Maruti Suzuki’s fighting back. Again.

In today’s Finshots, we tell you about how Maruti Suzuki is going through a déjà vu moment.

The Story

Maruti Suzuki just smashed its monthly sales record. It sold a whopping 1.99 lakh vehicles in October across domestic and international markets. The cars are rolling off the factory conveyor belt quite nicely. The stock has outperformed the Sensex by almost 20% this year. And some analysts believe the best is yet to come — they’re betting it could rise from ₹10,500 to even ₹14,500 in the not-so-distant future.

Exciting times, eh?

But wait…something isn’t quite right under its hood.

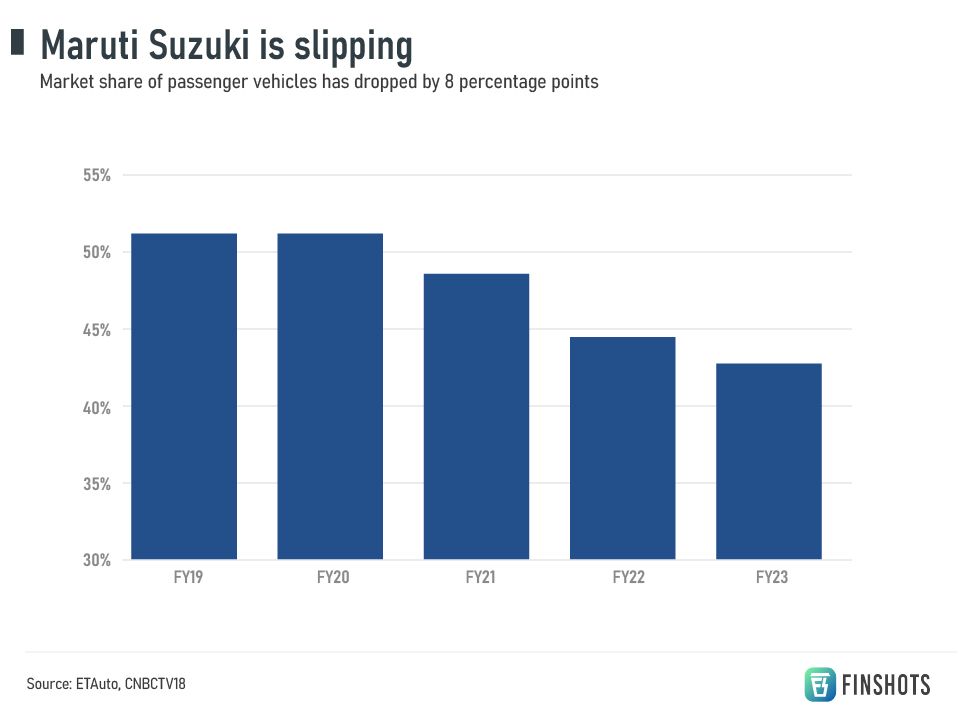

We’re talking about the company’s market share. In FY20, it commanded 51% of the market. But now, it has slipped to just 43%.

So, why is everyone still gung-ho about the prospects of the company?

Well, that’s probably because Maruti Suzuki has been in this dicey situation before and clawed out of it. In FY13, its market share had dropped below the 40% mark. And the alarm bells started ringing at the headquarters of the celebrated carmaker.

See, India was changing. Disposable incomes were rising and a shift to ‘premium’ brands was underway. On the other hand, Maruti had made a name for itself in the affordable segment. People associated the brand with ‘price consciousness’. After all, its most famous ad campaign was the one with the catchphrase “Kitna Deti Hai” (How much does it give?). It referred to the mileage one could squeeze out of their cars. So yeah, Maruti simply didn’t have the 'premiumness' that people were looking for.

The company had its back against the wall. It needed to do something radical.

