The Tata Capital IPO explained

In today’s Finshots, we take a closer look at 2025’s most awaited IPO — the Tata Capital IPO, which opens for subscription on Monday, October 6th, and closes on October 8th.

The Story

This story barely needs an introduction. You probably already know Tata Capital as the financial services arm of the mighty Tata group. It kicked off in 2007 with the simple idea of offering financial services to retail customers, small businesses, and corporates. But as years passed by, the company widened its net. From consumer loans to commercial finance to wealth advisory, it slowly built itself into a brand that comfortably sat under the Tata umbrella.

Fast forward to today and Tata Capital isn’t just another NBFC (Non-Banking Financial Company). It’s India’s third-largest diversified NBFC with assets under management or total loan book, standing tall at ₹2.33 lakh crores. And now, it’s gearing up to hit the market with a huge ₹15,512 crore IPO.

The larger portion of this or ₹8,666 crores is an offer for sale. That’s basically Tata Sons (which owns 88.6% of Tata Capital) and another key shareholder, International Finance Corporation, cashing out a bit of their stake. Together, they own over 90% of the company. And post-IPO, the overall promoter holding will fall from 95.6% to about 85.5%. The remaining or ₹6,846 crores is a fresh issue.

And that’s money Tata Capital will actually keep to strengthen its Tier-I capital. Think of this as the company’s financial cushion, made up largely of shareholders’ money and retained earnings. The RBI insists that NBFCs maintain a strong buffer like this to ensure that they can absorb risks if loans go bad. And for Tata Capital, topping up this safety cushion doesn’t just mean ticking a regulatory box. It also creates more room to lend in the future.

But does all of this automatically make its IPO a must-buy, you ask?

Well, to figure that out, you’ll need to dig into a few key numbers. Because it’s these metrics that will tell you whether 2025’s most hyped IPO actually lives up to the chatter.

Let’s start with the topline or the company’s income. In FY25, Tata Capital clocked in about ₹28,300 crores in revenue from operations. That’s no small feat. In fact, it translates into a solid 44% compound annual growth rate (CAGR) over just the past two years, which seems impressive.

But, when it comes to lending businesses like this, one number investors love to track is the Net Interest Margin (NIM). In simple terms, it’s the spread between what Tata Capital earns on the loans it gives out and what it has to pay on the money it borrows — be it bonds, bank loans, or deposits. For Tata Capital, this margin currently sits at 5.2%. That’s not bad at all. But here’s the catch. It’s lower than the peer average of 7.6%. Big names like Bajaj Finance and Shriram Finance are miles ahead, with margins pushing 9.5–10%.

Still, profits look healthy. Tata Capital pulled in ₹3,655 crores in FY25, growing at about 11% CAGR since FY23.

But revenue and profits don’t paint the full picture. You also need to check how efficiently the company puts money to work. That’s where ratios like ROE (Return on Equity) and ROA (Return on Assets) step in. ROE tells you how much profit Tata Capital makes from every rupee of investor money. Here, it stands at 12.6%. Decent, but again, peers average closer to 16%. ROA, on the other hand, measures how effectively the company uses its loan book and investments to churn out profits. Tata Capital sits at 1.8%, while competitors average around 3.2%.

Here’s the silver lining, though. If you look at asset quality, Tata Capital has been holding its ground quite well. Its Gross Stage 3 loans — basically loans that haven’t been repaid for more than 90 days, have been steady between 1.5–2% over FY23 to FY25. That’s stronger than the industry average of about 2.6%, which shows that it does seem to have tighter control over the quality of its loan book.

But even with these positives, there are a few risk factors you can’t ignore.

Take its loan book, for example. On the surface, it looks well spread out across retail, SME, and corporate customers. And thanks to its recent merger with TMFL, Tata Motors’ financing arm, it’s now a serious contender in vehicle finance too. TMFL alone brings in a big chunk of the commercial vehicle loans for the combined company.

