The Mamaearth IPO. Finally.

In today’s Finshots, we dive into the house of brands that Honasa Consumer Ltd has built before its IPO opens on the 31st of October.

The Story

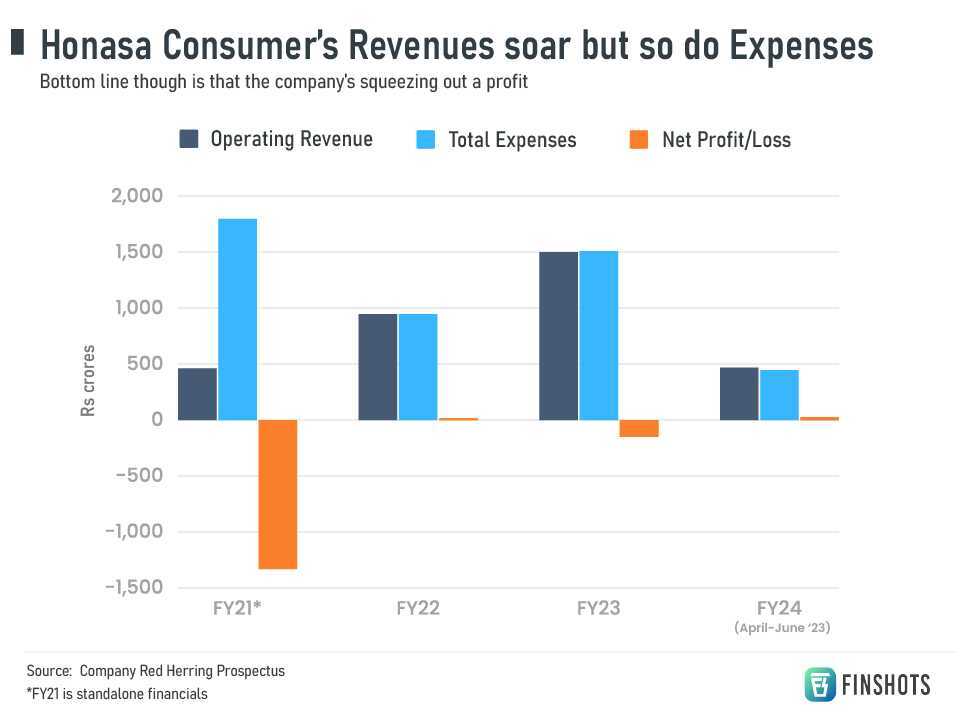

7 years old. Over ₹1,500 crores in revenues. A bottom line in the black. And a company on the verge of a massive IPO. That’s the Mamaearth story.

It’s quite phenomenal.

But hey, if the company wants you to part with your hard-earned money and buy its shares, you need to check under the hood, no? And the first step to that is to try and understand what exactly is Mamaearth and how on earth did it achieve this raging success!

Well, to understand this, let’s rewind to when it all started. To 2016. The folks behind Mamaearth were putting the final touches on the first product. And they realized something very quickly. Getting people to trust a brand new skin-care brand would be hard. Insanely hard. They’d be going up against the giants Hindustan Unilever. They needed something to stand out and break through the clutter.

Right then and there, they decided: “We need to become a “why-based” brand rather than a “what-based brand!”

Now if you’re scratching your head wondering what on earth that’s supposed to mean, here’s how the founder Varun Alagh put it in a podcast: “…millennials love to buy into brand’s purposes and love to buy into why they exist. Once they buy into why they exist, or why the brand exists, they actually buy whatever from the brand, not just a what.”

Here, the purpose was simple — Mamaearth created toxin-free products that were ‘mum-baby friendly’. That’s what the website says anyway. Now they just had to find a way to distribute it.

And then they had some other insights. They found that mothers who had infants above the age of 6 months actually turned to advice from other mothers. Whether it was through social media or whether it was through WhatsApp Groups, that’s where the target market was.

Then to take it up a notch, in 2021, they went and acquired a content company. It was called Momspresso. And it wasn’t just content. This company had actually created an entire influencer engagement platform of mothers. It was called Momspresso MyMoney and women could easily earn money by “influencing” others on the platform about various products.

And now that they had a network of “mumfluencers” they could really get down to business. They could literally sell them anything!

And just like that Mamaearth became a marketing powerhouse. Oh, they didn’t want to have a dearth of products that these influencers could market.

So they went on a product overdrive of sorts. And there’s something we should’ve told you at the start. The name of the company actually isn’t Mamaearth. It’s called Honasa Consumer Ltd. You see, Mamaearth is just one of the brands in their “House of Brands” ecosystem. Apart from this, they have Derma and Dr Sheth’s which they say is the kind that will be prescribed by dermatologists. They have Aqualogica. They have Ayuga for the ones who prefer Ayurveda.

And they just doubled down on product creation. I mean just look at the number of new products they’ve pushed into the market year after year — 91 of them in FY21, 122 in FY22, 252 in FY23, and in just the first three months of FY24, they launched another 89 products.

They don’t even want to control the hassles of production. Everything is outsourced to 37 contract manufacturers.

Honasa Consumer Ltd just wants to market the heck out of its products. Here’s something from the IPO document (italics added for emphasis): “Our success with Mamaearth and our ability to identify and cater to emerging trends has enabled us to develop repeatable brand building playbooks that have helped in scaling our newer brands at a fast pace.”