So in 2015, it did something that no other Indian car company had done — it created an entirely new sub-brand. It called this Nexa. The showrooms would be swankier. The staff would be people decked up in suits with prior experience selling high-end and luxury cars. They would roll out the red carpet for prospective customers. And Maruti did this because they realised that breaking their existing image would be hard. It would be tough for a brand to climb up that ladder and suddenly produce cars and tell people, “Hey, we’re premium too.” So it needed a completely new sub-brand to prove a point of how serious it was.

It worked!

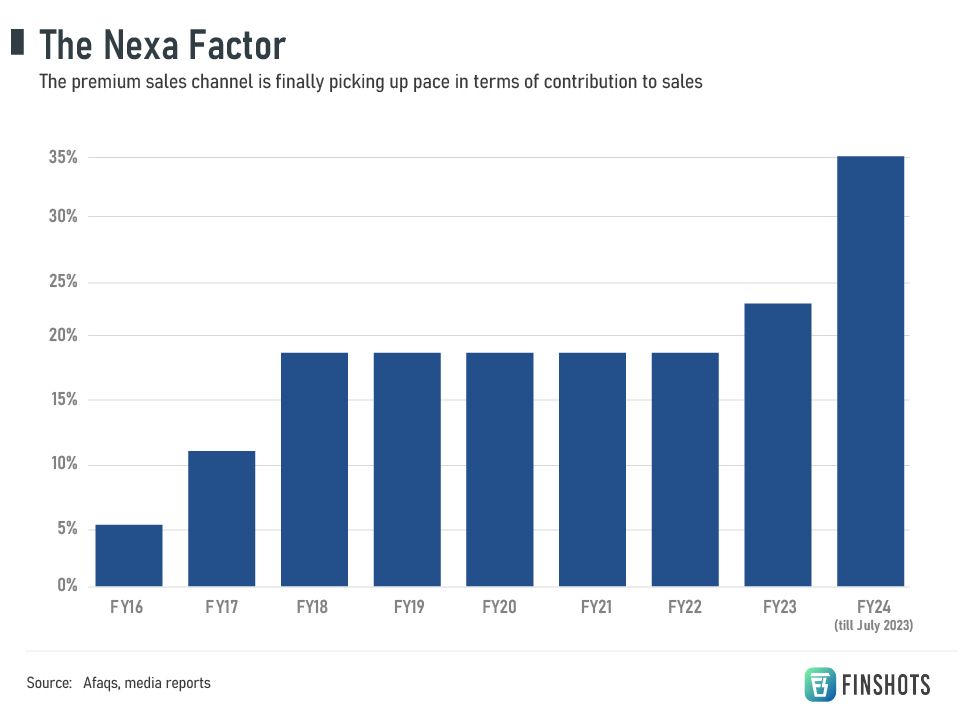

Okay. At first, it didn’t. The first launch was a weird crossover between a hatchback and an SUV. They called it S-Cross. And the sales numbers weren’t anything to write home about. But then came the premium hatchback Baleno. It quickly became a super hit. And by FY18, around 20% of Maruti’s overall sales came from these Nexa outlets.

Its overall market share was back at over 50%. And heck, even the tottering share price shot up. From January 2015 to May 2018, the stock zoomed by over 150%. Maruti had shown that it could drive itself out of a rut.

But hold on, if Nexa was so successful why is Maruti in trouble again, you ask?

Well, underneath the initial success, the cracks were starting to show.

For starters, by FY20, the dealers of Nexa weren’t happy. The sales were plateauing. From an average of around 75 units a month from FY16 to FY19, it began to drop to the mid-50s. And that was partly to do with the fact that there was no new product to excite the customers.

No one knew what was coming next either. As one dealer put it to ETAuto in 2019, “When we took Nexa, we had a product road map, that S-Cross, Baleno, Ciaz and Ignis was to come but now after XL6, it is not clear when the next product will come under Nexa.”

Also, the only thing that was driving Nexa’s success seemed to be the Baleno. As The Morning Context recently pointed out, 200,000 units of Baleno are sold through Nexa outlets each year. But the rest of the key models put together only account for 100,000 units. Nexa seemed to be a one-trick pony.

