Why is everyone dunking on Shark Tank India?

In today’s Finshots, we piece together the ups and downs of one of India’s most popular reality TV shows.

Before we begin, if you're someone who loves to keep tabs on what's happening in the world of business and finance, then hit subscribe if you haven't already. Just one mail every morning. Promise!

If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Shark Tank India has a simple premise.

You pitch your business idea under the glare of studio lights. Get lakhs or crores of funding from an investment partner who has been there and done that. Draw millions of eyeballs when the network airs your pitch. Become famous and successful.

Shark Tank is the new Indian dream.

In just 2 seasons, over 200,000 startups have applied to the show. And over 320 startups have pitched on the show. Heck, with a bit of over the top drama, it has infiltrated Indian households. And words like CAC, GMV, gross margins have become dinner table conversations.

But let’s just say that not everyone’s a fan of Shark Tank.

Just look at the bad press it has been getting in the past few months.

The hot news right now is that the judges or sharks are reneging on their commitments. That they’re not investing what they’d promised. PrivateCircle, a market intelligence firm, pored through corporate filings and found something quite shocking — out of the 65 deals aired on TV during the shows first season in December 2021, only 26 startups have got money — not including debt or loans — from the sharks.

That’s a measly 40% of promises being fulfilled even after 18 months since the show first aired.

And you know what’s annoying people even more?

One of the sharks had earlier claimed that they’d closed 70% of the deals from the season.

Well, that claim doesn’t seem so true now, does it?

Now this has split India down the middle into two camps. On one side you have the judges and their fans defending the show and the process. And on the other, we have everyone else screaming, “I told you the show was a farce,” or something along those lines.

But here’s the thing. There’s always more to these shows and stats than meet the eyes.

Firstly, before we lambast the Indian version of the show, we should look at what happens on its American counterpart too. When Forbes ran a survey of contestants who participated in Season 8 to 13, it found that at least 50% of the deals didn’t work out.

So yeah, things can change quite drastically after the studio lights go out. Whether it’s India or the US.

Secondly, a startup that struck a deal might choose to back out on their own. They might have had time to sleep on it and maybe felt that they gave away too much equity for too little. They might have felt that they wouldn’t be able to work with a particular shark because their styles don’t match. Or they might’ve received funding from some other party on better terms. There could be a whole host of reasons. And PrivateCircle does say that in 6 instances, it was the startup that backed out. There could be more, we don’t know

And finally, due diligence takes time.

If you’ve ever bought a used car from a dealer, you know how it goes. You visit the lot and find a car that catches your eye. You look at its cosmetics and see that there isn’t any visible problem. So you pay a deposit to lock-in the car for a week. The dealer can’t sell it to anyone else during that time. Meanwhile, you still need to look under the hood. Get an expert to evaluate if there are any hidden problems. Like an accident that damaged a part of the car. Or open traffic violations. If you find some minor discrepancies, you negotiate for a better price. If things look bad, you back away.

It’s pretty much the same thing on Shark Tank. The investors don’t really get all the nitty gritties of the company during the pitch. They still need to ensure that everything that the founders claim is true. That the books are spick and span. That takes a bit of time. And if they don’t like what they see, they could choose to back out.

So maybe we should give them the benefit of the doubt, no?

Well…maybe only partially. Because, sure we laid out some arguments in support of the sharks and the show, but that doesn’t mean that there isn’t a dark side to all this.

You see, the problem here is that, on average, venture capital deals take 83 days to close due diligence. So you can see why people wonder — what’s taking the sharks so long with theirs? And many of the founders have complained about the the tardiness of the sharks. Or the unprofessionalism, if you will. Inc42 apparently got access to a WhatsApp group that had many of these founders complaining about being ghosted by the sharks. Economic Times and Moneycontrol had reported something similar too. So you’d imagine there’s some truth to this.

Then there are some other issues that have slipped under the radar. Last year, The Signal highlighted a few problems of transparency.

For instance, for season one, the show had teamed up with an incubator called Venture Catalysts. These folks help early stage startups hit the ground running by writing cheques worth $250,000-$1 million. And since they were clued in to the startup ecosystem, the folks running Shark Tank India appointed them as the “exclusive startup ecosystem advisor”.

