The perks and pitfalls of being IEX

In today’s Finshots we tell you why everyone’s selling IEX’s stock like there’s no tomorrow and try to understand if that’s logic or just panic.

The Story

Back in 2008, the government opened up the power exchange market. The idea was to let power generation companies and electricity distribution companies (discoms) trade electricity in the spot market.

Now, if you’re wondering how electricity can be “traded”, here’s some context. The power that lights up your home or office doesn’t come straight from NTPC, Tata Power, Adani Power or any other power generator. Instead, it comes through a discom that buys electricity from these generators and then supplies it to your region.

To keep that going, discoms need to make sure that they always have just the right amount of electricity on hand. Too much power and they lose money on the excess. Too little and they’re staring at power cuts or load shedding.

So, they usually sign long-term contracts called PPAs (Power Purchase Agreements). These help lock in supply, but also lock in the price. And that’s a problem because when electricity prices fall, discoms will still have to pay the higher price agreed in the contract.

To fix this, the government introduced the concept of a power exchange. It allowed buyers and sellers of electricity to trade short-term contracts and adjust their supply based on demand, sometimes just a day in advance (this is called the DAM or Day Ahead Market), and sometimes even for the same day.

And when this market opened up, the Indian Energy Exchange (IEX) jumped in as the first platform for trading these electricity contracts.

