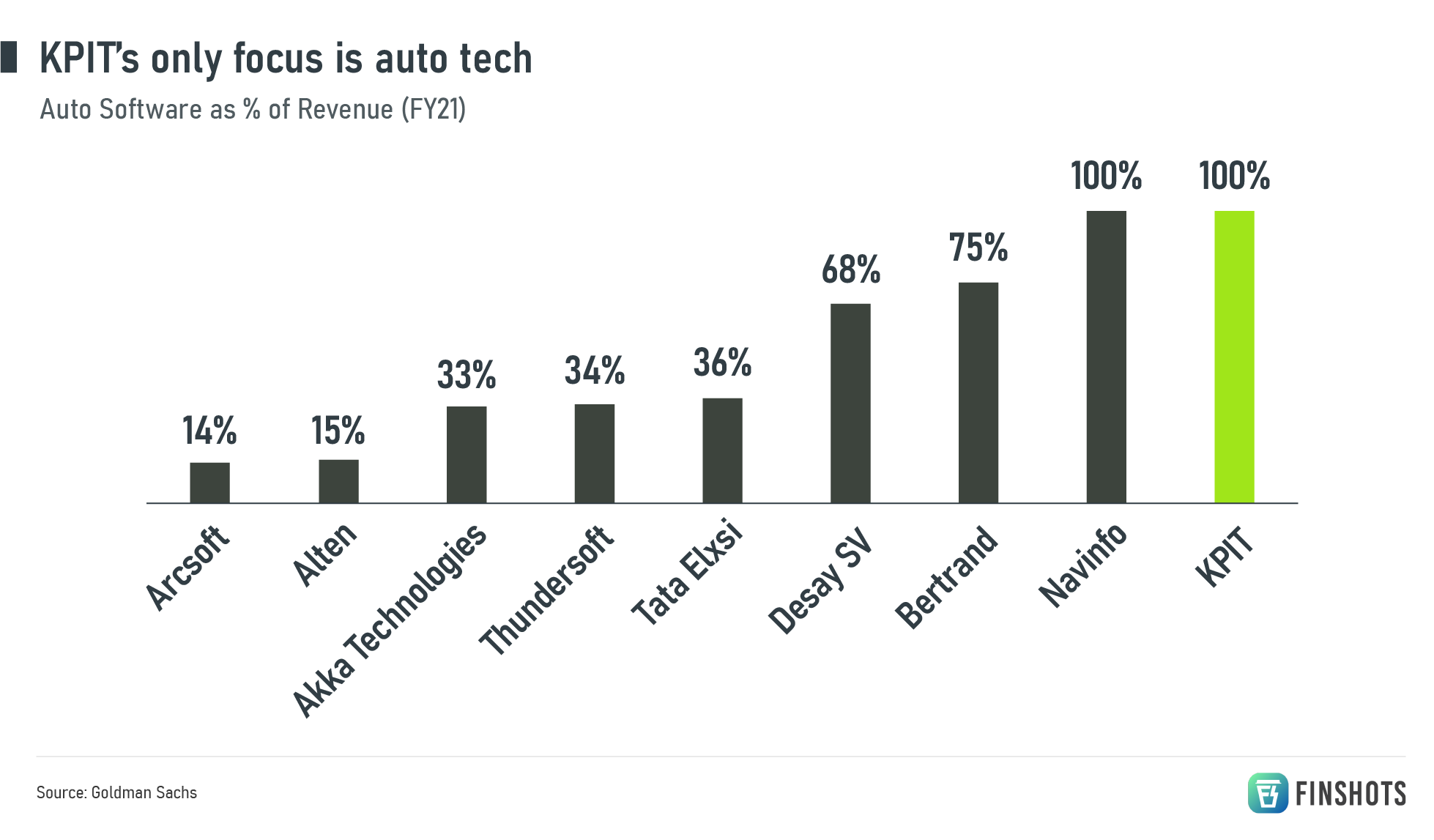

And after a few mergers and demergers, in 2019, they decided to focus squarely on this auto tech business. Their regular IT business was growing at a measly rate. So they said, “Look, we’re good at auto tech. And that’s what we’ll do. A 100% of our business focus will be on this.”

KPIT had cut its teeth in this business and built its tech chops. It was time to double down. It had to show its customers that it was dedicated to the craft of building technology only for the automotive industry. So it split the company into two — Birlasoft for the IT services. And KPIT Tech for auto engineering.

Now to capitalise on this and prove its mettle, it needed highly skilled workers with niche skillsets too. So it hired these folks. And as Goldman Sachs pointed out, you can see this clearly playing out in the average wages the company pays. It’s 50% higher than its rival Tata Elxsi which does a lot of the same stuff.