Now we’re not sure what that entails, but here’s the problem. 3 of Venture Catalysts’ own portfolio companies apparently raised money on Shark Tank. But there was no disclaimer that indicated that these startups were linked to an entity that was an advisor on the show.

That’s quite a conflict of interest, no? Especially when the folks at Venture Catalysts also were the ones who decided which startups would feature on the show in the first place. You can imagine some level of bias creeping in during the selection phase.

Also, the judges did ask one of these startups about its existing investors. But the final edits of the show that was aired didn’t reveal that Venture Catalysts was actually an investor.

For a show where startups have to be truly transparent or risk ridicule, this isn’t a good look.

Anyway, there’s just one little thing to chew on. Just a little one.

Last week, consultancy firm RedSeer published a report saying that at least 27 startups that appeared on the show quickly found success after it. They raised money from external investors at valuations that was 2.5 times higher than the show.

Now that’s a great thing right? The publicity probably helped the startups spin a better story.

But…what if the startups were undervalued on the show in the first place?

You see, for starters, the folks running the show at Sony ask founders to cut back on their demands. They might tell them to pitch for less money.

But that might result in startups having to give up a sizeable amount of equity too? Because they do have to give the sharks enough of the business to get them excited about it. And that itself could result in the founder having to undervalue the company right at the start. Then come the bouts of negotiation as the judges try to live up to their ‘sharky’ reputation. The valuation that the founder eventually receives falls significantly — by 60% on average.

So it’s no wonder then that the valuation rises after the show, right?

Put all of this together and you see why there’s so much backlash against the show.

Anyway, despite all these doubts cast over how things are run, the show does have some bright spots — It probably made the idea of entrepreneurship more palatable to Indian families. Parents might understand their children's’ ambitions better too. And may not ridicule their choices of quitting high-paying jobs and dreaming big. And that alone is enough to spark a bit of a revolution and encourage even more entrepreneurs. The only thing is, we’d do well to keep one thing in mind — at the end of the day, it’s reality TV. And that’s going to come with a side of drama.

What do you think about all this? Tell us.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and Twitter.

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

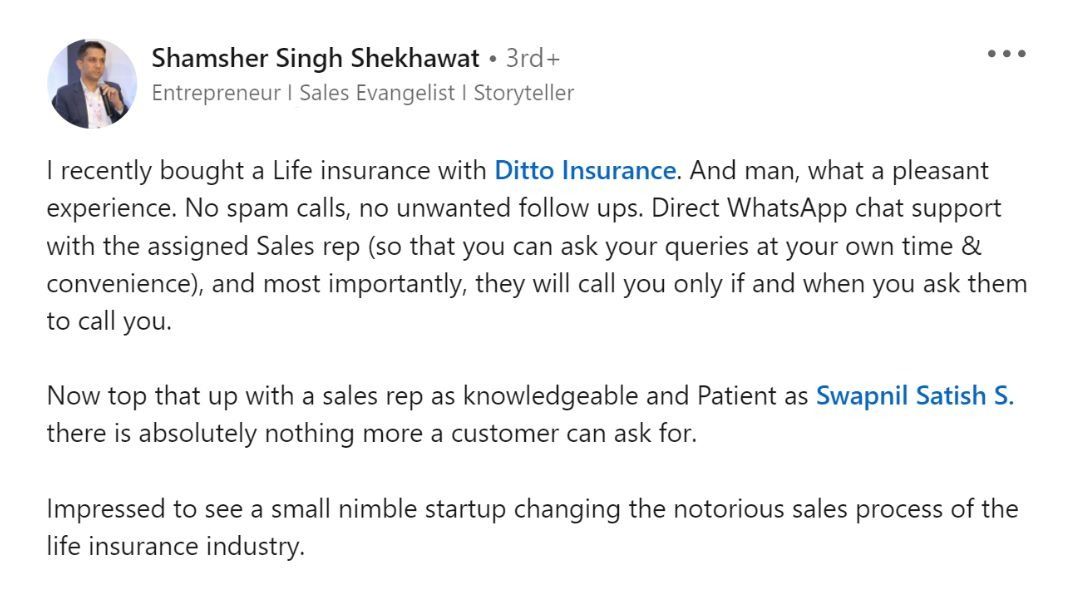

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here