The Zaggle IPO — a unique fintech + SaaS?

In today’s Finshots, we explore the IPO of Zaggle, a fintech software-as-a-service (SaaS) player

The Story

If you got your first job over a decade ago, you might remember that if you did well at work you'd probably find an envelope with some cash on your desk. Or maybe you’d get some coupons that could be spent only at select places. You’d stuff it into your wallet and go out to spend it.

It was a little cumbersome.

And that’s the problem the founders of Zaggle Prepaid Ocean Services (don't ask why it says Ocean) saw back in 2011. They wanted to make the lives of employees simpler. And that of the company too. So they introduced cards that could do the good work instead.

But wait…Zaggle isn’t a bank or an NBFC. Then how could it issue cards?

The trick is Prepaid Payment Instruments (PPIs).

Think of PPIs as a digital wallet or card that functions like a mini bank account. It could be a gift card that someone can top up with money. And the recipient of the card can use this “stored” money to make any purchase they want. And you don’t need to be a bank to deal with PPIs. You can simply partner with them to get the ball rolling.

And that’s what Zaggle did for nearly 3 years. They put their head down and went after improving the rewards and recognition (R&R) market through these cards.

Once they kind of had that in the bag, they turned to the next thing.

Again, rewind a decade. And you probably remember being issued some paper slips along with your monthly salary. You could use them to pay for food at the cafeteria. Or when you bought groceries. These expenses — up to a limit — could be claimed tax free. But the bits of paper were a headache. You could easily misplace it and there would be no way out.

So in 2016, Zaggle saw it as the next logical step. They’d launch a multi-wallet card along with Visa. Employees could use it online or offline. It could be for meal vouchers. It could be for transport. It could be for some other thing. But it was simple.

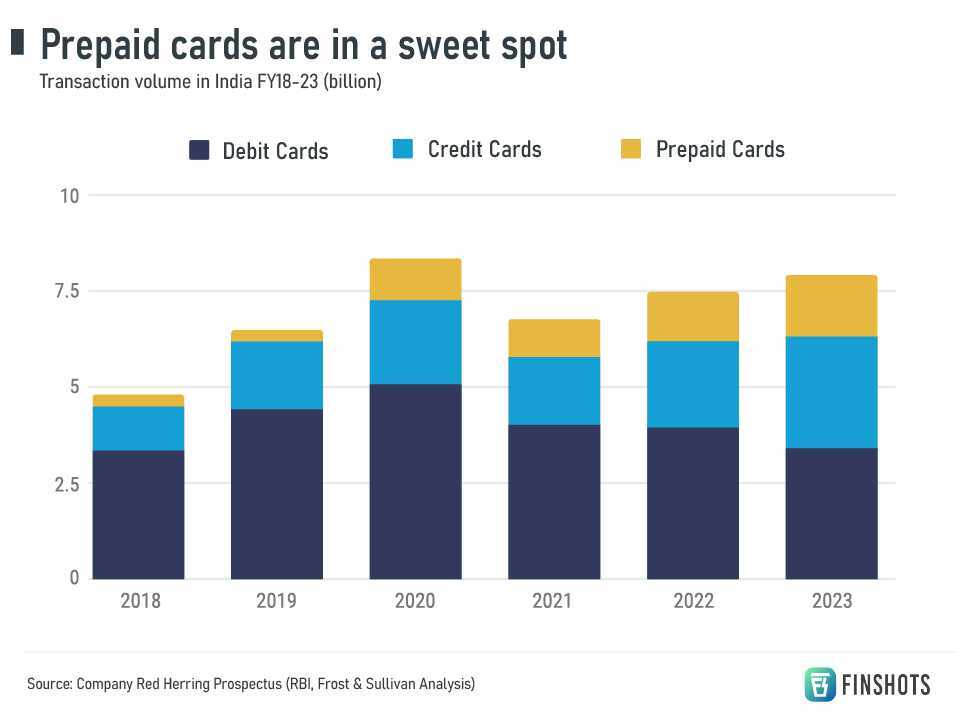

Zaggle’s evolution as a fintech had begun. And they were in the right place at the right time as the use of such prepaid cards began to explode.

Then came the biggie — expense management.

Say you had to travel to another city for an emergency meeting with a client, you might have had to swipe your own card. Then ensure that you carefully saved receipts right from the cup of coffee you had at the airport to the taxis to the food. And once you submit it, maybe wait for a month before it was reimbursed.

Now ask the HR team at your company and they’ll probably tell you that they don’t want to deal with the tedious task of tracking expenses and reimbursements of the employees. They don’t want to deal with bits of paper and receipts. And in large organizations, this could be quite voluminous. The HR would rather avoid this mundane stuff and pay attention to more value adding activities that can keep everyone engaged and motivated.

