A CEO can't be Eternal

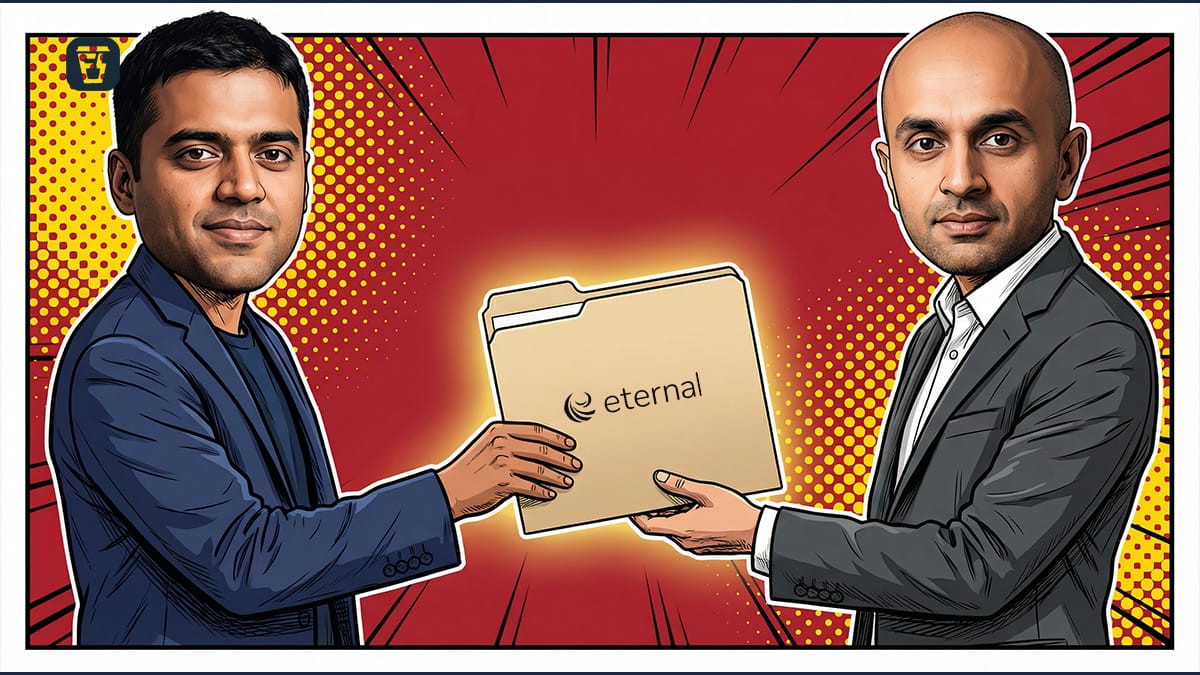

In today’s Finshots, we unpack Eternal’s Q3 (FY26) results and why the stock looks confused after Deepinder Goyal handed over the CEO reins to Albinder Dhindsa.

The Story

On Wednesday, you probably saw the news. Deepinder Goyal stepped down as CEO of Eternal.

In a letter to shareholders, Goyal said he would resign as Director, Managing Director, and CEO effective February 1st because he wants to pursue experimental ideas that, in his view, are better explored outside Eternal’s core business. That said, he isn’t walking away entirely. Subject to shareholder approval, he’ll continue as Director and Vice Chairman of the board.

The bigger headline, though, is succession. Albinder Dhindsa, the current CEO of Blinkit, will take over as CEO and step into Goyal’s shoes.

The timing made things even more interesting. The announcement came after market hours on a day when the stock had already jumped 5% on expectations of strong Q3FY26 results. That momentum carried into Thursday’s opening, with the stock touching its highest level in two months. But by the end of the day, it had given up ground and closed down a little over 2.5%. And today the stock seems to have slipped even further.

That’s a pretty mixed reaction for a stock over just two days. So let’s see why.

And to do that, let’s first zoom in to the Q3FY26 results.

Eternal reported a solid quarter on the surface. Revenues rose 20% QoQ to ₹16,315 crore, beating Bloomberg estimates by about 1%. Operating profit (EBITDA) jumped even more sharply — up 54% QoQ to ₹368 crore, which was nearly 10% better than what the street was expecting. That pushed margins up to 2.2%, compared to 1.7% last quarter.

Net profit also climbed, rising 57% QoQ to ₹102 crore. But it still fell short of estimates by around 11%.

So yeah, the results are a bit of a mixed bag.

And you might’ve also noticed something missing. We haven’t spoken about year-on-year growth at all. That’s intentional because the YoY comparison seems heavily distorted right now, largely because Blinkit shifted from a marketplace model to an inventory-led one starting Q1FY26. That change mechanically inflates revenue and profit numbers, making straight YoY comparisons far less meaningful than they appear at first glance.

If you read our recent daily story on the removal of “10-minute delivery” branding in quick commerce, this will sound familiar.

