Should you just 'index and chill'?

In today’s Finshots, we take a look at active versus passive investing. That’s it.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

You’ve probably heard the fable.

A blindfolded monkey throws darts at a newspaper’s stock listings and somehow beats professional fund managers in stock picking. It’s the kind of story investors love because it makes the stock market sound like a glorified casino where luck, not skill, separates winners from the rest.

Over time, it’s become gospel for “passive investing”: the idea that instead of chasing alpha (returns above the market), you should just buy the index and go play cricket.

But markets are rarely that simple. And to explain why, let’s flip that story on its head.

Imagine a thousand monkeys, each flipping coins ten times. A few of them will inevitably call heads ten times in a row, right? “That’s luck!” we’d say, smugly.

But then you notice something odd. All the winning monkeys come from the same village… and flip coins in the exact same peculiar way. Would you still call it luck?

That’s the point Warren Buffett wanted to deliver in 1984. While finance professors at the time sang praises of the “efficient market hypothesis” – the idea that no one can consistently beat the market because all known information is already priced in – Buffett pointed to a ragtag group of investors who had done precisely that, year after year, by a wide mile, all using the same philosophy.

But let’s park that story for a bit.

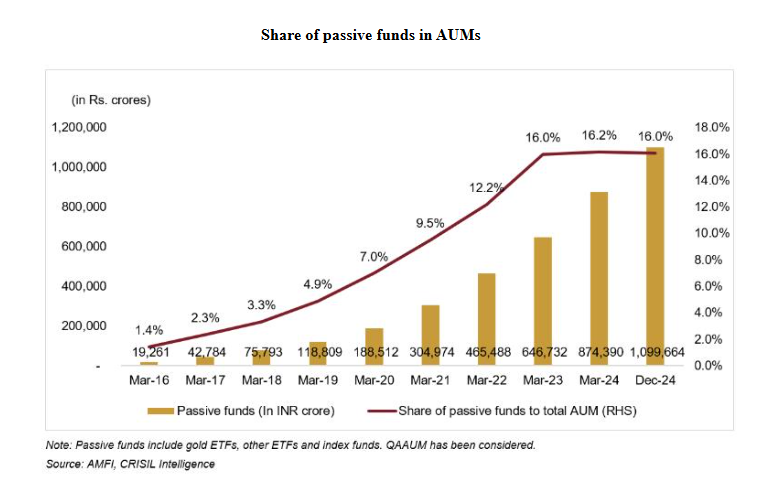

Why am I talking about monkeys and misfits now? Because passive funds are booming in India. From just 1% of mutual fund assets in 2016 to 16% today, or a sixteen-fold leap.

And somewhere between the blindfolded dart-thrower and Buffett’s coin-flipping village lies the real investing debate: is passive investing truly better than active?

So let’s try to understand it.

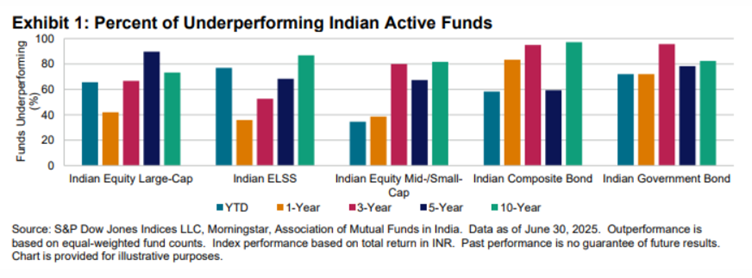

We’ll start with passive investing, because it’s beautifully counterintuitive. You do nothing, and somehow end up doing better than most people doing everything in the market. Here’s proof.

And why is that? Well, if you’ve got 3 minutes, you can read this story we wrote a while back. But the short answer is that passive funds simply mirror the market and let it do its thing. And weirdly enough, that’s why they work. By doing nothing, they eliminate the biggest destroyers of wealth: human psychology. In other words, our itch to act or to tinker the process that’s better left untouched.

Take a Sensex fund. It’s designed to do what Sensex does i.e. drop laggards and add top performing businesses to the list. So over time, the index quietly upgrades itself. It owns more of what’s working and less of what’s not. In that sense, it’s a built-in momentum investing machine.

