Understanding the Gaudium IVF IPO

In today’s Finshots, we break down the Gaudium IVF and Women Health IPO, which opened for subscription today and closes on 24th February 2026 (Tuesday).

The Story

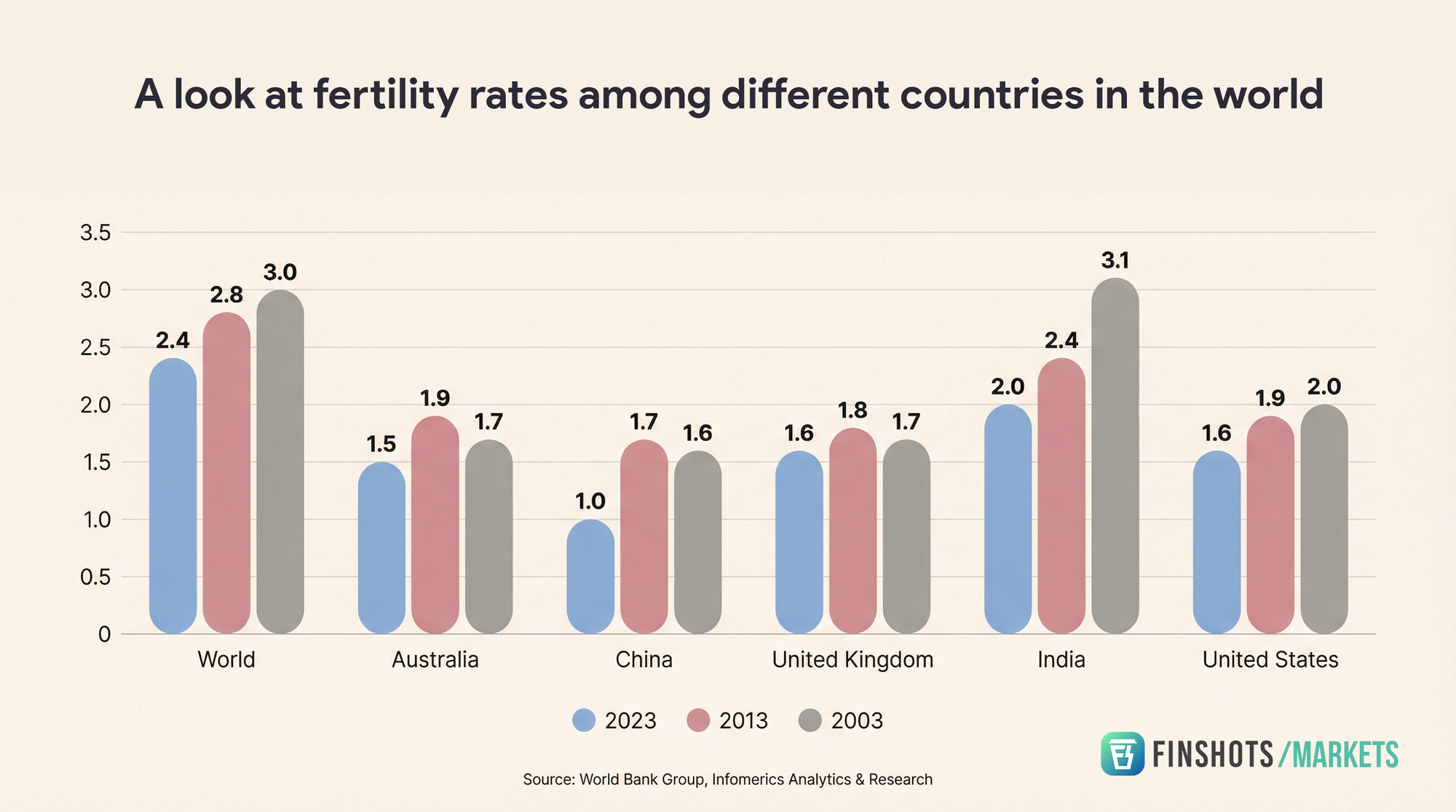

In 2003, India’s fertility rate stood at 3.1 births per woman. Cut to 2023, and it’s down to 2.

The fertility rate simply means the average number of children a woman would have over her lifetime, assuming she lives through her reproductive years (typically 15 to 49).