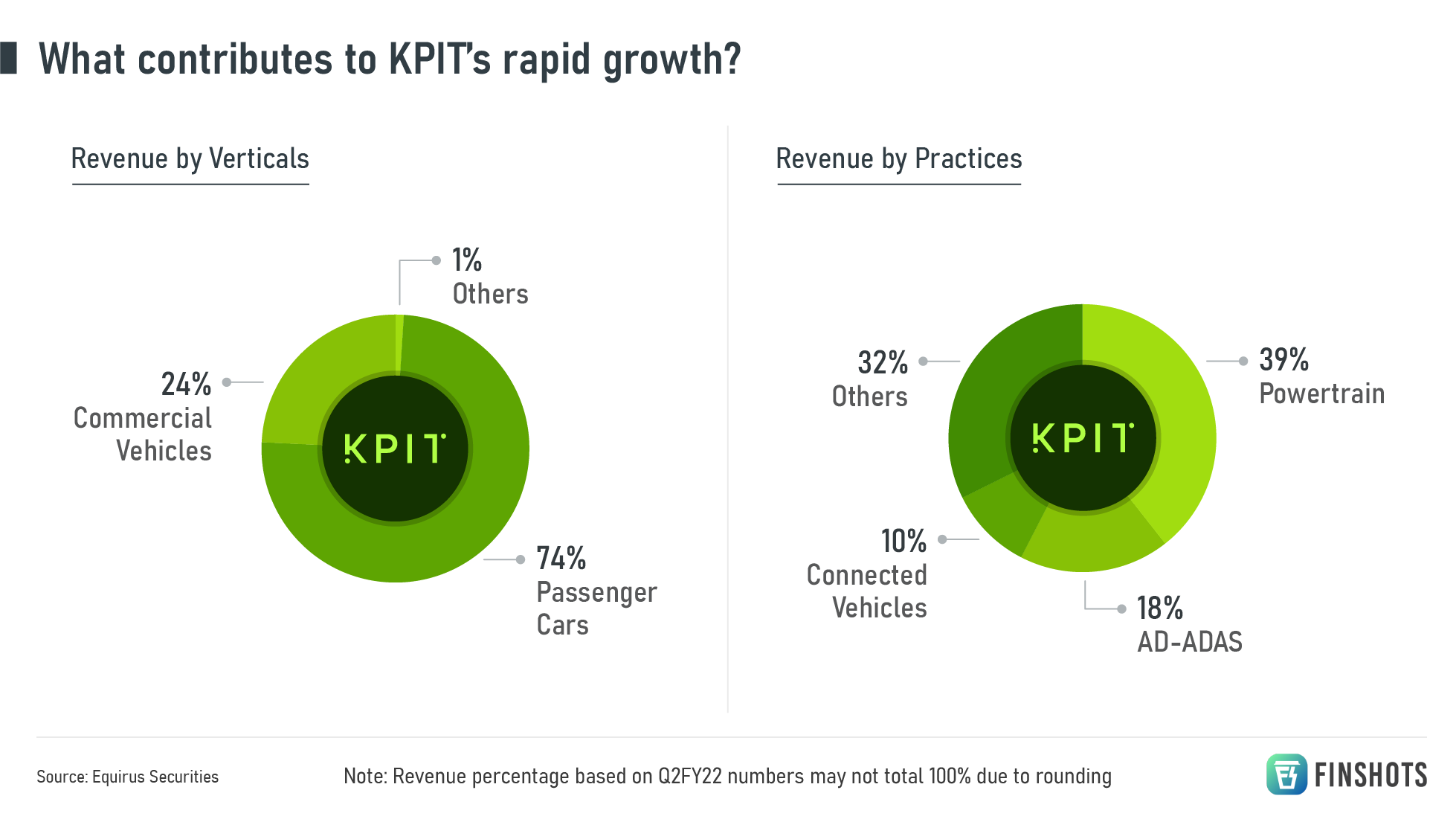

And over time, KPIT got its finger into every auto tech pie.

It built tech that would help carmakers improve fuel efficiency and reduce emissions. It created infotainment solutions and digital cockpits that would get the passengers to think they were in some kind of futuristic world. It developed ADAS or Advanced Driver Assistance Systems such as parking assistance and anti-collision. And it even started developing the middleware for cars. Think of middleware as the Android operating system of cars. It’s the foundation that runs everything. And apps and tech can be built on top of it. It was the whole shebang.

And KPIT was in the right place at the right time. Because according to Deloitte, electronics were only 27% of a vehicle’s cost in 2010. But it now accounts for a whopping 40% of the cost.

And since carmakers realise that this tech component is only going to inch higher and higher, they’ve been splashing cash on it. For instance, between 2010 and 2018, the sales of the top 20 carmakers around the world only grew by 6% annually. But, KPIT’s revenues soared by 22% (in US dollars).

So even if cars weren’t selling like hotcakes, the manufacturers weren’t hesitating to outsource development and keep up with the tech curve. Simply because they know that they need to innovate and launch products quicker. And to do that, they need the help of companies like KPIT to create a world of software-defined vehicles!

Now all this sounds great for KPIT. But what’s the risk lurking in the shadows?

Well, the big risk is that of concentration.

While KPIT has 55 active clients, 84% of sales come from its top 21 clients. And don’t forget that all of them are in the auto industry. So its fortunes are heavily linked to the demand for cars and how carmakers evolve.

Now, what if we have a scenario where auto manufacturers wake up one day and decide that they don’t want to outsource their crucial tech anymore? They might want to focus on captive centres that they themselves operate. Maybe they think that in a world where drivers are increasingly leaving it to their car computers to make driving decisions, they don’t want someone else’s software controlling things. And if that happens, you’ll see a lot of unhappy faces in the KPIT camp.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.

*The megatrend is commonly referred to as CASE because it includes one more element — Shared Mobility. This is nothing but the growth of ridesharing fleets and it’s based on the premise that car ownership levels will drop. That means companies operating in this domain will need to improve the car-sharing user experience using technology. But it’s still a small piece of the puzzle for KPIT Technologies.