Jindal vs Adani in a battle of the ports?

In today’s Finshots, we look at how JSW Infrastructure’s recent ₹2,800 crore IPO has got investors excited about the ports business.

The Story

Imagine you’re a steel producer with a massive operation in the hinterlands of India. You get a lot of export orders and you find yourself running to the port quite often to ship it across the deep seas. But whenever you use the port’s services, you end up shelling a lot of money. And over time, this pinches you a bit. The money is slowly trickling out of your pocket. So you might think, “Maybe it’s a good idea to own the port itself.”

And that’s exactly what the JSW Group run by Sajjan Jindal did in 2002. They were churning out all that steel in Tornagallu, a town in Karnataka. And one of the nearest ports was the Mormugao Port in Goa which was around 300km away by road. So they acted on it. They bid for the port. Not the whole thing. But a couple of berths — slots where their ships could come in for loading and unloading.

Within a couple of years, the JSW Group felt this was a viable business. They decided to create a separate entity that would have a single-minded focus on unlocking the value of handling ports — and JSW Infrastructure was born in 2006. What followed was a slow and steady expansion. In 2008, they built the Jaigarh Port in Maharashtra and followed it up with another port in Dharamtar in 2012. 3 years later, they moved to the east coast and bid for the Paradip Port in Odisha. And in 2020, they went after a port in Mangalore as well as in Ennore in Tamil Nadu. Meanwhile, they set up a port in the UAE as well.

Like we said, it wasn’t a mad rush to acquire and run ports. They took their time. And today, they have 9 ports which they manage across the country. They’ve become the second largest commercial port operator in India.

And there’s quite a bit of visibility on the revenue front from these ports too. The thing is, on average, they have at least 25 years to go on most of their port deals. You see, most of these ports are actually government-owned. They've just decided to act like a landlord and hand it out on rent for a certain number of years. The private company has the right to use the ports for that period and develop them as it sees fit. And it typically pays the government a royalty.

Sure, once the agreement ends, it’s an open field. Anyone else can come and bid for it again. But unless something catastrophic happens, it looks like JSW Infrastructure is sitting pretty for at least the next couple of decades.

They don't even have to actively convince customers to use their ports either. Because their biggest customer is the JSW Group itself. With steel, cement, and energy operations spread across the world, it meant that the ports business saw sticky revenues from the start. But of course, some diversification is always good and JSW Infrastructure has gradually reduced its dependence on the group. They’ve tapped third-party companies too. From accounting for just 25% of cargo volume in 2021, it makes up 35% today.

Can’t just depend on the parents for life, no?

And now, the opportunity is ripe for more.

What do we mean?

Okay. So think of India’s coastline — it's over 7,500 km long. And we’re probably strategically located in the world sea routes too. But yet, we haven’t really become popular for our ports. Just 2 Indian ports feature in the Top 50 list of Container Ports in the world. And maybe that’s because they haven’t been given the attention they need. For instance, as per a report in the Economic Times, the depth of the port areas that allow to float have been extremely low — just 7 metres in older ports. It’s just not enough to keep up with the ships and cargo sizes that are getting bigger and bigger. And that means, we’ll end up losing business too. Ships might choose to transit through other places with better ports.

But the government is intent on changing that. For starters, they have the Maritime Vision charted out for 2030 and it involves a massive investment of over ₹1 lakh crore to develop the infrastructure at ports. And then, the government wants to involve the private sector even more. Because 50% of the port capacity is managed by the government even today. So they want to share the work. And it looks like they have a pipeline of 81 public-private partnerships to be awarded before March 2025. A partnership could unlock the value of our ports faster.

So yeah, when the CEO of JSW Infrastructure said, “ the kind of pipeline of opportunity which is coming up is unimaginable,” you see what he means.

And when you know how things are shaping up, the timing of the ₹2,800 crore JSW Infrastructure IPO last month makes sense. They wanted the money to pay down debt. And to have a war chest ready to expand the port business as and when the government opens the door for partnerships.

