Is Biocon making a comeback?

A couple of days ago, Biocon announced that it had finally finished integrating Viatris’ business with itself. And since this was probably Biocon’s biggest acquisition till date, in today’s Finshots, we thought it’d be a good time to see what this biopharmaceutical company has been up to.

But before we get to the story, we want to talk about the Adani saga. Last week we had a new report coming out castigating the company once again and while we haven't covered the story in our newsletter just yet, we have a fact-based explainer on the whole matter on our YouTube channel. So do check it out. Link here.

The Story

From 2016 to 2020, Biocon was the darling of investors. Its stock soared by over 400%. And everyone was singing praises. But it has been all downhill from there. The stock has lost over 40% of its value while the Nifty Pharma index is up by ~20%.

So, what’s going on here, you ask?

Well, if you ask Biocon’s Founder and Managing Director Kiran Mazumdar-Shaw, you’ll get 3 reasons to explain the stock’s struggles.

- Indian investors don’t understand that Biocon is a unique stock. That Biocon isn’t like other pharma companies in India that simply make generic drugs.

- They invest a massive amount of money into research and development (R&D) and innovate their biologics business which takes time. In the pharma space, it’s probably the company with the highest R&D expense as a percentage of revenue.

- And finally, a couple of years ago, they paid over $3 billion to acquire a US company called Viatris. This was funded by a massive debt component and investors apparently don’t appreciate that since the pharma industry isn’t known for big debt balances.

But before we get into whether these reasons make sense, we need to get an idea of what Biocon actually does. After all, it might be quite easy to be confused about words like ‘generics’ and ‘biologics’.

Now remember that we’re attempting to simplify an extremely complex business here. But if we break it down, you’ll find primarily 3 parts to it.

Firstly, there are the generic and API segments.

This is really the heart of Biocon. See, you can either be an innovator and spend years and billions of dollars in research and development to create pathbreaking drugs. Or you could wait for patents of popular drugs to expire and create copycats called generics. These will be cheaper drugs that will be consumed by the masses. Now Biocon is not your regular pharma company that makes these drugs out of chemicals. It’s a biotech firm. That means it primarily uses living organisms such as bacteria to create the molecules needed for generic drugs. It’s about biology here.

Also, it provides active pharmaceutical ingredients (APIs) that drugs need — whether a new blockbuster one or a patent-free generic. Think of the API as the raw material needed to make the drug. And Mazumdar-Shaw says that the company has a 50% global market share for creating and supplying APIs for statins (a type of drug based on biology) used to treat cholesterol.

Secondly, there’s contract research.

This is the playground of its listed subsidiary Syngene. Think of it as the R&D centre. It helps third-party drug makers in drug discovery. It aids them in pre-clinical trials to prove drug efficacy. And then it even gets its hands dirty by manufacturing the drugs.

Now Biocon owns around 55% of Syngene. They used to own 70% a year ago but they sold a nice chunk of their stake to fund the acquisition of the US company and pay down debt.

Then there’s the biologics division.

Or what’s known as Biocon Biologics which is another subsidiary of the main company. And this is probably the most important piece of the puzzle right now. This is the business that everyone’s most excited about.

See, most diseases are treated using simple molecules. But complex ones like cancer need a different strategy and formulation. Because cancer isn’t like most diseases. It’s not caused by an invasion of a foreign pathogen. Instead, it’s a byproduct of rogue cells that destroy our bodies from within. That means using “simple molecules” to defend against a barrage of mutating versions of our own cells is an exercise in futility. What we probably need is a ‘biologic’ or a complex protein isolated from natural sources that can mimic our immune cells. Maybe that would help us in fighting cancer.

Now you’d imagine that the time and effort spent in creating these biologics is long and arduous. That’s why the ones who innovate are granted patents to prevent others from mimicking it. And Biocon has its novel biologics business where it puts its head down and tries to create breakthrough drugs.

But it doesn’t end there. It also does something called biosimilars. Think of it as a copycat version of a biologic. Kind of similar to how we have generic drugs in place of branded drugs. Once patents run out, these copycats can come to the fore.

We do have to point out that creating biosimilars is quite a tough gig. And that’s because they’re made using living systems such as yeast and bacteria. It’s not just a bunch of chemicals being put together. And each living system can have slightly different protein molecules. So you’re not really going to be able to replicate things to a T. You still have to spend considerable time and effort to get it as similar to the primary biologic as possible.

In fact, some estimates suggest that just developing biosimilars could take 5–9 years and cost over $100 million. Whereas a generic drug can be rolled out in a third of that time and just a couple of million dollars.

So yeah, you can see why biosimilars won’t be everyone’s cup of tea. And that’s where Biocon shines. For about two decades, they’ve been slowly building their biosimilar pipeline to treat diseases such as diabetes and cancer. It’s not something that most other pharma companies attempt.

