The Saatvik Green Energy IPO

In today’s Finshots, we break down Saatvik Green Energy’s ₹900 crore IPO which is open for subscription and closes on September 23rd.

But here’s a quick sidenote before we begin. In just a few days, GST on insurance premiums will be gone — making policies cheaper. And while most people will scramble to make sense of it, you can walk in prepared.

Join our 2-day masterclass where we break down health and life insurance in simple, actionable steps. You’ll know exactly what to buy, how much cover you should choose, and what traps to avoid.

👉🏽 Click here to reserve your spot today. Only few seats left — and this is your last chance to get clarity before the change.

Now, onto today’s story.

The Story

India’s green ambitions are solar-powered. Half of India’s installed power capacity now comes from non-fossil fuels, and solar alone accounts for nearly 49% of renewables.

So clearly, India wants to pivot away from coal, and a few solar companies are helping drive that shift.

But what really makes this clean energy pivot possible? Well, the panels themselves! You’ve probably seen them everywhere from residential houses to industrial parks and massive solar farms. These shiny modules are the building blocks of India’s solar push, and only a handful of companies manufacture them at scale. Because making them isn’t easy. For long, India depended on imports for 80–85% of its module needs. Domestic capacity has only recently caught up, thanks to policy pushes and demand spikes.

And this is the space where Satvik Green Energy, a relatively young player, is trying to cement its place.

Founded in 2017, it started as a small player with just 125 MW of capacity. But over the past eight years it has scaled up dramatically to 3.7 GW (gigawatt). And now, it wants to double that again. For investors, the pitch is simple: buy into India’s solar future through one of its fastest-growing module makers.

So let’s understand its business.

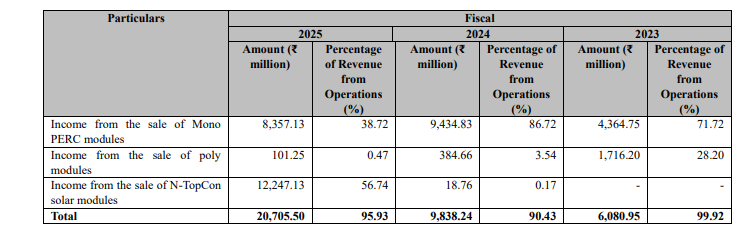

Saatvik makes three types of solar panels: the older MonoPERC modules, the newer N-TopCon modules, and some smaller sales of polycrystalline modules.

MonoPERC panels, short for monocrystalline passive emitter and rear cell, are like the “second-generation” panels that replaced the old clunky ones a few years ago. They’re designed to handle heat better and still keep working even on cloudy days. For a while, these were the company’s bread and butter.

Then came the upgrade — N-TopCon or Tunnel Oxide Passivated Contact panels. The idea here is simple. Engineers added a thin extra layer, called a tunnel oxide, on top of the regular design. This tiny tweak helps the panel trap more sunlight and convert it into electricity more efficiently. That’s why these panels are now Saatvik’s biggest money-spinner.

And finally, there are the polycrystalline panels, the older, cheaper cousins that still sell a bit but don’t dominate the charts anymore.

For a while, MonoPERC panels were the workhorse for Saatvik. In FY24, they brought in nearly ₹943 crores, but by FY25, their share slipped to ₹835 crores. And that wasn’t because demand collapsed but because Saatvik introduced N-TopCon panels, and customers quickly started switching. In FY24, these panels already contributed over ₹150 crores. But sales exploded to ₹1,224 crores in FY25, overtaking MonoPERC to become Saatvik’s biggest business line. In short, what started as a small slice of revenue turned into the company’s main engine in a year.

The older polycrystalline panels chipped in ₹101 crores in FY25, but they’re more of a legacy product now.

That shift in product mix is exactly what powered Saatvik’s rapid growth. From ₹531 crores in FY23, revenue doubled to ₹1,097 crores in FY24 and doubled again to ₹2,192 crores in FY25. And profits followed too, jumping from ₹100 crores in FY24 to nearly ₹214 crores in FY25.

The only catch? It’s that profits are slim compared to sales because making panels is capital-hungry. In FY25, expenses swallowed ₹1,912 crores of revenue, with raw materials and services alone costing ₹1,136 crores. And since 42% of those inputs (like solar cells and aluminium frames) are imported from China, costs can swing around with global price changes.

So Saatvik wants to bet on scale to take its growth story up another notch. Out of the ₹900 crores it’s raising through the IPO, nearly half — ₹477 crores — will go into building a massive 4 GW solar plant in Odisha. That will more than double its current manufacturing capacity from 3,742 MW (megawatt) to over 7,700 MW. And that’s quite a leap. Of course, it still trails the giants. Waaree sits at 13,300 MW and Premier Energies at 5,100 MW. But the Odisha project could help Saatvik close that gap faster.

Another ₹166 crores from the IPO will be used to repay debt of its subsidiary Saatvik Solar Industries, which is executing the Odisha project. This will bring down its leverage from a debt-to-equity ratio that’s already improved sharply from 7.1x in FY23 to 1.3x now. The rest is earmarked for small borrowings and general corporate needs.

Now, the Odisha project itself is a smart bet. It’s located in Tata Steel’s SEZ at Gopalpur, giving Saatvik easy port access for faster imports, plus a basket of incentives — no electricity duty, full stamp duty reimbursement, a ₹2/unit tariff subsidy for ten years, and even a 30% capital subsidy. Put together, these perks make the expansion far cheaper to execute for Saatvik.

But of course there are risks. Saatvik’s RHP makes it clear that the company’s growth story isn’t without its vulnerabilities. A big one is customer concentration. In FY25, just 10 clients accounted for nearly 58% of revenue, and this reliance has been even higher in earlier years. So losing even one large buyer could leave a serious dent in sales. Another is raw material exposure. The company depends heavily on imported inputs like solar PV cells and aluminium frames, with over 40% sourced from abroad. So if global prices swing or supply chains tighten, costs could climb and margins get squeezed.

And let’s talk about valuations. At the upper price band of ₹465 per share, Saatvik will be valued at around ₹6,000 crores. That’s still tiny compared to its listed rivals — Waaree at nearly ₹1 lakh crores and Premier Energies at about ₹47,000 crores. But to be fair, those players operate at a much bigger scale, with higher installed capacity and wider presence. Saatvik has been catching up fast though. And one of the most interesting figures is of its order book that’s jumped nearly tenfold in just a year — from ₹559 crores to over ₹5,000 crores — a sign that demand for its modules is very real.

The financial picture has also sharpened. Operating profit margins have risen from a thin 3.9% in FY23 to 16.4% in FY25, while net profit margins are holding around 9%. That’s lower than peers like Waaree and Premier, which run at 14% levels, but it shows steady improvement. Return on equity, a measure of how much profit the company makes on shareholder money, is a staggering 63% in FY25.

So yeah, Saatvik is at an inflection point. In just a few years, it has gone from a small player to a serious contender with a multithousand-crore order book and technology that’s in step with global trends. And the IPO gives it the firepower to double capacity and clean up its balance sheet, putting it in a stronger position to chase India’s solar boom. But the story, as we saw, isn’t without wrinkles, and a lot depends on whether the new Odisha plant helps these numbers scale further without eroding profitability.

So while this isn’t a finished product like the existing listed players, it’s more of a growth bet — one that could shine brighter if the execution matches the ambition, or dim quickly if costs and competition catch up. And the coming years will decide how brightly this bet on solar shines.

Until then…

If this story helped you understand the Saatvik Green Energy IPO better, why not share it on WhatsApp, LinkedIn, and X?