ITC — The Budget Stock

In today’s Finshots, we talk about why ITC’s share may have hit a record high.

The Story

The Budget is always a big deal for one stock — ITC. That’s because whenever the government wants to tweak taxes on cigarettes, they use the Budget speech to announce it to everyone in India. And these tax tweaks matter to ITC because the company sells a lot of cigarettes. A lot of it.

So on Wednesday, when Ms Nirmala Sitharaman slipped in a line saying that the tax would be hiked by 16%, investors were probably gutted. They felt that the good run had come to an end. And the stock dropped by 5% within a matter of seconds.

But…it took just about 30 minutes for things to change.

See, cigarettes face all kinds of taxes. There’s GST at 28%. But that’s not what the Finance Minister tinkered with. That’s up to the GST Council to tweak. And it’s at its highest level anyway.

Then there’s a Compensation Cess which is around 5% plus a certain fixed amount. This is a tax that was levied to compensate states. You know, when GST was introduced, states had to forego some of their control over imposing certain kinds of taxes. And this special tax on certain ‘sin’ goods like cigarettes would compensate states for losses.

Finally, there’s something called the National Calamity Contingent Duty (NCCD) which is kind of like excise duty. Don’t ask why it’s called NCCD or what the money is put towards. But this is typically a fixed charge based on the size of the cigarette — for instance, if the cigarette size is 65mm, the duty is ₹0.44 per stick.

And that’s what the government decided to hike. Nothing else. It wasn’t an exorbitant hike either. Just 16%. Sure, on the face of it, 16% sounds like a lot to digest. But do the math and you’ll see that it only takes the NCCD to ₹0.51 per stick.

Is that a body blow to ITC? Absolutely not. Some estimates peg that they’ll only have to increase the price of cigarettes by 1–2% and they’ll be able to pass it along to smokers.

And smokers are sticky customers. They like their specific brands. They have their preferences. They’ll shell out a premium. And meagre price increases won’t hurt them. The demand is relatively inelastic. Also, remember, ITC is a virtual monopoly in this organized cigarette business — 8 out of 10 cigarettes sold legally is an ITC brand. And beating the giant is hard. It’s got a phenomenal distribution network it has built over the past 100 years. In fact, ITC claims that it sells cigarettes through over 7.1 million outlets — double the number of outlets of its nearest competitor.

So when investors digested all of this, they probably realized they overreacted. This increase wasn’t going to drive smokers away from ITC and into the arms of cheaper and illicit sources of tobacco. Within 30 minutes, the stock had recovered and then some.

Investors were so happy that they kept buying the stock on Thursday too. And ITC shares hit an all-time high.

Now it’s anybody’s guess if the trend will persist. Because if there’s one thing for certain, it’s that you never know which side stock price movements will swing.

But we can still ask — is the 16% NCCD hike such a big deal?

Well, we can’t be sure that’s the only thing driving the stock. It’s the stock market after all. And it has a mind of its own. But we can posit a few theories.

For starters, it’s not just that the hike in duty was minimal. It’s about the expectations of the hike. If most investors expected a bigger hike and were pleasantly surprised that it wasn’t to be, they’ll be tempted to load up on the stock.

Also, now that the hike is out of the way, there won’t be any shocks for the foreseeable future. The uncertainty has been knocked out. And investors like to have some degree of certainty about how things will play out in the future. You see, ITC has been selling a lot of cigarettes in the past couple of years — much more than what investors anticipated in fact. Despite all the anti-tobacco campaigns and warnings about the ill effects of tobacco, people are buying cigarettes. The stable tax regime has helped it and that has allowed it to bite into the share of the illicit market.

