The untold story of Varun Beverages

In today’s Finshots Markets, we explain how Pepsi’s bottling partner is blitzing the market.

Also, a quick side note. If you're someone who has great communication skills and are enthusiastic to join our team, Ditto is looking to recruit new Insurance Advisors. You don't even have to know much about Insurance-- We will train you from scratch and you can enjoy working remotely with a great team. Click here to apply.

The Story

PepsiCo doesn’t really run its own show in India. It has a loyal partner of nearly 30 years in the country — a company by the name of Varun Beverages Ltd (VBL). The crudest and most simple explanation of VBL’s role is that it bottles the fizzy drink for sale.

All that PepsiCo really does is lend its brand name, sell the concentrate that makes the beverages to VBL, and dabble in a bit of its own marketing by splashing ₹350 crores a year — you know, by getting superstars like Salman Khan to endorse it. It prefers being asset-light and doesn’t want to set up manufacturing facilities in every nook and cranny.

So when you spot a bottle of Pepsi in your kirana store, it’s not because PepsiCo, the American giant, dropped it there. You can bet that it was delivered and stocked by Varun Beverages.

Now when VBL went public in 2016, there was no fanfare. The stock price dropped by 6% on the day it was listed on the stock exchanges. People whispered about its wonky financials — a couple of years of losses and mounting debt were worrisome.

But that’s all in the past. The stock’s fizzing and investors just can’t get enough. In the past 1 year, the share price has jumped by 100%. And if you’d decided to take a punt on the stock 5 years ago, you be sitting on a handsome profit of 500%.

It sounds too good to be true. And it gets you thinking — what’s so special about Varun Beverages?

After all, it cannot launch its own products. It cannot really decide on prices on its own. It’s even 100% dependent on PepsiCo for the raw material that goes into the beverages. And it’s the Pepsi brand that drives the sales.

Without PepsiCo, there’s no Varun Beverages.

That seems quite risky. No?

Well, on the face of it, yes. But you could flip this thinking a bit — maybe it’s PepsiCo who is dependent on Varun Beverages.

What do we mean?

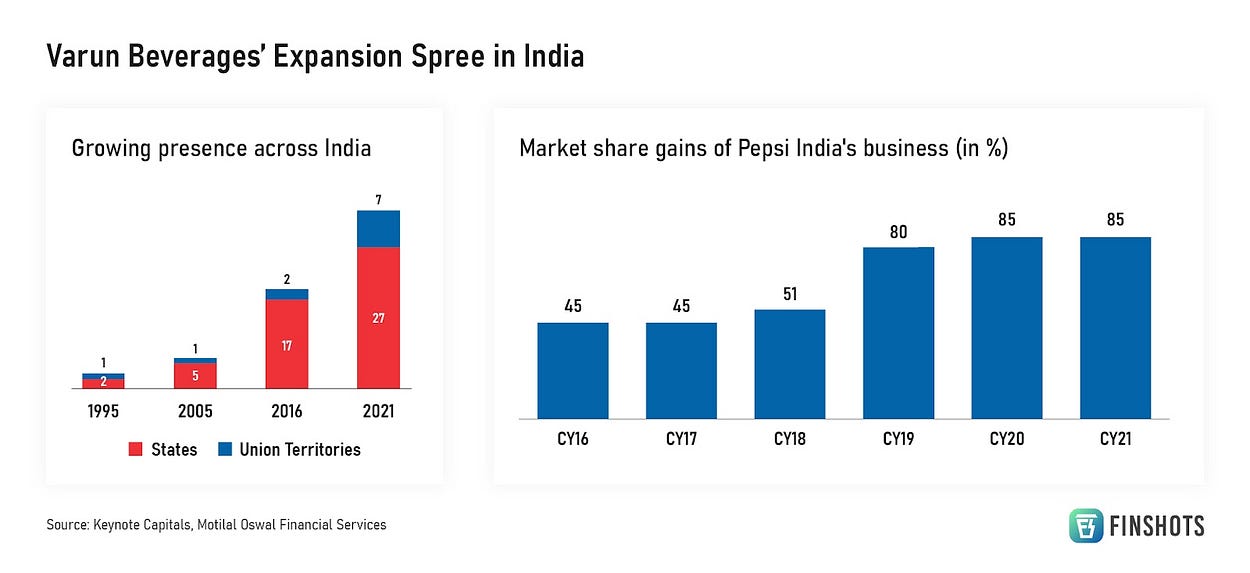

Well, until a few years ago, VBL wasn’t the top dog in PepsiCo’s India business. In 2011, it contributed just 26% of PepsiCo’s beverage sales in India. But by 2021, things look significantly different. It contributed to a staggering 85% of PepsiCo India’s beverage sales.