But that also creates its own feedback loop. As the biggest stocks get the biggest flows, they keep getting pricier. That’s what happened in the US during the tech boom. As trillions flooded into index funds, the S&P 500 got concentrated in Big Tech. It worked brilliantly, until those very names stumbled.

You could still argue: “So what? Even then, drawdowns weren’t catastrophic. Passive funds save me fees. Unless an active manager beats the index by 3–5% net-net, it’s not worth the headaches.”

And you’d be right. So with that outperformance benchmark in mind, let’s see whether active investing still has a leg to stand on.

First, it’s important to understand that passive investing shines in efficient markets like the US where information spreads fast and prices adjust instantly. But India is a little different. Our markets are still evolving and inefficiencies exist like a small cap no one tracks, sectors the herd ignores or the disclosures that take time to penetrate. In other words, there are pockets where skill can still shine.

And that’s what most active strategies bet on. They’re not trying to beat the market every single month but trying to spot these mispricings before others do. Like playing long-term themes (like India’s manufacturing push or financial inclusion) before they become index darlings. And sometimes, they win big. Especially in small and mid-cap segments, the parts of the market that are least efficient, least researched, and most chaotic.

And there’s data to back this. As one study notes, over the past 5 years, both the Nifty Smallcap 100 and active small-cap funds delivered about 33% CAGR. But over 10 years, small-cap funds pulled ahead by 18% CAGR vs 14% for the index. And even if you look at rolling returns to smooth one-off bull runs, between Sep 2020 and Sep 2025, the Nifty 250 Smallcap returned 18% annually on a five-year rolling basis. 12 out of 13 small-cap active funds beat that. And 10 of them returned over 20%.

That’s real outperformance. Pure impressive ‘alpha’.

Also, consider this. When you buy an index, it’s not all that diversified. Take Nifty 50. It’s top-heavy, dominated by banks, IT, and Reliance. So buying the index could often mean doubling down on a handful of giants. Not exactly “owning the market”, is it?

And passive isn’t as passive as it sounds. You’re still constantly choosing which index to buy. Nifty 50 vs Nifty Next 50 vs ESG… that’s decision-making in disguise.

Then there’s behaviour. Many “passive” investors did panic-sell in recent crashes when they should’ve been adding or doing nothing. So, the label didn’t save them from themselves.

Meanwhile, even a modest active strategy outperformance can compound brutally over time. ₹10 lakh at 10% for 10 years becomes ₹25.9 lakh. At 4% alpha, that is 14%, it becomes ₹37 lakh. That’s ₹11 lakh more in the same market but with a different process.

Of course, that’s the theory. In practice, only a handful of active funds manage to beat the market consistently, and even fewer do so after accounting for fees and taxes. The rest lose to passive funds because the odds are simply stacked against them. As markets evolve, cycles change and styles go in and out of fashion. So an active fund that thrives in one decade can struggle in the next. And if investors can’t stomach short-term underperformance, they often abandon ship right before things turn. That’s why investor returns often trail fund returns.

Which again brings us back to the important question. Which strategy can prove better, active or passive?

Well, neither. Or rather, both.

Because, you see, the smartest investors treat the debate not as a binary but as a balance. They build a “core-satellite portfolio”: a passive core that compounds steadily, surrounded by smaller active or factor-based satellites that chase alpha. The passive core provides stability, risk mitigation and discipline. While the active satellites allow conviction and flexibility. And how much you allocate to each depends on your risk appetite, belief, and temperament.

For instance, for someone starting out in the markets, index investing could prove to be a great teacher with low-cost, low-fuss and one that lets you live through market cycles without panic. And for someone who knows their investing style, or has a manager whose process they can explain to a 10-year-old, it would make sense to slowly explore active exposure in staggered phases.

And the real secret to good active investing may not be “picking right” funds or stocks once. It’s rather about following the right process, repeatedly. Which brings us back to Buffett’s parked story.

In 1984, Buffett wrote an essay titled The Superinvestors of Graham-and-Doddsville. It was his tribute to the fifteenth anniversary of Graham and Dodd’s Security Analysis, the book that shaped his philosophy and fortune. The “coin-flipping monkeys” were his metaphor for a very real tribe who beat the market year after year across decades. They didn’t share a hometown or fancy degrees but an unusual philosophy from Graham and Dodd’s book which boils down to three deceptively simple ideas:

- Treat a stock like a business. Not a ticker symbol, not a trend, not a bet. A business with revenues, costs, risks, and a future you can value.

