Godrej has a new playbook

In today’s Finshots, we look at how Godrej Consumer Products’ acquisition of Raymond Consumer could evolve.

The Story

If you’re an FMCG company that’s looking to grow in today’s cut-throat business environment, you probably have three options.

Firstly, you could choose to build a new sub-brand from scratch. But it’s not easy. You need a lot of money to create and market it effectively. Not to mention how time-consuming it is. It may not be worth it since most FMCG products operate on wafer-thin margins anyway.

Then there’s the second option of snapping up an emerging D2C brand. This is what all the cool kids are doing these days. But most of these brands aren’t churning out high profits. And they have a limited audience anyway. So trying to blitzscale it to a mass, commercial scale is a little hard.

Then there’s the third option of simply buying a legacy brand with mass appeal. You probably get a pretty solid customer base. And hefty revenues that you can just add to your topline.

And it’s this third option that the 125-year-old Godrej Group is attempting right now. It wants a piece of another nearly century-old consumer care company, the Raymond Group. And it’s all set to splash nearly ₹3,000 crores for a couple of legacy brands — Park Avenue deodorants and KamaSutra condoms.

Now GCPL loves brands. It houses some of the most recognizable brands in India across categories — Cinthol soaps, Good Knight mosquito repellents, Godrej Expert hair colour, and even the Hit insect sprays. Buying Park Avenue and KS just adds to its roster.

And it’s quite a crucial decision because Godrej has been stuttering of late. Its popular brands haven’t supercharged business growth for the FMCG company. Its sales and profits have grown much slower than its peers. For instance, as The Ken pointed out, between 2017 and 2022, while its larger rival HUL has grown its sales by 10% annually, GCPL has managed to grow by just 6%. The profit growth is even bleaker — GCPL’s profits grew by a measly 5% while HUL’s grew by 15%.

So it needs to do something to change its fortunes. It wants a bigger brand portfolio. It wants an underpenetrated market. And right now, that’s deodorants and condoms — segments that GCPL believes are ripe for massive growth.

And if you look at how Raymond Consumer Care makes money, you’ll see 80% of its sales are thanks to these two segments. So it seems to be the perfect fit.

Sure, it’s not a market leader. But it’s right up there.

In the deodorants category, Park Avenue is at number 2 as per data from Nielsen. The only one ahead of it is Vini’s Fogg. And the most interesting thing is that Raymond is on the podium without spending massively on advertisements and promotions. In fact, while Raymond spends roughly 5% of its revenue on ads, Vini’s has been spending anywhere between 13–20%.

But despite this, Godrej’s research seems to suggest that people’s perception and satisfaction are way higher with the Park Avenue brand when compared to 5 other competitors.

Now that’s quite a confidence booster for any potential acquirer, right?

Then there’s the mandatory stat about under-penetration. Yeah, Indians don’t seem to have latched on to deodorants. Only 1 in 5 urban males in India use deodorants. So Godrej is banking on seeing this rise over the next few years.

Then there are condoms.

And here Godrej is eyeing the premiumization play.

See, a big chunk of the market in India is categorized under the mass commercial segment. These are ones priced below ₹10. But in the past 5 years, the trend seems to be changing. While the overall sales of condoms have flatlined, there’s a stark difference in growth within segments. The mass commercial category has seen degrowth to the tune of 2% every year. While the premium commercial segment that commands a higher price has grown by 21% annually.

So yeah, that’s why GCPL is betting on this acquisition. It needs to fuel its growth. And with its distribution reach that’s 4 times wider than Raymond’s, it’s hoping to unlock the true potential of these legacy brands.

But acquisitions aren’t a magic wand. The team will have to put in the hard yards. And there are plenty of ifs and buts with this deal too.

For starters, there’s a problem with margins.

See, Raymond’s EBITDA margin is hovering around 5% thanks to its high fixed costs. And it’s quite shockingly low when you compare it to its rival Vini’s which is 5 times higher at 25%. Getting this to head north will be an uphill task for GCPL.

The other thing analysts are questioning is why wouldn’t Godrej just capitalize on its existing brands.

It does have Cinthol which is a pretty popular soap in the country. And while Godrej has tried to extend the brand into deos, it hasn’t worked out yet. So maybe Godrej needs to refocus a bit on Cinthol instead of looking elsewhere.