And Zaggle saw the opportunity to expand its business in this domain too. It began to create Software that would digitize this process. And help companies manage overall expenses on a single dashboard. Zaggle could sell it for a subscription. And they even had software to manage employee rewards and recognition. It wasn’t just about the cards.

Now there’s a bunch of other little stuff that they do too. But that’s the gist of the business segments that Zaggle dabbles in. It’s quite diversified. And you see how they’re a fintech + SaaS company now, don’t you?

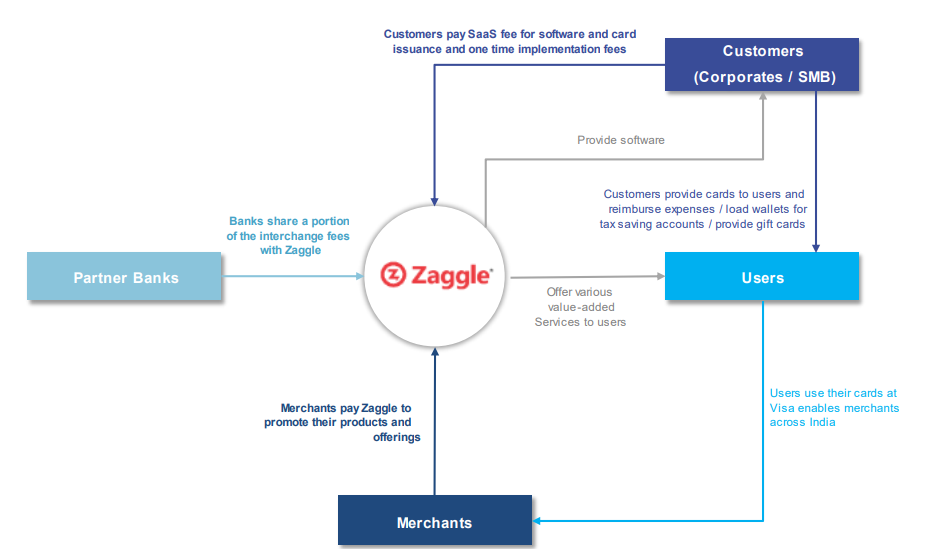

Anyway, that means Zaggle's revenue stream is quite diversified too.

For starters, there’s revenue from corporate clients for issuing reward points (Propel points) to their employees. These are the points that can be redeemed for stuff on the platform. Then there’s the money they earn from banking partners whenever prepaid cards are swiped at offline or online points of sale which is part of what they call Program fees. They charge customers multiple fees for implementing the products. And they also earn a recurring subscription from the software they sell. And they’ve also started earning commissions from their ‘value added services’ — for instance, they’ve tied up with Fibe and Tata Securities for loans and wealth management products that employees can avail. So each time someone signs up, Zaggle gets paid.

And it’s a pretty hot market. Even globally, investors have been pouring billions of dollars into funding these expense management companies. As one CEO put it, it’s part of “a desire on the part of companies of all sizes and stages seeking to save money by managing their spend better.”

So Zaggle seems to be in quite a sweet spot. And by offering this full product suite, they’ve quickly amassed a loyal customer base of over 2,400 customers split 75:25 between large corporate accounts and small businesses. We say loyal since Zaggle seems to be pretty good so far with customer retention. The churn rate is just about 1.50% in the past 3 years. Although we do have to mention here that it’s a young company with even younger products. So the churn rate could go up in the future as competition gets more intense too.

And maybe the company is aware of this. Maybe that’s why nearly 70% of the ₹560 crore IPO is an issue of new shares. The company will receive fresh funds and the number one item on their agenda is to acquire new customers and retain existing ones — which probably means fresh spends on building out tech as well.

Now all this sounds great, right?

So, what’s the catch in the IPO? What are the risks?

Well, the borrowings have risen quite a bit. In March, the company raised ₹50 crores as a loan from a fixed-income focused Alternative Investment Fund (AIF). Sure, part of the IPO proceeds will be used to repay this. But you have to wonder why a SaaS company resorted to debt especially when it was so close to an IPO. Because the end result right now is that the company seems quite leveraged. The ratio of debt to equity is nearly 3 times.

Then there’s the fact that even though the revenues look good on paper, there’s quite a bit of expenses too. For instance, there’s a cost that the company bears when reward points are redeemed or gift cards are used — 63% of Zaggle’s total expenses are attributed to this segment. And the end result is that the company makes just ₹20 crores in profits on over ₹550 crores of revenues. It’s not a great net profit margin.

Then there’s the valuation. A PE (Price-Earnings ratio) of nearly 70 times is causing some discomfort among potential investors already. Many feel that the company does not have the track record to really command this premium.

So yeah, it might be a unique HR fintech company operating in a segment that’s poised to grow. It might be a 12-year-old startup that’s actually profitable. But there are some question marks you need to mull over before the IPO closes on 18th September.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and Twitter.