Is the rupee too weak or the dollar too strong

In today’s Finshots, we explain why India’s currency is under pressure, how global rate cuts and oil prices play into it, and what it means for ordinary Indians.

The Story

For the last few quarters, India’s economy has been doing quite well. We posted 7.4% GDP growth in January-March 2025, 7.8% in April-June, and 8.2% in July-September this year.

This ideally tells us that the economy is doing quite well. But when you look at inflation, the picture becomes even more interesting. October’s inflation data came in at just 0.25%, and, without the jump in global gold prices, it would have actually been negative. Food prices alone saw nearly 5% deflation, and food has around 46% weight in the inflation basket.

And here’s the thing. When inflation falls below the RBI’s target range, the central bank is not supposed to sit still. It is believed to nudge inflation up, not down. This is why the Monetary Policy Committee cut the repo rate again on Friday morning, by 25 basis points to 5.25%. This is the fifth rate cut this year, adding up to 125 basis points of easing. Lower rates should, in theory, boost borrowing, revive demand, and push inflation a little closer to the 4% target.

However, every time the RBI cuts rates, it also chips away at the attractiveness of the rupee. Lower interest rates make Indian bonds slightly less appealing to foreign investors. And when investors pull money out, they sell rupees and buy dollars.

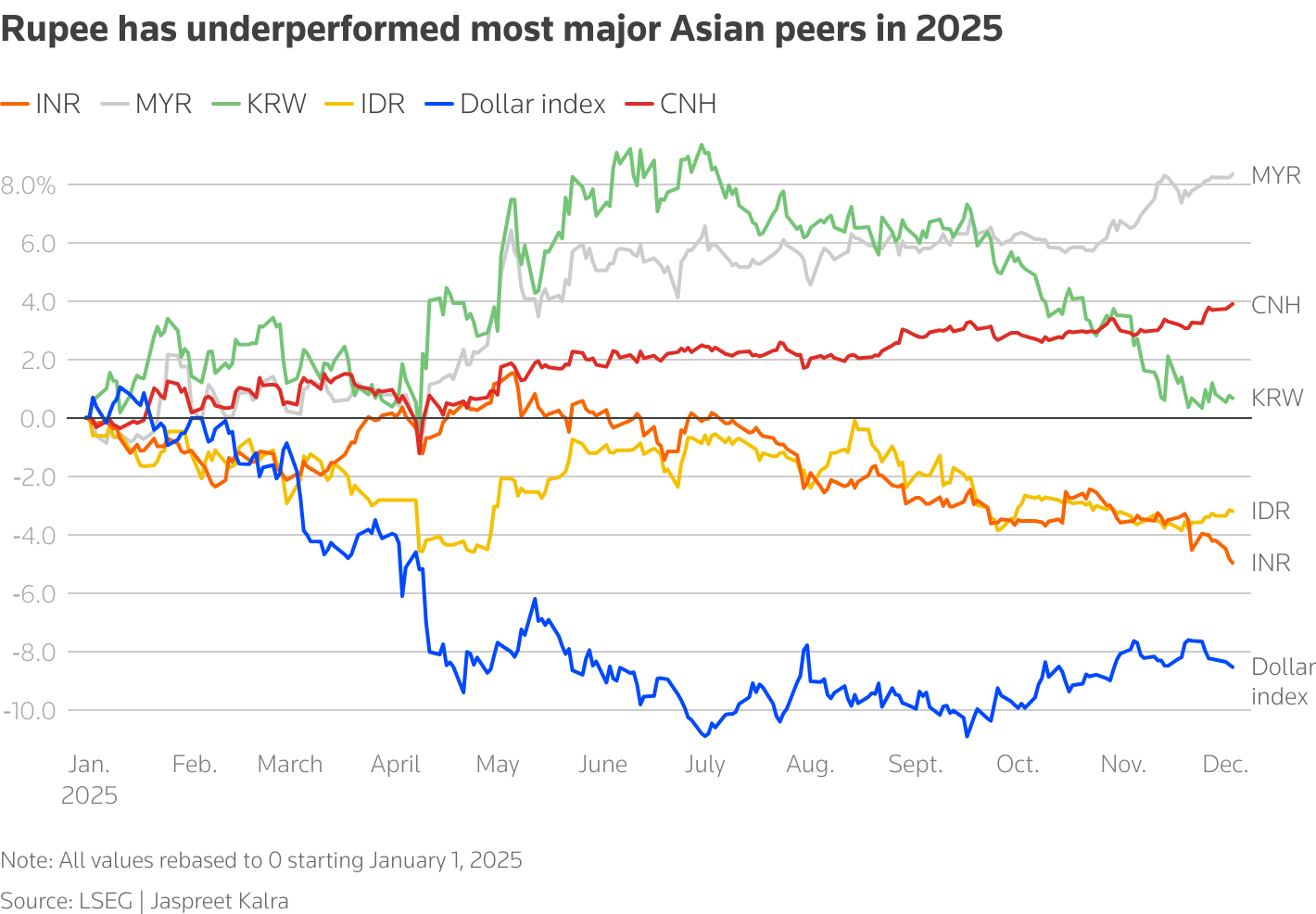

That puts pressure on the currency. Which brings us to the puzzle at the heart of the story. India is the fastest-growing major economy in the world, and yet the rupee has touched an all-time low against the US dollar. So how does a booming economy end up with a weakening currency?

That’s where things get interesting.

The Indian rupee is currently hovering around ₹90 for $1, a level that was unthinkable just a few years ago.

Now, a weaker currency usually brings cheer to exporters because every dollar they earn fetches more rupees back home. But here’s the real problem.

India is structurally a net importer. We rely heavily on foreign crude oil, gold, electronics, and industrial machinery. That means every time the rupee weakens, our import bill balloons.

And this year, the squeeze is even tighter. India has been cutting back on discounted Russian crude because of the additional tariff. That pushes more of our oil demand back onto the global market, where payments are strictly in USD. If the US rolls back tariffs as India reduces its Russian imports, the rupee could get some temporary relief. But for now, oil is exerting steady downward pressure.