In Blinkit’s original model, it wasn’t really selling groceries as a retailer. It functioned more like a connector. Local kirana stores or FMCG brands stocked their products in Blinkit’s dark stores. When you placed an order, Blinkit matched you with the seller, handled the delivery, and took a commission for its service. The inventory didn’t belong to Blinkit, which meant it had limited control over pricing. And if products went unsold or spoiled, that risk sat with the seller.

Because of this, Blinkit earned only a commission. So on a ₹500 order, it pocketed roughly 18%, which is just a small slice of the total bill.

Now contrast that with the inventory-led model Blinkit has shifted to. Here, it behaves like a traditional retailer. It buys goods directly from brands, stores them in its own dark stores, and sells them under its own name. That gives Blinkit full control over pricing, but it also takes full responsibility if products remain unsold or lead to customer complaints. The upside, however, is that when you place a ₹500 order, the entire amount comes to Blinkit. And after accounting for the wholesale cost of goods, whatever remains is its margin.

This shift matters because the old model capped Blinkit’s earnings by design as it could only earn a commission. The new model is riskier, but it allows Blinkit to retain a much larger share of every order, which can meaningfully improve profitability at scale.

There’s evidence that this works. Zepto, which has always operated on an inventory-led model, reportedly earns higher margins (take rate) of around 23%.

But the point here is that this also changes how Blinkit reports its numbers. Earlier, it recognised only the commission as revenue. Now, it recognises the entire order value. So revenue and operating profit growth suddenly look explosive. As much as over 200% YoY growth in revenue from operations and over 125% YoY growth in EBITDA.

If you look a little closer though, the picture is less rosy. Net profit margins have actually fallen from 1% in Q3FY25 to 0.6% in the most recent quarter. Which tells you that while the headline numbers look impressive, the underlying improvement is far more modest than it first appears.

There’s another factor at play here, apart from the broader market itself falling.

It’s the management change.

And that’s likely why the market’s reaction looks so polarised.

The easiest way to explain this is through something called the halo effect (sometimes also called the halo error). The term was coined by American psychologist Edward Thorndike back in 1920. In simple terms, the halo effect is a cognitive bias where we form an overall, often inaccurate judgement about something based on one strong positive trait.

Over time, this idea made its way into business thinking too. When a company performs well, we tend to evaluate its leader too favourably. A classic example is Apple and Steve Jobs. Even today, many people instinctively link Apple’s innovative edge to Jobs. Some even feel the company’s innovation may have plateaued because he isn’t around anymore. But that belief is shaped by bias because you don’t really know what the alternate best-case scenario could have been.

The same logic applies to Deepinder Goyal and Eternal.

Goyal founded Zomato and took it from zero to one. It grew into a food delivery giant, went public, and then expanded further through acquisitions of WOTU (rebranded as Hyperpure), Grofers (now Blinkit), and Paytm’s entertainment ticketing business, which later became District. That journey took the company from one to ten. And Eternal went from a single-product business to a platform trying to do many things at once.

Naturally, investors may end up attributing much of Eternal’s success to Goyal alone.

But if the company now wants to scale further, this transition might actually be the right moment to test what Eternal looks like under new leadership. Especially when that leadership comes from Albinder Dhindsa, the executive who turned Blinkit into Eternal’s fastest-growing vertical.

In fact, there’s some compelling research showing that founders who run their companies for too long can actually hurt valuations, sometimes by as much as 50% over time. Another study suggests there’s an optimal “sweet spot” for CEO tenure: about 4.8 years. That’s the point where performance tends to peak across customer satisfaction, employee relations, stock returns, and even volatility.

As the research puts it,

In the early days, your [founder’s] heroics were the engine of growth. You willed the company into existence. But as you scale… those same heroics signal to investors that the machine is broken. They don't see a high-performing CEO; they see a single point of failure. If you are the "Hub" in a Hub-and-Spoke model, you haven't built a business; you've built a high-paying job that no one else wants to buy.

Not just that. Studies from the University of Chicago and MIT suggest that individual CEOs account for just 2–4% of a company’s overall performance. This means that keeping one leader at the helm for too long can quietly limit growth. Ideas saturate, perspectives narrow, and execution starts revolving around a single vision.

So yeah, maybe the leadership change at Eternal is not only justified but also well-timed. And we’ll only have to wait and see if Dhindsa’s stint as CEO takes Eternal from 10 to 100, as Goyal believes.

Until then…

Liked this story? Don’t forget to share it with a friend, family member or even strangers on WhatsApp, LinkedIn and X.

The #1 Financial Mistake Most Indians Make

Delaying buying a term insurance plan.

There could be many reasons for this, but for a lot of people, it's simply because they're unsure or just haven't had the right guidance.

The truth is, term insurance is one of the simplest and most affordable ways to protect your family financially if something were to happen to you. If you’re unsure where to begin, Ditto can help. Book a FREE consultation with an advisor who’ll walk you through it.

PS: Ditto is rated 4.9 on Google (13,000+ reviews)!