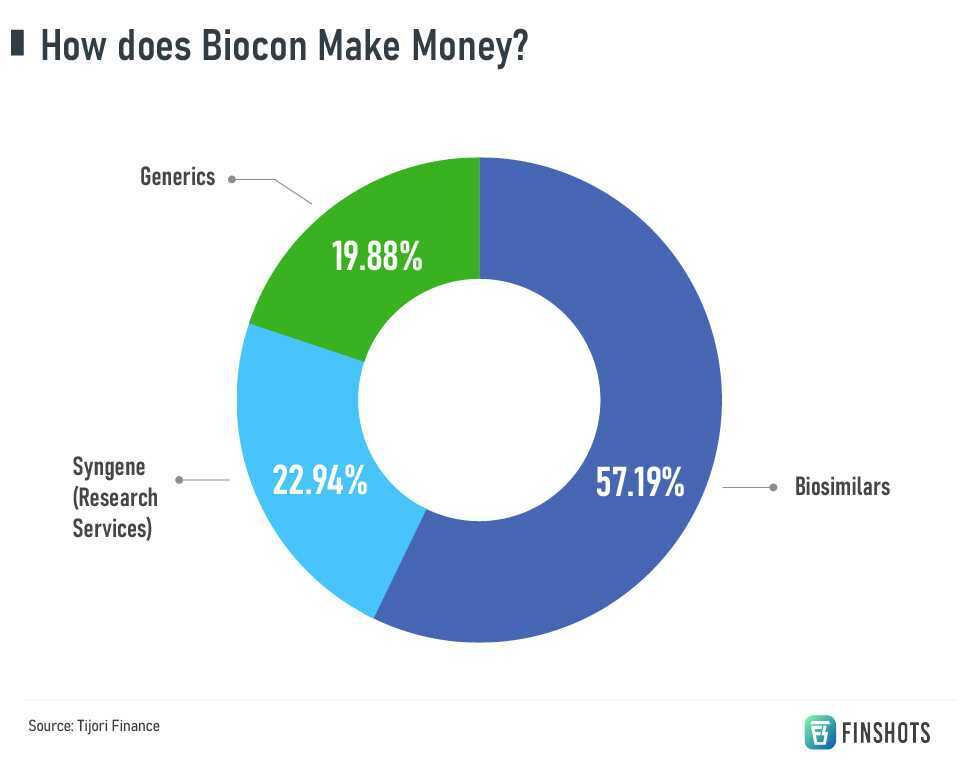

In fact, over half of Biocon’s revenues now come from the biosimilars division. Generics make up about 20% and the rest of it is accounted for by Syngene’s R&D.

And as per a 2020 report by HDFC Securities, this decade could see nearly $300 billion worth of biosimilars opening up for development. So the opportunity is there for the taking.

So this finally brings us back to Mazumdar-Shaw’s argument that investors don’t understand the business.

Now on the face of it, it’s a little hard to believe that theory. Otherwise, why else would they have rushed to invest for all those years earlier? Could it be because it was a shiny new thing and they didn’t want to miss out? We can’t be sure.

But let’s say the average investor has no clue about this. They might be concerned as to why the business isn’t like other pharma companies. Sure. But they’ll still look for external cues — such as a prominent investor picking up a stake or brokerages gushing about the opportunity of a lifetime.

And the thing is — Biocon had both.

Over the past 2–3 years, the subsidiary Biocon Biologics has caught the fancy of PE investors. It has raised millions from Goldman Sachs, Tata Capital, and even vaccine giant Serum Institute of India — the same folks behind manufacturing the Covid vaccines.

And you had brokerages like JM Financial, which exactly a year ago, published a report saying “Biocon: On the cusp of transformation.”

In such a case, you’d think that investors would start to believe in the Biocon story, right?

So, it may not just be a ‘lack of understanding’. But as JM Financial pointed out, the much-touted biosimilars business may not have panned out as expected. Sure, it’s a big revenue contributor but there have been delays in approvals. And it hasn’t been able to capture market share in the US as expected. The original biologics continue to stand their ground. And that might have spooked Dalal Street a bit. If you pore through recent analyst reports, you’ll see phrases like “missed estimates”. So even though business is picking up in the rest of the world, at the end of the day, everyone wants to see success in the US.

And even beyond this, there could be other niggling worries. Like corporate governance!

Yup, a year ago Biocon was rocked by a scandal. The CBI pointed its finger and accused top officials of trying to bribe their way into regulatory approvals for an insulin injection which was a biosimilar product. Of course, Biocoin denied all allegations. But you’d imagine that investors might be a bit iffy about buying the stock of a company that was in this sort of negative spotlight, right?

So yeah, there might be a few reasons why investors gave up on the stock. They might’ve just seen more near-term opportunities elsewhere. After all, investing is all about tradeoffs. No one has infinite amounts of money. They constantly need to make a choice. And short-term outlooks play a huge role in making these allocations too — especially if most brokerages don’t have a strong ‘buy’ call on the stock.

But maybe, as Biocon’s debt is pared down and success in biosimilars becomes more evident, investors will come roaring back. We’ll have to wait and see.

Until then…

Don’t forget to share this article on WhatsApp, LinkedIn, and Twitter.