But it wasn’t just that. Some industry experts believed that Nexa simply focused on the experience. They didn’t realise that people were demanding higher-quality products too. Maruti’s cars remained pretty much the same in terms of build quality and safety.

And not to forget, just like how Maruti Suzuki was late to the premiumisation trend, they seemed to be missing the bus on another emerging trend — SUVs. India wanted bigger, more powerful cars with an imposing road presence. You just need to look at sales numbers to get the gist of what’s happening. In FY19, 1 in 4 cars sold was an SUV. Today, 1 in 2 cars is an SUV. And Maruti simply didn’t have these SUVs in their product arsenal. Sure, you could argue they had the Brezza but it wasn’t enough.

Ergo, the market share dropped again.

But now, Maruti is trying to resurrect itself again. I mean, if you talk to their Senior Executive Director of Marketing and Sales, you’ll probably hear this line, “It’s a war cry..it is there in our organisation..it is like constructive paranoia…which means you cannot rest easy..”

And it’s trying not to repeat its past mistakes.

It launched multiple premium vehicles under the Nexa brand. All of them designed like an SUV — Grand Vitara, Jimny, Fronx. They expect these models to do the heavy lifting now. It’s even relying on promoting hybrid options for these SUVs to attract folks who may not love the idea of relying on electric charging stations yet. And to double down on all this, Maruti Suzuki even has a new ad that calls itself “№1 Makers of SUV”. It’s trying to send a message to prospective buyers that there’s no one better.

Will it work?

We don’t know. But Maruti needs it to.

Because the latest car sales numbers across India also reveal something quite startling — the sales of entry-level small cars have taken a beating in the past year. People say it’s probably because the income of the rural population that typically favours these cars has been depressed too. And since Maruti’s popular in this segment, it could hurt the company’s prospects. On the other hand, the sales of SUVs keep rising at a fast clip as urban incomes remain fairly strong. And that’s the market Maruti is trying to veer into right now.

And maybe the early signs are positive. In July 2023, Maruti Suzuki became the #1 and #2 best selling car brand in India. Yup, their mass car umbrella brand called Arena took pole position while Nexa snatched the second spot from Hyundai. The SUVs seem to be doing the trick.

Also, Maruti probably remembers the complaint that dealers had — about the missing product pipeline. So last month, it announced a massive ₹1.25 lakh crore expansion plan over the next seven years. It even promised to churn out new models — from 17 options to 28.

So yeah, there’s a lot happening at Maruti’s HQ. And we’ll just have to wait and see how it all pans out for India’s #1 car maker.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and X (formerly Twitter).

📢Finshots is now on WhatsApp Channels. Click here to follow us and get your daily financial fix in just 3 minutes.

Stop Paying Your Medical Bills From Your Pocket!

2/3rd of all medical bills in India are paid out of pocket. And it’s wiping out your savings:

You can’t expect to grow your investment if you can’t protect your savings. Even if you start with ₹1 Lakh and compound it by 10% every year, a trip to the hospital can wipe out your gains and your principal in a few days.

Medical inflation is growing at over 10% in India: While healthcare procedures have generally become more accessible, a stay at the hospital can set you back quite a bit, simply because the rooms are now expensive.

No tax benefits: When you’re paying for medical procedures out of pocket, you don’t get to have tax benefits. However, if you have insurance, you can protect your savings, avail of tax benefits and beat medical inflation all at the same time.

So get yourself a comprehensive medical insurance plan right now before you start your investment journey.

But who can you trust with buying a health plan?

Well, the gentleman who left the above review spoke to our team at Ditto. With Ditto, you get access to:

1) Spam-free advice guarantee

2) 100% free consultation from the industry's top insurance experts

3) 24/7 assistance when filing a claim from our support team

You too can talk to Ditto's advisors now, by clicking the link here