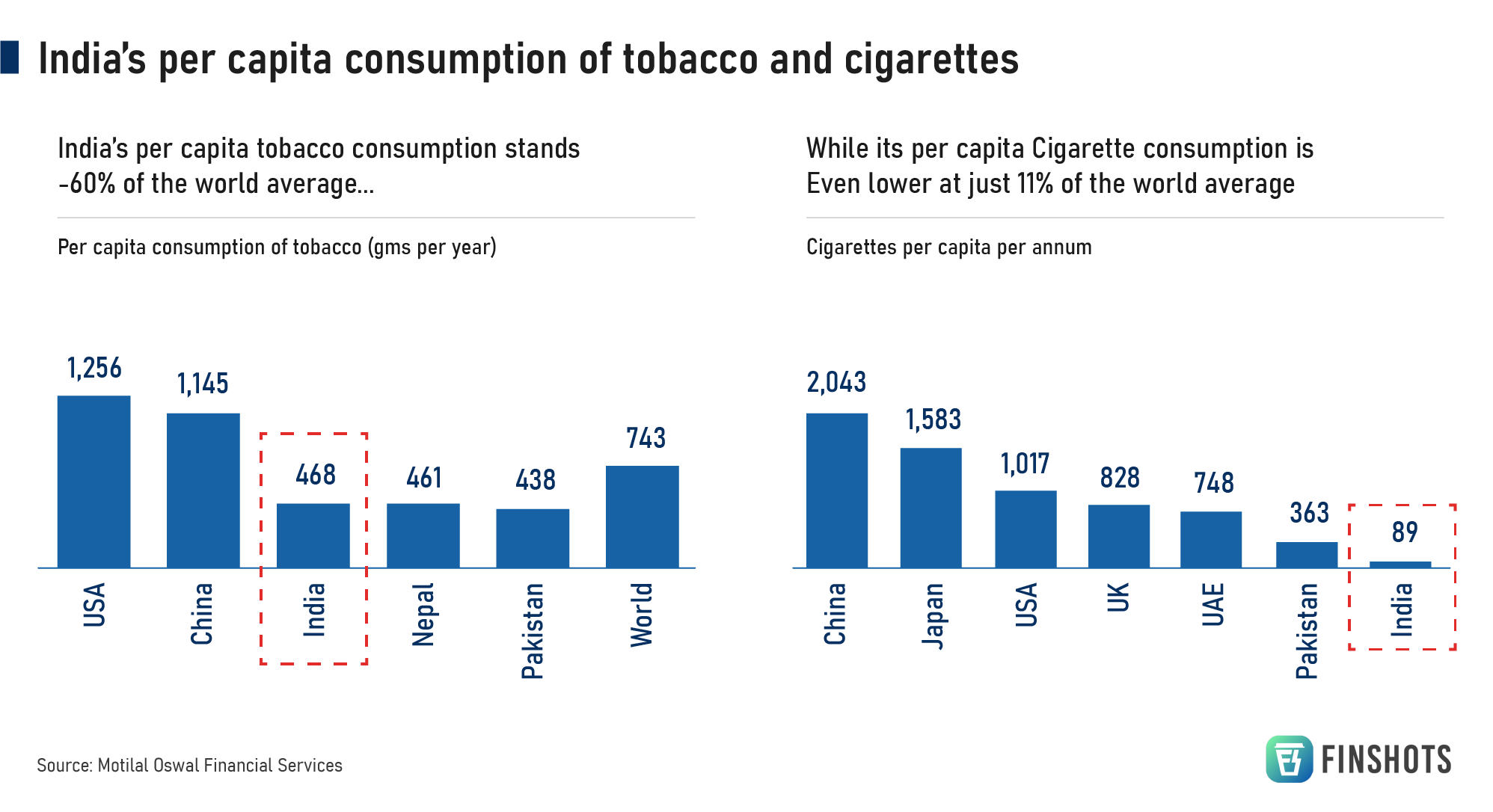

Because — and don’t hate us for throwing this in here — low per capita consumption leaves room for cigarettes to grow in India! While on average, people across the world smoke 800 cigarettes a year, India’s consumption of the legal variety is just 89 cigarettes. Most folks in India still prefer other tobacco products such as beedis and ghutkas. But if the tax regime remains more or less stable and as per capita incomes rise, we might see a gradual shift to cigarettes. It’s a long shot but it’s possible.

And don’t forget that ITC is staying ahead of the curve too. They’ve already launched a 5-pack of cigarettes. They know that 75% of all cigarettes in India are sold as single sticks. People prefer buying singles because it’s just easier and cheaper to do it for a quick fix. So, by shrinking the packet, ITC is trying to widen its prospective customer base.

If the rumours are true and the Indian government bans the sale of single sticks across the country, ITC will be fully prepped. It won’t cede market share to the illicit cigarette business that easily.

But this dependence on cigarettes can’t be the only thing driving the stock, no? After all, despite being still known as a tobacco company, less than 40% of its revenues come from cigarettes these days.

ITC has got its hands in many pies — it sells biscuits, atta, and noodles. It has a chain of hotels. It has an agri-business that supplies and exports wheat. It even sells paper and packaging products.

And all its businesses are in a sweet spot at the moment.

Take FMCG for instance where they’ve personal care products, biscuits, and even instant noodles. ITC has built all this from the ground up. They’ve built their products. They’ve built a robust supply chain. And they’ve had to pump in the cash for marketing and stuff to ensure that people remember all its brands. That means that they haven’t really seen massive profitability from the segment over the past decade. ITC’s net margins on these products have been quite poor — typically at just 2–3% while its peers command over 15%. But that’s slowly changing. Its net margins have inched upwards to nearly 7%. And investors now expect this to keep improving.

And while the hotel business is typically capital-intensive and doesn’t yield a lot of profits, ITC has tweaked its strategy. It doesn’t want to splash the cash and embark on a massive hotel acquisition spree anymore. It wants to be more asset-light. So it has been building up its portfolio of hotels by entering into contracts to simply manage existing properties owned by others. Such as managing hotels under businessman Ravi Pillai’s RP Group Hotels & Resorts under the ITC brand. This way, ITC keeps its foot in the hospitality door but shells out less cash in the process. And with tourism and conferences picking up after the pandemic, the wind is blowing in favour of hotels too.

Even its agri-business that helps it create frozen peas and shrimps and papers ( that has the Classmate brand of books) has picked up pace in a big way.

But will the good times last for ITC?

Well, investors have a love-hate relationship with ITC. They know it’s a sin stock that’s at the whims and fancies of the government. They know that while the cigarette business is only 40% of revenues, it’s still the cash cow that contributes to 80% of ITC’s profits and allows the company to diversify its business interests. They know that foreign investors have cut their holdings from 20% in FY13 to just 12% in FY22.

But they also know that the company has a lot of cash and is hell-bent on diversifying and shedding the tag of simply being a tobacco player.

So yeah, we’ll simply have to wait and see how ITC’s future pans out now.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you’re at it.

1. Just head to our website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!