Add to that a globally strong dollar. Even as India posts stellar GDP numbers and ultra-low inflation, the USD has surged on the back of high US yields and global uncertainty. When the dollar strengthens broadly, all emerging-market currencies get pulled down with it. And the rupee is caught in that tide.

But there’s a deeper twist. When food prices plunge and overall inflation nearly dips negative as we mentioned earlier, it should normally point to economic weakness. But India is doing the opposite. It’s growing at over 8% GDP growth, something no other major economy is doing right now. This unusual combination of high growth plus near-zero inflation creates a strange backdrop for our currency.

So, is the Indian rupee weak, or is the US dollar simply too strong?

To answer this question, we shall go over a few scenarios and let you decide for yourself.

The USD side of the story

The dollar has surged for months as US bond yields have remained high and investors sought safety. But the US economy is now showing cracks. Job numbers are soft, and the Market expects the Fed to cut rates sooner than planned. This is exactly what President Trump has been pushing for. And the next Fed chair will almost certainly be someone that he prefers. That means more cuts are likely.

Rate cuts usually weaken a currency because investors who want fixed returns move their money out to countries offering higher yields. So, in theory, a Fed rate cut means a weaker USD over time.

However, the dollar has a sort of dual personality.

The USD is also the world’s safe-haven currency. If the Fed cuts because the US economy is in real trouble, markets panic and investors buy more dollars, not sell them. In such scenarios, every emerging market currency weakens, regardless of how well its own economy is doing. We could say that India is simply caught in that global crosscurrent.

The INR side of the story

Some rupee pressures are homegrown. A booming Indian economy needs more oil, more electronics, more capital goods. So, we naturally increase imports.

However, exports aren’t rising at the same pace. They’re steady at best. In fact, several exporters, especially those dependent on the US, have seen demand soften. This widens the trade deficit, putting steady downward pressure on the Indian rupee even before external factors come into play.