But wait...there could be one big hurdle in their path — the Adani Group!

Yup, they’re the largest private port operator in India. They had just two ports in FY11 and today they have 14 ports in their bag. The expansion has been rapid. Remember how we said that JSW is the second-largest port operator in the country? Well, the difference between #1 and #2 is actually quite stark — Adani commands a 24% volume share whereas JSW Infrastructure is a mere 6%.

And Adani has diversified the business even more. Not just in terms of locations — they acquired a 70% stake in Israel’s Haifa Port in FY23 — but also in terms of the kind of shipments they handle.

What do we mean, you ask?

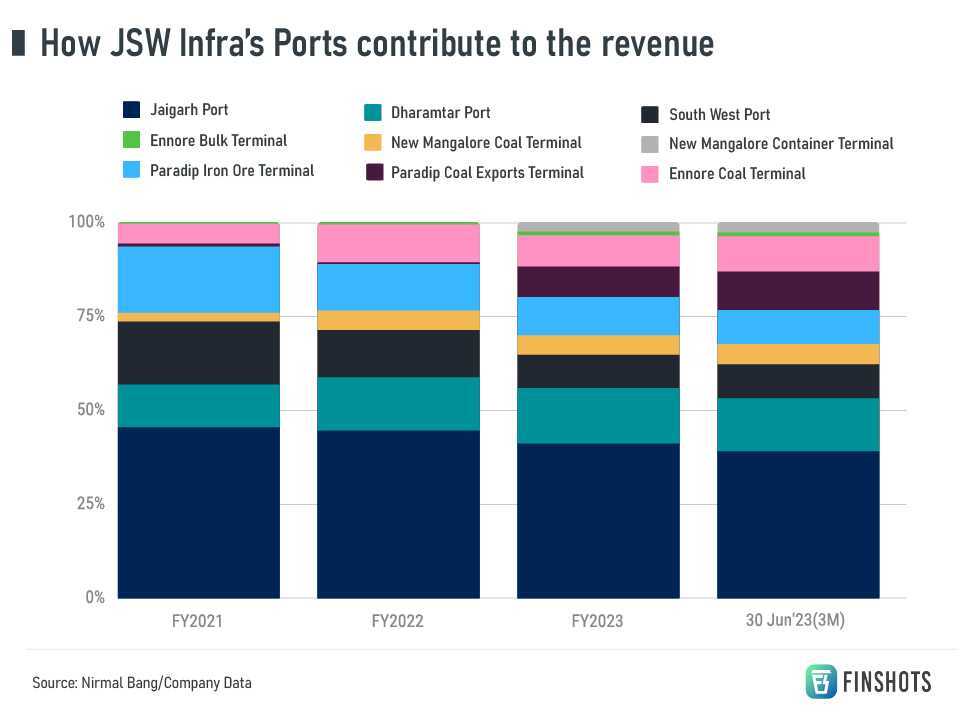

Well, JSW is still focused on shipping commodities. We’re talking about materials like iron ore and coal. They make up nearly 90% of the cargo it ships.

The Adani Group on the other hand has been focusing on growing their container shipping business. You know, when folks like Amazon or Hyundai want to ship stuff, they stuff it into these massive containers. That kind. And from 32% of revenues in FY16, it has inched up to 38% in FY23. That’s the area they want to tap even further now.

Not to forget that Adani has a full fledged logistics play too — Adani Logistics. That means customers not only get access to ports but Adani can help them with warehousing, moving their goods by rail or air or even via trucks to get one from one point to another. JSW isn’t quite there yet when it comes to these expanded services.

Put simply, Adani is a goliath in the industry and JSW will always have competition.

So how does JSW make up for this lost ground?

Well, it has a few things going for it.

