Cut the prices already

In today's newsletter, we ask one important question—"Why won't Real Estate Developers simply cut prices?"

The Story

A few days ago, the honourable minister Piyush Goyal dropped a few truth bombs while addressing the top Real Estate Developers in the country. He said and I quote — “Unless you reduce your rates, you are stuck with your material. You can choose to be stuck with your material and default with the bank and let the material go away, or you can choose to get rid of whatever you bought at high prices. You can think it as a bad decision or an unfortunate situation and move forward”

The comments came at a time when many people were expecting the government to intervene and announce a bailout package for the real estate industry. However, that whole hypothesis broke down, the moment these comments were made public. So why did Piyush Goyal make these assertions and why are Real Estate developers so skittish about reducing property prices?

Well, you could trace the problem back to the economic boom of the 2004–08 era when GDP growth was constantly surging at 9–10% every year. In a bid to exploit the growth opportunities available, Real Estate Developers launched new projects worth lakhs of crores setting off the biggest investment boom in the country’s history. And then in 2008, the Global Financial Crisis (GFC) threatened to play spoilsport.

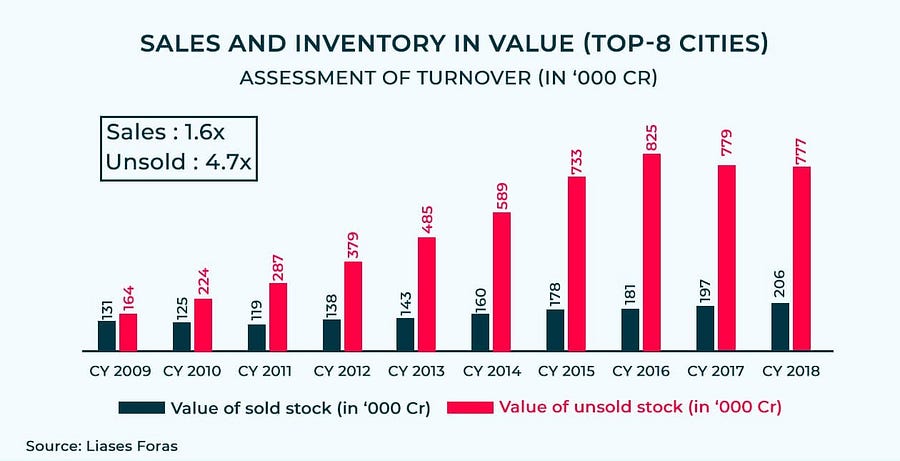

Growth rates moderated. Demand took a hit. Wage rates plateaued. And Real Estate companies finally realised that they had overstretched themselves after having borrowed large sums of money pursuing extravagant projects. After all, you can’t expect a middle-income consumer to fork over 1 Crore for a 2 BHK property. And as a consequence, unsold homes (inventory) started piling up across the country.

Usually, when this happens, the best recourse is to simply reduce prices and get rid of all the stuff that’s not selling. However, that wasn’t happening in the Real Estate industry.

Why, you ask?

Two words — Holding power. Most developers were convinced they could hold on to unsold inventory and finance new projects with borrowed money. They were hoping for a bounce-back in prices and they were willing to wait it out. Unfortunately, there was no bounce back. The Real Estate sector did not witness a resurgence of any sort. And by 2015, they had no choice but to reduce prices. However, there was a slight complication. As the former economic advisor, Arvind Subramanian succinctly put it-

“While developers could in principle tempt buyers into the market by reducing prices, they couldn’t do this in practice because lower prices would have destroyed the (notional) value of the collateral that they had pledged in order to secure their lending.”

You see, developers were borrowing all that big money by pledging the only collateral they owned — their properties. And the value of the collateral is highly dependant on how you’re pricing your properties. So if you start selling all your unsold homes at throwaway prices, you’ll have to revalue all the properties you’ve pledged with the bank. Ergo, the value of your collateral diminishes.

And the bank will promptly ask you to put up more money to shore up the value of said collateral. If you don’t pay up, they are going to come for you. So cutting prices has its downside.

However, once RERA (Real Estate Regulation and Development Act), Black Money Act, Demonetisation, and GST took centre stage, developers were willing to throw in the towel and sell properties at a discount. But by then, their costs had bloated exponentially and their margins were receding fast. Any substantial discount would mean selling properties below cost. Here’s another handy chart from Liases Foras to show how residential developers in Mumbai were losing the plot completely.

And with COVID, these problems have only exacerbated. So if anything, this ought to be the most opportune moment to cut prices. But alas, they have another contention.

“Reducing real estate prices is a theoretical proposition as the I-T department will penalise you. Both the buyer and the seller have to bear a 35% penalty if a property is transacted at below 10% of the RR rates” — Niranjan Hiranandani, President, ASSOCHAM & Co-Founder & Managing Director, Hiranandani Group.

So here’s the deal. The RR rate or the Ready Reckoner rate is the lowest price at which a property has to be registered (in a particular area) in case you wish to transfer it to somebody else. This price is important because it’s used to calculate the stamp duty payable to the state government. And since the government can make money here, there’s a perverse incentive for the state to keep hiking this price every year, even if they don’t see a proportionate increase in the market price.

And Real Estate developers contest that property prices are already hovering pretty close to these rates. Any further reduction would mean attracting heavy penalties.

Now do bear in mind, the Indian Real Estate market isn’t just the Mumbai Metropolitan Region (MMR) or the National Capital Region (NCR). However, the ‘inventory problem’ is particularly acute in Mumbai and NCR, which is why most people talk about use cases specific to these areas when they discuss problems plaguing the industry.

Anyway, irrespective of what the Real Estate Industry feels right now, it doesn’t look like the government is going to offer them a helping hand anytime soon. As Uday Kotak said — “Real estate players [should] move inventory and clear the stock they have. They should not be looking at the rear-view mirror while driving a car, but looking in front.”

So maybe, its time to finally move on. Maybe its time to sell what you have and start over again.

Until then…