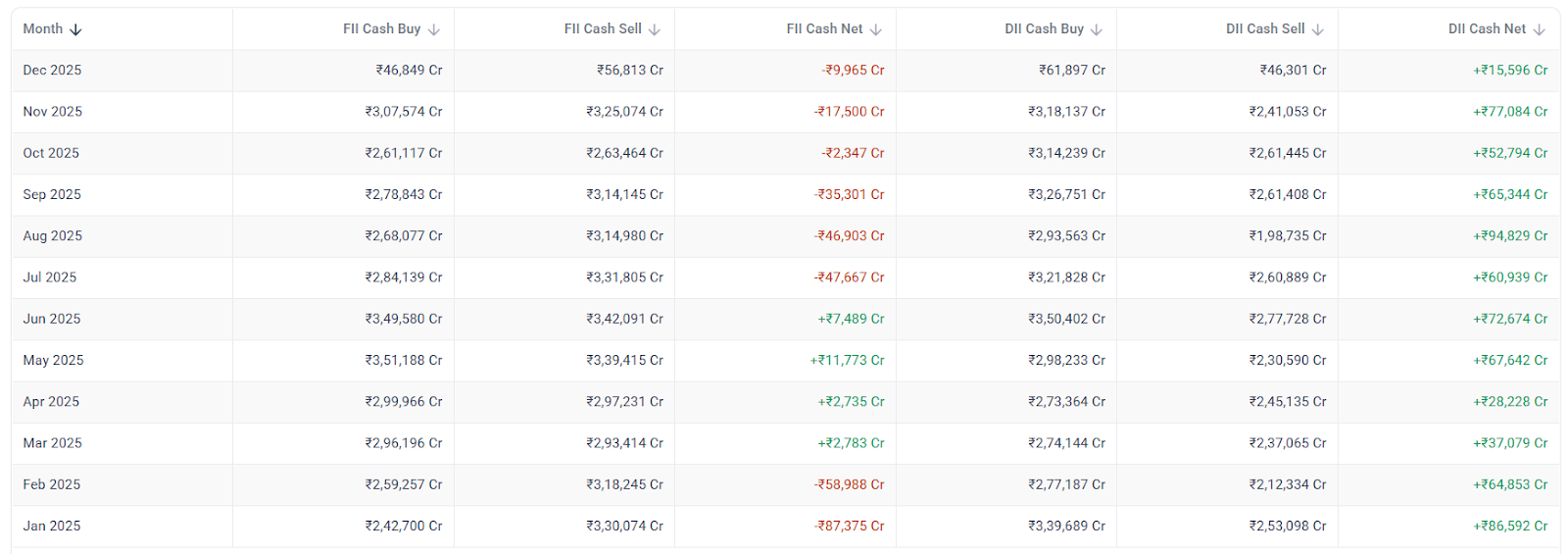

Add to this the role of Foreign investors (FIIs). Now, let’s say an FII earns 10% returns in the Indian market. If the rupee weakens by 3%, their effective return in USD drops to just 7%.

This currency hit makes foreign investors more cautious, and when the rupee shows persistent weakness, FIIs often pull out money to protect their USD returns. That outflow weakens the rupee even further.

In fact, we can see that this is precisely what’s playing out in the stock market for the last 6 months at least:

Does this mean India should rethink everything and go back to the gold standard? Of course not. But it does mean the rupee’s slide shows up in ways that matter to everyday Indians.

For starters, we will have costlier oil imports. Every $1 increase in crude oil widens India’s import bill sharply. And a weaker rupee multiplies that impact.

Then, we have precious metals. When the rupee falls, gold becomes more expensive even if global prices stay flat. When international prices rise, and the rupee falls, the effect doubles. This is why we Indians buy gold not just as a crisis hedge, but as a currency hedge.

Then we have costlier flights, imported electronics, and even app-store purchases priced in USD. All of this will get more expensive, and households will feel this pain long before any inflation data captures it.

However, there is a silver lining. In theory, exporters benefit. But India relies on imported inputs for chemicals, electronics, engineering goods, and even pharmaceuticals. When import costs jump, the export advantage erodes. Only a narrow band of exporters (like software service companies) enjoys the clean benefit of a weak rupee.

But here’s where the deeper problem lies. Deflation suggests weak pricing power, something usually seen in slowing economies. But India’s strong GDP growth shows rising output, investment, and activity. This disconnect tells us that “deflation” is not a sign of economic slowdown, but something else. Some high-weighted items are seeing prices fall, but services and broader economic activity remain strong (at least on paper).

There you have it, folks. The rupee crossing another unfortunate milestone is a reminder of how global politics, India’s energy dependence, and the dollar’s dominance shape the daily life of ordinary Indians.

While it is not catastrophic per se, it has consequences and opportunities.

India can use this moment to rethink its vulnerabilities, such as oil dependence, import-heavy manufacturing, and limited export diversification, and push for structural reforms that make the currency more resilient over time.

The falling rupee is not a verdict on India’s economy. It is simply a nudge, telling us where the cracks still lie. What we do next will determine whether this becomes a short-term discomfort or a long-term turning point.

Until then…

If this story helped you understand the tug-of-war between the rupee and the dollar, share it with a friend, family member, or even strangers on WhatsApp, LinkedIn, and X.