But the worrisome part is its unsecured loans or loans given without any collateral to fall back on, have consistently made up more than 20% of Tata Capital’s portfolio over the past three years. That’s not a small number. If too many borrowers default, it could eat into asset quality (which, to be fair, is currently better than peers) and force the company to set aside higher provisions. And that could hurt profitability down the line.

Then there’s the legal overhang. Tata Capital has 283 criminal cases pending against it. Most of these revolve around loan disputes, repossession of vehicles, forgery allegations, or settlement issues. Typically, its borrowers or guarantors have taken the company or its employees to court and filed FIRs, claiming foul play. And while not all of these cases may be material in nature, together they add up to a contingent liability of ₹765 crores. To put that in context, this figure is way above the materiality threshold of ₹165 crores, which is 5% of the company’s average profit after tax over the past three years.

And finally, there’s the valuation question. At the top end of the price band of ₹326 per share, Tata Capital would be valued at 33 times its earnings over the last twelve months and 4.2 times its book value. Compare that to its peers, which trade at a P/E (Price-to-Earnings ratio) of 27.2 and a P/B (Price-to-Book value) of 3.6, and it’s clear the stock looks a bit pricey.

Add to that a market that’s already seeing a flood of massive IPOs, and this one could feel like a lot to digest. The Economic Times recently highlighted how mega IPOs over ₹10,000 crores have often disappointed. Take HDB Financial’s ₹12,500 crore IPO. It spiked 14% on listing day, but today it trades just 4% above its issue price. Or last year’s NTPC Green Energy ₹10,000 crore offering, which still lingers below its ₹108 issue price. And with LG Electronics’ IPO coming up next week, investors may feel a little overwhelmed.

So yeah, whether they'll still jump in on Tata Capital is something we’ll have to wait and see. Even if they do, it may be more to do with the Tata tag rather than immediate gains, despite this being one of the year’s biggest IPOs.

Until then…

If this story gave you a quick breakdown of the Tata Capital IPO, do us a favour and tell your friends, family, or even strangers about us on WhatsApp, LinkedIn, and X.

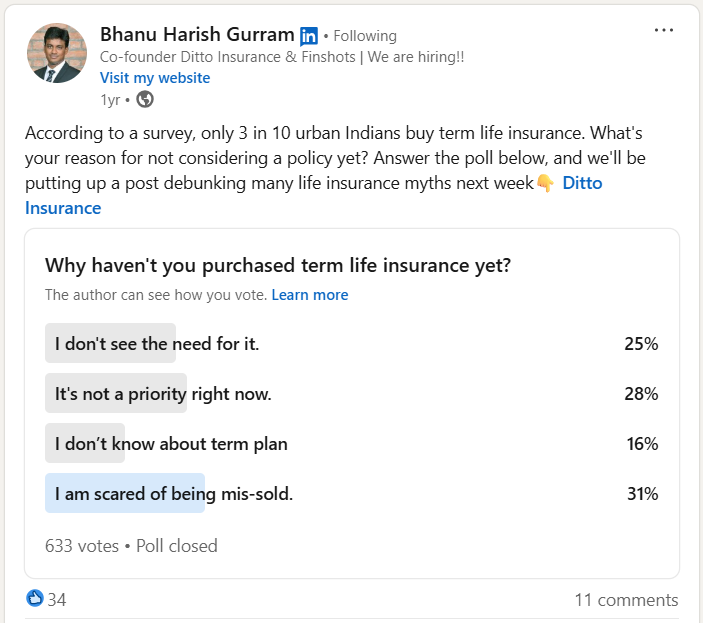

Our Co-founder Asked People Why They Avoid Term Insurance. The Top Reason? Right Here. 👇

31% said their biggest fear is being mis-sold. Many worry that agents may push costly plans or add confusing extras without full transparency.

That's a valid concern. After all, how can you trust something you don’t completely understand?

That’s why Ditto, a product of Finshots, has pioneered India’s #1 Spam-Free insurance platform. Our IRDAI-Certified advisors offer honest advice and help you find the right plan. Book a FREE consultation today.