India’s first retail REIT is here!

In today’s Finshots, we offer a primer on Real Estate Investment Trusts and the Nexus REIT IPO.

But before that a quick update on our latest video. Gold prices have been going up for the past year or so and everybody wants to know what's driving the rally. So if you've been curious about the rise in gold prices or if you were wondering where gold is headed next, this will be a good video to watch. Link here.

The Story

Everyone loves a little real estate in their portfolio. It could be a piece of land in an area where you think the prices will soon soar. Or it could be that swanky commercial property in a prime business district that could fetch a decent chunk of rental income.

But there’s a problem. Making these investments isn’t easy. First, you need to get some lawyers and do your due diligence. Ensure that all the property papers are in order. Then, you need the big bucks to invest and enter the game. It might eat away all the capital you have and that’s a big concentration risk.

Naturally, this means real estate bets aren’t for everyone. But a few years ago, something emerged that could potentially fix this conundrum for investors — Real Estate Investment Trusts (REITs).

Think of these in the same way as a mutual fund. You have a professional fund manager who’ll pool investors’ money and invest in a bunch of real estate properties. It could be in properties like those big IT parks with offices of the biggest tech giants in the world. Or it could be in malls that house big fashion brands and restaurants. The manager takes a fee for handling all of this.

As an investor, you get to own a diversified portfolio of prime real estate. Without the need to break the bank. And you don’t even need to get involved in the daily operational headache of managing the property yourself. But you still get a share of the rent.

And in India, we have three REITs available on the stock exchange — Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust. But they are all quite similar. They play on big companies taking up office space and paying rent.

But if you are someone who saw the crowds at the malls and wanted a piece of the rent that all these brands paid, it just wasn’t possible. Until now…

This week, India got its first retail REIT in the form of Nexus Select Trust REIT that’s owned by the global private equity behemoth Blackstone.

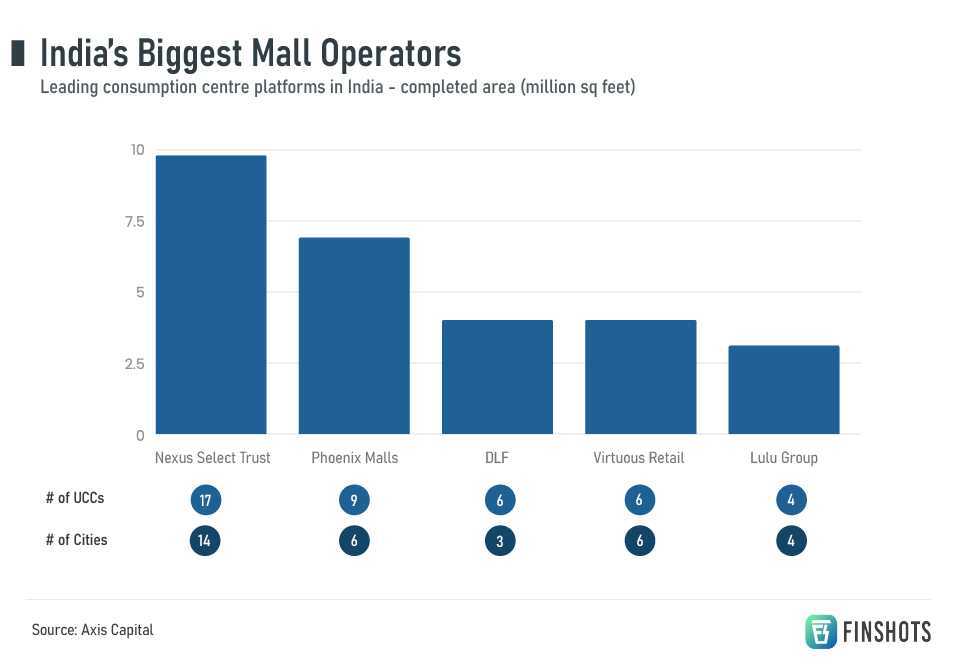

Now if you haven’t heard of Nexus, just know that it is one of the biggest mall operators in the country. The Nexus Select Trust manages nearly 10 million square feet of retail space across 17 malls or what they call Urban Consumption Centres (UCCs) in 14 cities in the country. The next biggest is Phoenix Mills with 9 UCCs in 6 cities. So yeah, Nexus is the leader of retail in India. Period.

So if you want a share of the rent that fashion giant Zara and PVR cinemas pay, you know what to do.

So how does one invest in this, you ask?

Well, all REITs first raise money from the public through an IPO. For instance, the ₹3,200 crore Nexus REIT IPO opened for purchase on the 9th of May and closed on the 11th. Investors could choose to pick up a minimum of 150 units within a set price band — ₹95 to ₹100 per unit.

And just like an IPO, units are allotted and it soon begins to trade on the stock exchange. For Nexus REIT, d-day is the 19th of May. Once it’s listed, anyone can buy or sell its shares at a click of a button.

So how do you get a rental payout?

Well, it’s kind of like how a company pays out dividends. It’s just that REITs mandatorily have to pay at least 90% of their cash flow back to investors. And this happens every 6 months.

So when you take a bet on a REIT, it’s not really in the hope that the price will soar on the stock exchange. That’s a nice bonus. The real hope is that the REIT manager has chosen a bunch of good properties that will yield a nice rental yield.

But before you decide to pick up a REIT based on this yield that you see printed somewhere, you need to consider how you’ll be taxed as well. Now this can be a little complicated so we won’t go all that deep. We’d recommend that you actually check with a tax advisor. But we’ll try and give you the gist of it at least.