- Let the market be your servant, not your guide. Graham called it Mr. Market and emphasised imagining it as your erratic business partner. Some days he’s euphoric and offers to buy your shares at crazy prices. Other days he’s gloomy and offers to sell at a steep discount. Your job isn’t to match his mood, but to make the most of his mood swings.

- Always demand a margin of safety. In other words, leave room for error in the price by paying say 60 cents for a dollar worth of business.

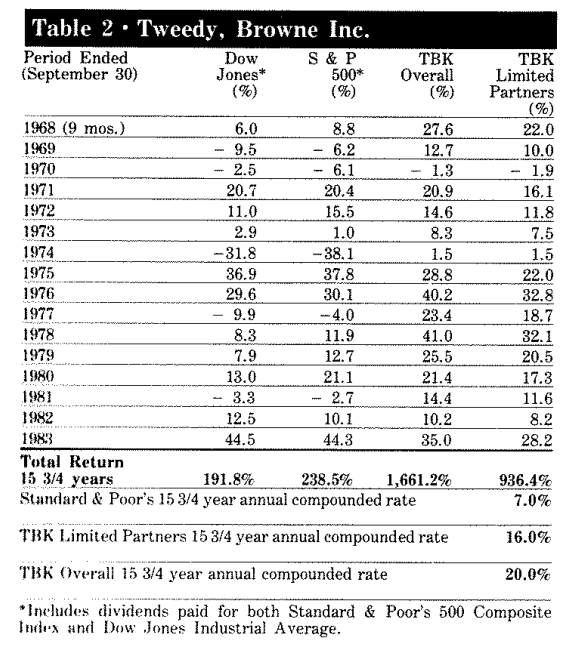

All the investors in that pack from Walter Schloss, Bill Ruane, and Tom Knapp followed the same philosophy. And to see how powerful it proved to be, look no further than Tom Knapp, and his firm Tweedy, Browne partners.

Knapp wasn’t some Wall Street rockstar. He studied liberal arts, got into investing through a summer job, and eventually stumbled upon Graham’s work and went to open his little firm called Tweedy, Browne. And all he did was scour balance sheets, bought stocks selling at throwaway prices, ignored Mr Market’s noise, and insisted on a margin of safety every single time.

And by how much did he outperform the passive index doing so?

Between 1968 and 1983, his fund delivered a staggering 1,661% return versus 238% for the S&P 500.

That’s the part of active investing, people underappreciate. It’s boring, methodical, relentless, yes, but that same process takes out human intervention out of the play just like passive investing. Tom followed through it, and by the time most investors were still chasing hot tips, he had already packed his bags and bought a beach house.

So yeah, if you’ve got the temperament to stomach volatility, the curiosity to dig deep, and the discipline to follow through, active investing can earn its place in your portfolio just as passive investing.

One last thing. Whether you lean active or passive, your allocation towards them is an important part of the puzzle. Because even the best active strategy or the cheapest passive one can’t fix a badly balanced portfolio. Your allocation decides your risk, protects your downsides, and whether you’ll stay the course when the market slaps you in the face.

Because the market will always have its monkeys and its misfits, its flukes and its fundamentals. You’ll meet both in your portfolio someday. And the trick isn’t to outsmart either but build a process that survives both.

Anyways, that’s all we got about the active versus passive investing debate. And whether you agree or disagree, let us know your thoughts!

Until then…

If this story helped you understand active and passive investing better, why not help your friends, family, or even strangers understand it too by sharing it on WhatsApp, LinkedIn, or X? And ask them to subscribe.

How Strong Is Your Financial Plan?

You've likely ticked off mutual funds, savings, and maybe even a side hustle. But if Life Insurance isn't a part of it, your financial pyramid isn't as secure as you think.

Life insurance is the crucial base that holds all your wealth together. It ensures that your family stays financially protected when something unpredictable happens.

If you’re unsure where to begin, Ditto's IRDAI-Certified insurance advisors can help. Book a FREE 30-minute consultation and get honest, unbiased advice. No spam, no pressure.