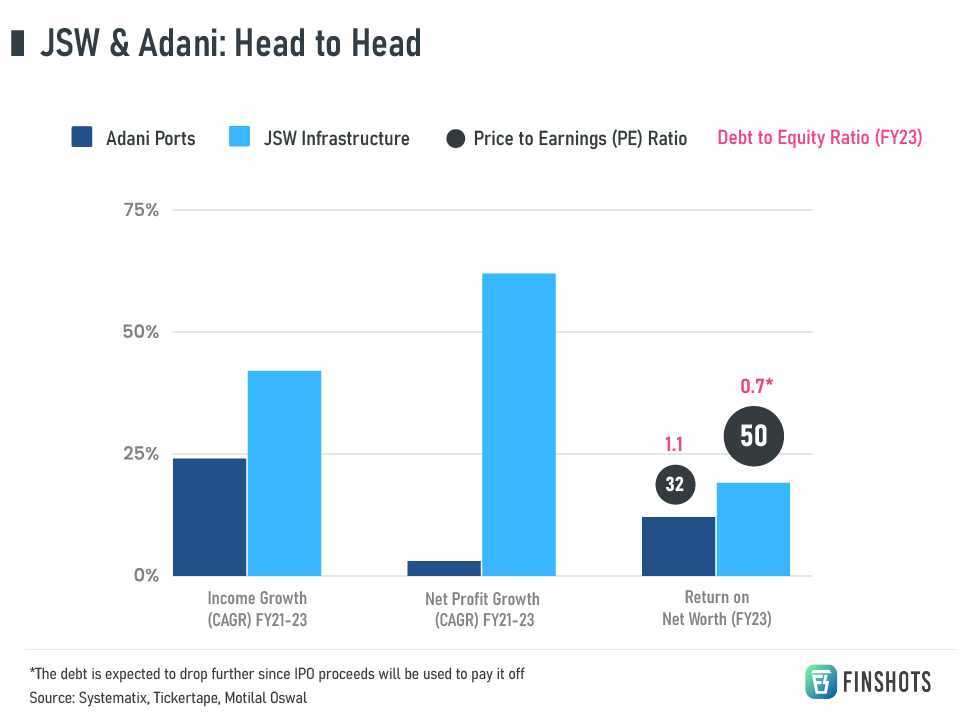

Its net profits have zoomed by 62% annually while Adani Ports has struggled. Meanwhile, paying off debt with the IPO proceeds also will make it a debt free company for now. And that’s something that Adani can’t claim just yet.

And maybe that’s why investors are willing to pay a premium for the company right now. It’s already trading at 50 times its FY23 earnings compared to 32 times for Adani Ports.

There’s just one more thing to chew on — JSW has disrupted giants before. As Menaka Doshi wrote in Bloomberg recently:

“A decade ago, JSW Steel Ltd. succeeded in closing a 75-year gap with Tata Steel Ltd., becoming India’s largest domestic producer of the metal. So, when I interviewed Arun Maheshwari, chief executive of the ports company, JSW Infrastructure Ltd., I had to ask if the group intended to do to Adani what it did to Tata. Maheshwari responded with a flat ‘no comment.’

So yeah, tell us — Who will you bet on? Because the ports business is certainly heating up now.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and X (formerly Twitter).

Ditto Insights: Why you must buy a term plan in your 20s

The biggest mistake you could make in your 20s is not buying term insurance early.

Here’s why

1.) Low premiums, forever!

The same 1Cr term insurance cover will cost you much lower premiums at 25 years than at 35 years. What’s more- once these premiums are locked in, they remain the same throughout the term! So if you’re planning on building a robust financial plan, consider buying term insurance as early as you can.

2.) You might not realize that you still have dependents in your 20s:

Maybe your parents are about to retire in the next few years and funding your studies didn’t really allow them to grow their investments — which makes you their sole bread earner once they age.

And although no amount of money can replace you, it sure can give that added financial support in your absence.

3.) Tax saver benefit: You probably know this already — section 80C of the Income Tax Act helps you cut down your taxable income by the premiums paid. And what’s better than saving taxes from early on in your career?

So maybe, it’s time for you to buy yourself a term plan. And if you need any help on that front, just talk to our IRDAI-certified advisors at Ditto Insurance.

Go to Ditto’s website — Click here

Click on “Book a free call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!