Now, 2 children per woman might sound perfectly reasonable. But here’s the catch. To keep a population stable, the rate needs to be at least 2.1. That’s what demographers call the replacement level. And that tiny 0.1 gap actually matters because when you compound that shortfall across millions of families, it means fewer young people entering the workforce in the future and a larger elderly population to support. Over time, that shift can weigh on economic growth.

And the reasons behind this decline aren’t exactly surprising. Urban couples today are prioritising education and careers before marriage and children. At the same time, medical advances like egg freezing and IVF (In Vitro Fertilisation, where an egg is fertilised with sperm outside the body in lab conditions) have made people more comfortable delaying parenthood. Besides, rising incomes and even EMI financing for fertility treatments, which can cost several lakhs, have made assisted reproduction more accessible beyond just big cities. Add to that modern lifestyles that include long sitting hours, stress, smoking, alcohol, and other factors contributing to infertility among both men and women.

Put all this together, and you can see why assisted reproductive technology (ART) has quietly become one of the fastest-growing segments in healthcare. For context, the global IVF market was about $27 billion in 2024 and is expected to double to $54 billion by 2034. India’s market, though smaller at roughly $1 billion, could quadruple in the same period.

And that’s the backdrop against which Gaudium IVF and Women Health now plans a ₹165 crore IPO. If it pulls this off, it would become the first pure-play fertility services company in India to hit the stock market.

So let’s understand Gaudium IVF’s business model and whether it’s worth the money it’s asking for.

But for that we’ll have to give you a fair idea of what IVF clinics actually do.

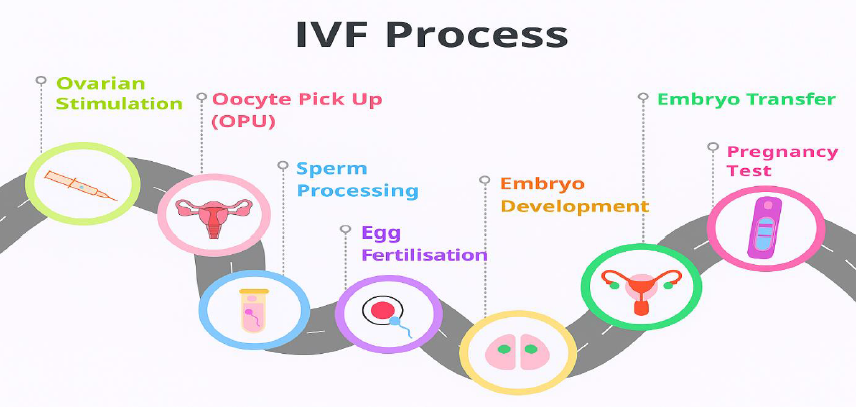

At its simplest, you can think of an IVF clinic as a specialty hospital for people who can’t conceive naturally. The process itself is fairly structured. Doctors stimulate the ovaries — the organs that store and release eggs, using hormones. They then retrieve the eggs, select the healthiest sperm from the partner or a donor sample, fertilise the egg in a lab, and create embryos (the early stage of a developing baby formed from a fertilised egg). These embryos are grown for 3–5 days before one or more are transferred into the uterus. Then comes the longest two-week wait for a pregnancy test.

That’s the core service, around which IVF clinics build their revenue.