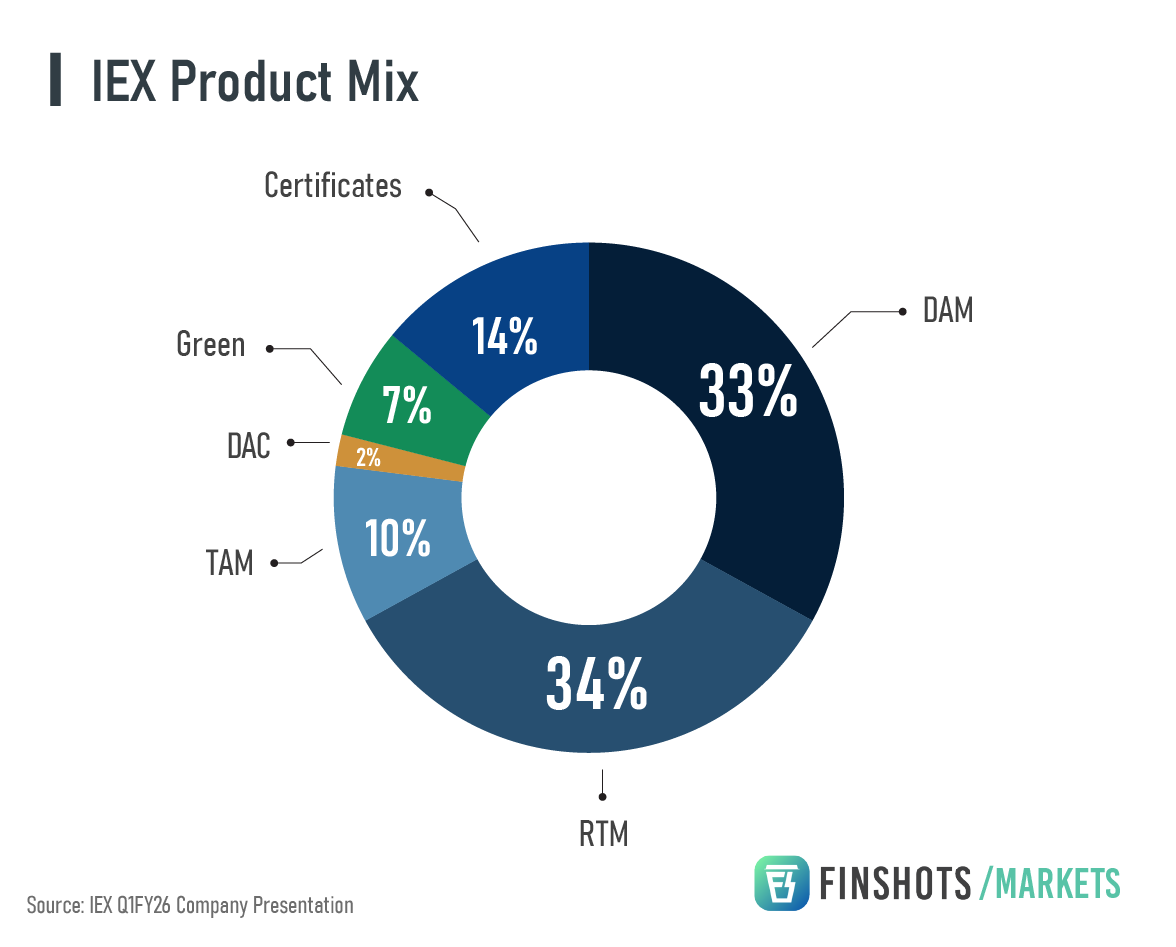

Thanks to its early start, it quickly built a near-monopoly. Buyers and sellers flocked to it. And as more joined in, even more followed. It was the classic network effect in action, which might also explain why it dominates the DAM — one of the most active segments of power trading. About half of its revenues today come from this one category.

So even though competitors like PXIL (Power Exchange India Limited) came up later, they couldn’t really break IEX’s hold. Lower fees didn’t matter. What mattered was liquidity or the number of buyers and sellers on the platform. And since IEX had the biggest pool, it also had the best prices. That alone could save buyers lakhs or sometimes even crores.

