A profitable Zomato is finally here...but for how long?

In today’s Finshots, we dive into the food delivery company’s latest financial report.

The Story

₹2 crores as profit after tax (PAT). That’s what Zomato managed to pull off this quarter.

And everyone’s overjoyed. Investors, the founders, other startups. And they’re raving about Zomato because no one expected the company to turn a profit this quickly. Hell, even Zomato’s team predicted that profits were at least 3 quarters away. So it’s a nice little surprise.

But how did Zomato get here, you ask?

Well, it’s not rocket science. As Deepinder Goyal, Zomato’s CEO had pointed out earlier, the company just needed to do two things — “increase profits in food delivery and reduce losses in the quick commerce (Blinkit) business.”

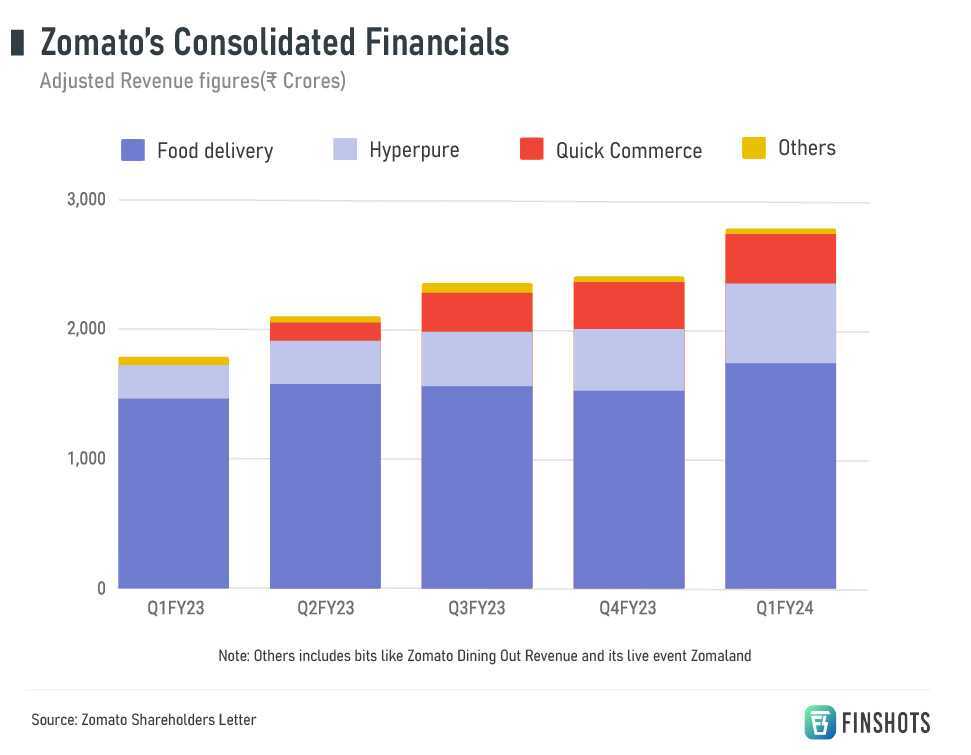

So, let’s look at how food delivery is stacking up. And we’ll focus on this primarily since it’s still what Zomato does best.

Now there are 3 key metrics when it comes to this business.

There’s the Gross Order Value (GOV). You calculate this by looking at the total money spent by users ordering food. This figure has risen by 11% over the previous quarter. Sure, a part of it could be attributed to seasonality — school holidays, IPL, and other summer events we witnessed during the first quarter of the financial year. But, if you rewind a bit, you’ll see that the GOV was stagnant at ~₹6,500 crores for the entirety of last year. So things seem to be looking better this year.

But does that mean more people are now using the platform to order food?

Well, that’s why we look at something called the Monthly Transacting Users (MTU).

Now, on average, there are around 17.5 million people using the platform on a monthly basis. But the surprising bit is that this number hasn’t moved much. In fact, nine months ago Zomato had 17.5 million monthly transacting users. So they haven’t been able to push more users to transact on the platform. And that’s a bit of a worrying sign. Investors will have to wonder if the food delivery business has already captured all the low-hanging fruit.

What do we mean?

Well, at first glance, the penetration levels of online food delivery (at around 15–16%) seem quite low. You could argue that there's still a big market to claim.

But let’s just draw a parallel with e-commerce for a second. A few months ago, we dived into a report by venture capital firm Blume Ventures. We pointed out that in the case of e-commerce, 19% of India’s households shop online. Similar to food delivery, no?

Now if you break this down further, you’ll see that within the high-income category (greater than ₹6 lakhs), the e-commerce penetration is already at 37%. It’s right up there.

While we don’t have a similar breakdown for food delivery, it might well be the case. And maybe that’s why Zomato has been pruning its city portfolio — in January this year, it decided to exit from 225 cities. The business just wasn’t good enough.