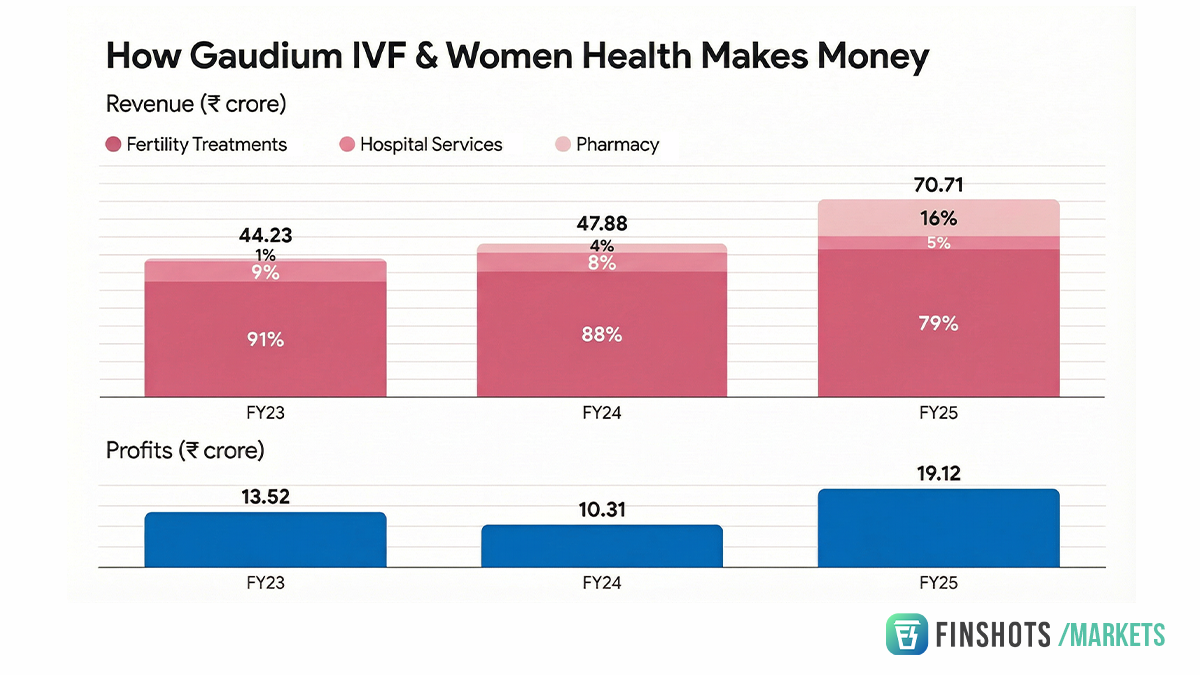

First, there’s fertility treatment, the biggest bucket by far. This includes IVF, but it doesn’t stop there. It also covers male infertility treatment, Intrauterine Insemination (IUI), where sperm is placed directly inside the uterus to improve chances of conception, Intracytoplasmic Sperm Injection (ICSI), often combined with IVF for male fertility issues, ovulation induction to stimulate egg release, surrogacy, infertility surgeries, and treatment for PCOS (Polycystic Ovary Syndrome or hormonal imbalance in women that can lead to infertility). In Gaudium’s case, this segment contributed 79% of total operating revenue in FY25.

Next are hospital services, contributing about 5%. Gaudium runs a 15-bed hospital in Janakpuri, Delhi NCR, which is also where it is based out of. It handles day-care procedures related to women’s and child health, IVF treatments, and even deliveries for patients who choose to have their babies there.

Now we know what you’re thinking. Just one hospital in Delhi sounds limited. But Gaudium doesn’t rely on a single location. It follows a hub-and-spoke model. Meaning, it operates 7 main hubs across Delhi (two centres), Mumbai, Ludhiana, Srinagar, Patna and Bengaluru. These are full-service centres where advanced procedures are carried out.

Around these hubs, Gaudium has built a network of 28 spoke centres and alliances with infertility clinics in smaller towns. These handle consultations, preliminary treatments and follow-ups. Only patients who need advanced care are referred to the hubs or to the hospital for day-care procedures.

These locations are deliberately chosen in states where fertility rates are below 1.8. This model helps Gaudium stay asset-light, expand its reach, and grow without having to pour massive capital into building hospitals everywhere.

Finally, there’s pharmacy services, contributing 16% of revenue. The in-house pharmacy supplies medicines and consumables for treatments and supports other centres.

Together, this translated into ₹70 crore in operating revenue in FY25, growing at a 26.5% CAGR (compound annual growth rate) over two years. Profits rose from ₹13 crore in FY23 to ₹19 crore in FY25. EBITDA margins remain strong at 40–45%, while PAT margins dipped from 30% in FY23 to 21% in FY24, before recovering to 26% in FY25.

Now that might sound odd. Revenue and EBITDA have gone up. So why were profit margins under pressure?

The answer lies in something called average revenue per person (ARPP). This fell sharply from ₹3.44 lakhs in FY23 to ₹1.89 lakhs in FY24, before bouncing back to ₹3.55 lakhs in FY25.

The reason is fairly simple. An IVF cycle isn’t a single event. It’s a series of stages — ovarian stimulation, Oocyte Pick Up (OPU) where mature eggs are retrieved, fertilisation in a lab, embryo development, embryo transfer (ET), and finally the pregnancy test.