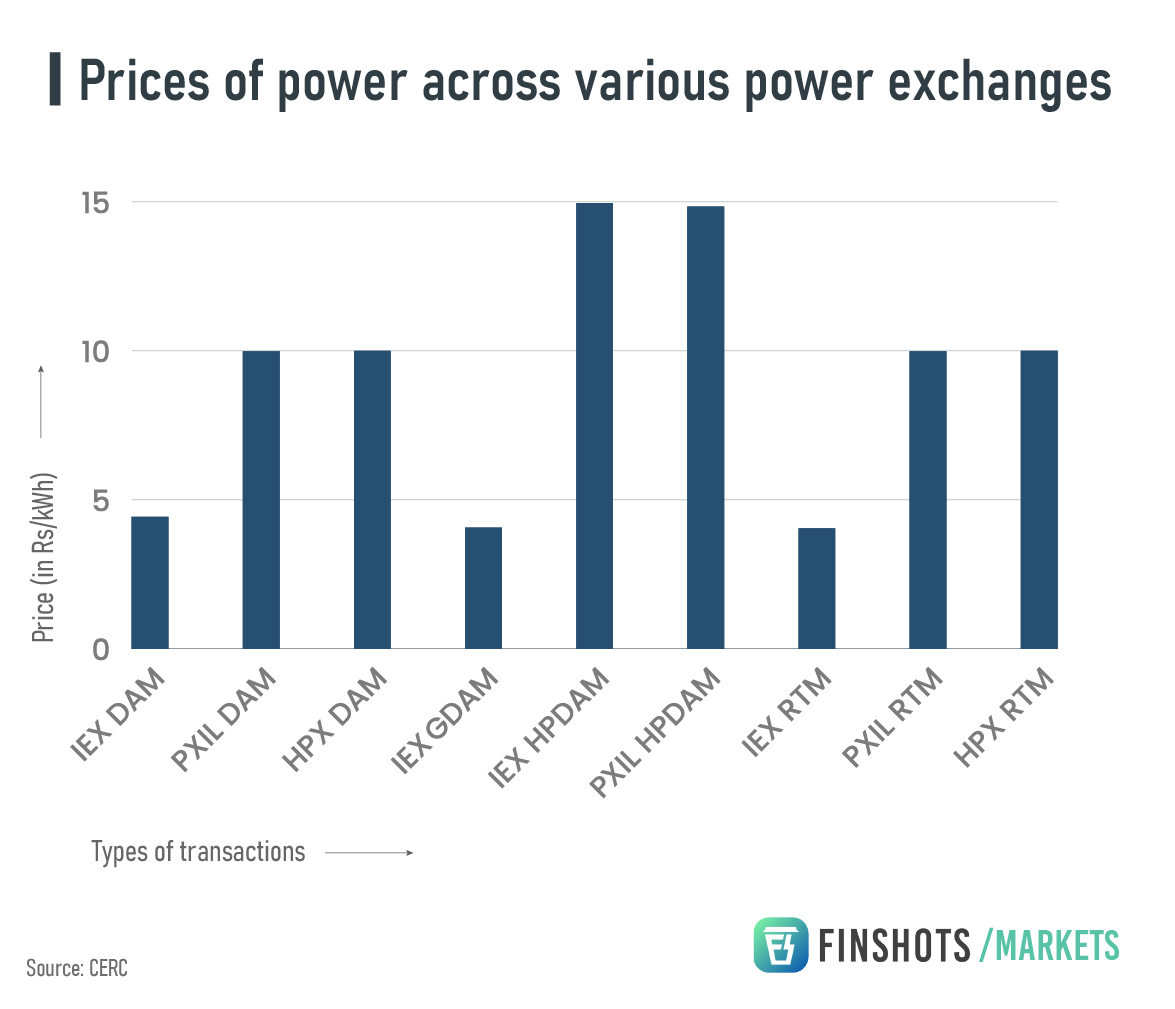

By now, you’ve probably figured that each power exchange, whether it’s IEX, PXIL or the newer Hindustan Power Exchange (HPX), determines its own electricity prices based on demand and supply on its platform.

