An illustrative guide explaining the rise of the Speciality Chemical Segment

About a year or so ago, we wrote a rather elaborate article explaining the rise of the Indian Speciality Chemical Industry. Unfortunately, at the time, we didn't have an audience as large as this one. So we thought we could perhaps rehash the old illustrative guide once again for the benefit of our new readers, and if you're the kind of person that appreciates visuals, this is just the kind of story that'll thrill you.

The Story

As thick smog blankets the skies of Beijing, the Communist Party in China begins a serious rethink. For the past three decades, China had grown exponentially on the back of a manufacturing revolution buoyed by a supply of cheap credit, cheap labour and easy access to raw materials. Toxic factories mushroomed across the country burning dirty fuel, most notably coal; turning the blue skies of northern China into a dark cesspool of carbon and Sulphur dioxide. The accompanying economic boom also resulted in a surge of motorized vehicles, further deteriorating air quality. Pollution masks became a staple among Chinese citizens and by some estimates, over a million people were expected to die prematurely in the process.

The Resistance

On 28th February 2015, Chai Jing, an investigative journalist releases the documentary film, “Under the Dome”, chronicling the devastating effects of air pollution in China. After her infant daughter is diagnosed with a benign tumour (likely caused by the pollution) she begins on a journey to shed light on the ill effects of air pollution. Within 48 hours of the release of the documentary, the film garners 100 million views and sparks a wide-ranging discussion on the interweb. The public outcry forces the government authorities to immediately reiterate their stand on pollution. Within a few days of the release of the documentary, Chinese State Media bans the film. But the damage has been done. Chinese authorities must act and act quick.

The Collective Action

China had already declared war on pollution, almost a year before the release of Chai Jing’s documentary. However, like most things, nobody expected to see any real progress outside of a few stern warnings and petty fines on prime polluters. But this time around, the collective call for action forces the Chinese top brass to sit up and take notice. Within just one year, China sees widespread closures of polluting factories and large fines imposed on other non-compliant actors. The state also works on getting its industries future-ready by mandating companies to adhere to strict emission standards using modern eco-friendly technology. This time the war has truly begun.

The After Effects

Many coal-burning plants are forced to shut down. Others are asked to temporarily halt operations until they can comply with the new emission standards. Meanwhile, experts begin to take stock of the situation. One of the worst affected industry it seems is the — Chemical industry. Being some of the worst polluters in the country, chemical companies take a big hit on both their revenue and profit levels. The chemical market was already on a downtrend given the economic slowdown in China. With the added pollution curbs, however, both internal production and exports take a nosedive.

The Opportunity

This presents an opportunity for the Indian Chemical Industry to slowly start chipping away at China’s market dominance. Post the global financial crisis, prices of chemicals witnessed a steep decline, after China began flooding the market with cheap exports. This forced domestic companies to underutilize their plants' operating level. When companies (with large fixed costs) underutilize their plants, their profitability suffers. Also, most Indian companies were largely compliant with emission norms after having spent significantly on eco-friendly tech. But all this spending made their products less competitive (price-wise) against Chinese exports. So the chemical industry was plagued with serious problems for much of the last decade.

Now, with the sudden shift in supply dynamics, Indian chemical companies finally see their fortunes turn. Utilisation levels improve, economies of scale kicks in and margins trend upwards.

Special, Not Commodity

Within the chemical industry, there are two broad divisions — Commodities and Specialized. Although the borders separating the two can get rather blurry, there is a general consensus that the commodity chemicals are high volume bulk products with little differentiation. Specialty chemicals meanwhile are low volume, high margin products sold to niche segments. This gives specialty chemicals an edge, both in terms of customer loyalty and product differentiation. And it should come as no surprise that most people have been concentrating on specialty chemical companies mainly for their potential to generate higher revenues and margins compared to the commodity chemical producers. They are also able to generate more stable streams of revenue compared to commodity businesses (which are highly cyclical). Finally, most specialty chemical formulations are patent protected and not easy to mimic, which gives them better pricing power. All this and more makes the specialty industry more attractive than plain old commodity chemicals.