And not all stages earn the same money.

The ET stage typically brings in higher realisations and better margins. But in the earlier stages, especially OPU, the clinic incurs heavy costs on medication and consumables. And over the past few years, OPU cycles have increased from 1,167 in FY23 to 1,563 in FY25. Meanwhile, ET cycles have actually fallen from 2,345 to 1,913.

So more revenue came from relatively lower-margin stages. Add to that the fact that total expenses as a percentage of revenue rose from 58% to 64%, and you can see why margins took a hit.

That said, even with this blip, Gaudium’s profitability still stands out. Its PAT margin of 26% is comfortably higher than unlisted peer Indira IVF, which operates at around 18%. It’s also ahead of global players like Progyny in New York at 4–5% and Inspire IVF in Bangkok at 15–20%.

Another advantage for Gaudium IVF comes from tighter regulations.

In recent years, India has made its surrogacy and ART laws far stricter. Commercial surrogacy has been banned. Now, only married women who already have at least one biological child and are relatives of the intended parents, can act as surrogates. Embryo trading and sex selection are banned too.

This has reshaped the industry. What was once a largely unregulated space dominated by small clinics is gradually moving towards organised, compliant chains that can handle stricter oversight. That naturally favours scaled players like Gaudium IVF, especially with its hub-and-spoke model.

Now sure, tougher rules have reduced some of the earlier medical tourism, particularly around commercial surrogacy. But India still enjoys a strong cost advantage. An IVF cycle here costs about $3,000–4,000 versus $15,000–20,000 in the US. And that price gap keeps India attractive to foreign patients, giving Gaudium IVF another structural edge.

But that said, there are a few things you should think about before deciding whether this IPO is worth betting on.

First, success rates — arguably the most important metric in this business. Gaudium IVF claims a success rate of 58%. That sounds solid. But peers like Indira IVF and Inspire IVF report success rates over 70%. In a space where outcomes matter more than branding, that gap is hard to ignore.

Second, there’s a sizeable contingent liability (a potential financial liability that may or may not occur depending on the outcome of the case) of ₹44 crores tied to direct tax proceedings. To put that in perspective, that’s roughly 76% of the company’s net worth of ₹58 crores as of September 2025. Now, the promoter, Dr. Manika Khanna, who’s also the founder, has formally undertaken that if this liability materialises and the company can’t meet it, she will infuse funds through unsecured debt or equity. That offers some comfort. But it’s still a risk you can’t ignore.

And then there’s a small contradiction in how it plans to use the IPO money. Of the ₹90 crores that Gaudium IVF will raise through a fresh issue of shares, ₹50 crores will go towards setting up new IVF centres, ₹20 crores to repay debt, and the rest for general corporate purposes. But remember, Gaudium’s key strength, something it has also highlighted in its RHP, has been its asset-light hub-and-spoke model. So, expanding physical centres more aggressively feels slightly at odds with that narrative. Plus, expanding while dealing with a high employee attrition rate of 63% and relying on just five embryologists to support a growing business seems like another red flag.

As for the valuation, it’s hard to evaluate whether the ₹575 crore it’s commanding is fair, since there isn’t a listed peer in India to compare it with. But if you look at the industry average among global listed companies, at the upper end of its offer price band of ₹79, Gaudium IVF trades at a P/E (Price to Earnings ratio) of 25. That’s almost at par with the global industry average of around 26.

So yeah, that’s pretty much all there was to unpack about the Gaudium IVF IPO. And while it may not be a name you hear every day, it definitely gave us a good excuse to break down how India’s IVF industry actually works.

And we’ll only have to wait and see whether this IPO has a healthy “success rate” of its own.

Until then…

If this story helped you understand Gaudium IVF’s business and how IVF clinics operate, share it with your friends, family, or even curious strangers on WhatsApp, LinkedIn, and X.

Did you know? Nearly half of Indians are unaware of term insurance and its benefits. Are you among them?

If yes, don't wait until it's too late.

Term insurance is one of the most affordable and smartest steps you can take for your family’s financial health. It ensures they do not face a financial burden if something happens to you.

Ditto's IRDAI-Certified advisors can guide you to the right plan. Book a FREE consultation and find what coverage suits your needs.

We promise: No spam, only honest advice!