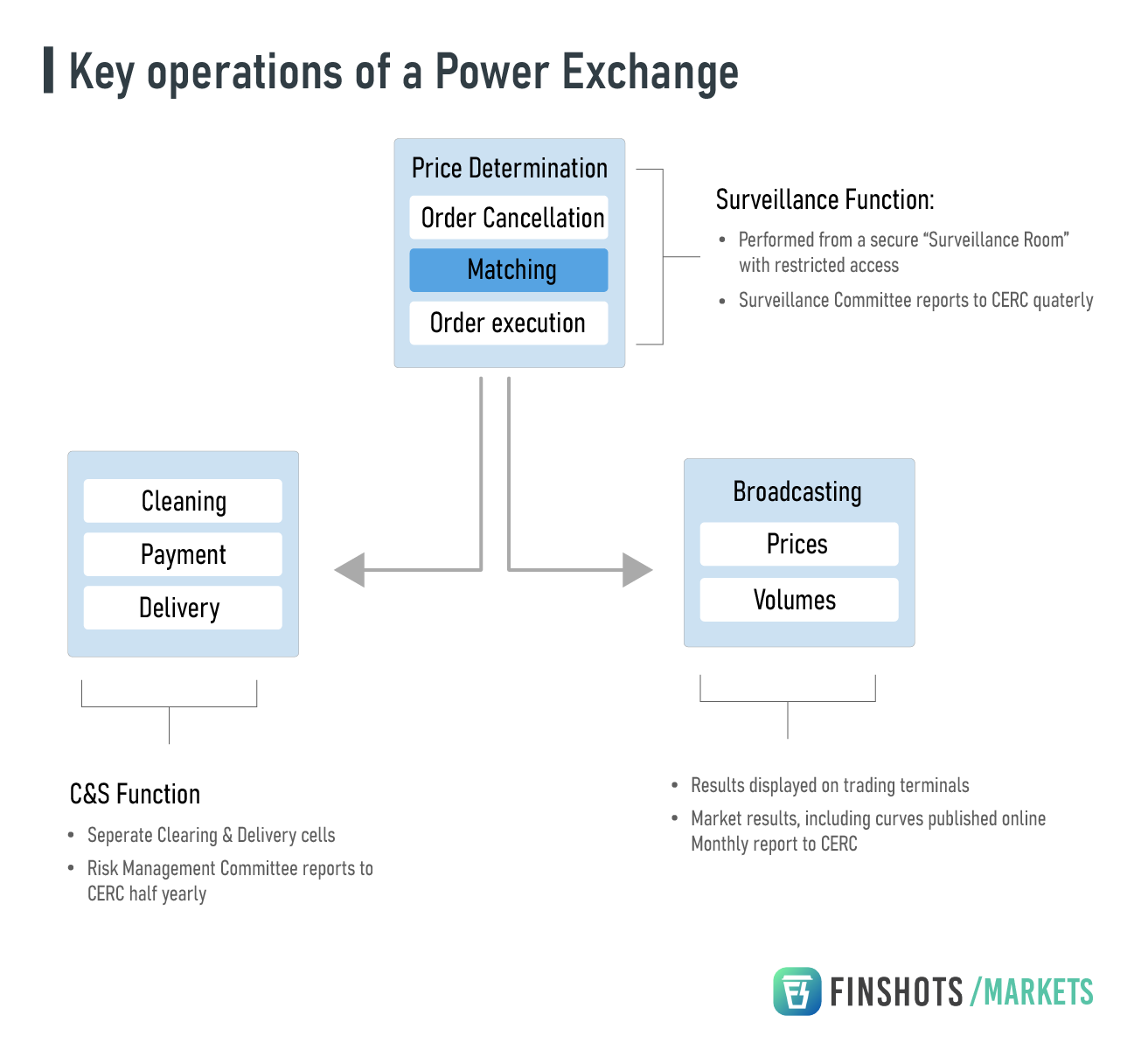

But just a few days ago, India’s electricity regulator, CERC (Central Electricity Regulatory Commission), passed an order that could shake things up. From January 2026, the DAM segment will move to something called market coupling.

What’s that, you ask?

Well, it means that a central authority will step in to match buy and sell orders across all exchanges. So if someone’s buying power on IEX, they could end up buying from a seller on PXIL because all the orders are being matched centrally.

And that’s a big blow to IEX.

It loses its edge. It won’t have pricing power anymore. And that could seriously dent its revenue.

And you only have to glance at IEX’s financials to see how much this could hurt.

IEX charges 4 paise as transaction fees per unit traded. That might seem small, but with billions of units traded — over 121 billion units (BU) in FY25 — it earns ₹657 crore in revenue, of which about 75% comes from transaction fees. And that topline has been climbing north since the past few years.

And since IEX’s a tech platform, and requires minimal capex, it earns profit margins of over 65%. Plus, it’s almost debt-free. ROE? About 40%.

But with coupling, that edge erodes. Now, buyers and sellers can be on different platforms and still complete a trade at the same price. If all platforms offer the same rate, users might drift to those with better UX or lower fees.

And pricing matters because there’s a huge gap in prices on IEX and its competitors.

And this isn’t the first time IEX has stumbled on coupling chatter. It’s had knee-jerk reactions every time the topic pops up. We even did a detailed video back in 2023 explaining why coupling was a matter of ‘when,’ not ‘if.’

So now that it’s real, what does it actually mean for IEX?

Well, three things.

First, revenue. DAM contributes about one third of IEX’s traded volume. If customers start placing orders on rival platforms, volumes will shrink. And that means lost revenue from its bread and butter category.

Second, monopoly. IEX currently handles 85% of exchange-based power trading. But with price discovery unified, platforms like PXIL and HPX (backed by BSE and PTC India) are on a level playing field.

Third, pricing power. Today, IEX charges standard transaction and onboarding fees. But what stops PXIL or HPX from undercutting? Even a tiny fee cut can dent IEX’s earnings by a meaningful margin, analysts say. So price wars may be coming.

But that’s the worst-case scenario. Now let’s flip the script and ask “Could this actually turn out to be a win for IEX instead of something to lose sleep over?”

Because you see, mutual funds still own a decent chunk of IEX.

Maybe they like that it’s capital-light, profitable, and has a huge runway. After all, only 7% of India’s total electricity is traded on exchanges today (the rest comes through PPAs). The government wants to take that to 25% over the next five years.