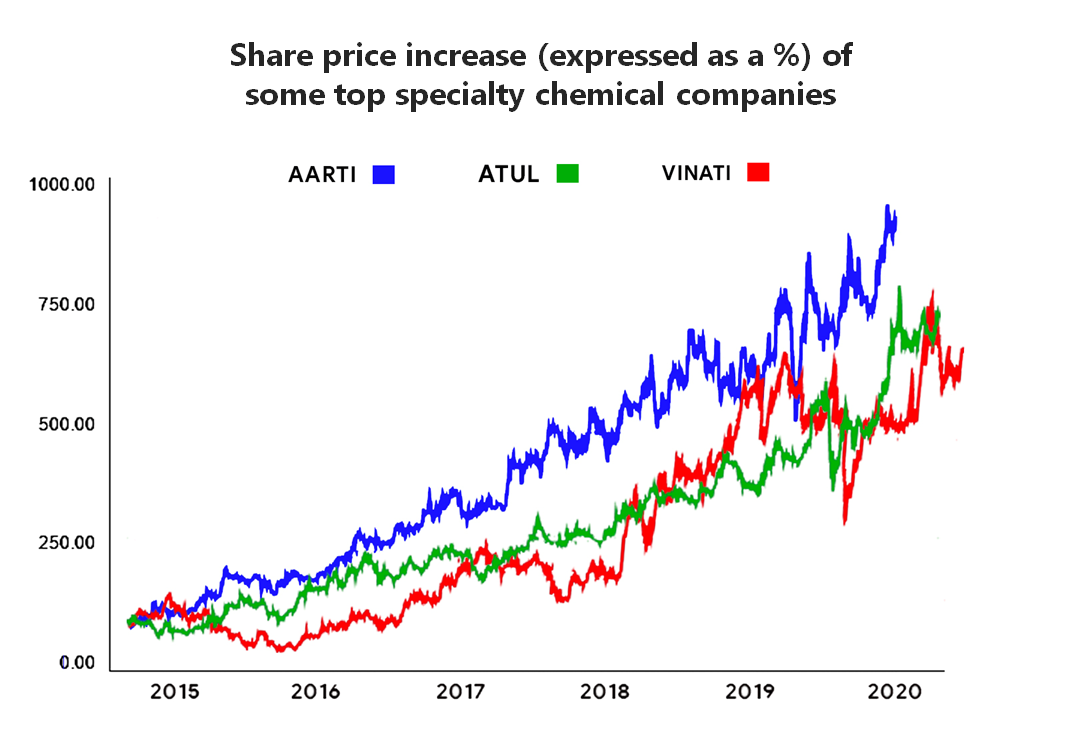

Returns Aplenty

This sudden shift in Industry dynamics hasn’t gone unnoticed. Stock prices of most specialty chemicals have soared over the past few years. More brokerage houses are now sitting up and taking notice. Business news channels are constantly interviewing promoters of obscure chemical companies highlighting all the new promise and this has culminated in more retail participation in what was once an esoteric industry in itself.

The Future

Most people are fully aware that Chinese exports are going to catch up soon, if they haven’t already, that is. This begs the question. What now? There are some competing theories here. The first theory is that this advent is a structural shift. Even if Chinese manufacturers were to begin flooding the market; this time they will not have a cost advantage as they did earlier (because of the added environmental cost). Second, the contention is that with the new economies of scale and a product lineup that’s priced competitively, Indian manufacturers can focus on catering to the burgeoning domestic demand. India still imports a lot of chemicals and so ideally, there’s a big market still waiting to be addressed. So maybe manufacturers will find some luck here. Also, trade conflicts with China could spur other countries (mainly the US) to source alternatives elsewhere. Maybe India could answer this call.

Finally, the hope is that the growth of the chemical industry will roughly mimic the growth of the end use segments. As India begins to consume more food, wear more clothes, buy more plastic the chemicals that go into the production of these consumption goods ought to grow at the same pace. The final theory is that this momentum will only spur specialty chemicals to recklessly add more capacity, only for them to see pain later.

Bottom line - No matter how things pan out, Indian specialty chemicals have come a long way and if things do work out for the industry going ahead, we hope that it’s not at the expense of clean air.

Let us know your thoughts on Twitter.

Until then…