Launch. Market. Repeat.

But some would argue that it’s too soon to say if the House of Brands approach is working. It’s still Mamaearth driving nearly a two-thirds of the company’s revenues. If you think about it though, Mamaearth is a 7 year old brand. The others are just 2–3 years old. So it might be a while before we see that contribution numbers shift.

Meanwhile, Mamaearth is going through a metamorphosis of sorts. They decided they didn’t want to be just a digital company anymore. So they ventured into physical stores too.

But people complain that this could turn out to be quite costly. Because there are distributors in the middle. They have to be paid commissions. And apparently, Mamaearth often shelled out a whopping 50% in commissions. So then why even go down this route, you ask? Why couldn’t they just double down on their direct to consumer strategy?

Well, here’s something we wrote earlier this year about D2C brands going down the ‘phygital (physical + digital) route.

Customers who visit a physical store spend more money. In fact, they spend 60% more on average per order. They’re willing to splurge on higher-priced items. It’s not just that. These customers even frequent the store more often. And they’re not window shopping. They’re taking out their wallets — the time between purchases also dropped by 28% versus online shoppers.

All this leads to one thing — the cash register rings ka-ching at physical stores! And this is what the researchers called the ‘supercharged consumer.’

Maybe that’s what they want. And to capture these supercharged consumers they’ve launched 85 Exclusive Brand Outlets that cater only to Mamaearth’s needs. We don’t know if it’ll work. But, if you add this along with the distribution at third-party retailers together and already, the offline channel accounts for 35% of the company’s revenues. This share has nearly doubled in the past couple of years.

So now that we’ve got the brand story and business model out of the way, we have to turn to the finances, right? Because at the end of the day, Venture Capital investors might rely more on a story but public market investors demand the numbers.

Now the first thing that stands out when you look at the financial statements is the massive loss of over ₹150 crores in FY23. But that was because their acquisition of Momspresso turned out to be a dud. They had to write it off. And if you ignore that, FY23 would’ve resulted in a profit of around ₹4 crores. And in the first 3 months of this financial year (April-June 2023), they’ve achieved ₹25 crores in net profits too.

So yeah, the bottom line is that right now company actually has a bottom line that’s in the black. It’s profitable.

But you might want to take that with a pinch of salt. Companies typically find ways to pad up their profits before a mega event like an IPO. For instance, they might cut back on advertising since that’s one of the easiest things to cull. We’re not saying that Mamaearth did that — they still spend 35% of revenues on advertising. But it’s still a drop from the typical 40% they’ve done in the past.

Will advertising continue to be on the lower side?

Well, it does seem unlikely. They might have to really step it up as they try and ramp up sales from the other brands. And not to forget that their behemoth rivals aren’t going to sit idly by. Many of them are snapping up these D2C brands. They want the customers. They want the playbook. And they’ll expand their portfolio quickly. That could very well still be a threat to Mamaearth. So if the advertising expenses climb again, it could be a threat to profitabaility.

But the elephant in the room here is still one of valuation.

Honasa is eyeing a valuation of nearly ₹10,500 crores. Now one way to look at this is that when the news of a impending IPO began swirling earlier this year, everyone estimated that the ask would be a valuation anywhere in the range of ₹15,000-₹20,000 crores. So maybe saner minds have prevailed.

Also, the IPO valuation kind of mirrors its last valuation during a fundraise in January 2022. You could read into it and wonder if there’s something going wrong the company that the valuation hasn’t changed at all. Or in another sense, you could think it’s the company simply telling public market investors, “Look, we’ll give you the same pricing as what we gave the VCs. We’re not trying to squeeze more out of you. We’re the nice guys.”

But even then, the valuation is rich. Let’s assume that the company can maintain the current run rate of profits. That means, by the end of FY24, we should be looking at ₹100 crores in profits. Seems a bit crazy, but let’s go with it. That translates into a price-to-earnings (PE) of 100. Which means investors should be willing to say that for every rupee of profit the company makes, they’re willing to pay ₹100.

Is the Indian Beauty and Personal Care (BPC) really going to blow up so massively that companies in the space should get rich valuations? Also, is Mamaearth’s massive brand factory in the right place at the right time to capitalize on this growth at the expense of other brands?

We don’t know. So you tell us. Would you bet on Mamaearth?

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and X (formerly Twitter).

📢Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.

Ditto Insights: Why you must buy a term plan in your 20s

The biggest mistake you could make in your 20s is not buying term insurance early.

Here’s why

1.) Low premiums, forever!

The same 1Cr term insurance cover will cost you much lower premiums at 25 years than at 35 years. What’s more- once these premiums are locked in, they remain the same throughout the term! So if you’re planning on building a robust financial plan, consider buying term insurance as early as you can.

2.) You might not realize that you still have dependents in your 20s:

Maybe your parents are about to retire in the next few years and funding your studies didn’t really allow them to grow their investments — which makes you their sole bread earner once they age.

And although no amount of money can replace you, it sure can give that added financial support in your absence.

3.) Tax saver benefit: You probably know this already — section 80C of the Income Tax Act helps you cut down your taxable income by the premiums paid. And what’s better than saving taxes from early on in your career?

So maybe, it’s time for you to buy yourself a term plan. And if you need any help on that front, just talk to our IRDAI-certified advisors at Ditto Insurance.

Go to Ditto’s website — Click here

Click on “Book a free call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!