So the market is still nascent. And if the pie grows, IEX could still benefit, even with a lower share than what it has today. The thesis is simple. As electricity becomes more flexible and green, long-term power contracts (PPAs) will lose some relevance. Short-term trading will rise. And IEX, already the dominant platform, will benefit.

That thesis doesn’t just fall apart because of market coupling. Not entirely. And you need to look at what IEX’s Chairperson and MD, Mr. Satyanarayan Goel, himself thinks about market coupling to know why…

I don't think we have ever said that in case of coupling we will be able to maintain the market share. What we always say is that even in the case of coupling, we are doing a lot of customer-centric activities to ensure customer loyalty, and we should be able to retain a significant market share.

Hmmm.

Maybe he’s right.

Because just think about food delivery platforms like Swiggy and Zomato for a moment. You might prefer using Swiggy over Zomato, while your friend might prefer Zomato, even though prices on Swiggy can sometimes be lower than on Zomato, and vice versa. So, the choice of app isn’t always about which one is cheaper. A lot of it comes down to habit. You’re used to how the app looks and feels. And honestly, no one wants to spend time relearning a new app.

Now we totally know that power traders aren’t quite like us folks who order food. They’re rational and cost-driven, especially when big trades worth lakhs or even crores, are at stake. But even they might hesitate to switch platforms unless the alternatives are drastically better than IEX.

Besides, IEX’s business isn’t limited to dominating just the DAM segment, but also the Real Time Market (RTM), Term-Ahead Market (TAM) and even the green energy market.

And these segments aren’t being subject to coupling yet. Just yesterday, IEX posted solid quarterly results (Q1FY26). Profits were steady. Volumes held up. And RTM and green segments led the performance with a 40–50% YoY growth.

So with all these pros and cons, how do you figure out whether IEX deserves a spot in your portfolio?

Well, to answer that, let’s tell you about something oddly interesting that happened just before the CERC announcement. Options data showed a spike in put buying on IEX. Meaning some traders bet big that the stock would fall. And it did. Whether that was prescience or privileged info, maybe we’ll never know. But it’s a reminder that in regulated businesses, one circular can change your portfolio overnight. And that’s why many investors avoid regulation-heavy sectors altogether.

Still, if you understand power trading, track quarterly results, and can stomach some volatility, IEX may still make sense. It has a lead, a solid business, and a large market ahead. Even with coupling risk priced in.

But if you’re looking for a no-drama multibagger, remember that the moat in one of its marquee segments has narrowed. The path ahead could be volatile. And the market is re-rating IEX from a monopoly to just another strong player.

That’s not necessarily bad. It’s just a different story.

Market coupling for DAM is still months away. Implementation could be messy. Power sector reforms rarely run on time. In fact, even in Europe, coupling took nearly a decade to become fully functional.

That gives IEX breathing room to improve offerings, lower fees, add features and retain users.

And in a world where customer habits are sticky, even a rational trader might think twice before jumping ship. Especially if their current ride is fast and reliable.

Until then… we’ll have to wait and watch if IEX will be able to catch up to its valuations in the coming years.

If you liked this story, don’t forget to share it with friends, strangers and power sector fans on WhatsApp, LinkedIn or X!

🔊Introducing Pitch Perfect 2025!

If you've been following us for a while, you know our story didn't begin in a corporate boardroom. It started in a college dorm room with 3 broke students who chose to skip placements and chase something bigger.

That something was Finshots.

Today, Finshots reaches over 500,000 readers, and through Ditto, we've empowered 800,000+ Indians to make smarter insurance decisions.

Now, we're looking for the next game-changing idea to back.

Introducing Pitch Perfect 2025 – a flagship startup pitch challenge powered by Zerodha.

So, if you've got a BIG idea that could help Indians get better with money, pitch it to us!

What's at stake:

✅₹10,00,000 in prizes

✅Potential funding from Zerodha Rainmatter

✅All-expenses-paid trip to Bangalore to pitch directly to Nithin Kamath and industry veterans

Ready? 👉Apply Now!