So if the urban areas are already quite tapped out, Zomato just has to find ways to squeeze out revenue from its existing users.

This brings us to the Average Order Value (AOV). This is quite important to track because it costs the company pretty much the same money if they’re delivering an order that costs ₹200 or delivering an order that costs ₹400. But, they earn higher commissions from the higher order value.

Unfortunately, Zomato didn’t break this down for food delivery. But it did say there was a ‘modest uptick’. In FY23, it was around ₹407. So it’s probably a bit higher now.

But investment research firm Nomura also calculated something else — how often Zomato’s users were ordering every month. They’re asking if the quirky push notifications are doing a good job of nudging users to place more orders. And their estimate is that the frequency has gone up from 3 orders a month to 3.4 now.

What could be a reason for this?

Maybe it’s Zomato Gold.

See, Zomato’s had a lot of variations of their infamous subscription service over the years. There was Gold. Then there was Pro. And there is Gold again. And here’s how Zomato described its features when it relaunched in January this year.

The key highlight of Zomato Gold is ‘On Time Guarantee’ [if you dont’ get food on time you get a cashback]. This feature was three years in the making, and the tech which powers this feature is a significant achievement for our team. Gold members also get priority access to more restaurants during peak times and offers from a number of restaurants on both delivery and dining-out. We have also made our intercity delivery from legendary restaurants (called Intercity Legends) exclusively available to Gold members. And of course, free delivery on orders meeting certain criteria. In less than a month, the Zomato Gold program has scaled to 900k+ members.

This means that Q1FY24 (April-June) is the first full quarter of the revamped Zomato Gold program. And orders from Gold subscribers already make up 30% of the GOV in food delivery. So if Zomato’s hunch is right, this time, it certainly looks like they have struck Gold. Literally.

Put all this together, you’ll see that the food delivery business has steadily been churning out profits in the background even though we haven’t seen superlative growth.

The problematic child was Blinkit, the quick commerce, loss-making delivery player Zomato bought in June 2022. Investors were not happy back then and the stock quickly slumped by 30% after the announcement.

But it looks like things are finally turning around here too.

The GOV has doubled from ₹1,000 crores to ₹2,000 crores in the past year. The AOV has crept upwards to ₹582. And what they call ‘contribution’ has fallen sharply. Think of this as the money that the company makes on each delivery after deducting the cost of getting it to your doorstep. And after including any other processing fees. If you calculate this as a percentage of the GOV, it’s almost positive now.

Maybe a part of this is because Blinkit has been cutting down the amount of money it pays out to delivery riders. As per a Medianama report a few months ago, the cuts were drastic:

Irfan (alias), a Blinkit delivery executive, informed us that when he was working with Blinkit earlier (when it was called Grofers), he was earning Rs 50 per order. When the company transitioned its name to Blinkit, its earnings were reduced to (on average) Rs 25 per order. Now, under Zomato’s leadership, the earnings have further reduced to (on average) Rs 15 per order.

Even Albinder, the CEO of Blinkit pointed out how they had a temporary business disruption in the month of April resulting from the change in the delivery partner payout structure. So while this won’t please gig workers, it’ll make shareholders happy.

And with only 4 million households MTUs on Blinkit at the moment (compared to 17.5 million for Zomato), the runway for growth is much bigger. In fact, Deepinder Goyal thinks that it’ll be more important to Zomato’s shareholders than food delivery in 10 years time. That’s an interesting bet.

So all in all, definitely looks like a good show at Zomato, no?

But there’s one little secret we have to share too…despite all this, Zomato actually still suffered a loss of ₹15 crores.

Yes, a loss!

So what’s the ₹2 crores profit everyone’s talking about then, you ask?

Well, as Moneycontrol pointed out, there was a tax provision that came to the fore. Or a line item called “deferred tax” worth ₹17 crores. And once the adjustment was made, voila, we had a profit worth ₹2 crores.

Now think of deferred tax as a situation where Zomato may have incurred a loss at the moment but these losses can be used to offset future taxes when the company starts making profits. And while we don’t exactly know what led to Zomato’s deferred tax windfall, just know that it’s really not something new in the food delivery company’s books. They’ve been claiming deferred taxes for a few quarters now.

So the million-dollar question is — can Zomato sustain the profits if it has come on the back of a tax gain?

Well, probably.

Let’s ignore the deferred tax for a bit. Just look at the overall loss itself. In the past couple of quarters, it was nearly ₹200 crores. So it has already narrowed sharply to the ₹15 crores that we see now. And with its efforts to cut costs even further, things are looking good.

So we’ll just have to wait and see how the story plays out, no?

Until then…good luck, Zomato. Everyone’s rooting for you.

And don't forget to share this article on WhatsApp, LinkedIn, and Twitter.