But Godrej has a response to that. They had a slide in their presentation which said — “If you are not among the first few entrants, you can only enter if you have a seriously disruptive product.” And since their surveys indicate that people are fairly loyal to their deos and don’t switch often, they wanted something which already had a strong presence in the market.

But how true is that, really?

Well, HDFC Securities doesn’t think that argument holds water.

Remember Axe that’s owned by HUL? Well, a decade or so ago, the brand went all guns blazing with ads about the Axe Effect — where women would swoon over any man who’d sprayed the deo. The men loved it and pretty soon, Axe commanded a market share of over 20%.

But it didn’t last long. Competitors came into the mix and Axe began to cede its pole position. Today, its market share has dropped to just 7%.

Where did the loyalty go?

So sure, Godrej can ramp up the ad spends and promote Park Avenue and KS, but just because it’s a legacy brand with good recall doesn’t necessarily mean that it’ll be a winning recipe.

Also, there’s something else that’s quite interesting. Last year, The Good Glamm Group was rumoured to be in talks to buy Raymond Consumer. The deos would’ve fit right into Good Glamm’s personal care portfolio. But they pulled out apparently because the two parties couldn’t agree on the right valuation.

Cut to today. After GCPL announced the deal, Good Glamm’s Chief Business Officer weighed in on Twitter. He thinks that the only way for Park Avenue and KS to grow in the deo space was to innovate because, at the moment, it’s just a price war replete with constant 2+1 offers.

Maybe this explains why Raymond’s Maximum Retail Price to Net Sales Value isn’t something to be proud of. It’s quite high at 50% which indicates there’s a lot of leakage happening between the MRP and the actual selling price. Maybe the company’s being forced to offer discounts to its channel partners to drum up sales. It could be hard for GCPL to deal with such an environment too.

Also, there are concerns that GCPL might have overpaid just a tad bit. Because when private equity firm KKR bought a majority stake in Vini Cosmetics in 2021, they snagged it an Enterprise Value to EBITDA multiple of 35 times. On the other hand, GCPL’s acquisition seems to be at nearly 55 times.

And when you put all these together, you can see why despite Godrej’s belief that things will be on track by the next financial year, most others think that the fruits of this acquisition won’t materialize for at least the next 3 years.

Will investors be patient?

Guess Godrej will find that out soon enough.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

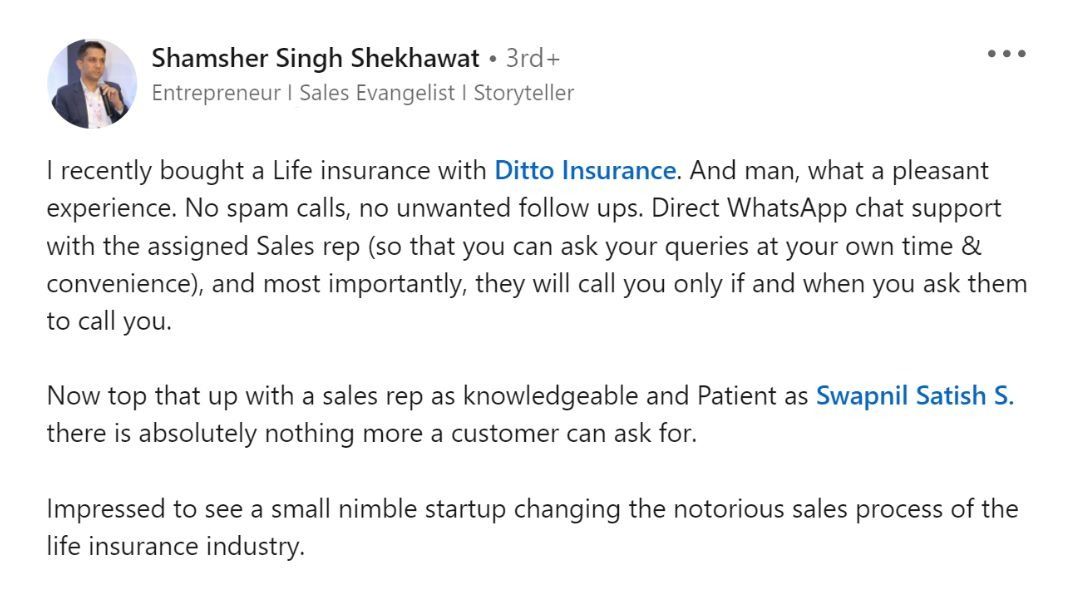

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here