See, REITs primarily make 3 different types of payouts to investors.

Firstly, there’s the rental income that it gets from the properties that are part of its portfolio. Then, there could be a dividend it gets from a subsidiary (called a Special Purpose Vehicle or SPV) it has invested in. And also, it could give a loan to this SPV on which it gets periodic interest and repayment of the loan* too.

Now if you’ve invested in a REIT, you’re going to have to break down the exact source of the payout you’ve received to pay tax.

In most cases, you can consider the dividend payout to be tax-free in your hands. On the other hand, you’ll have to add the interest and rental portions to your overall income. So if you typically pay a 30% tax on your income to the government, that’s what you’ll pay on this bit of the REIT payout too.

Oh, and if you buy a REIT share on the stock exchange for ₹100 and sell it 3 years later at ₹110, you’ll have to pay a 10% tax on those profits or gains above ₹1 lakh in the financial year. If you sell in a shorter time span, you’ll pay a higher tax of 15%.

So yeah, there’s quite a bit to keep in mind here when it comes to paying tax on your REITs investment.

But anyway, now that we’ve got most of the generic stuff out of the way, let’s turn our attention back to the Nexus REIT specifically. How do we even evaluate a REIT?

Well, there are a few things to keep in mind.

In the commercial property space, vacancy is the biggest issue. And there’s a measure called the Weighted average Lease Expiry (WALE). It’s basically a snapshot of how much time is left for the property to go vacant. The higher the better. And for Nexus REIT, it stands at 5.7 years. Now since we don’t have a retail REIT to compare this to, we have to look at the commercial property REITs which all have a WALE that’s closer to 7 years.

Then there’s the Occupancy Rate which indicates whether the malls are doing a good enough job of attracting renters. In the case of Nexus REIT, the occupancy rate is at a very solid 96%. And they’re also keeping their existing tenants happy. Because out of over 4 million square feet of leasable area that were added in the past four years, 75% of it was picked up by brands that were already associated with Nexus malls.

Also, the diversification of the portfolio ensures that the risk to cash flows is limited in case tenants look elsewhere. And for Nexus REIT, no single tenant contributed to more than 2.8% of its gross rentals. And its top ten tenants account for just 20% of it.

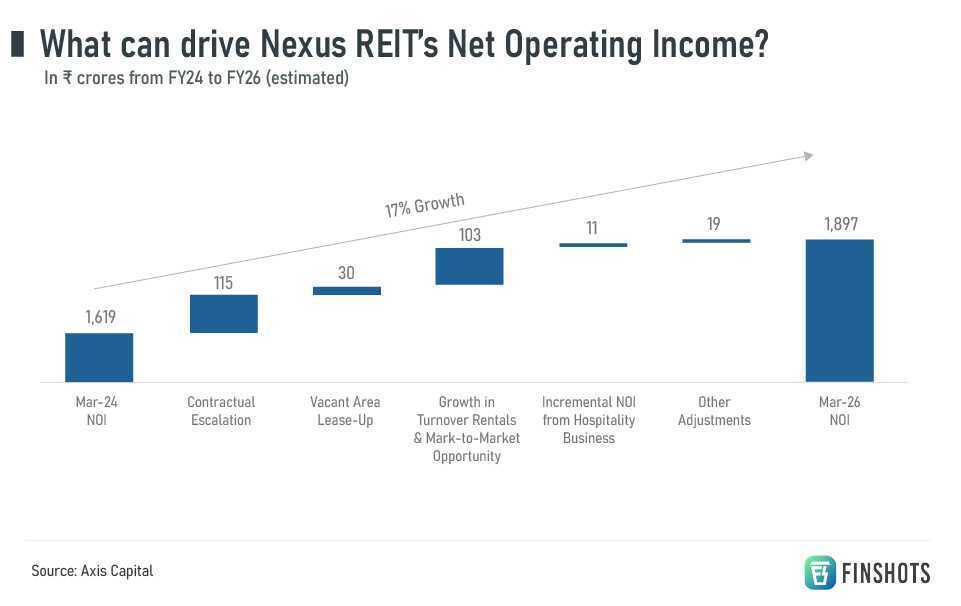

And finally, there’s the Net Operating Income (NOI) which is nothing but the lease rentals after adjusting for the operating expenses. Now the lease rentals can be tied to a fixed annual escalation. And it’s also linked to the sales of the stores. If stores sell more, Nexus can earn a higher rent. And this NOI is projected to grow organically by 17% in the next 3 years.

And at the end of it all, there’s just one number that matters to investors — the yield! And for Nexus REIT, the approximate pre-tax yield at the time of the IPO is around 8.25%.

So yeah, while all these are great signs, as an investor, you do have to remember a couple of things.

For starters, if the stock price rises after the IPO and you pick it up, you’ll probably get a lower yield and that’s something to watch out for.

You also have to remember that since REITs are listed on the stock exchange, they’re prone to the mood swings of investors. In the past, we’ve seen that whenever the RBI raises interest rates, the share prices of these investments drop. That means when you’re trying to sell the REIT, you could face losses. So don’t go by the ‘yield’ alone.

And finally, you’re betting on people going to malls and shopping. That online shopping isn’t really killing the physical experience altogether. That’s the only way your yield will hold good. If brands don’t renew their leases or manage to negotiate for lower rents, then that’s a bit of a problem.

So yeah, we hope this primer’s given you something to think about when you’re looking at REITS as your next ‘real estate’ investment.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.

*The taxation on the repayment of loans in REITs is a bit tricky. But if you want a fair understanding, we’d recommend this article by LiveMint which offers a nice teardown.