And it got here simply by virtue of convincing PepsiCo that there existed no better partner for the beverage giant in India. See, until 2019, PepsiCo ran its own bottling and distribution unit in the south and west zones of India. But at some point, PepsiCo probably just thought, “Hey, VBL can run it in India better than us!” So PepsiCo took a step back and re-franchised its units. It handed it over to its trusted partner. And this gave VBL a presence across 27 states and 7 union territories in India.

VBL is a Pepsi monopoly really.

That means — PepsiCo needs Varun Beverages as much as Varun Beverages needs PepsiCo.

And slowly but steadily, it has gained the right to bottle and distribute pretty much every PepsiCo beverage that exists. Including Tropicana Slice, Gatorade, and Aquafina. Today, it also has a new beverage in its arsenal — Sting, an energy drink that’s priced at just one-fifth of Red Bull and which already contributes to 8% of the total sales.

But why stop at bottles and drinks? PepsiCo’s food portfolio is quite lucrative too. In March, it signed a deal with PepsiCo to manufacture one of its snacks, Kurkure Puffcorn in India. And who knows, it could soon be in charge of Lay’s and Doritos too. It could give it a nice little revenue mix.

And the advantage is that the more products that VBL handles, the easier life gets for retailers too. They don’t have to deal with VBL for some beverages and Pepsi for the food. When one entity manages the entire product mix, it could deepen the relationship with the stores too and give the company a leg up. Maybe it’ll be able to snatch more shelf space. And it could even result in higher sales that way. It’s something that PepsiCo will want.

Sure, you could argue that the world is trying to cut back on carbonated, sugary beverages. And that could be a blow for VBL. But you can be sure that it’s something PepsiCo is deeply thinking about. New product launches to keep up with the times will always be a part of the game plan.

And if you just look at India, the potential is still wide open.

Out of a total of nearly 10 million retail outlets spread across India, VBL has entrenched itself in only around 3 million stores. For the simple reason that most retail outlets can’t really stock visi-coolers because of electricity issues. But as India’s electrification programme picks up pace over the next few years, that could open up an opportunity like no other.

There’s also the matter of under-penetration. Take Bihar, for instance. According to a report by Motilal Oswal, Bihar’s per capita consumption of carbonated drinks is just 30% of the national average. So convincing the people to drink up could be quite a lucrative proposition for the company. That’s why VBL is upping its manufacturing capacity in the region too.

And since VBL has the right to bottle Pepsi in India till 2039, it’s hard to see someone else breaking in.

But it’s not just India. The world is an oyster for Varun Beverages. Okay, maybe not the world, but, definitely Africa. See, PepsiCo only has a presence in 13 countries in Africa at the moment. Its rival Coca-Cola already serves 50 countries. So there’s a massive opportunity there to widen the reach. And VBL’s already doing a great job in Zimbabwe where it started with a negligible market share and now controls 50% of the market.

So if PepsiCo wants to spread its wings, it has the perfect partner in VBL. And this could give the company a nice boost in international sales.

It all looks hunky dory for VBL, doesn’t it?

But there’s always some risk in the shadows.

See, a lot of VBL’s growth has come on the back of acquiring PepsiCo’s other franchise partners. But since it commands a near monopoly now, that avenue is cut off. It has to grow organically by snatching away market share from rivals. And that could be a tough gig. Because Coca-Cola reigns supreme in India. It even has the uber-popular Thums Up in its portfolio. So making further inroads isn’t going to be a cakewalk for PepsiCo.

Also, competition is heating up from other biggies. We’re talking about Reliance’s acquisition of Campa Cola — a once iconic brand that it’s trying to revive. And there are plenty of other branded players who’re trying to make a dent regionally.

Anyway, for now, the story is written in VBL’s favour. Whether you get a burger, fried chicken, or a cheesy pizza, you’ll get something to wash it down with. And that something might well be an ice-cold bottle of Pepsi. That’s what investors are betting on — no matter the food, there’s always Pepsi!

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you’re at it.

1. Just head to our website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!